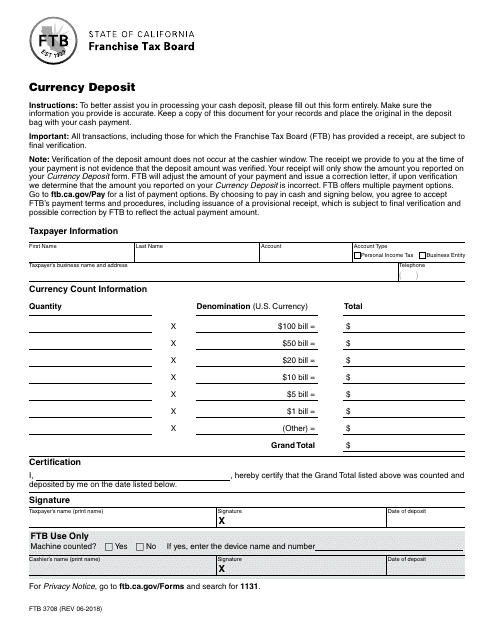

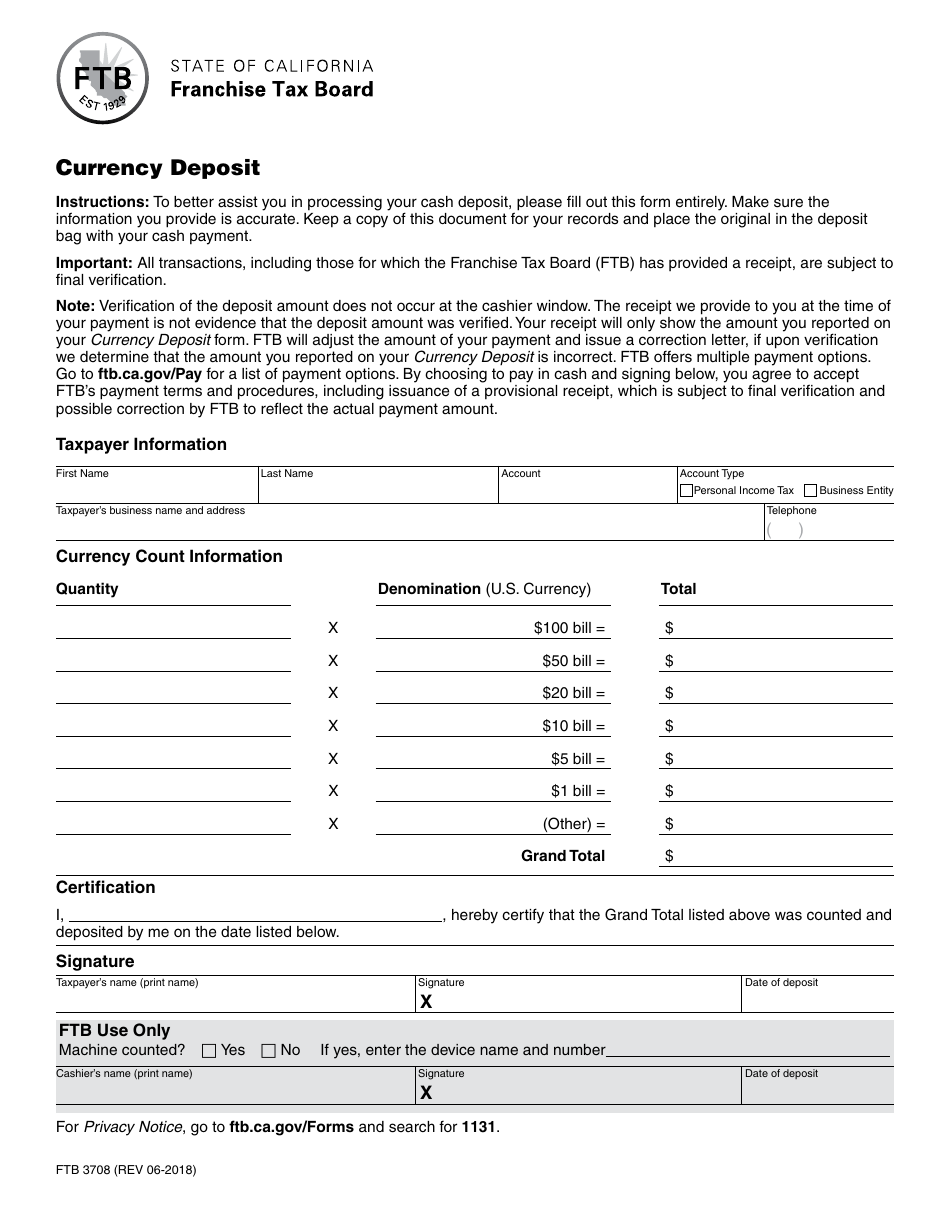

Form FTB3708 Currency Deposit - California

What Is Form FTB3708?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3708 Currency Deposit?

A: Form FTB3708 Currency Deposit is a form used in the state of California to report deposits of currency over $10,000 made to financial institutions.

Q: Who needs to file Form FTB3708 Currency Deposit?

A: Any resident or nonresident of California who makes a cash deposit of $10,000 or more to a financial institution needs to file Form FTB3708.

Q: Are there any penalties for not filing Form FTB3708 Currency Deposit?

A: Yes, failing to file Form FTB3708 can result in penalties and fines imposed by the California Franchise Tax Board.

Q: What information is required to be reported on Form FTB3708 Currency Deposit?

A: Form FTB3708 requires you to provide your personal information, details of the financial institution, and information about the cash deposit.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3708 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.