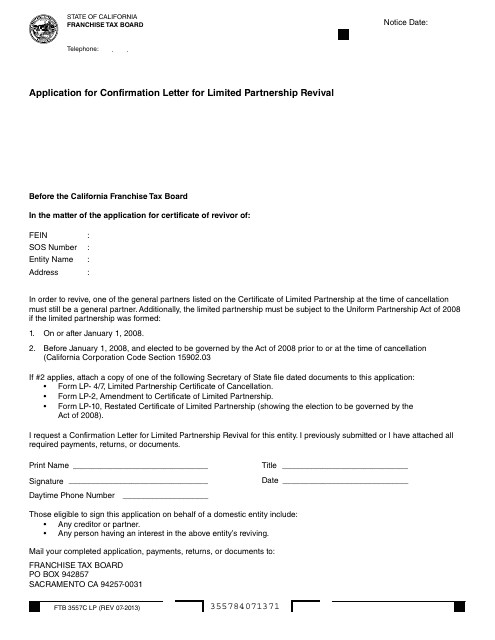

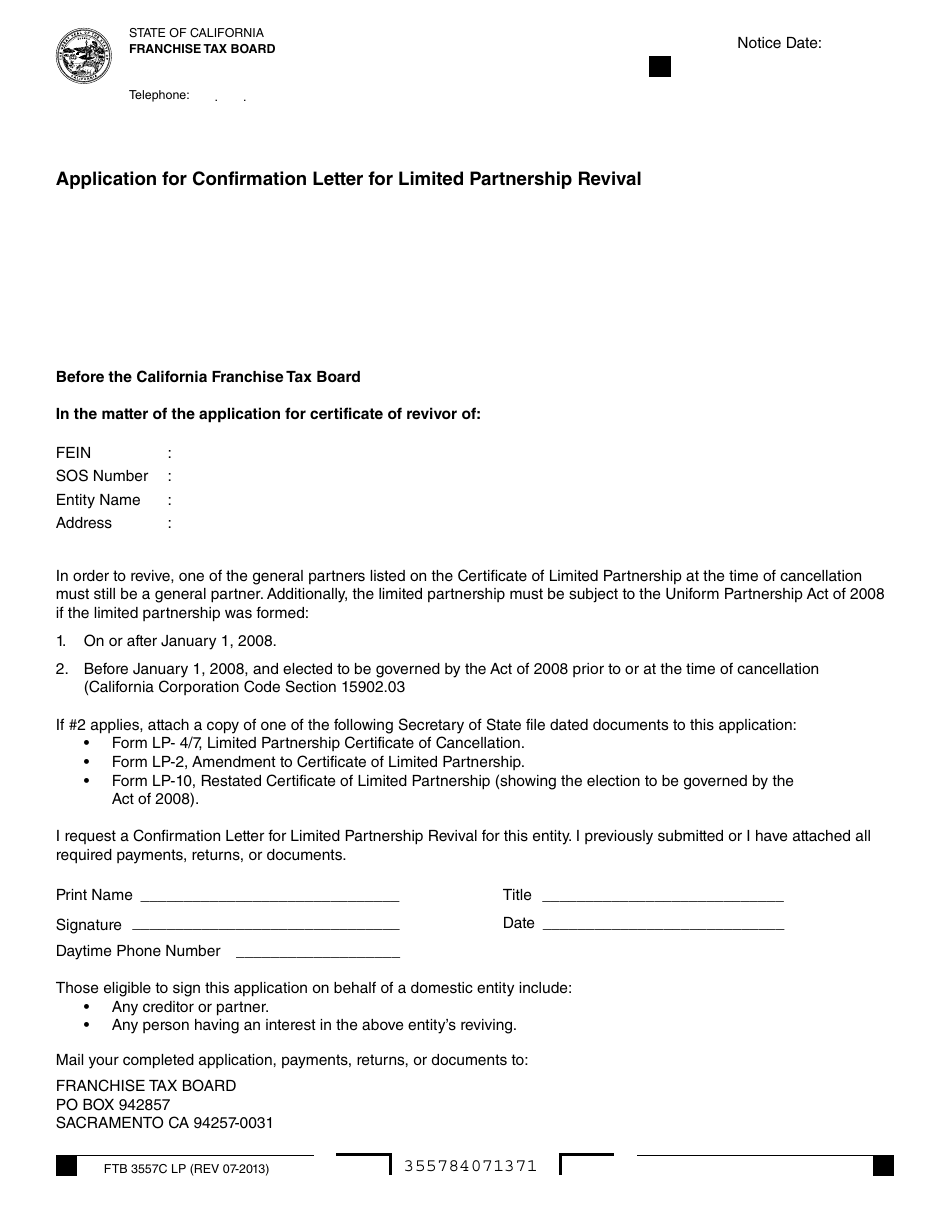

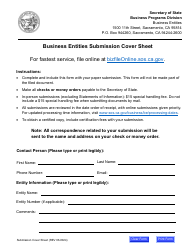

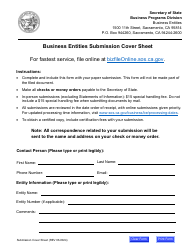

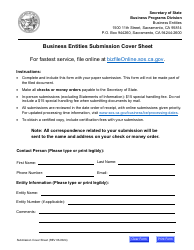

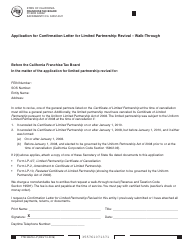

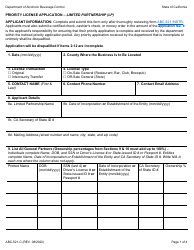

Form FTB3557C LP Application for Confirmation Letter for Limited Partnership Revival - California

What Is Form FTB3557C LP?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3557C?

A: Form FTB3557C is an application for confirmation letter for limited partnership revival in the state of California.

Q: Who can file Form FTB3557C?

A: Any limited partnership that has been suspended by the Franchise Tax Board of California can file Form FTB3557C to request a confirmation letter for revival.

Q: Why would a limited partnership file Form FTB3557C?

A: A limited partnership would file Form FTB3557C to reinstate its status as an active entity after being suspended by the Franchise Tax Board.

Q: Are there any fees for filing Form FTB3557C?

A: Yes, there is a fee of $25 for filing Form FTB3557C.

Q: What information is required on Form FTB3557C?

A: Form FTB3557C requires information such as the limited partnership's name, address, tax identification number, and the reason for the suspension.

Q: How long does it take to process Form FTB3557C?

A: The processing time for Form FTB3557C can vary, but it generally takes several weeks to receive the confirmation letter.

Q: What is the purpose of the confirmation letter?

A: The confirmation letter issued after filing Form FTB3557C serves as proof that the limited partnership's status has been revived and it is once again an active entity.

Q: Is Form FTB3557C specific to limited partnerships in California?

A: Yes, Form FTB3557C is specific to limited partnerships in the state of California.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3557C LP by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.