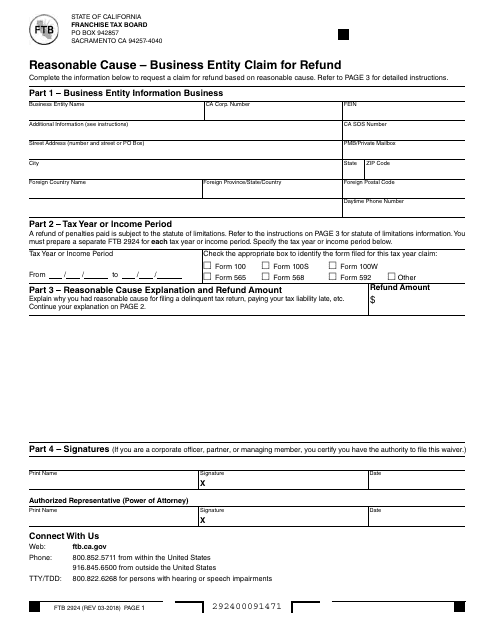

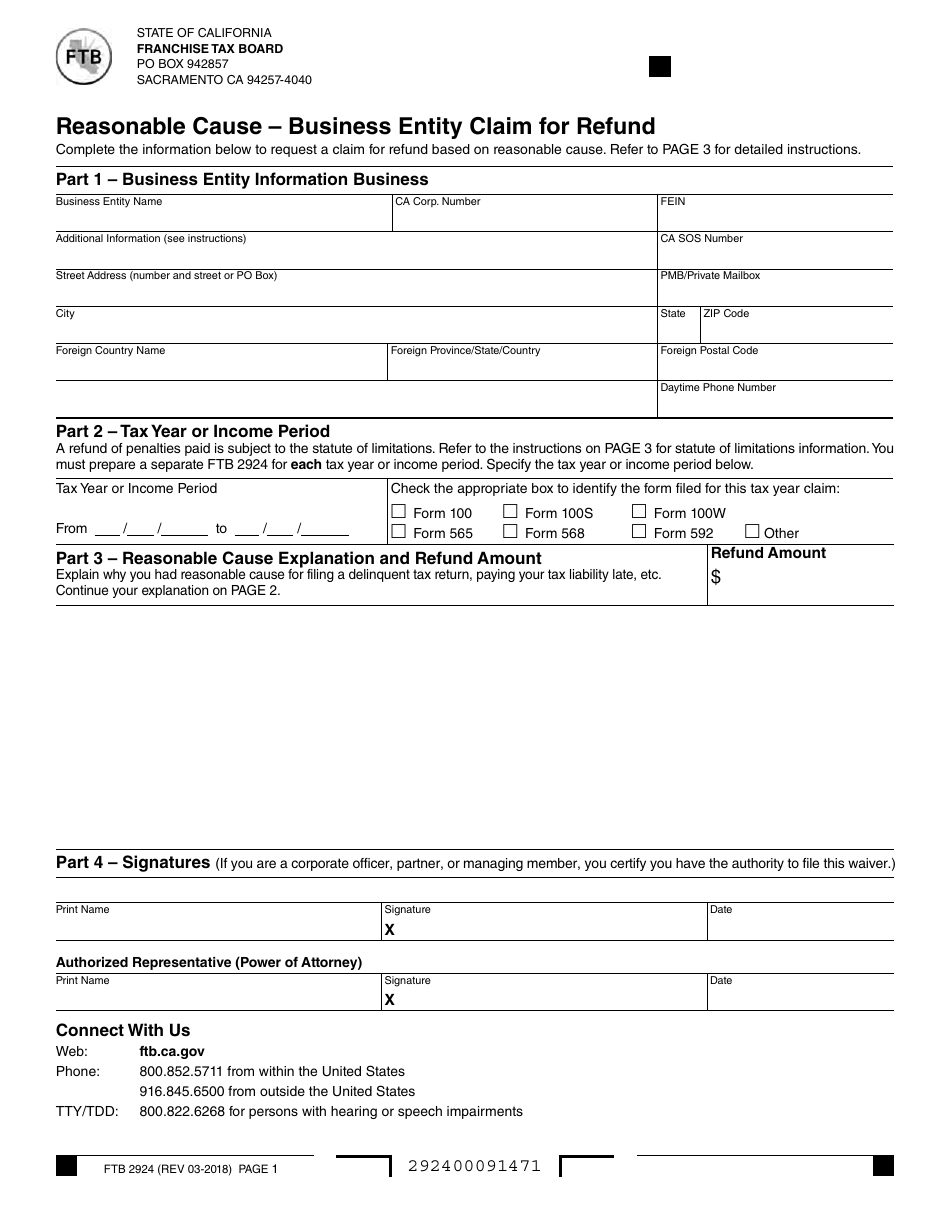

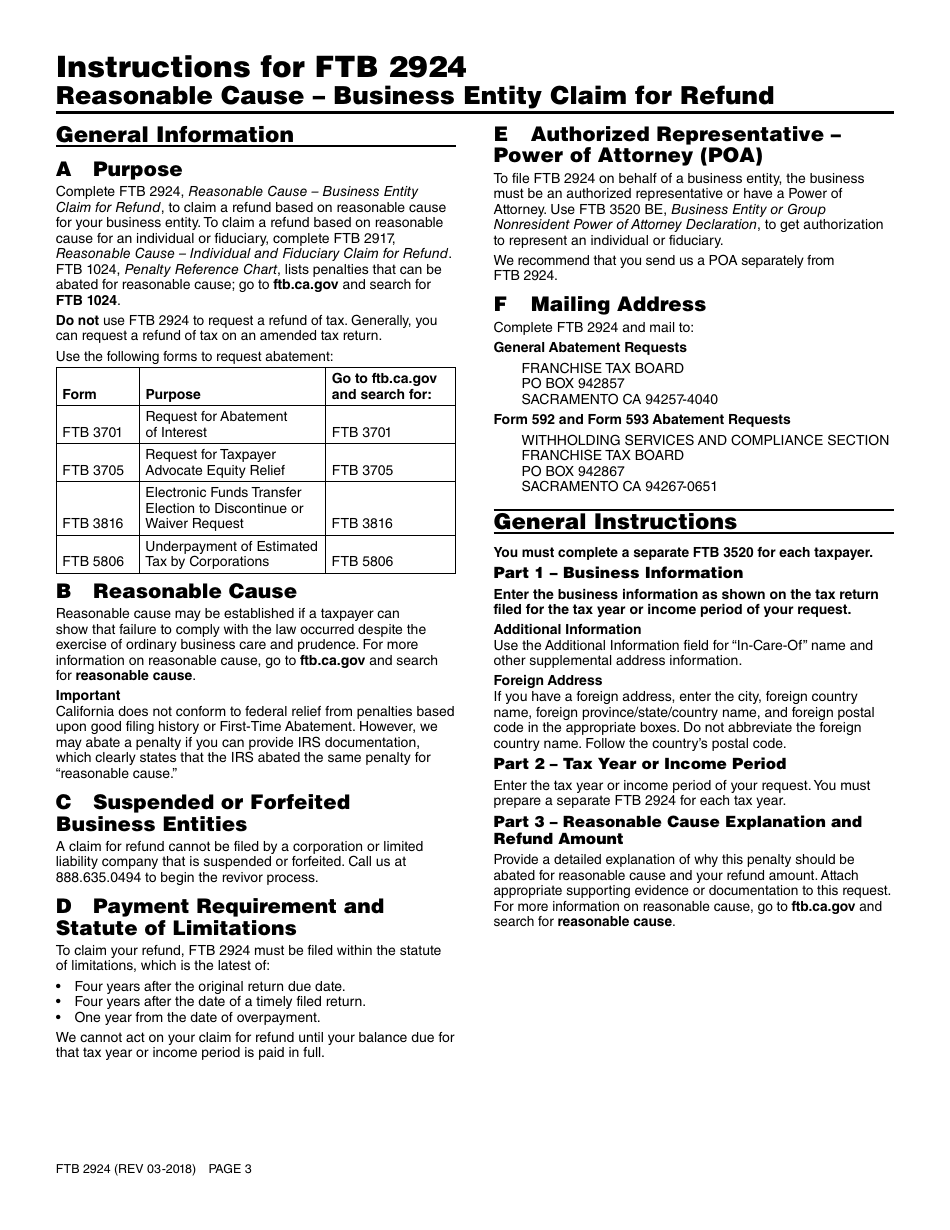

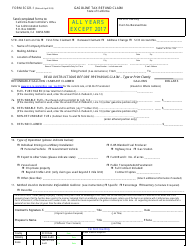

Form FTB2924 Reasonable Cause - Business Entity Claim for Refund - California

What Is Form FTB2924?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FTB Form 2924?

A: FTB Form 2924 is the Reasonable Cause - Business Entity Claim for Refund form in California.

Q: What is the purpose of FTB Form 2924?

A: The purpose of FTB Form 2924 is to claim a refund for a business entity in California based on reasonable cause for missing the deadline to file or pay taxes.

Q: What is reasonable cause?

A: Reasonable cause is a valid excuse or explanation for why a business entity was unable to file or pay taxes on time.

Q: Who can use FTB Form 2924?

A: The FTB Form 2924 can be used by business entities in California that have a valid reasonable cause for missing the tax filing or payment deadline.

Q: What supporting documents are needed with FTB Form 2924?

A: Supporting documents may include a detailed explanation of the reasonable cause, evidence to support the explanation, and any other relevant documentation.

Q: When should I submit FTB Form 2924?

A: FTB Form 2924 should be submitted as soon as possible after the discovery of the reasonable cause, but no later than four years from the original due date of the return or one year from the date of overpayment.

Q: What happens after I submit FTB Form 2924?

A: After submitting FTB Form 2924, the California Franchise Tax Board (FTB) will review the claim for refund and the supporting documents. If the FTB determines that the reasonable cause is valid, a refund may be issued.

Q: Are there any penalties associated with filing FTB Form 2924?

A: There may be penalties and interest associated with filing FTB Form 2924 if the California Franchise Tax Board (FTB) determines that the reasonable cause is not valid or if the claim for refund is denied.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB2924 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.