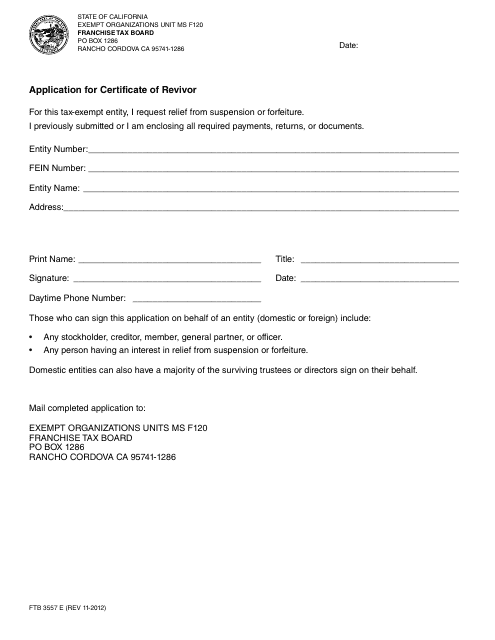

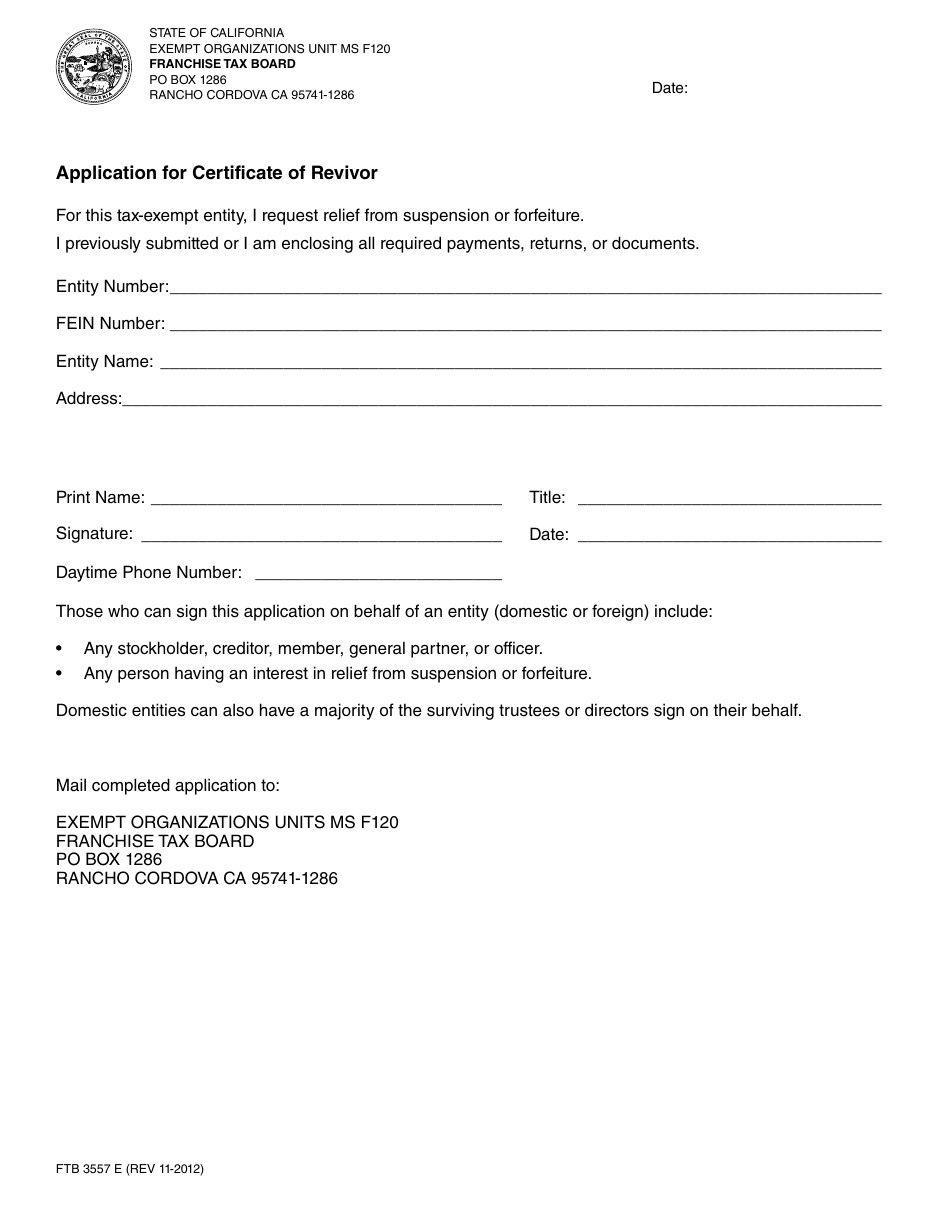

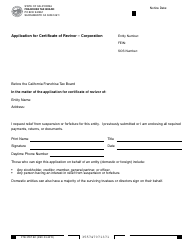

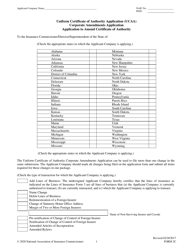

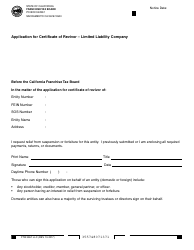

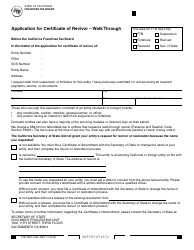

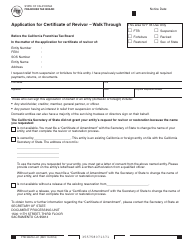

Form FTB3557 E Application for Certificate of Revivor - California

What Is Form FTB3557 E?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3557 E?

A: Form FTB3557 E is the application for Certificate of Revivor in California.

Q: When should I use Form FTB3557 E?

A: You should use Form FTB3557 E when you want to revive a California business entity that has been suspended or forfeited.

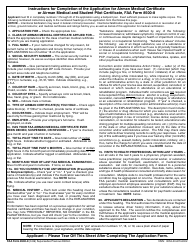

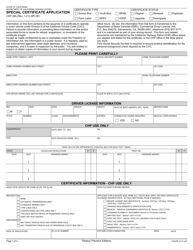

Q: How do I fill out Form FTB3557 E?

A: You need to provide the requested information, such as the entity name, identification number, and the reason for the suspension or forfeiture.

Q: Are there any fees to file Form FTB3557 E?

A: Yes, there is a fee to file Form FTB3557 E. The fee amount varies depending on the type of entity.

Q: How long does it take to process Form FTB3557 E?

A: The processing time for Form FTB3557 E varies, but it typically takes several weeks.

Q: What happens after I file Form FTB3557 E?

A: After you file Form FTB3557 E and pay the necessary fees, the FTB will review your application and determine if your entity can be reinstated.

Q: Can I file Form FTB3557 E if my entity is dissolved?

A: No, you cannot file Form FTB3557 E if your entity has been dissolved. You would need to file the appropriate paperwork to reinstate the entity first.

Form Details:

- Released on November 1, 2012;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3557 E by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.