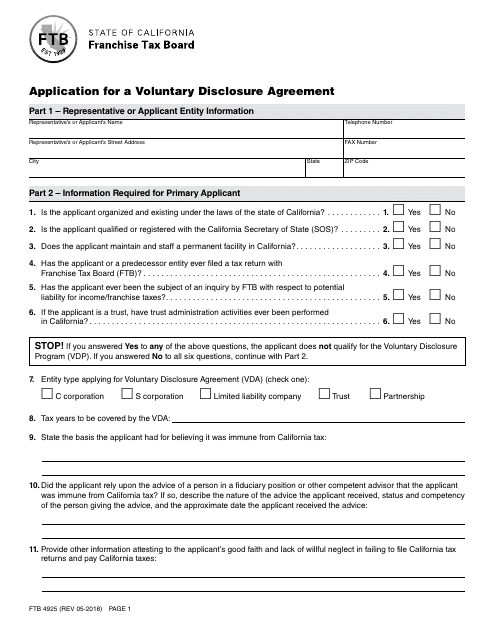

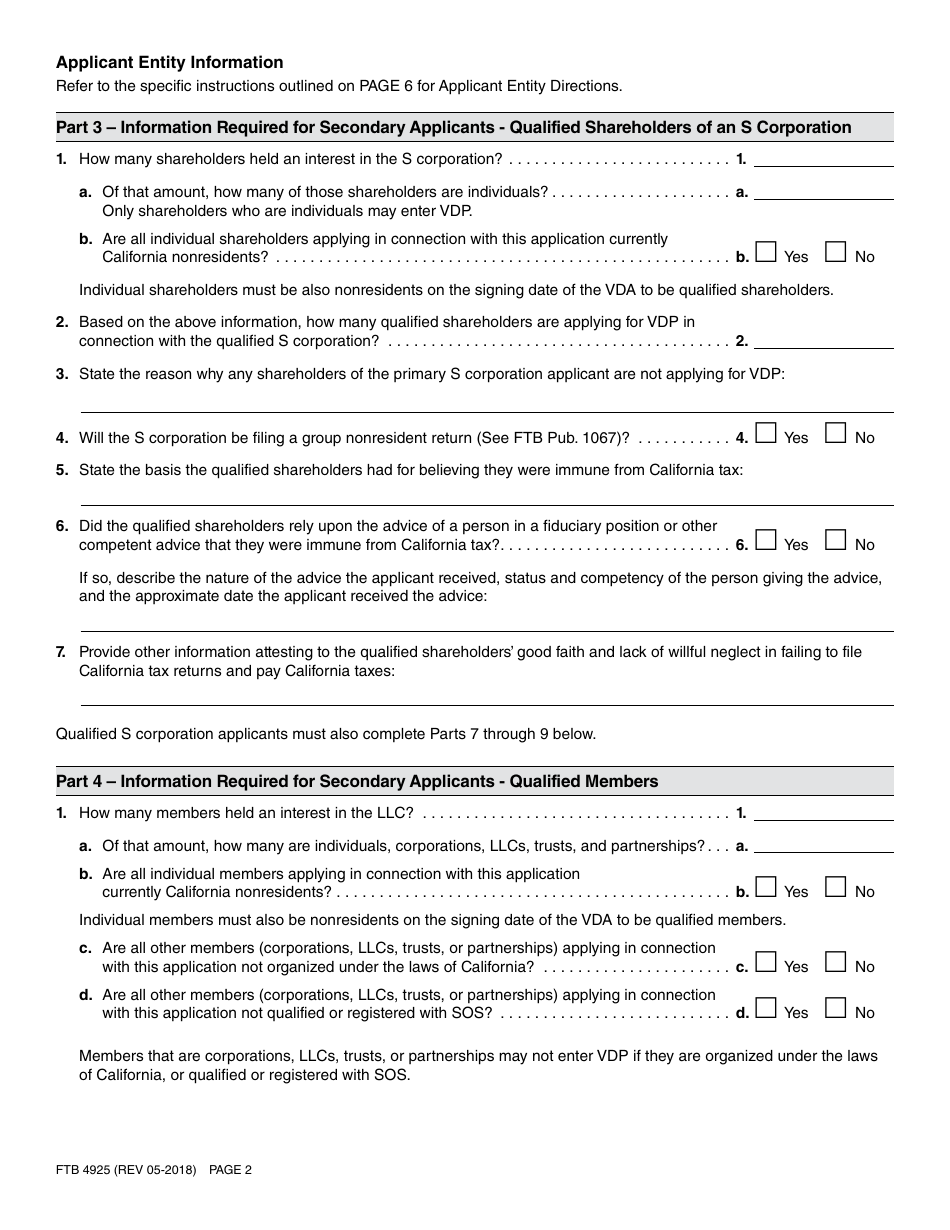

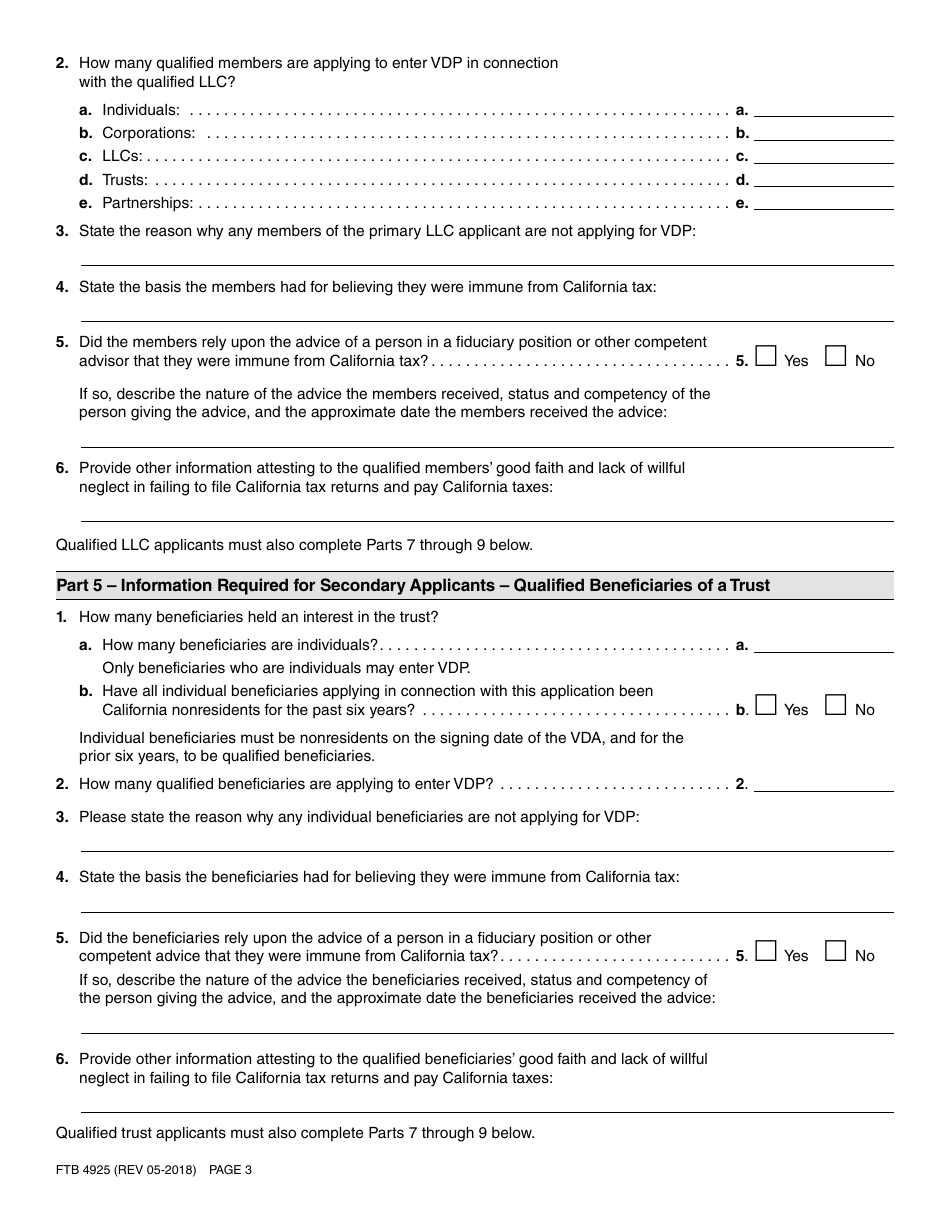

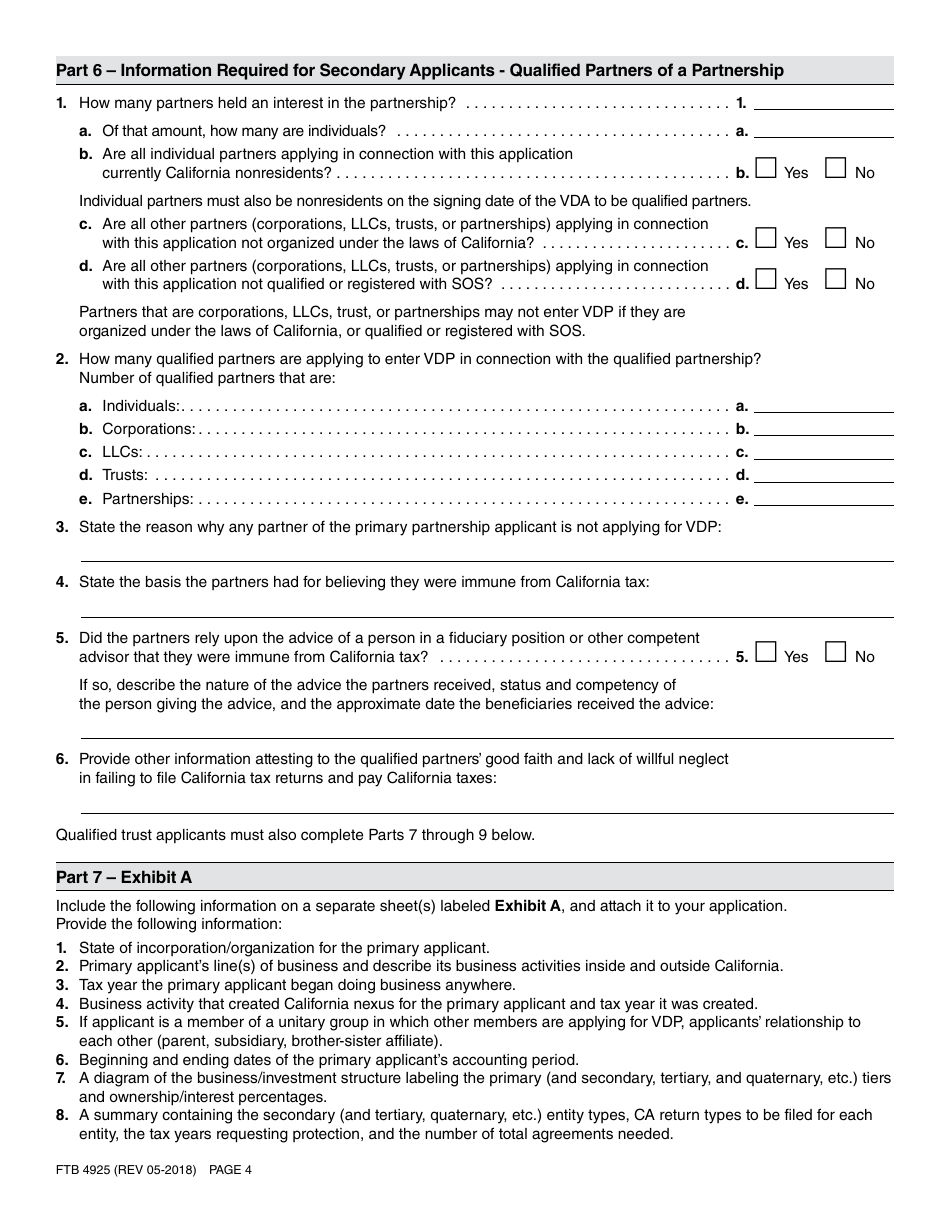

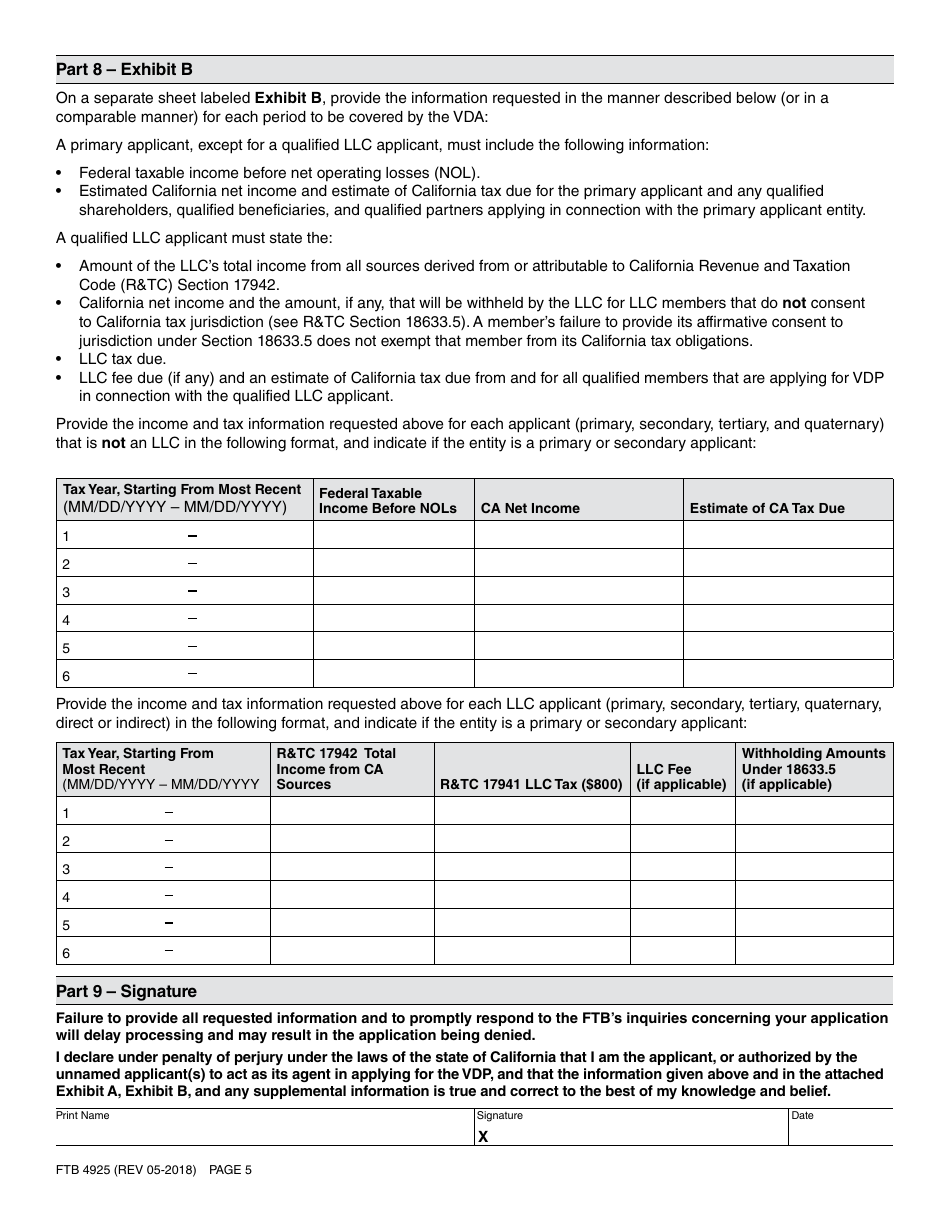

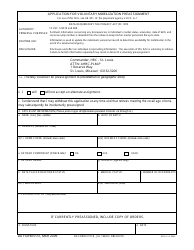

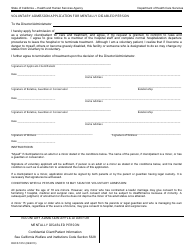

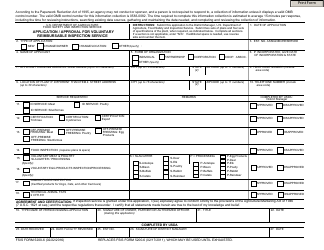

Form FTB4925 Application for a Voluntary Disclosure Agreement - California

What Is Form FTB4925?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

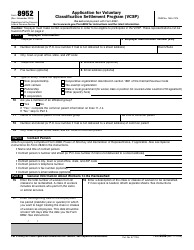

Q: What is Form FTB4925?

A: Form FTB4925 is the application for a Voluntary Disclosure Agreement in California.

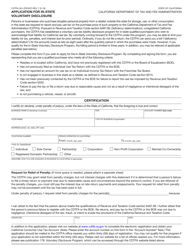

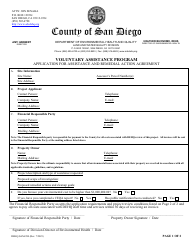

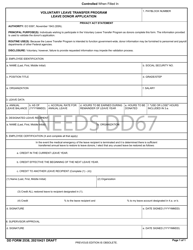

Q: What is a Voluntary Disclosure Agreement?

A: A Voluntary Disclosure Agreement is an opportunity for taxpayers to disclose and pay any outstanding tax liabilities they may have in California.

Q: Who needs to file Form FTB4925?

A: Taxpayers who have outstanding tax liabilities in California and want to voluntarily disclose them should file Form FTB4925.

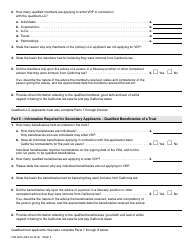

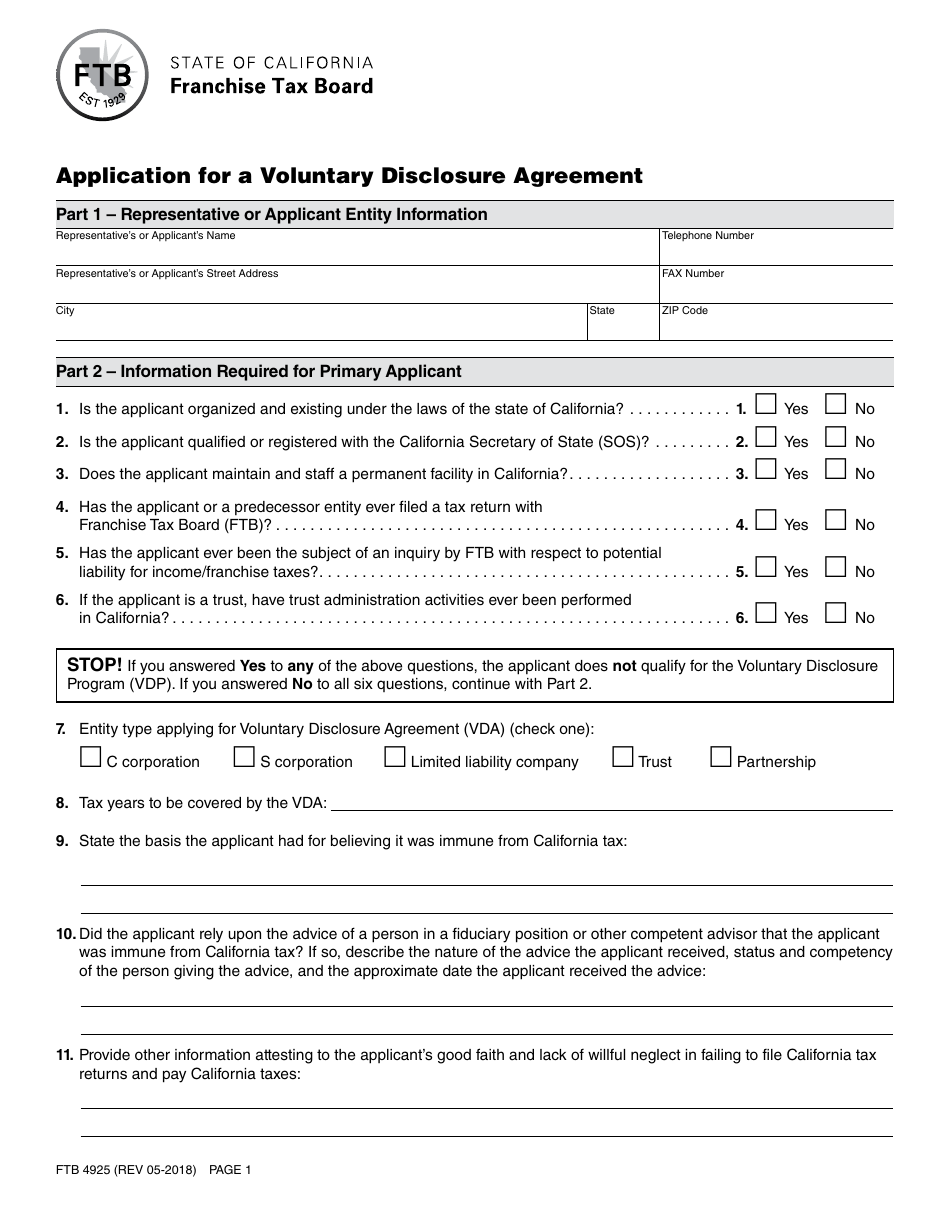

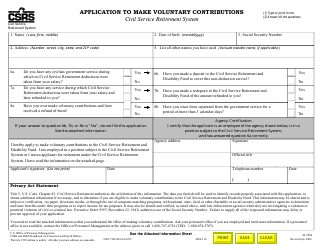

Q: What information is required on Form FTB4925?

A: Form FTB4925 requires the taxpayer to provide detailed information about their outstanding tax liabilities, including the tax years involved and the amount owed.

Q: Are there any penalties for filing Form FTB4925?

A: By filing Form FTB4925 and entering into a Voluntary Disclosure Agreement, taxpayers may be able to avoid certain penalties that would otherwise apply.

Q: Can I use Form FTB4925 for other tax liabilities?

A: No, Form FTB4925 is specifically for the disclosure of outstanding tax liabilities in California.

Q: Is the information provided on Form FTB4925 confidential?

A: Yes, the information provided on Form FTB4925 is generally treated as confidential by the California Franchise Tax Board.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB4925 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.