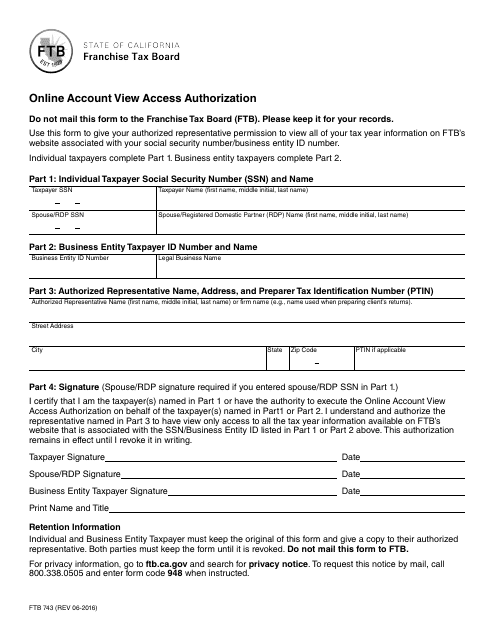

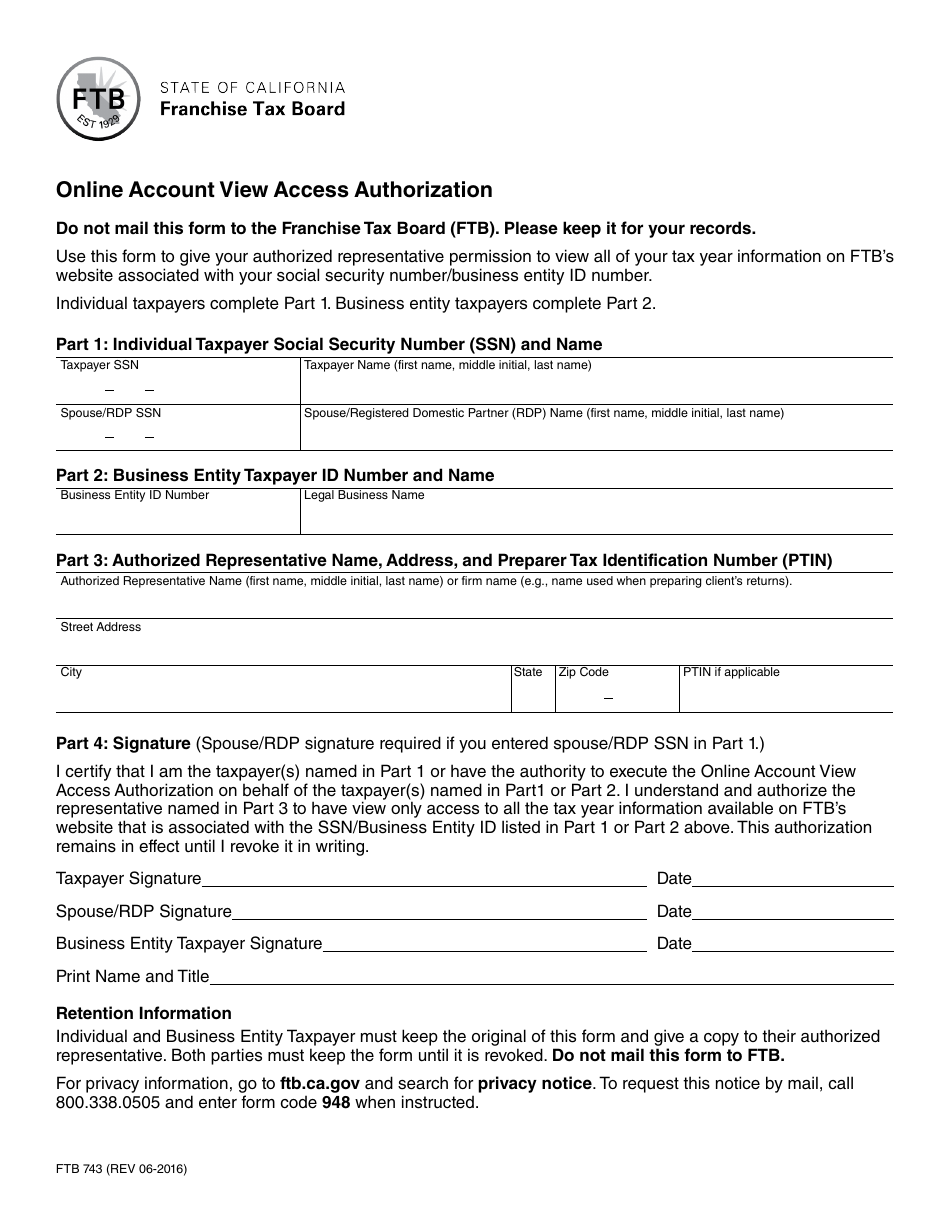

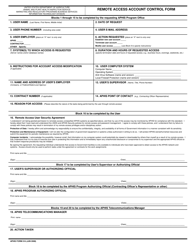

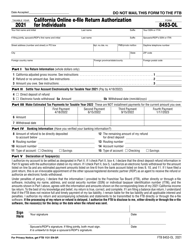

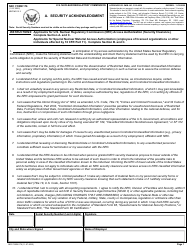

Form FTB743 Online Account View Access Authorization - California

What Is Form FTB743?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who can use Form FTB743?

A: Form FTB743 can be used by individuals or businesses who have filed tax returns with the California FTB.

Q: What information do I need to provide on Form FTB743?

A: On Form FTB743, you will need to provide your personal information, such as your name, address, and Social Security Number or taxpayer identification number.

Q: How long does it take to process Form FTB743?

A: The processing time for Form FTB743 can vary, but it typically takes a few weeks for the FTB to review and approve the access request.

Form Details:

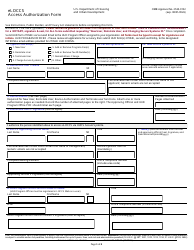

- Released on June 1, 2016;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB743 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.