This version of the form is not currently in use and is provided for reference only. Download this version of

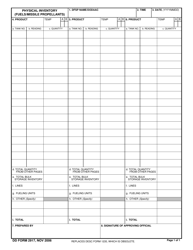

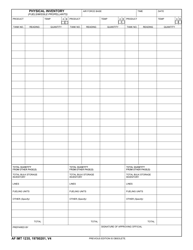

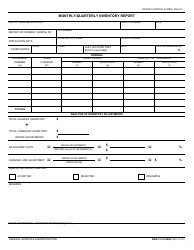

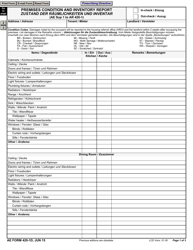

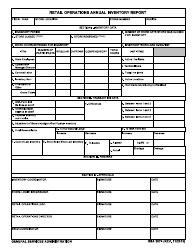

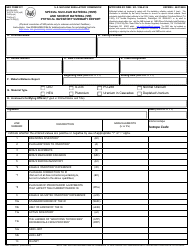

State Form 56305 (IVT-1)

for the current year.

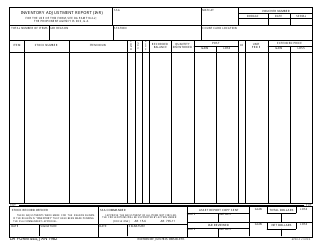

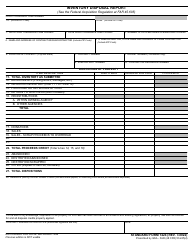

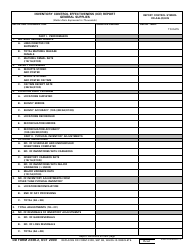

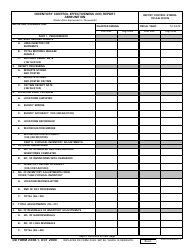

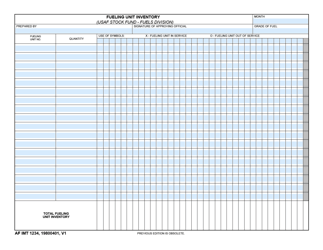

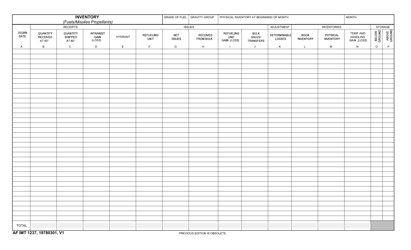

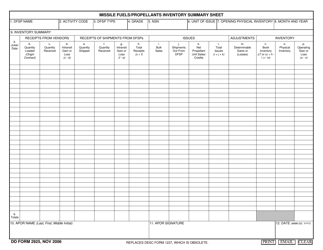

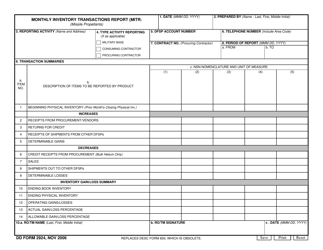

State Form 56305 (IVT-1) Fuel Inventory Report - Indiana

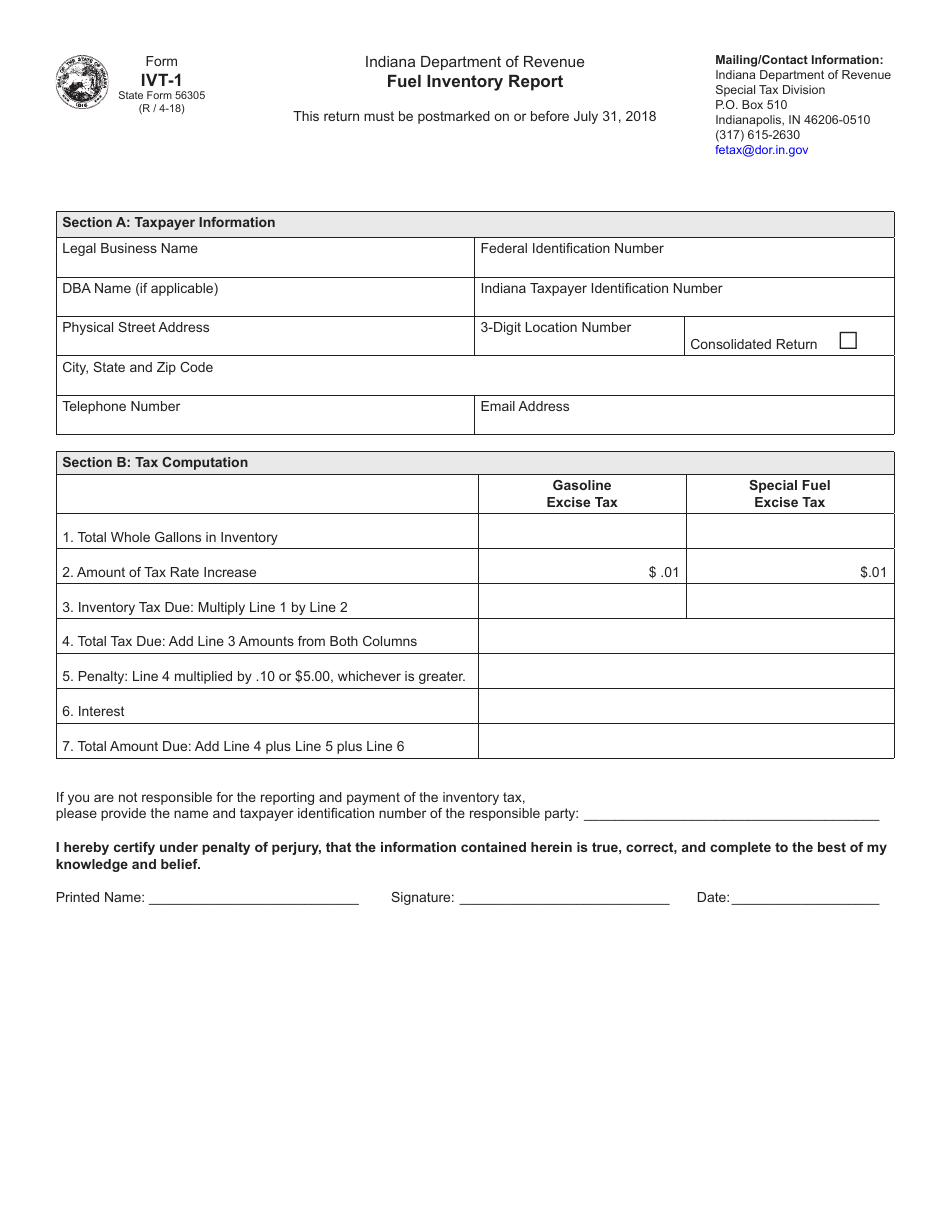

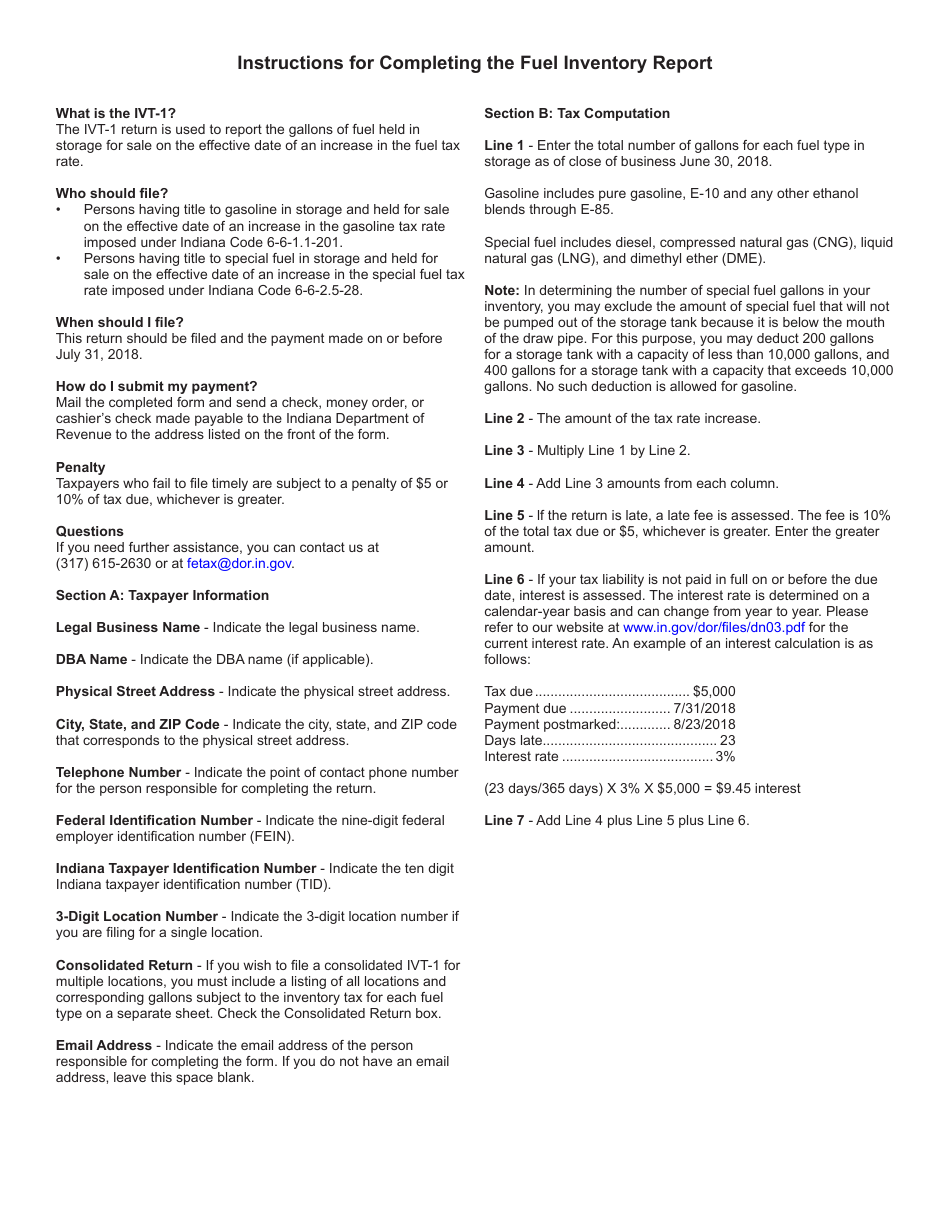

What Is State Form 56305 (IVT-1)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

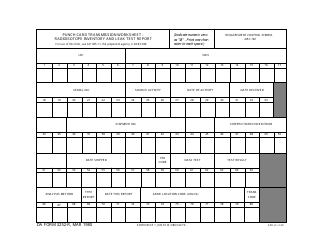

Q: What is Form 56305?

A: Form 56305 is the Fuel Inventory Report for the state of Indiana.

Q: Who needs to file Form 56305?

A: Anyone who owns or operates a facility with a regulated fuel storage capacity in Indiana needs to file Form 56305.

Q: What is the purpose of Form 56305?

A: The purpose of Form 56305 is to report the inventory of regulated fuels stored at a facility in Indiana.

Q: When is Form 56305 due?

A: Form 56305 is due by the 15th of each month for the previous month's inventory.

Q: Are there any penalties for not filing Form 56305?

A: Yes, failure to file Form 56305 or filing an incomplete or incorrect form may result in penalties imposed by the Indiana Department of Revenue.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 56305 (IVT-1) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.