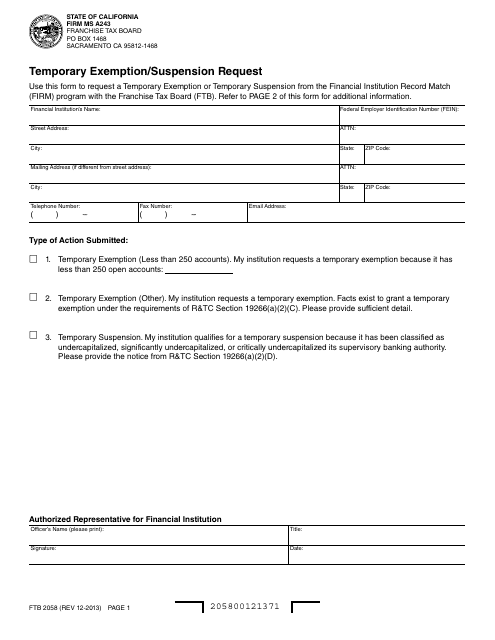

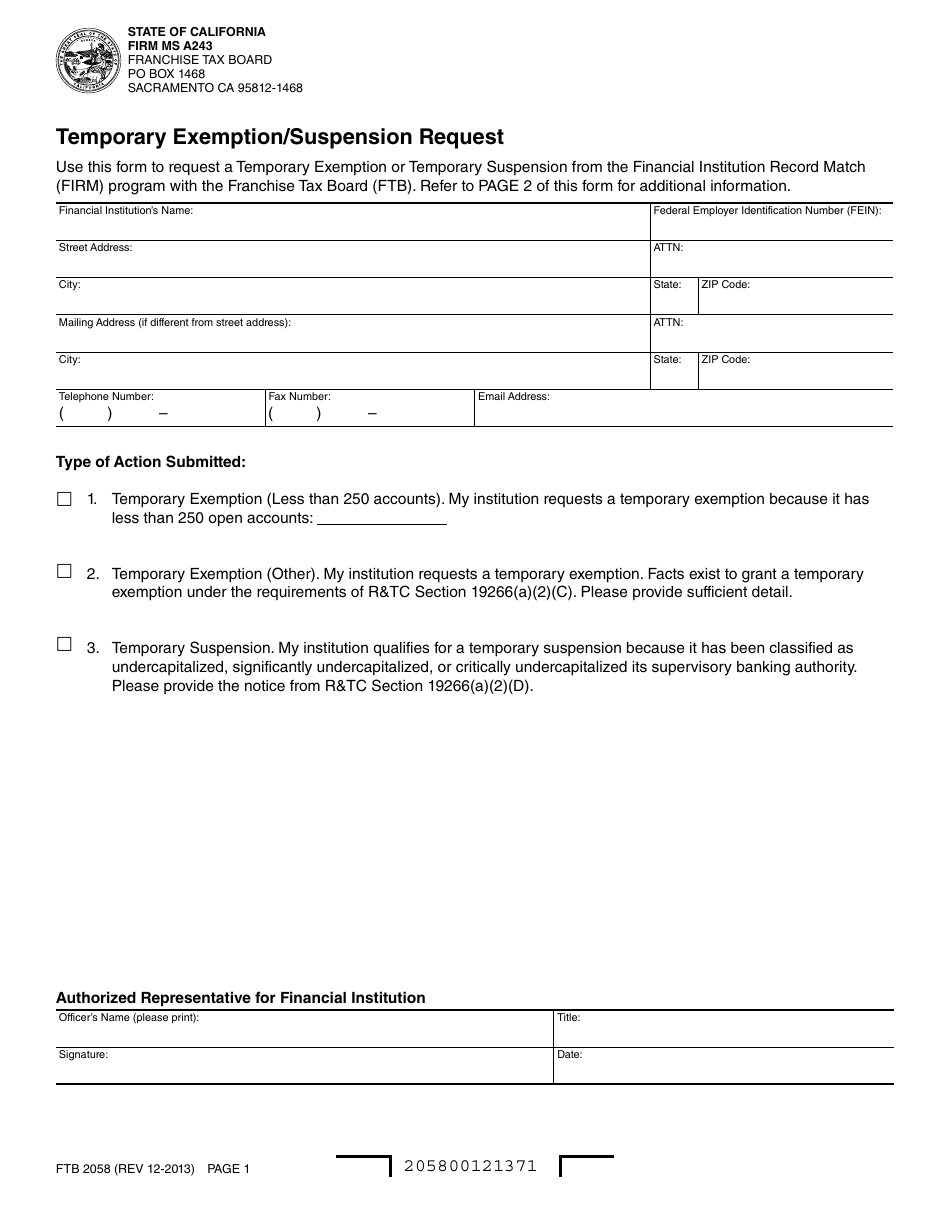

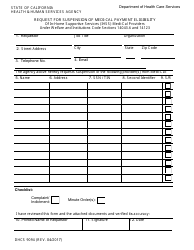

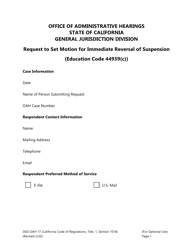

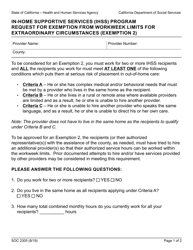

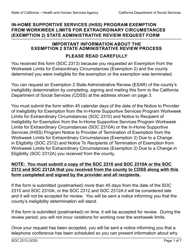

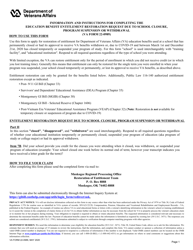

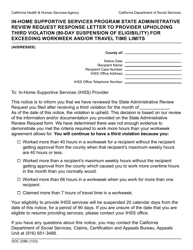

Form FTB2058 Temporary Exemption / Suspension Request - California

What Is Form FTB2058?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

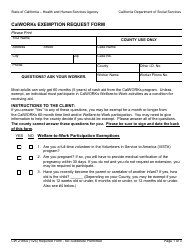

Q: What is Form FTB2058?

A: Form FTB2058 is a form used to request temporary exemption or suspension in California.

Q: What is the purpose of Form FTB2058?

A: The purpose of Form FTB2058 is to request temporary exemption or suspension from certain California tax liabilities.

Q: Who can use Form FTB2058?

A: Individuals and businesses in California can use Form FTB2058 to request temporary exemption or suspension.

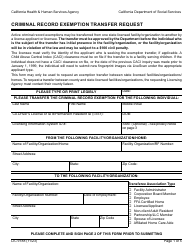

Q: What types of tax liabilities can be exempted or suspended using Form FTB2058?

A: Form FTB2058 can be used to exempt or suspend individual income tax, corporate tax, or franchise tax liabilities in California.

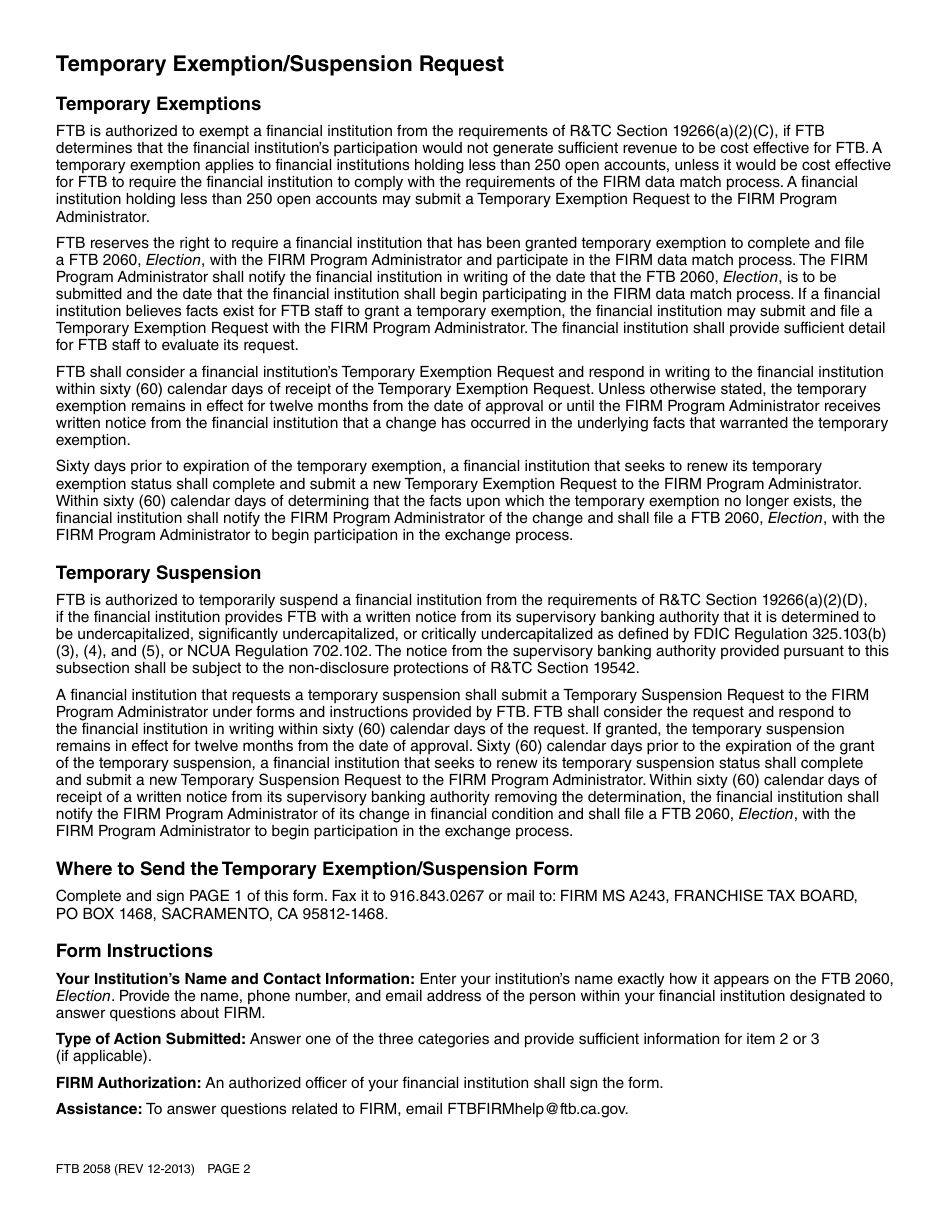

Q: How long does the temporary exemption or suspension last?

A: The temporary exemption or suspension requested using Form FTB2058 is generally granted for a period of 12 months.

Q: Are there any fees associated with submitting Form FTB2058?

A: There are no fees associated with submitting Form FTB2058.

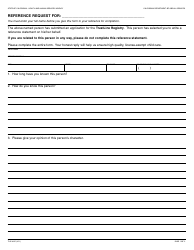

Q: What should I do if I need assistance with completing Form FTB2058?

A: If you need assistance with completing Form FTB2058, you can contact the California Franchise Tax Board for guidance.

Form Details:

- Released on December 1, 2013;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB2058 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.