This version of the form is not currently in use and is provided for reference only. Download this version of

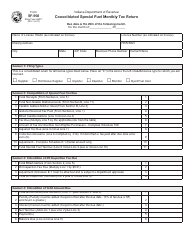

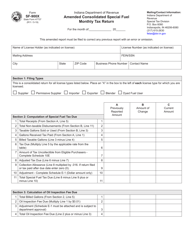

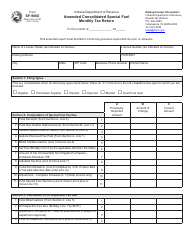

State Form 49875 (MF-360X)

for the current year.

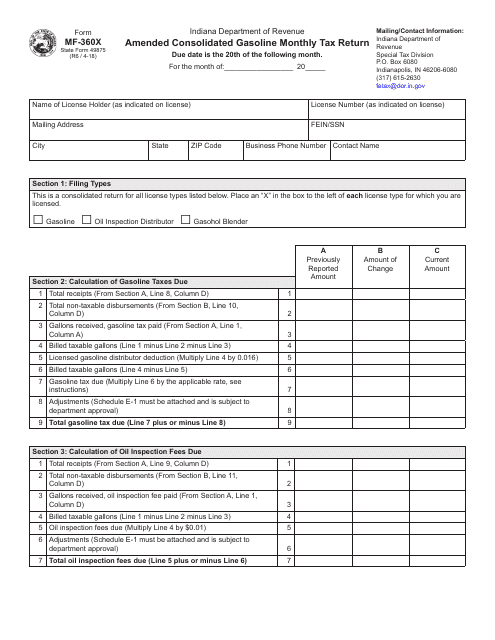

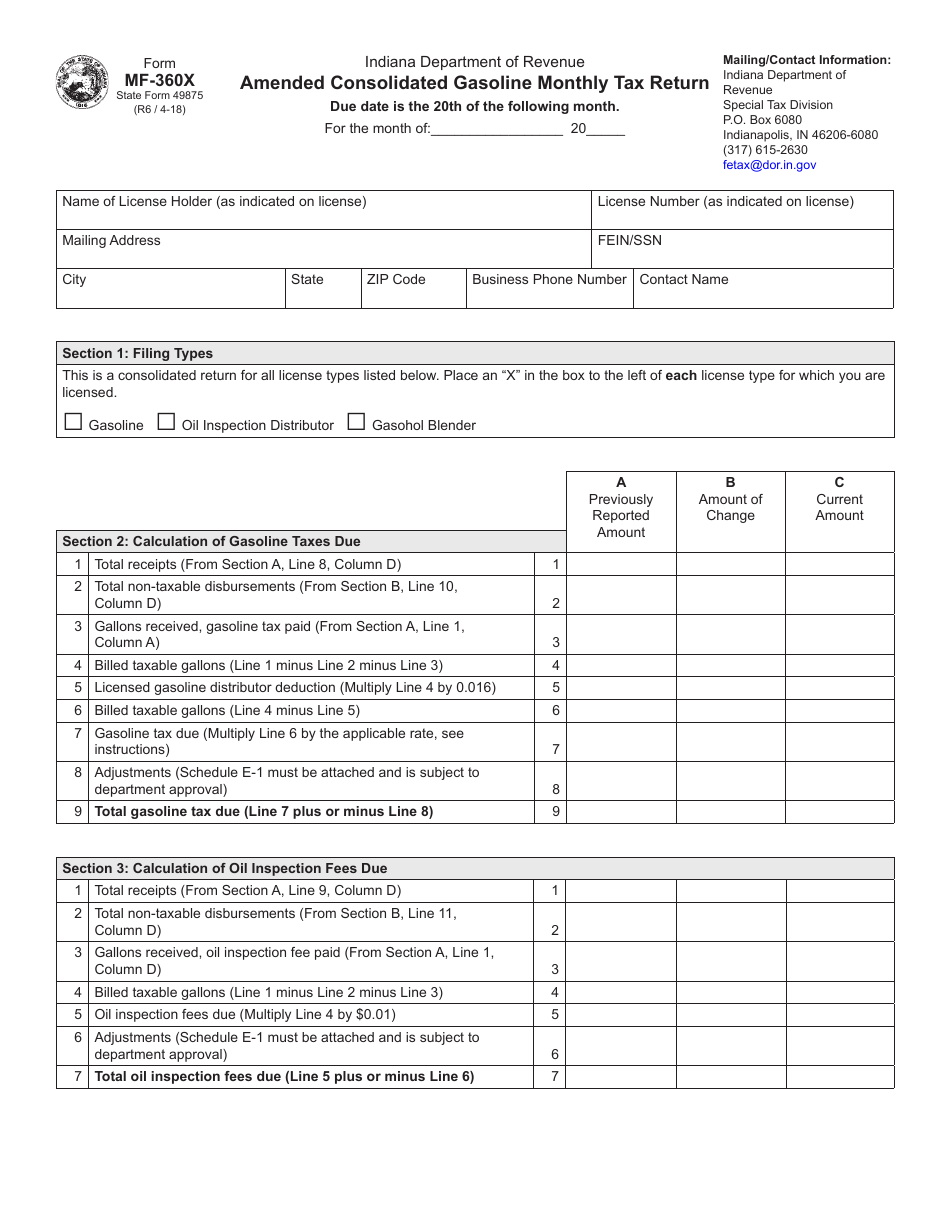

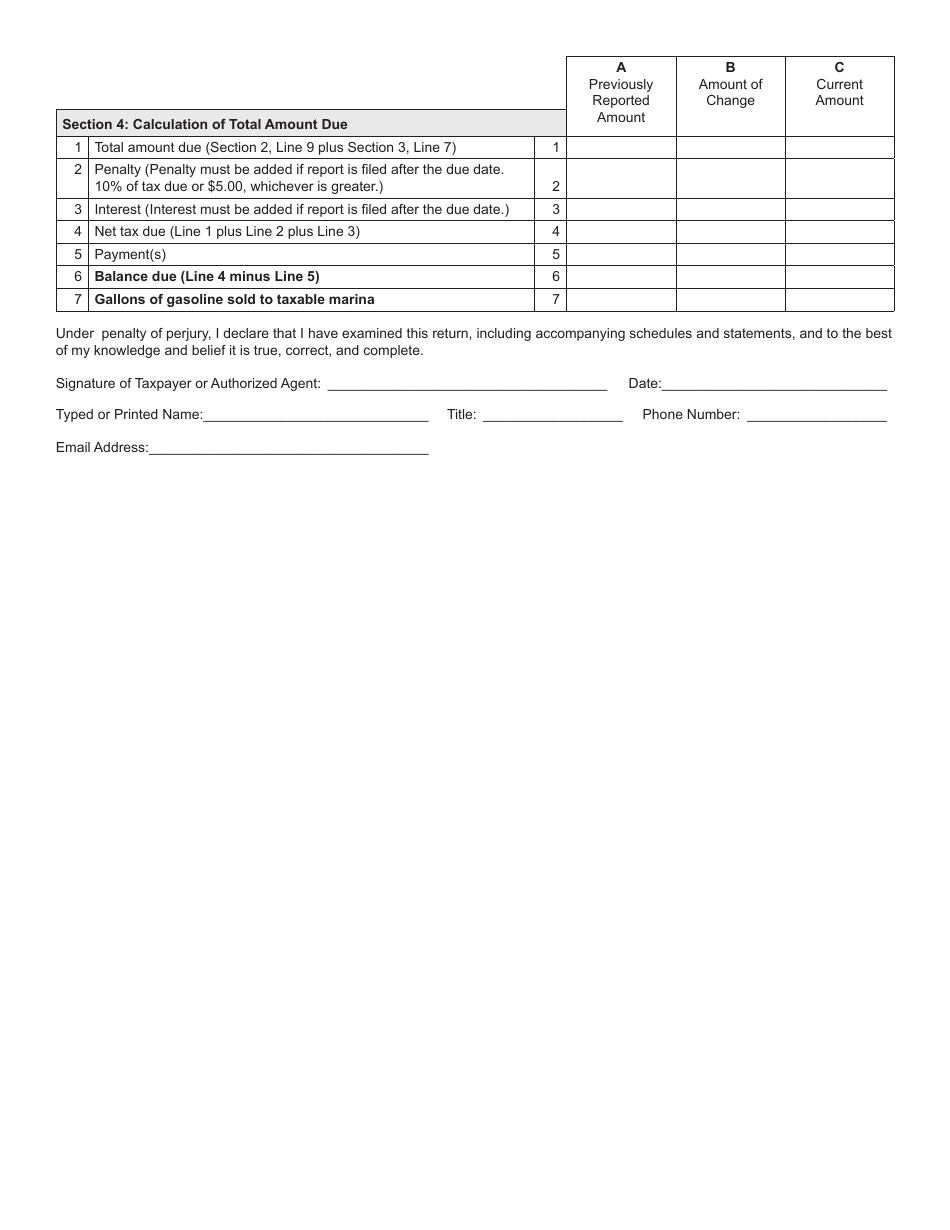

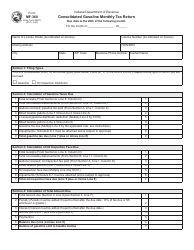

State Form 49875 (MF-360X) Amended Consolidated Gasoline Monthly Tax Return - Indiana

What Is State Form 49875 (MF-360X)?

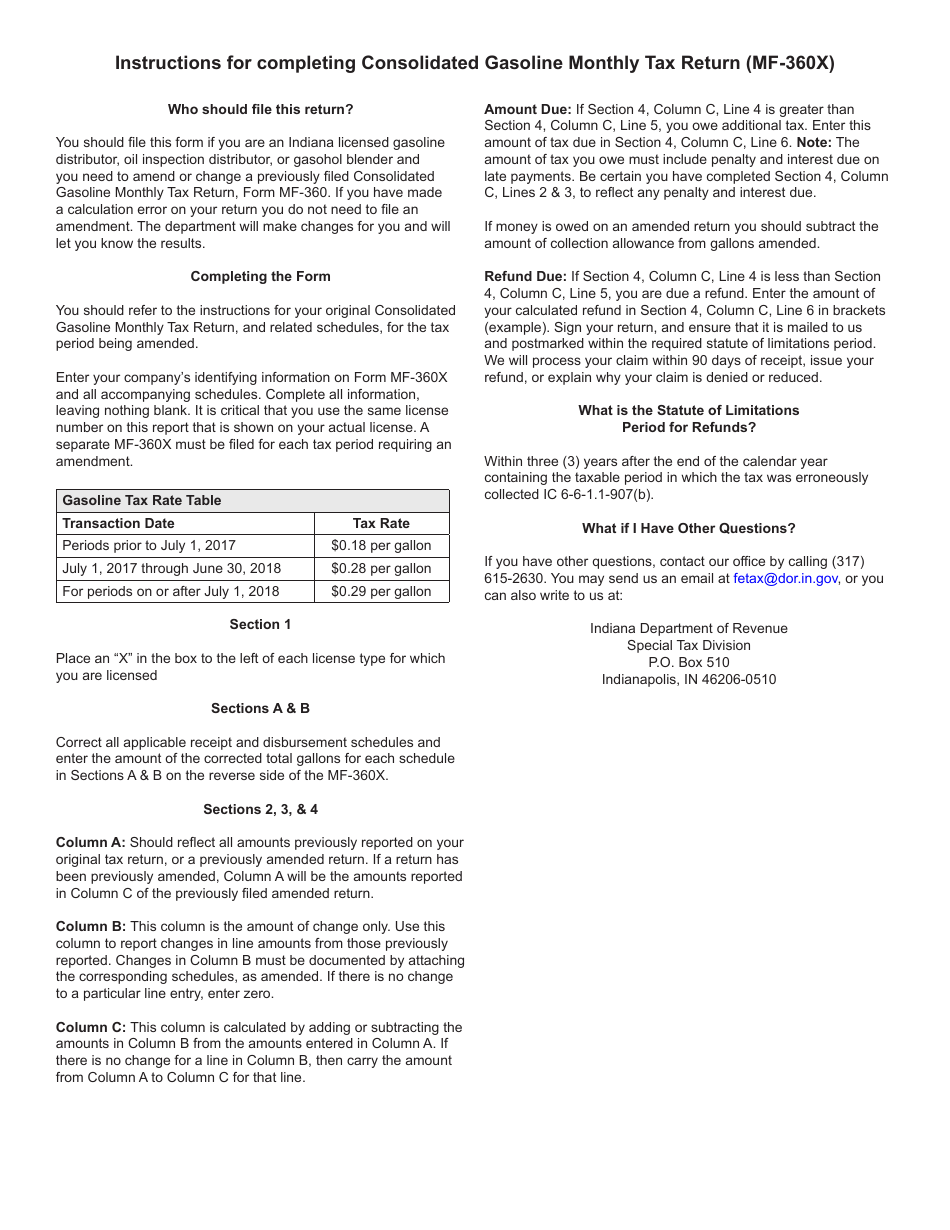

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 49875 (MF-360X)?

A: State Form 49875 (MF-360X) is the Amended Consolidated Gasoline Monthly Tax Return specific to Indiana.

Q: What is the purpose of State Form 49875?

A: The purpose of State Form 49875 is to report and amend the monthly gasoline tax payments in Indiana.

Q: Who needs to file State Form 49875?

A: Businesses and individuals who are engaged in the sale or distribution of gasoline in Indiana need to file State Form 49875.

Q: How often do I need to file State Form 49875?

A: State Form 49875 needs to be filed on a monthly basis.

Q: Are there any penalties for not filing State Form 49875?

A: Yes, failure to file State Form 49875 or paying the required taxes may result in penalties and interest.

Q: Can I file State Form 49875 electronically?

A: Yes, the Indiana Department of Revenue provides an electronic filing option for State Form 49875.

Q: What information do I need to complete State Form 49875?

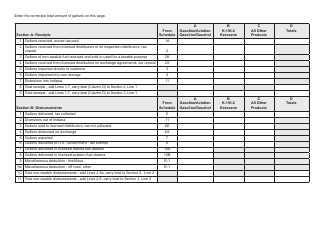

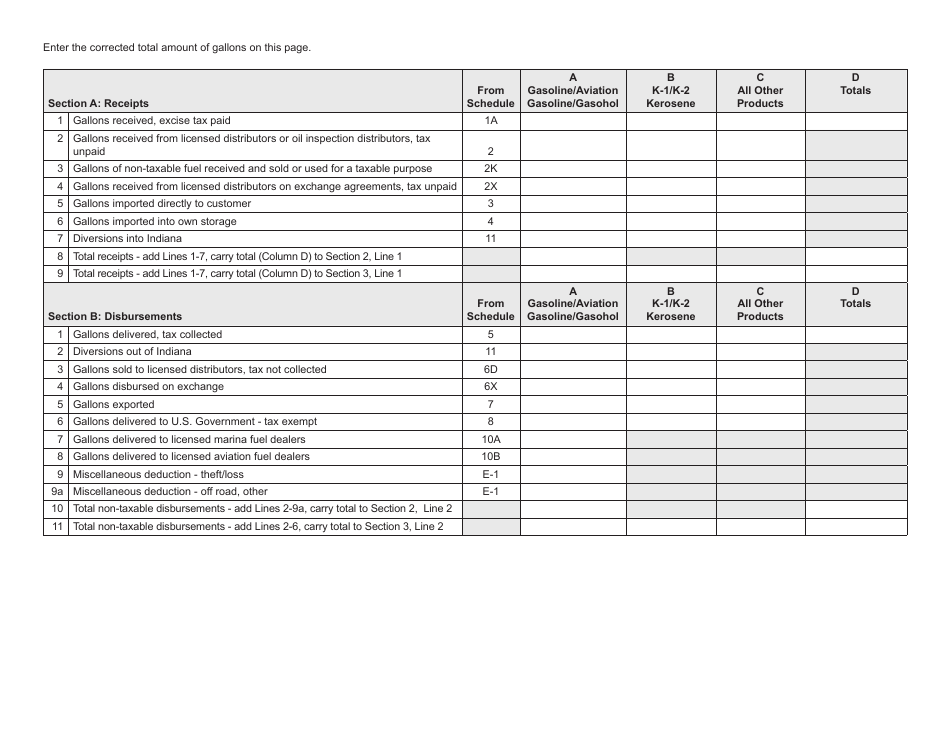

A: To complete State Form 49875, you will need to provide information on the gallons of gasoline sold or distributed, the tax rate, and any adjustments or credits.

Q: Is there a deadline for filing State Form 49875?

A: Yes, State Form 49875 needs to be filed by the 20th day of the month following the reporting period.

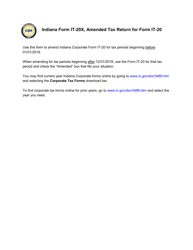

Q: What should I do if I made an error on a previously filed State Form 49875?

A: If you made an error on a previously filed State Form 49875, you should file an amended form to correct the error.

Form Details:

- Released on April 6, 2018;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 49875 (MF-360X) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.