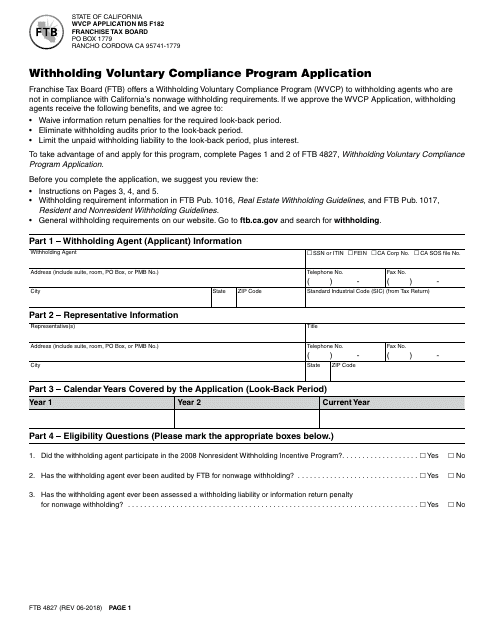

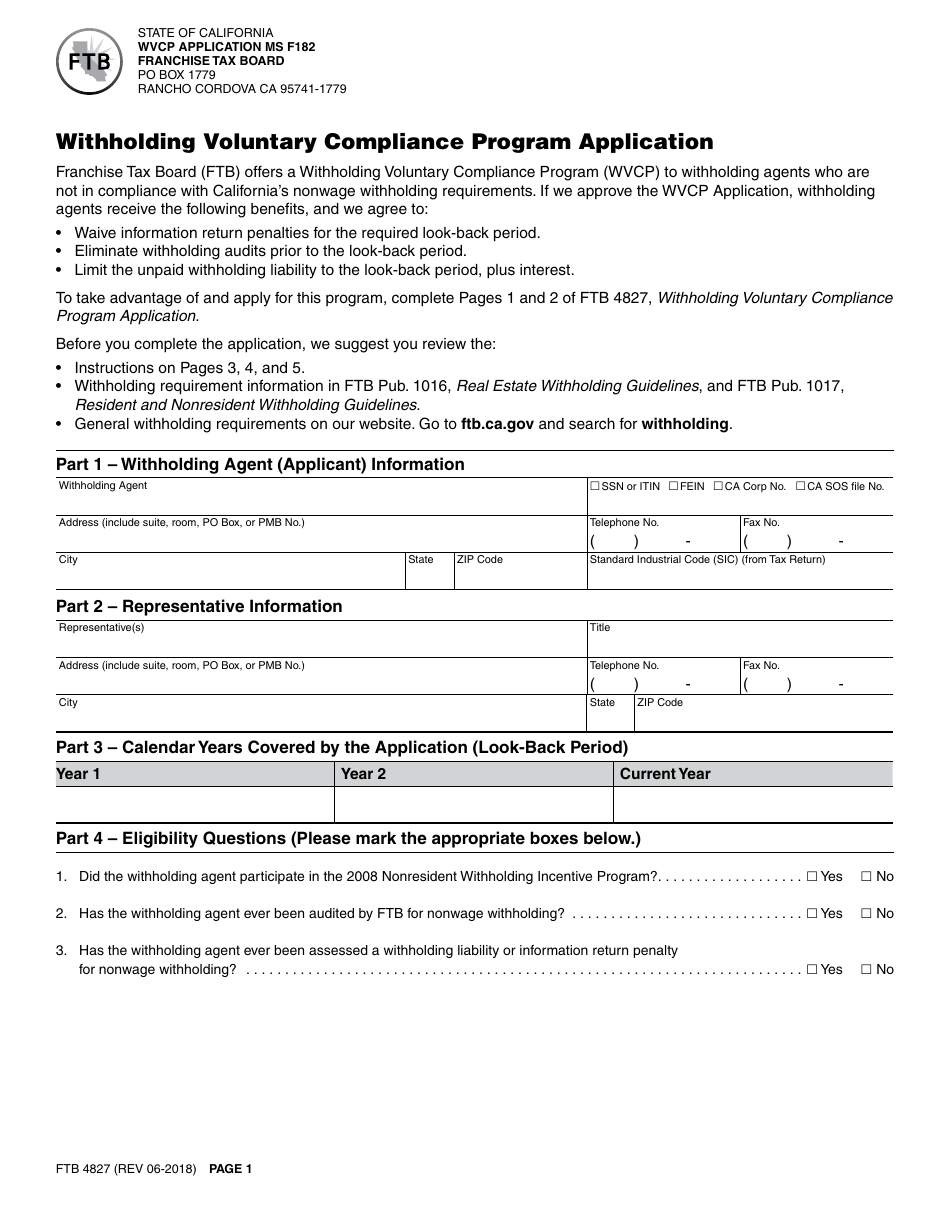

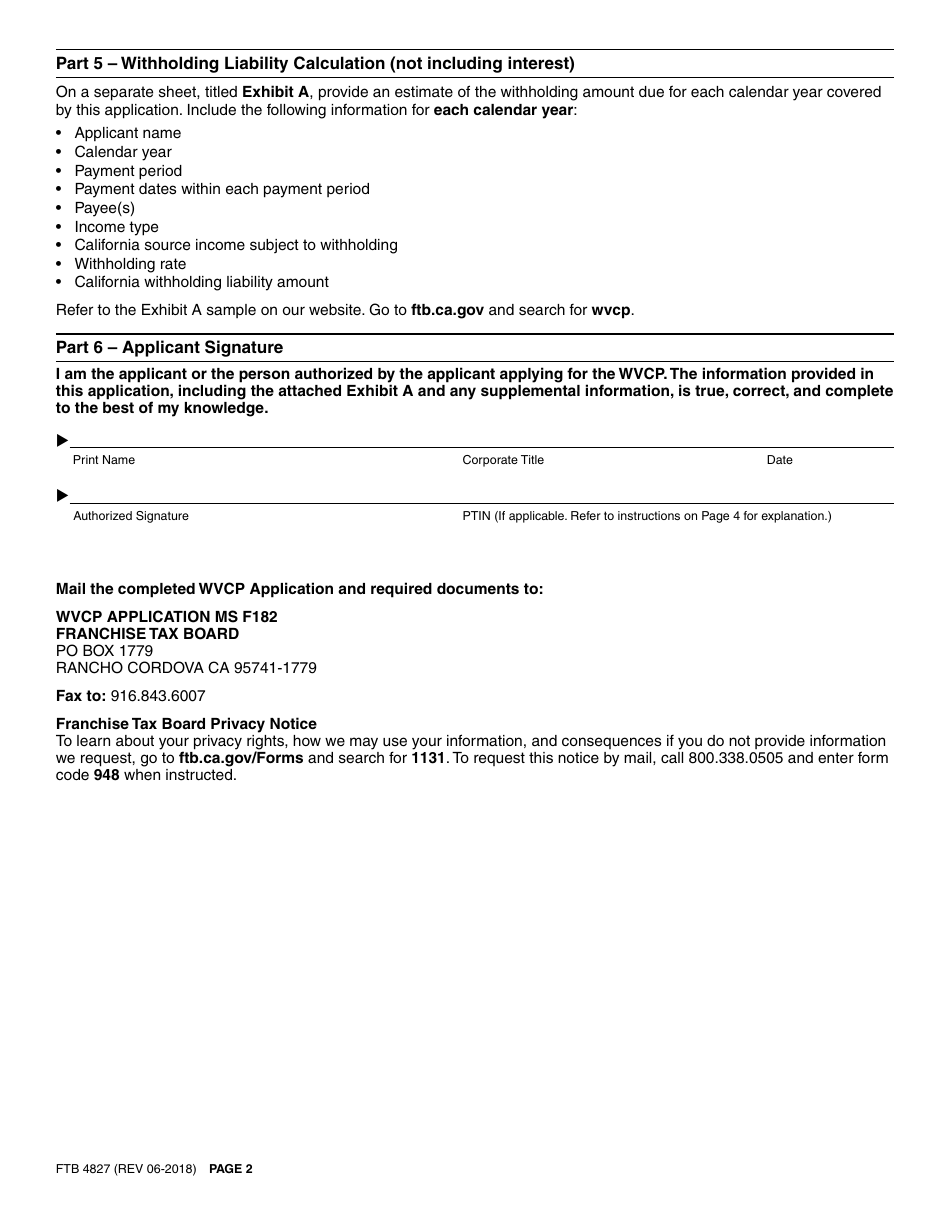

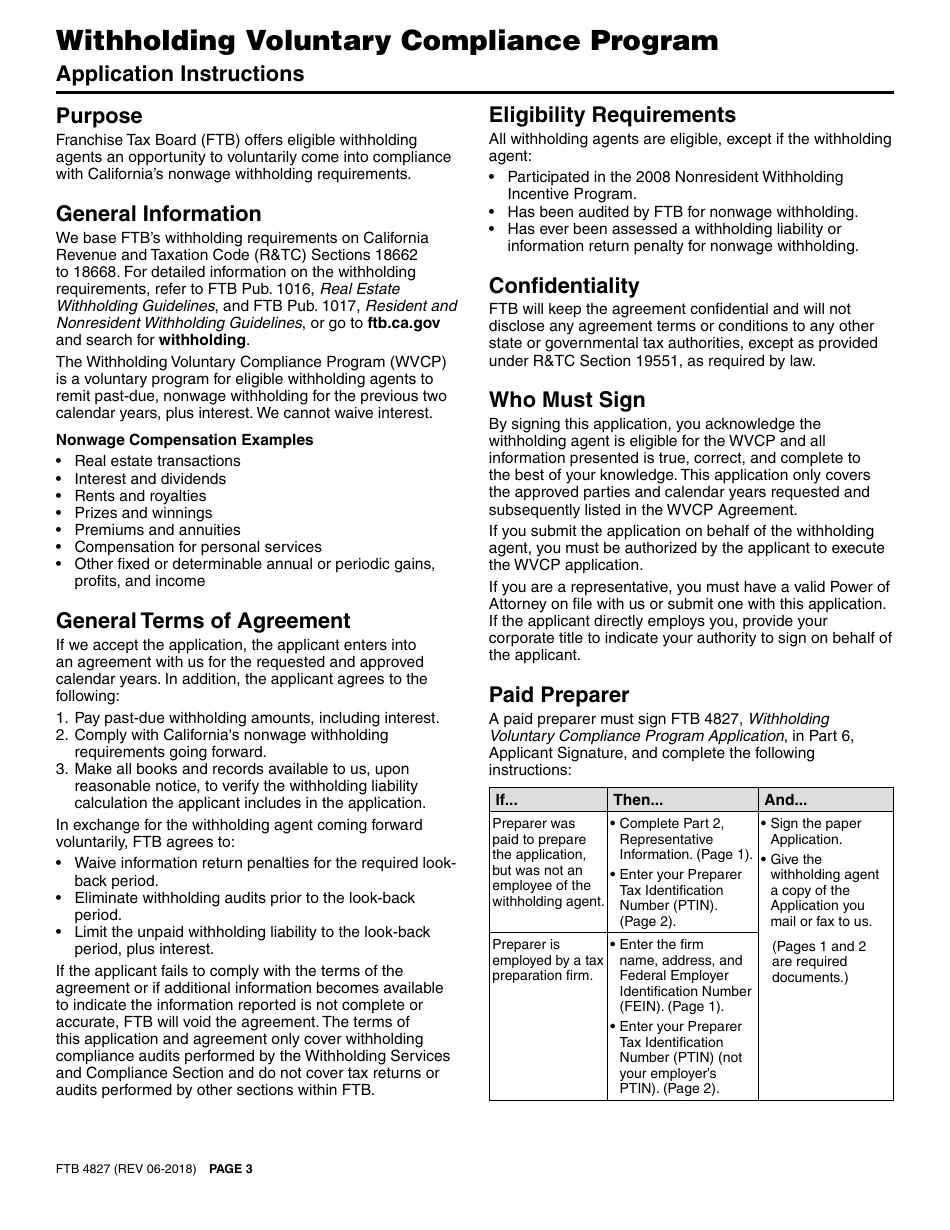

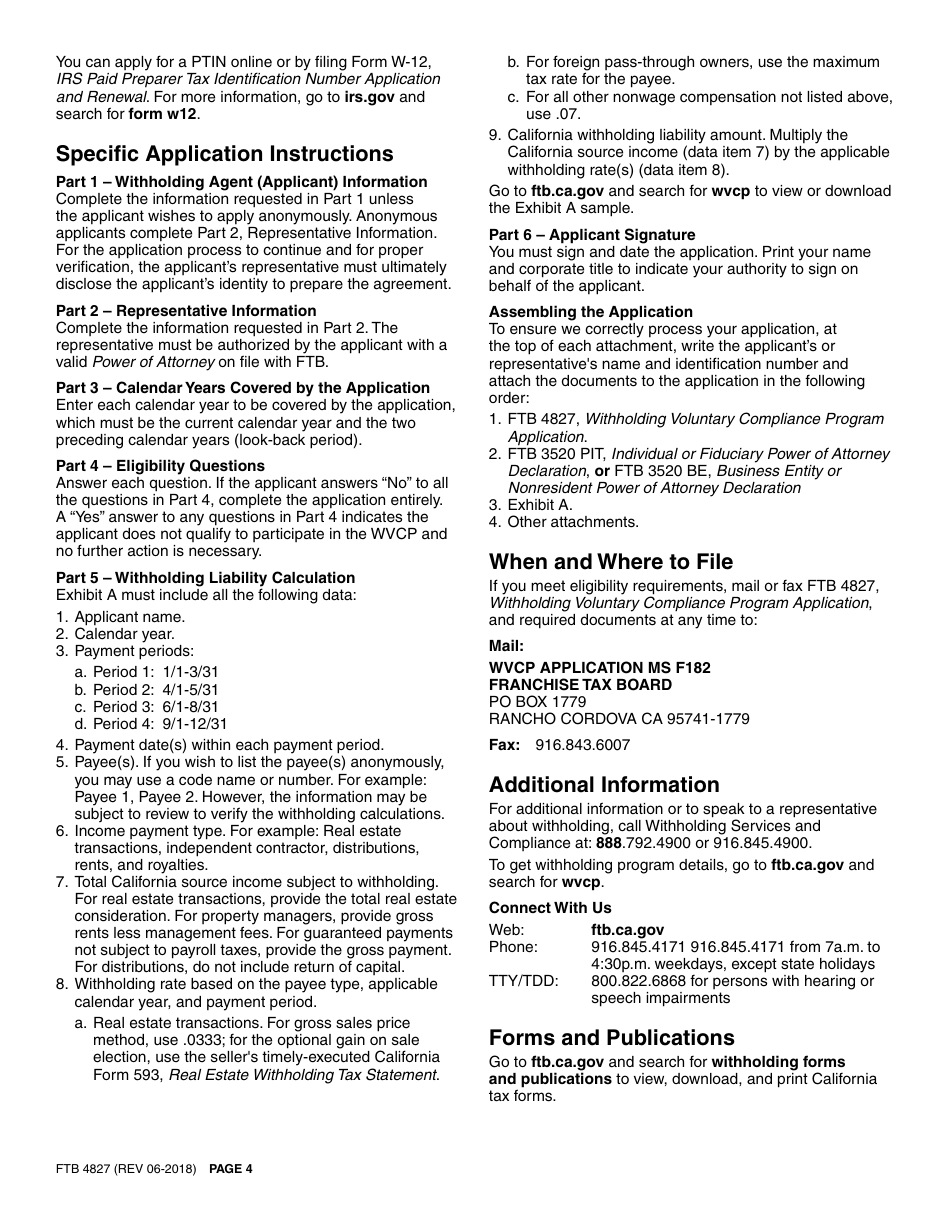

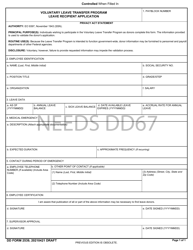

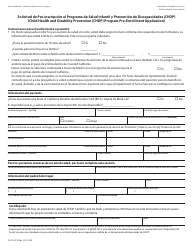

Form FTB4827 Withholding Voluntary Compliance Program Application - California

What Is Form FTB4827?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FTB Form 4827?

A: FTB Form 4827 is the Withholding Voluntary Compliance Program Application.

Q: What is the purpose of Form FTB 4827?

A: The purpose of Form FTB 4827 is to apply for participation in the Withholding Voluntary Compliance Program in California.

Q: Who should file Form FTB 4827?

A: Individuals or businesses that want to voluntarily comply with California withholding requirements should file Form FTB 4827.

Q: How do I file Form FTB 4827?

A: Form FTB 4827 can be filed electronically or by mail. The instructions on the form provide information on how to file.

Q: What are the benefits of participating in the Withholding Voluntary Compliance Program?

A: Participating in the program allows individuals or businesses to avoid penalties and interest for failure to withhold California income tax.

Q: Are there any eligibility requirements for the program?

A: Yes, there are eligibility requirements for the program. The instructions on Form FTB 4827 provide information on these requirements.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB4827 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.