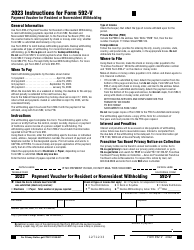

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 540NR Schedule CA

for the current year.

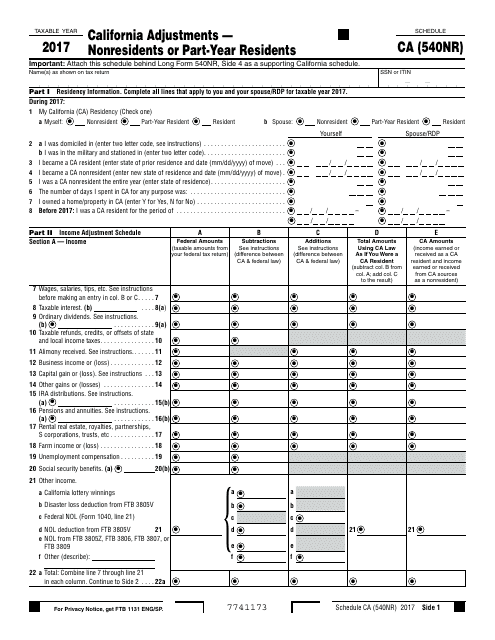

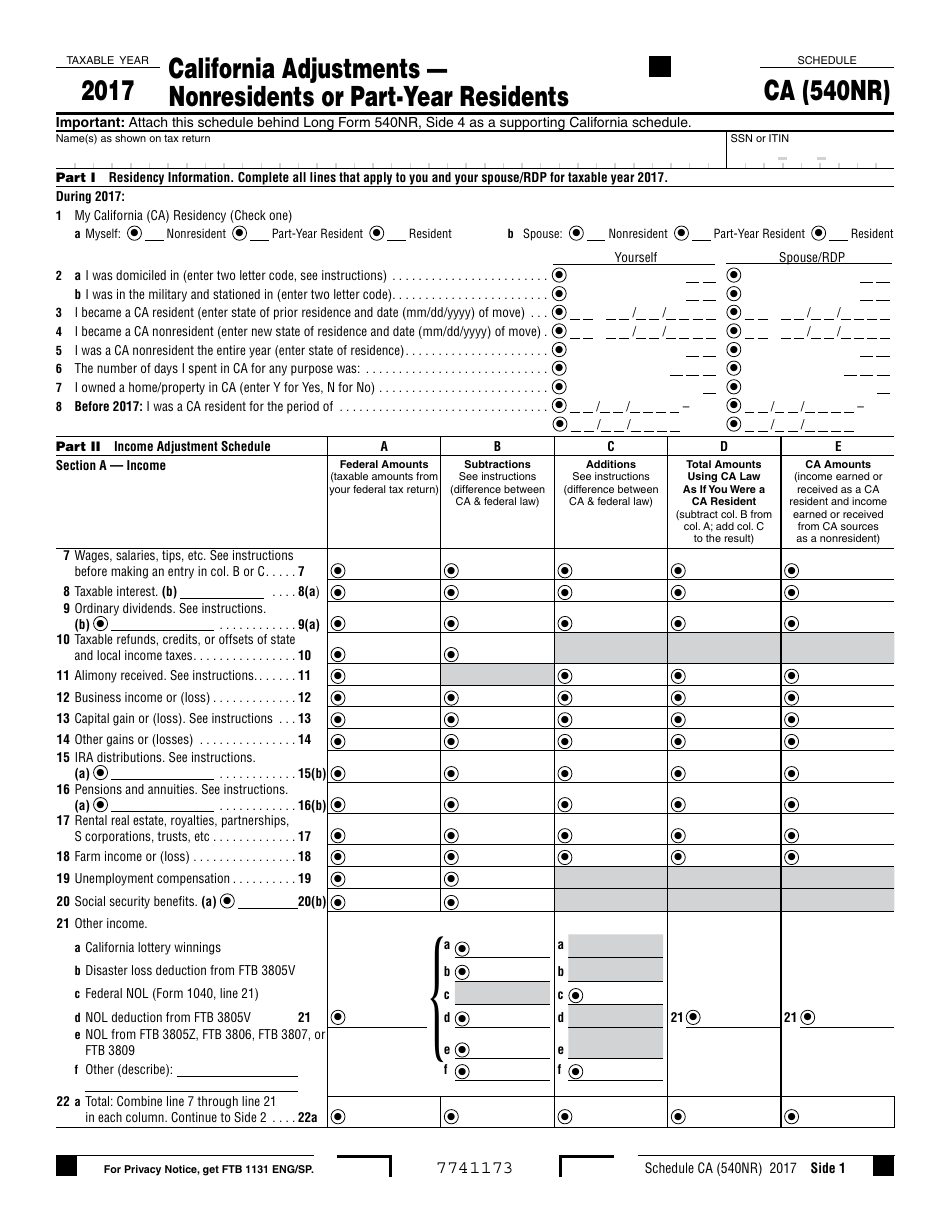

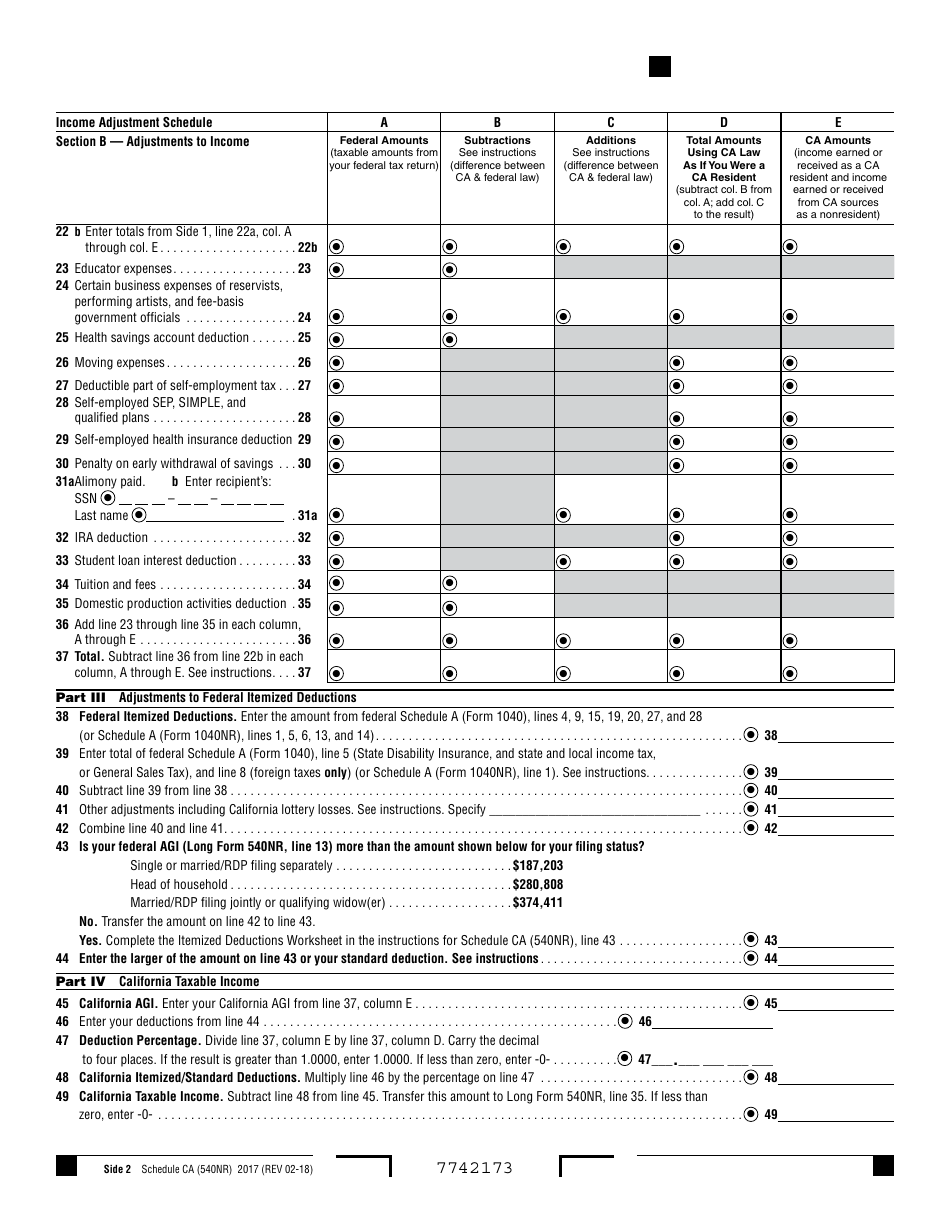

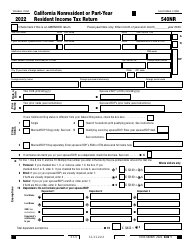

Form 540NR Schedule CA California Adjustments " Nonresidents or Part-Year Residents - California

What Is Form 540NR Schedule CA?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 540NR Schedule CA?

A: Form 540NR Schedule CA is a tax form used by nonresidents or part-year residents of California to report their California adjustments.

Q: Who should file Form 540NR Schedule CA?

A: Nonresidents or part-year residents of California who need to report their California adjustments should file Form 540NR Schedule CA.

Q: What are California adjustments?

A: California adjustments are certain income and deduction items that are specific to the state of California.

Q: What is the purpose of Form 540NR Schedule CA?

A: The purpose of Form 540NR Schedule CA is to calculate the amount of California adjustments that will be included in the nonresident or part-year resident's California tax return.

Q: When is Form 540NR Schedule CA due?

A: Form 540NR Schedule CA is typically due on the same date as the nonresident or part-year resident's California tax return, which is generally April 15th.

Q: Do I need to file Form 540NR Schedule CA if I didn't have any California adjustments?

A: If you didn't have any California adjustments, you may not need to file Form 540NR Schedule CA. However, it is always recommended to consult with a tax professional or the California Franchise Tax Board to determine your filing requirements.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 540NR Schedule CA by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.