This version of the form is not currently in use and is provided for reference only. Download this version of

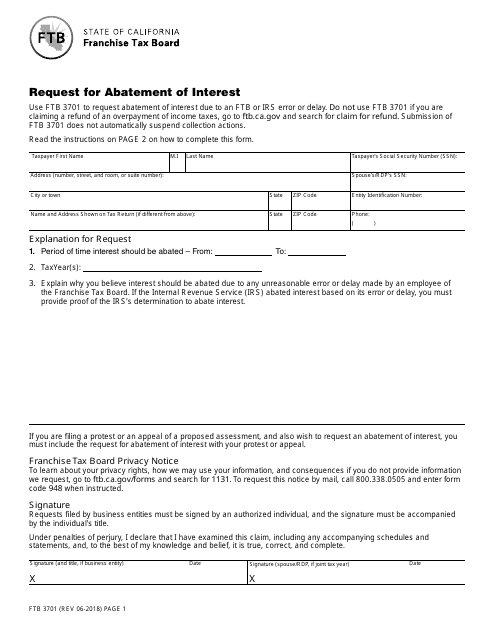

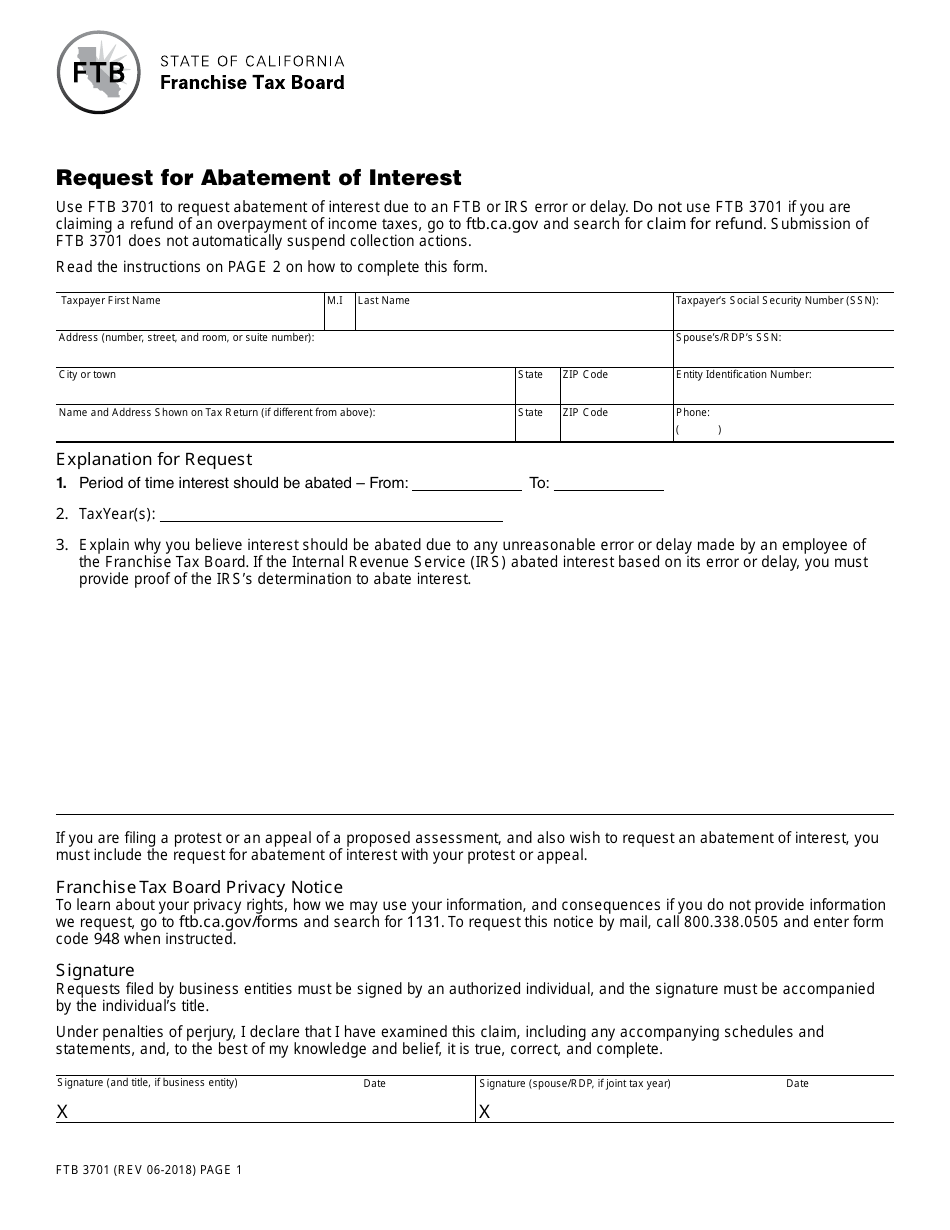

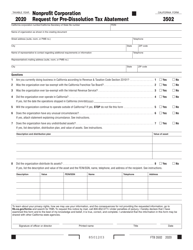

Form FTB3701

for the current year.

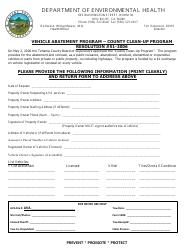

Form FTB3701 Request for Abatement of Interest - California

What Is Form FTB3701?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3701?

A: Form FTB3701 is a request form used in California to seek abatement of interest on taxes.

Q: Who can use Form FTB3701?

A: Individuals or businesses who owe taxes to the California Franchise Tax Board (FTB) and want to request abatement of interest can use Form FTB3701.

Q: What is the purpose of using Form FTB3701?

A: The purpose of using Form FTB3701 is to request the FTB to waive or reduce the amount of interest that has been assessed on unpaid taxes.

Q: What information is required on Form FTB3701?

A: Form FTB3701 requires information such as the taxpayer's name, social security number or taxpayer identification number, tax year(s) involved, the reason for the request, and supporting documentation.

Q: Is there a deadline for submitting Form FTB3701?

A: Yes, there is a deadline for submitting Form FTB3701. It is generally within a specific timeframe from the date of the notice assessing the interest.

Q: Will the interest abatement be automatically granted?

A: No, the interest abatement will not be automatically granted. The FTB will review the request and determine if it meets the criteria for abatement.

Q: What happens if my request for interest abatement is denied?

A: If your request for interest abatement is denied, you have the option to appeal the decision with the FTB.

Q: Is there a fee for submitting Form FTB3701?

A: No, there is no fee for submitting Form FTB3701.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3701 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.