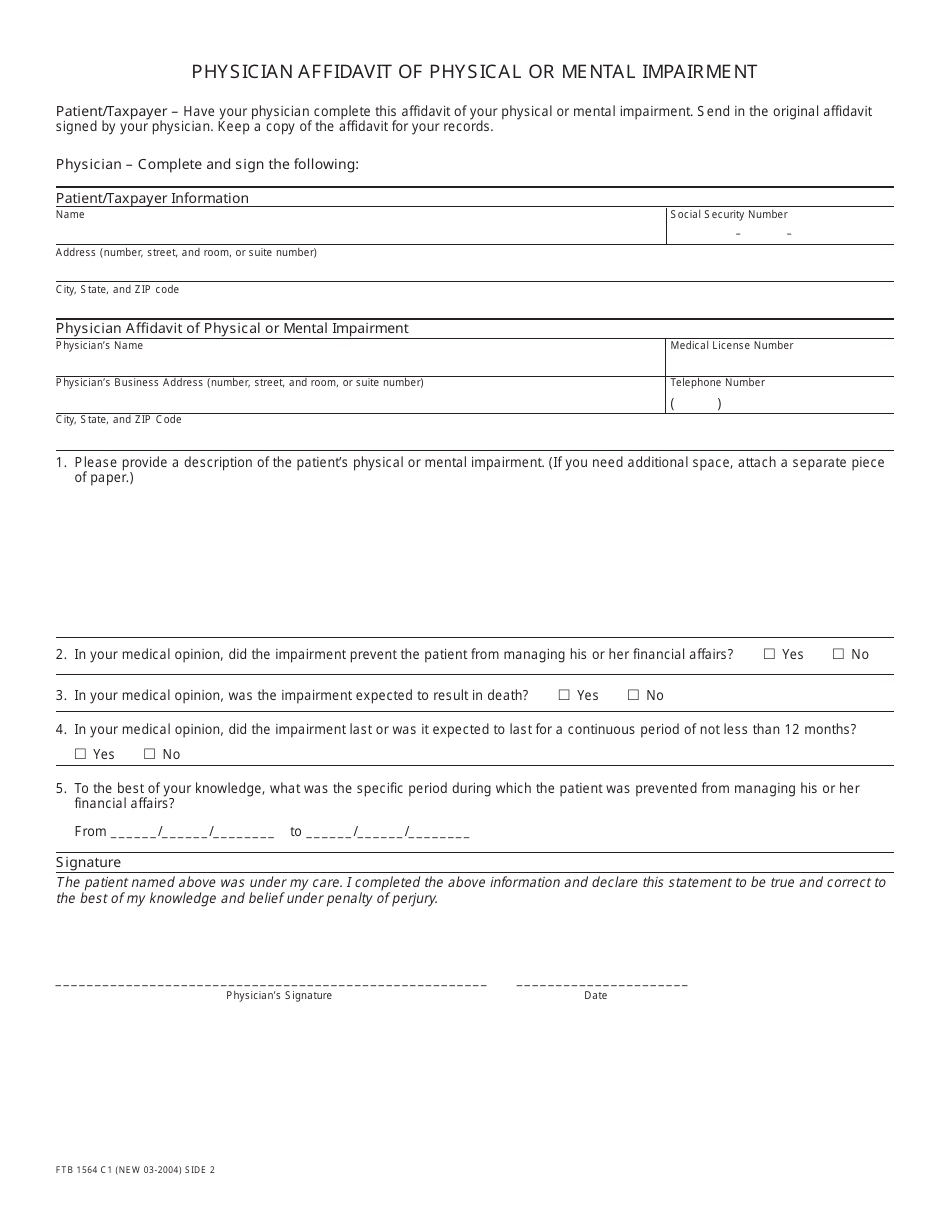

Form FTB1564 Financially Disabled - Suspension of the Statute of Limitations - California

What Is Form FTB1564?

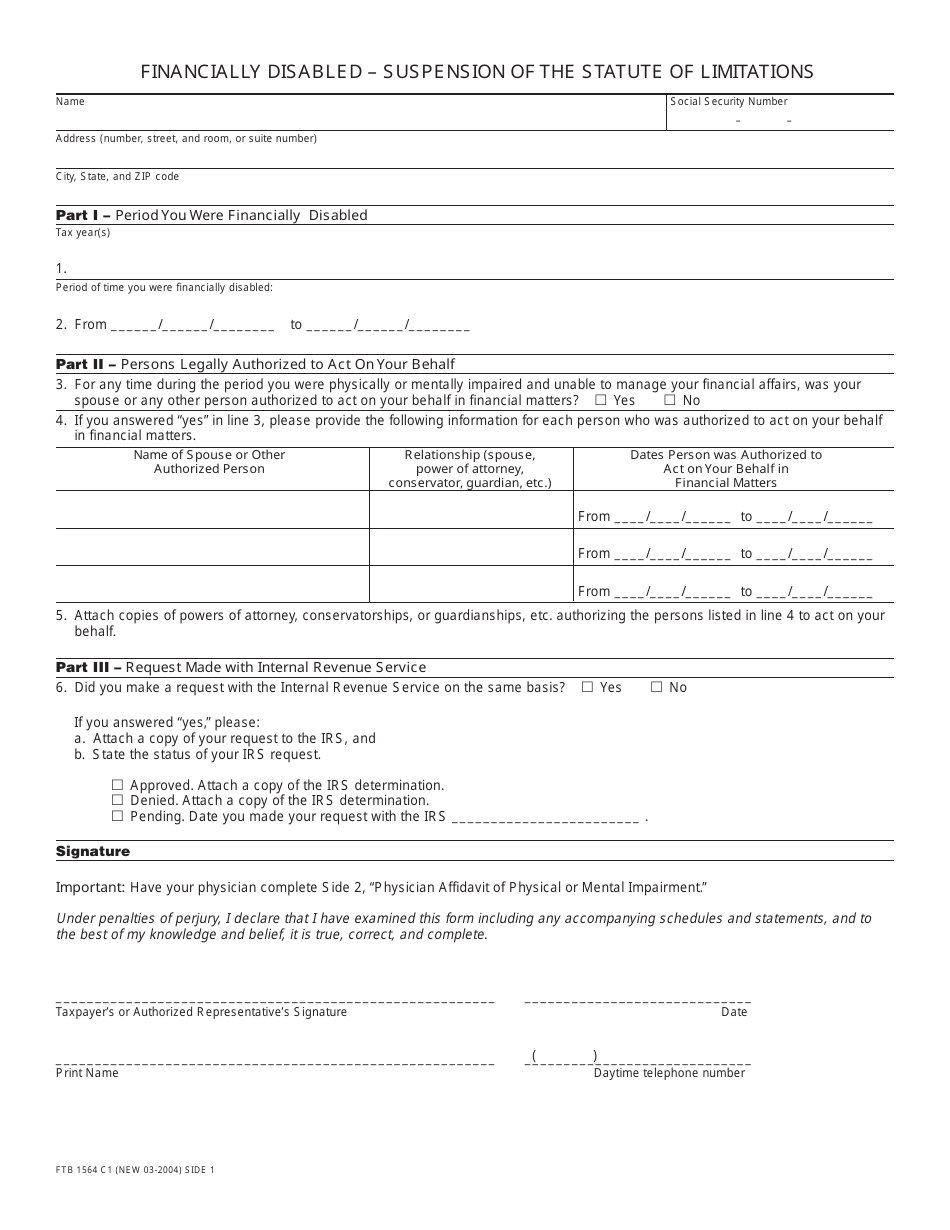

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

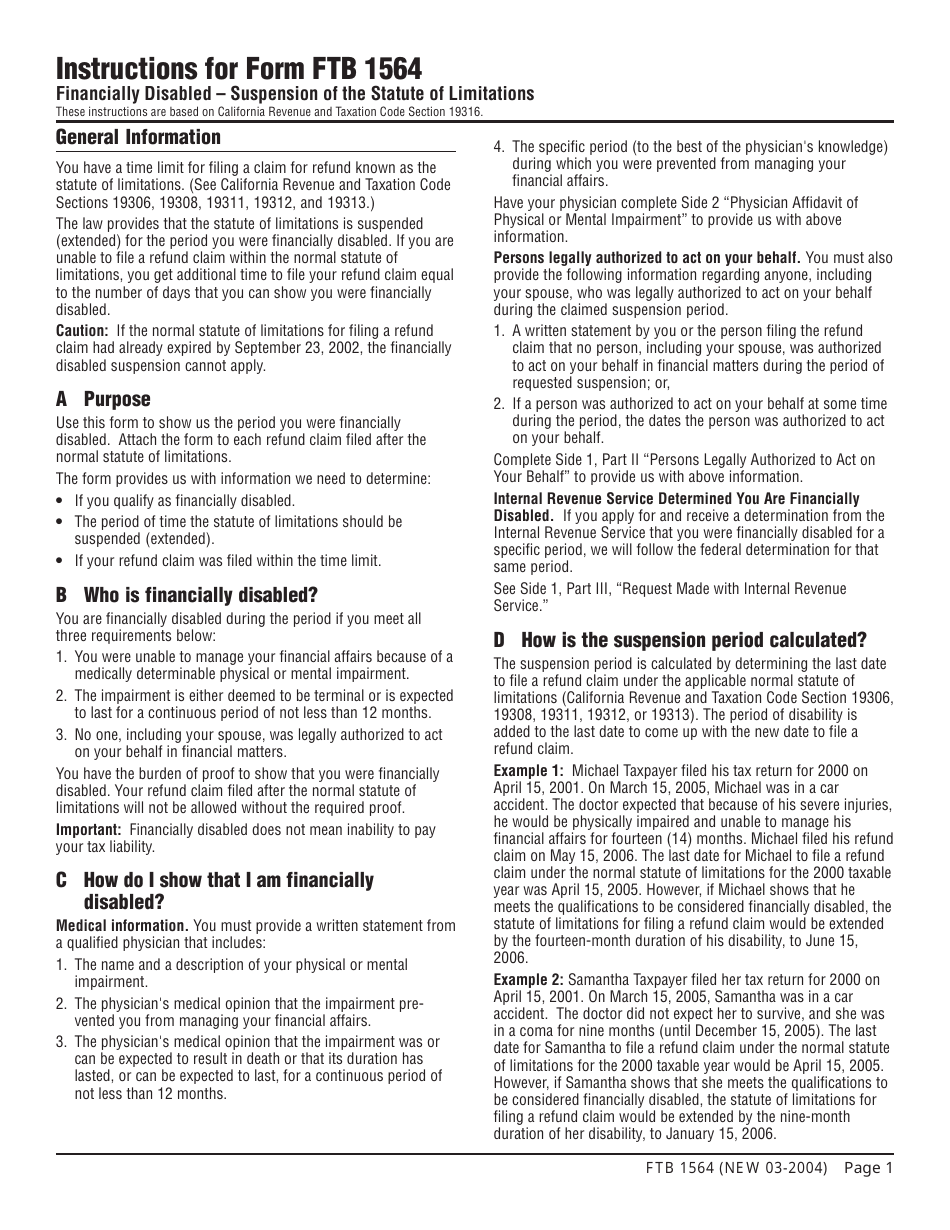

Q: What is Form FTB1564?

A: Form FTB1564 is a document used in California to request suspension of the statute of limitations due to financial disability.

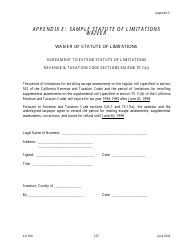

Q: What is the statute of limitations?

A: The statute of limitations is the time limit for the California Franchise Tax Board (FTB) to collect taxes.

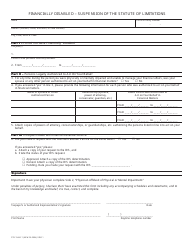

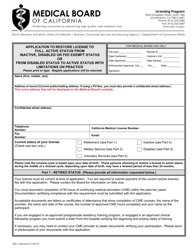

Q: Who can use Form FTB1564?

A: Individuals who are financially disabled and unable to pay their taxes can use Form FTB1564 to request suspension of the statute of limitations.

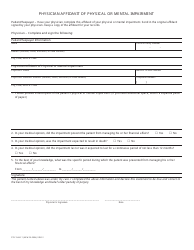

Q: What qualifies as financial disability?

A: Financial disability is defined as a condition that renders an individual unable to manage their financial affairs.

Q: How does Form FTB1564 help with the statute of limitations?

A: By submitting Form FTB1564, the statute of limitations for tax collection is suspended until the financial disability is resolved.

Q: Are there any fees associated with Form FTB1564?

A: No, there are no fees associated with Form FTB1564.

Q: What supporting documentation is required for Form FTB1564?

A: You may be required to provide medical documentation or other evidence of your financial disability when submitting Form FTB1564.

Q: How long does the statute of limitations suspension last?

A: The suspension of the statute of limitations typically lasts as long as the financial disability persists.

Q: Can I still file tax returns while the statute of limitations is suspended?

A: Yes, you should still file your tax returns even if the statute of limitations is suspended due to financial disability.

Form Details:

- Released on March 1, 2004;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB1564 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.