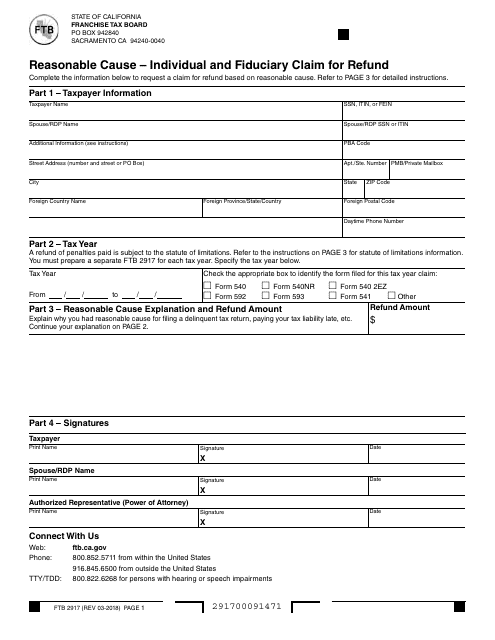

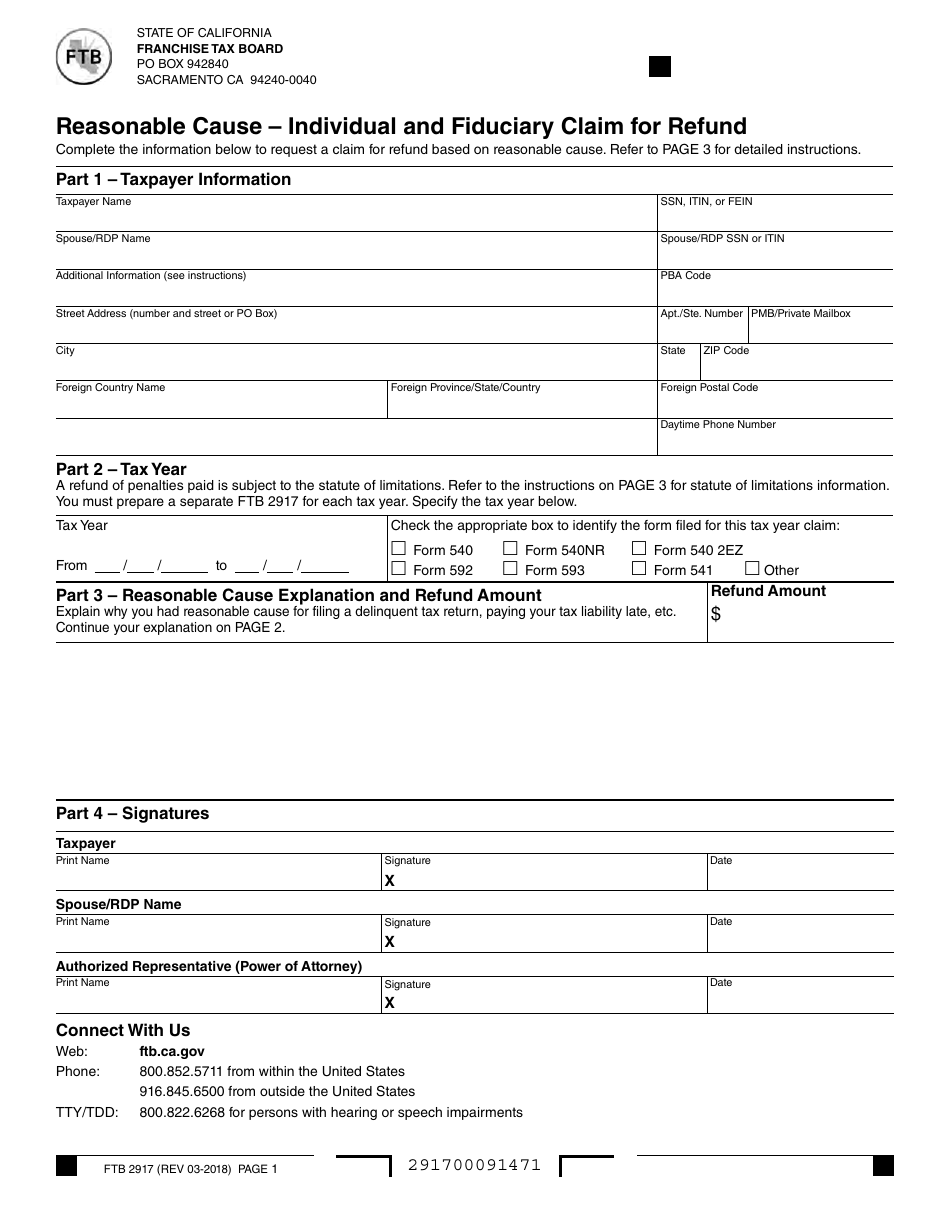

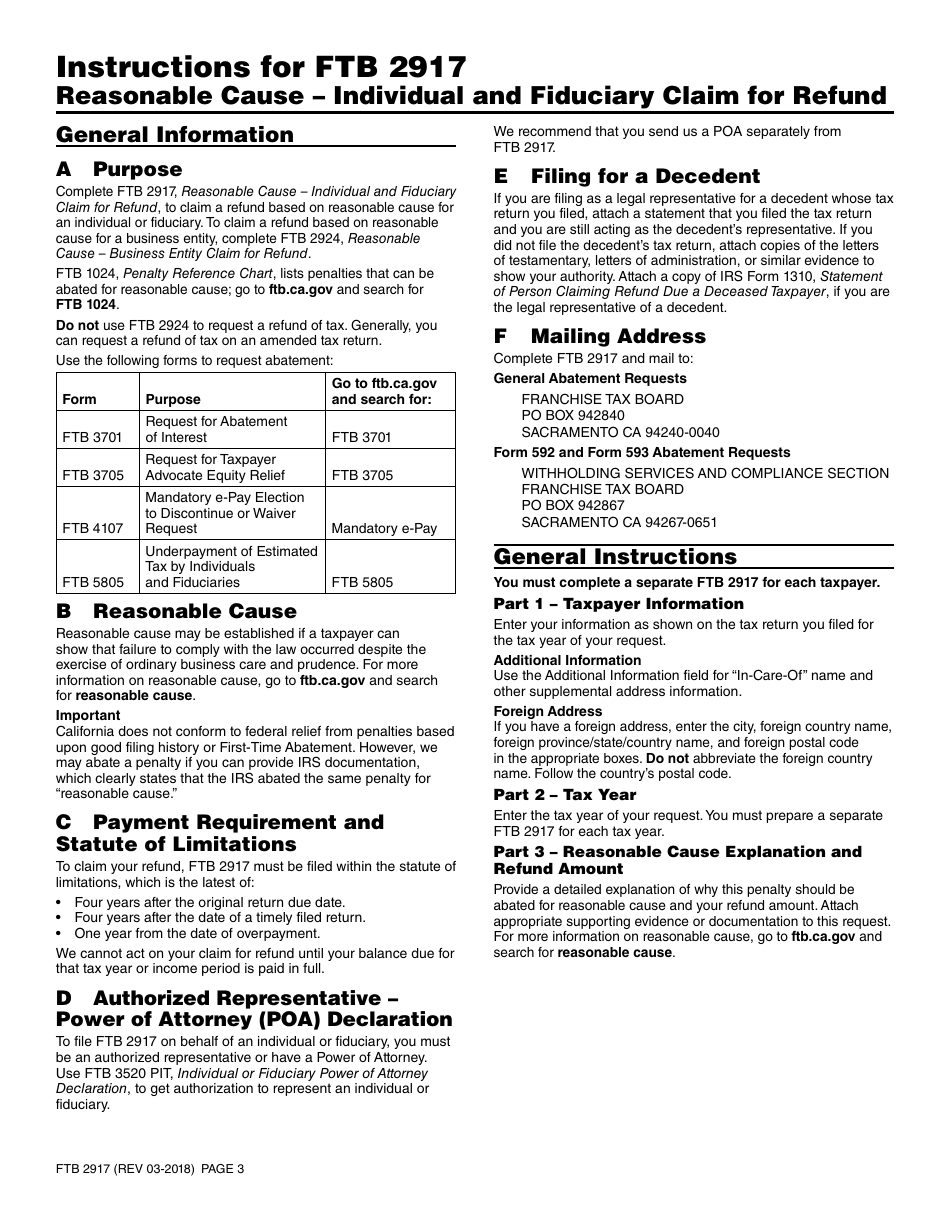

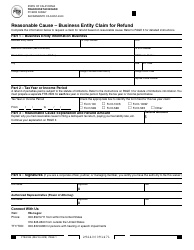

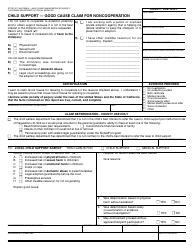

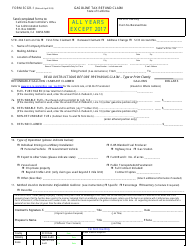

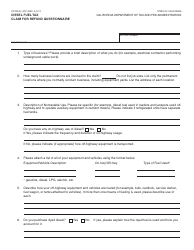

Form FTB2917 Reasonable Cause - Individual and Fiduciary Claim for Refund - California

What Is Form FTB2917?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB2917?

A: Form FTB2917 is a document used to request a refund of taxes paid to the state of California.

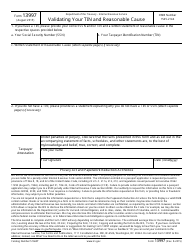

Q: What does Reasonable Cause mean?

A: Reasonable cause refers to a valid and justifiable reason for not meeting a tax obligation or requirement.

Q: Who can use Form FTB2917?

A: Both individuals and fiduciaries can use Form FTB2917 to claim a refund if they have reasonable cause.

Q: What is the purpose of Form FTB2917?

A: The purpose of Form FTB2917 is to provide individuals and fiduciaries with a way to claim a refund if they believe they have reasonable cause for not paying or overpaying taxes.

Q: What should be included in Form FTB2917?

A: Form FTB2917 requires the taxpayer to provide detailed information about their tax liability and the reasons for their claim of reasonable cause.

Q: Are there any deadlines for filing Form FTB2917?

A: Yes, the form must be filed within the applicable statute of limitations for claiming a refund in California.

Q: Is there a fee for filing Form FTB2917?

A: No, there is no fee for filing Form FTB2917.

Q: What happens after submitting Form FTB2917?

A: After submitting the form, the California Franchise Tax Board will review the claim and make a determination on whether to approve the refund based on the reasonable cause provided.

Q: Can I attach supporting documents to Form FTB2917?

A: Yes, it is recommended to attach any relevant supporting documents that can help establish the reasonable cause for the refund claim.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB2917 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.