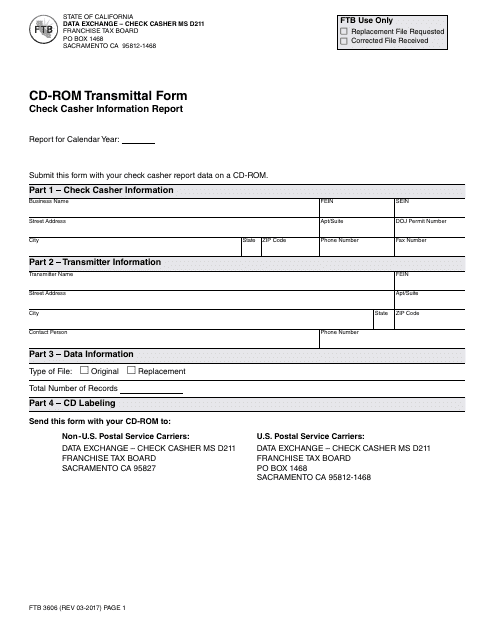

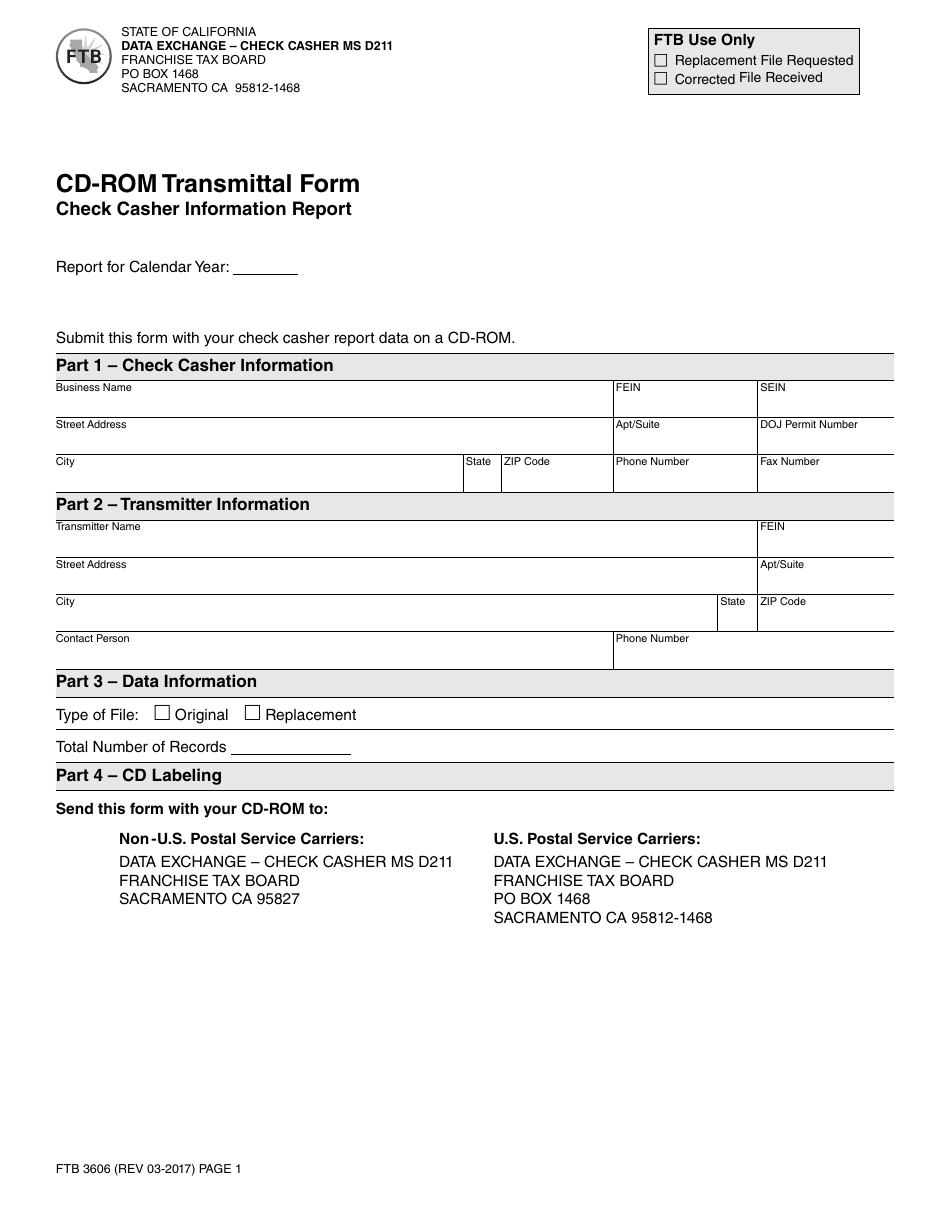

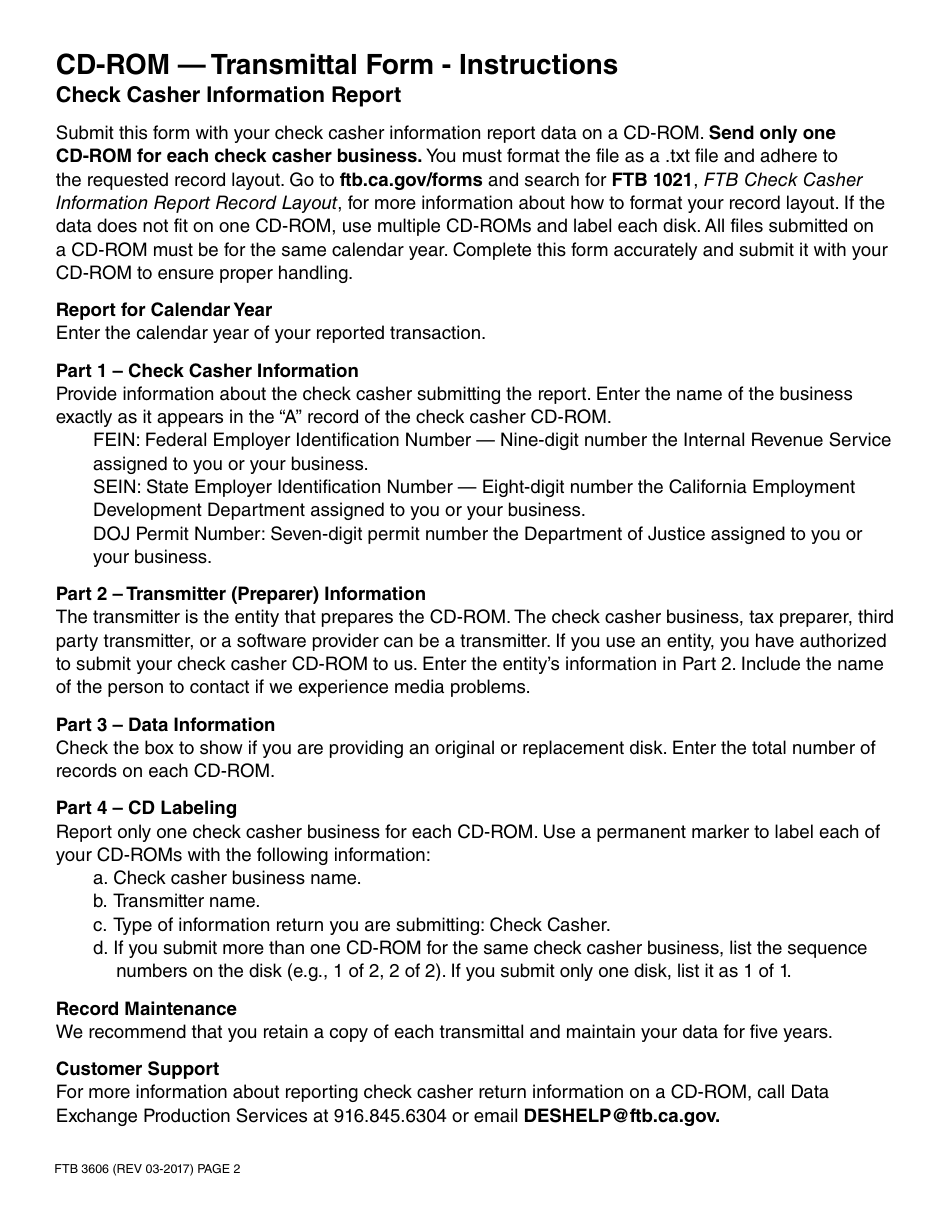

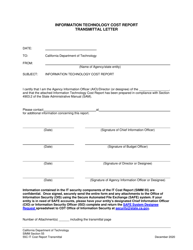

Form FTB3606 Cd-Rom Transmittal Form - Check Casher Information Report - California

What Is Form FTB3606?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3606?

A: Form FTB3606 is a Cd-Rom Transmittal Form - Check Casher Information Report in California.

Q: Who needs to file Form FTB3606?

A: Check cashers operating in California need to file Form FTB3606.

Q: What is the purpose of Form FTB3606?

A: Form FTB3606 is used to report information about check cashers to the California Franchise Tax Board (FTB).

Q: What information is required on Form FTB3606?

A: Form FTB3606 requires check cashers to provide information about their business, transactions, financial statements, and employees.

Q: When is Form FTB3606 due?

A: Form FTB3606 is due on or before April 15th of each year.

Q: Are there any penalties for late filing of Form FTB3606?

A: Yes, there are penalties for late filing of Form FTB3606. The penalties will vary depending on the circumstances, so it is important to file the form on time.

Q: Is Form FTB3606 confidential?

A: No, the information provided on Form FTB3606 is not confidential and may be disclosed to the public.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3606 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.