This version of the form is not currently in use and is provided for reference only. Download this version of

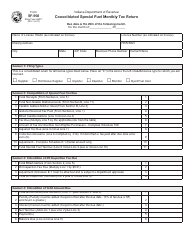

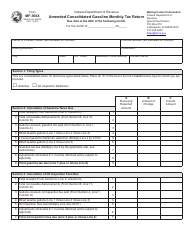

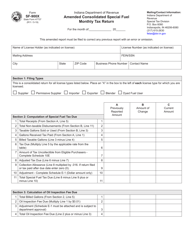

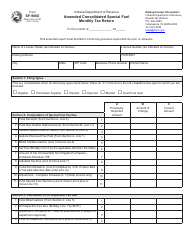

State Form 49276 (MF-360)

for the current year.

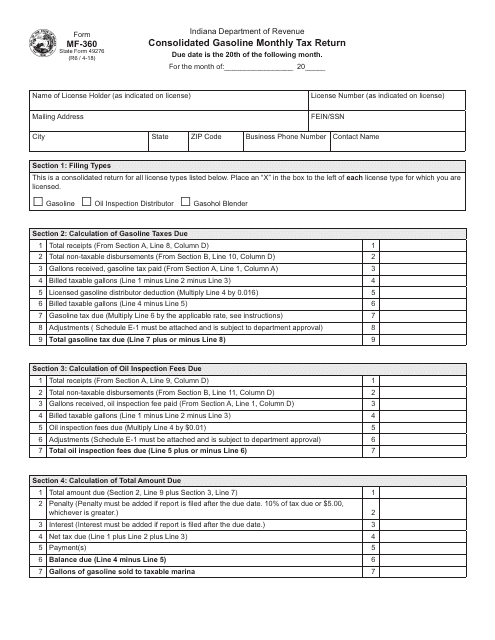

State Form 49276 (MF-360) Consolidated Gasoline Monthly Tax Return - Indiana

What Is State Form 49276 (MF-360)?

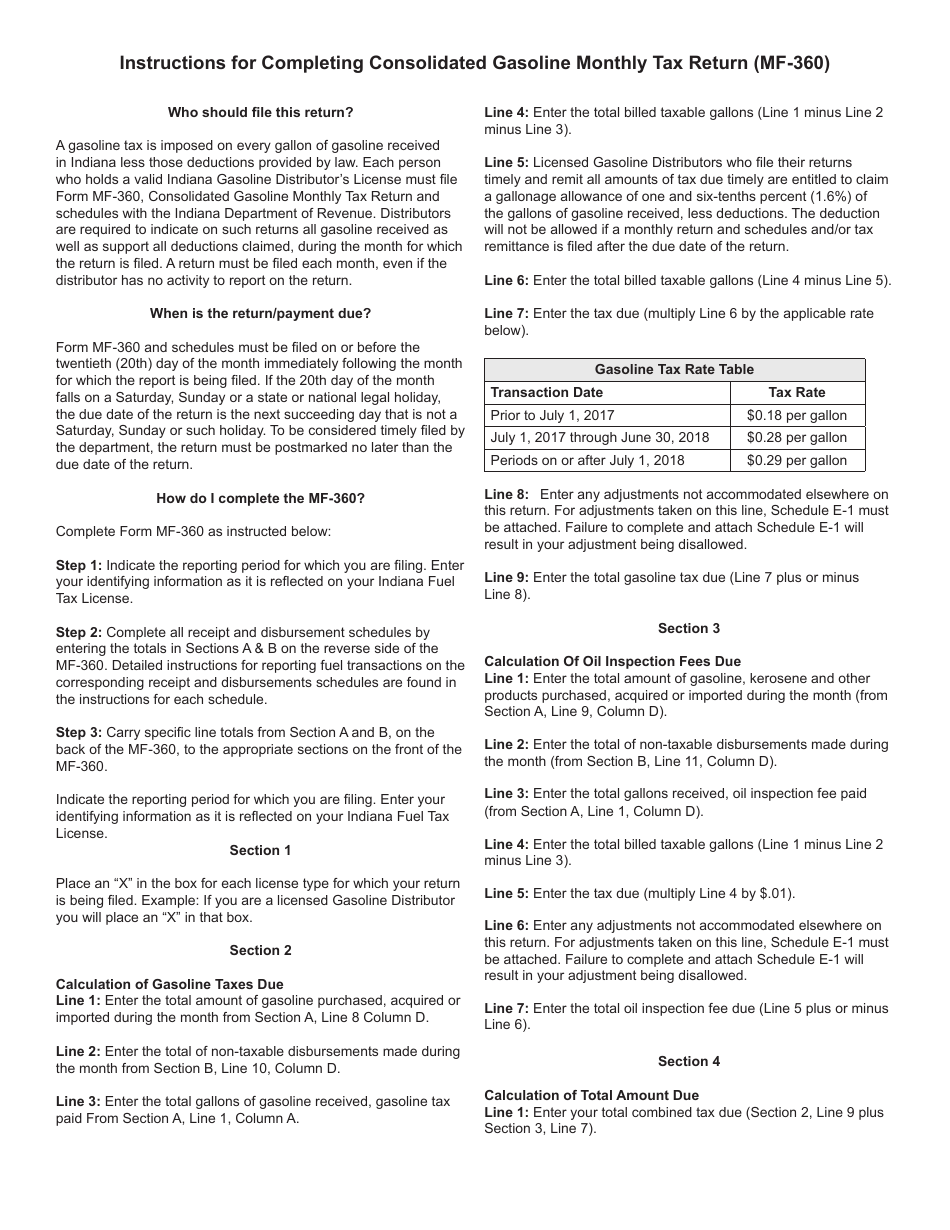

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 49276 (MF-360)?

A: Form 49276 (MF-360) is the Consolidated Gasoline Monthly Tax Return for the state of Indiana.

Q: Who needs to file Form 49276 (MF-360)?

A: This form must be filed by businesses in Indiana that sell gasoline.

Q: What is the purpose of Form 49276 (MF-360)?

A: The purpose of this form is to report and pay the monthly gasoline tax liability to the state of Indiana.

Q: How often do I need to file Form 49276 (MF-360)?

A: Form 49276 (MF-360) must be filed on a monthly basis.

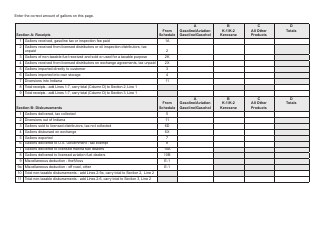

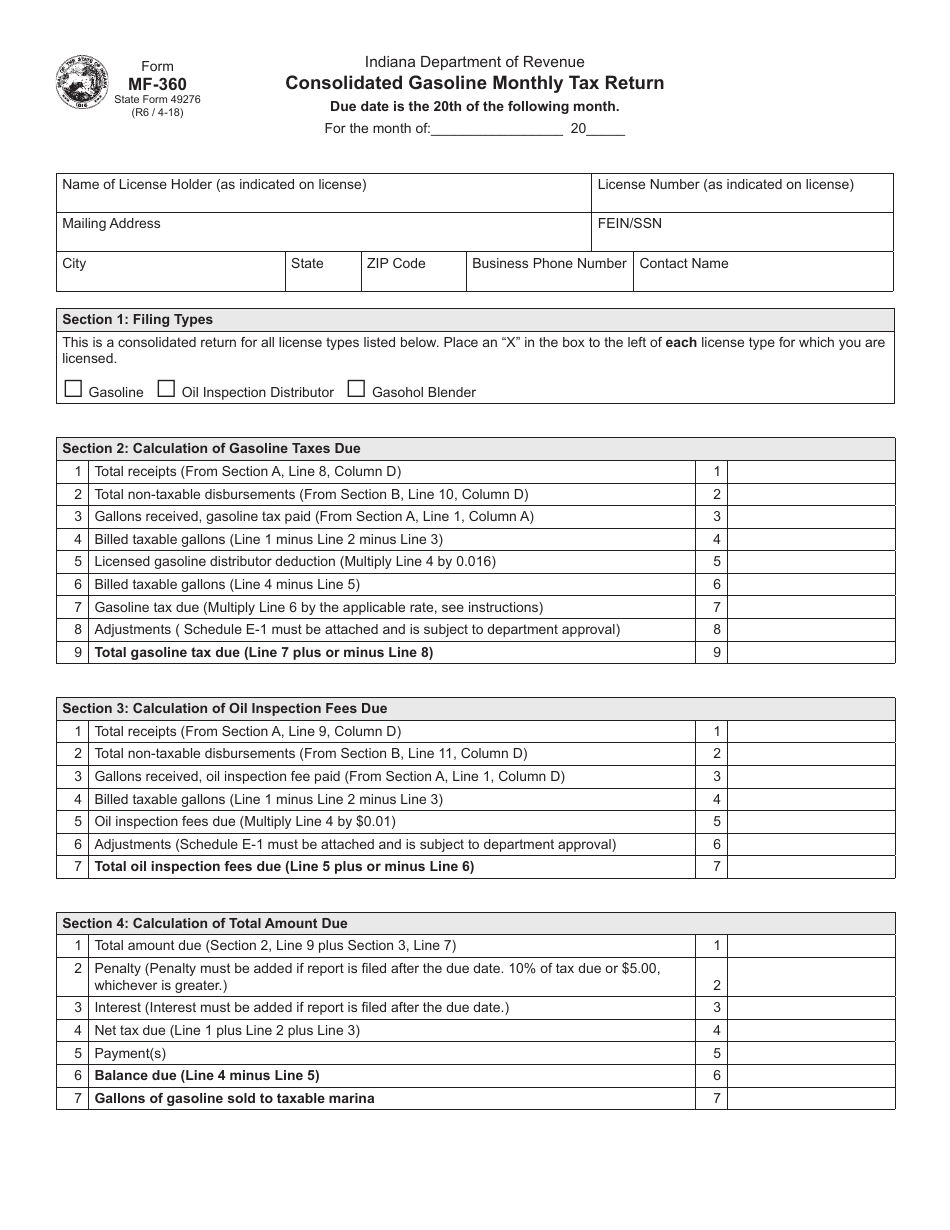

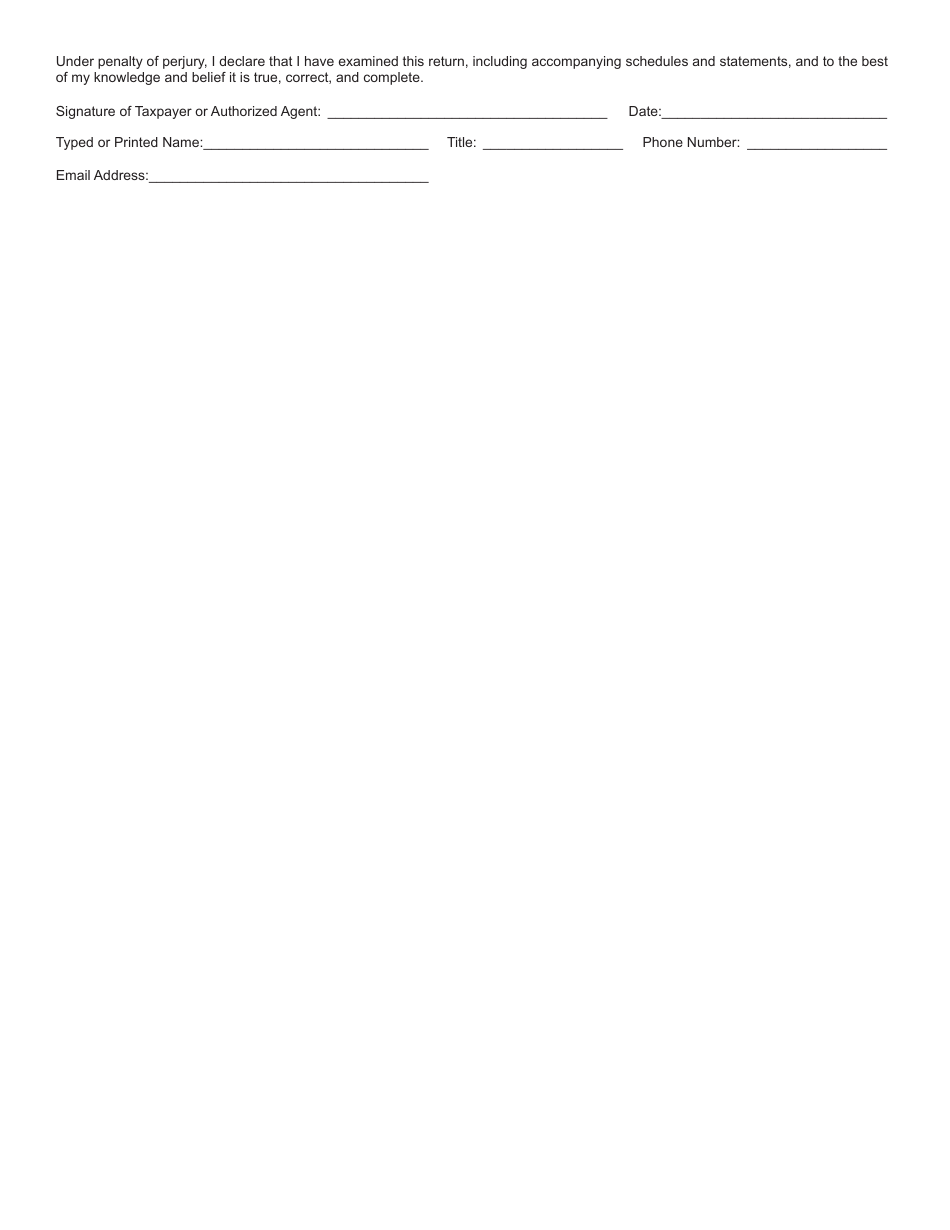

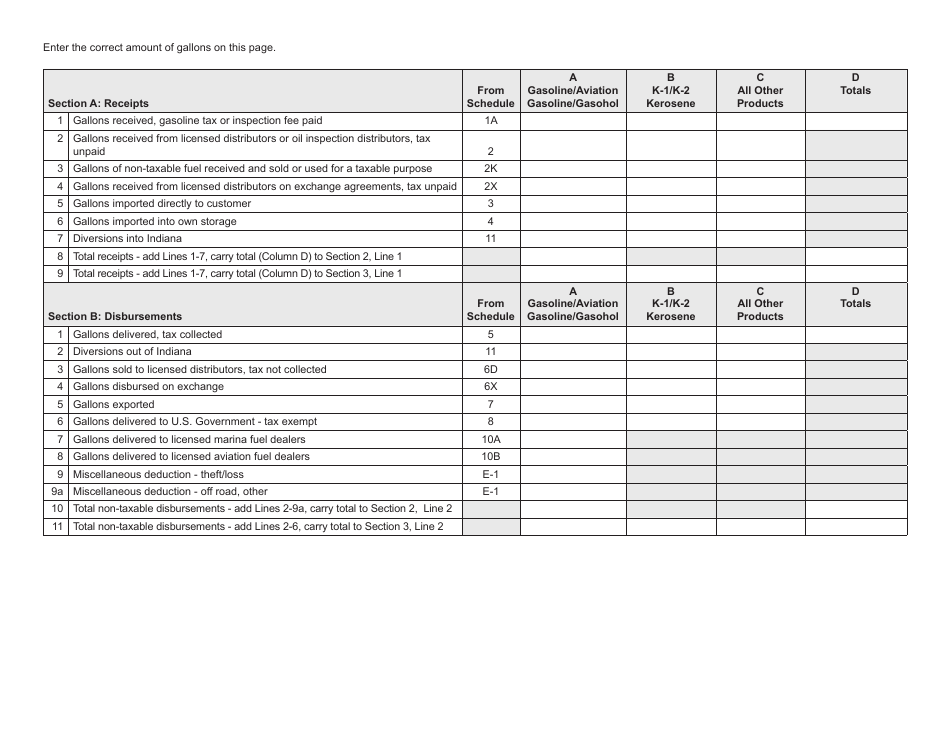

Q: What information do I need to complete Form 49276 (MF-360)?

A: You will need to provide details about the gallons of gasoline sold, tax rates, and any credits or deductions applicable.

Q: When is the deadline to file Form 49276 (MF-360)?

A: The form must be filed and any taxes owed must be paid by the last day of the month following the reporting period.

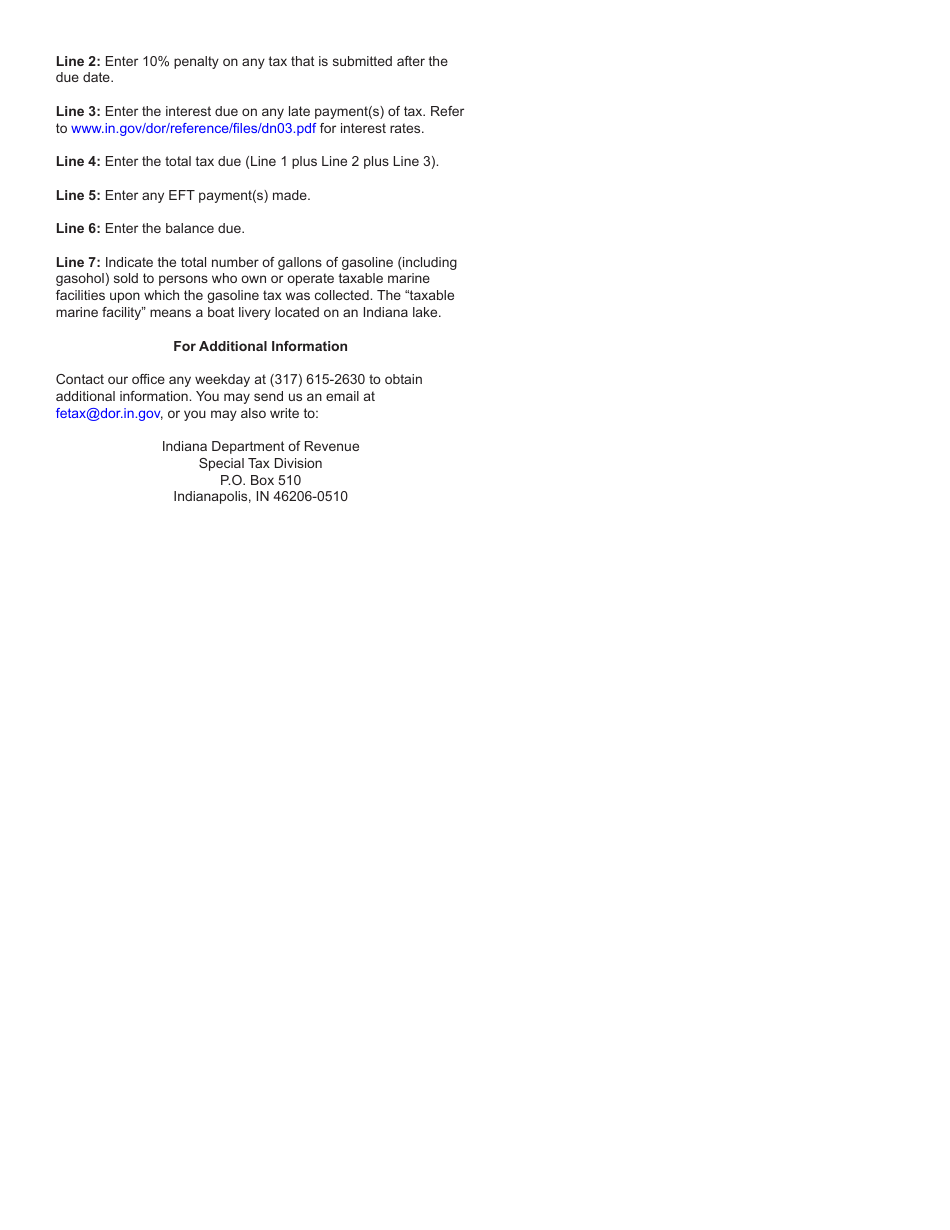

Q: Are there any penalties for late filing of Form 49276 (MF-360)?

A: Yes, there are penalties for late filing or failure to file this form, including interest charges on unpaid taxes.

Q: Can I file Form 49276 (MF-360) electronically?

A: Yes, the Indiana Department of Revenue allows electronic filing of this form.

Q: Is Form 49276 (MF-360) only for businesses?

A: Yes, this form is specifically for businesses that sell gasoline in Indiana.

Form Details:

- Released on April 6, 2018;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 49276 (MF-360) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.