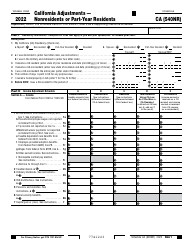

This version of the form is not currently in use and is provided for reference only. Download this version of

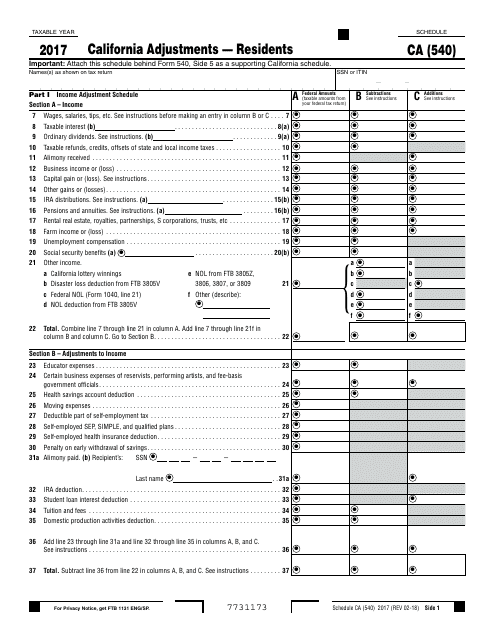

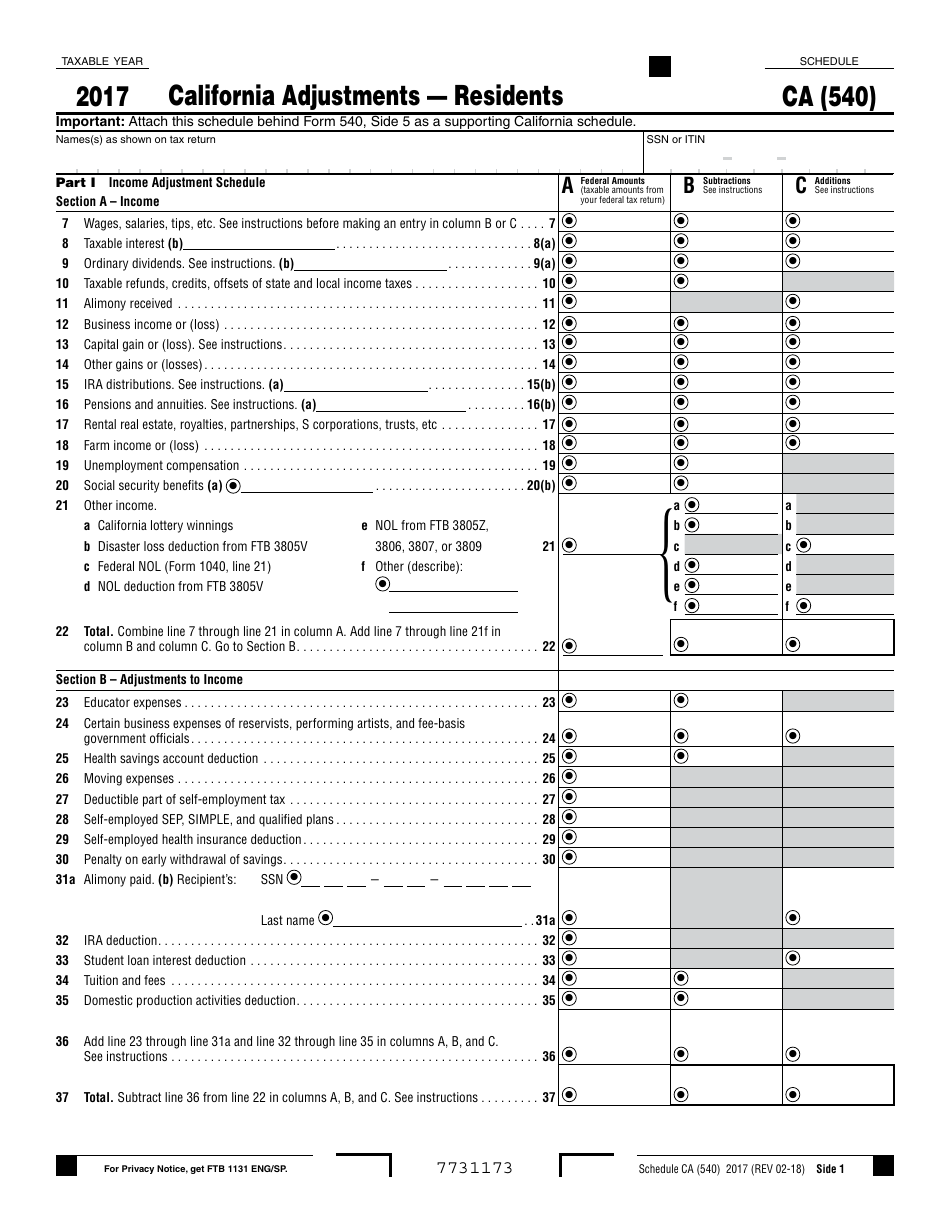

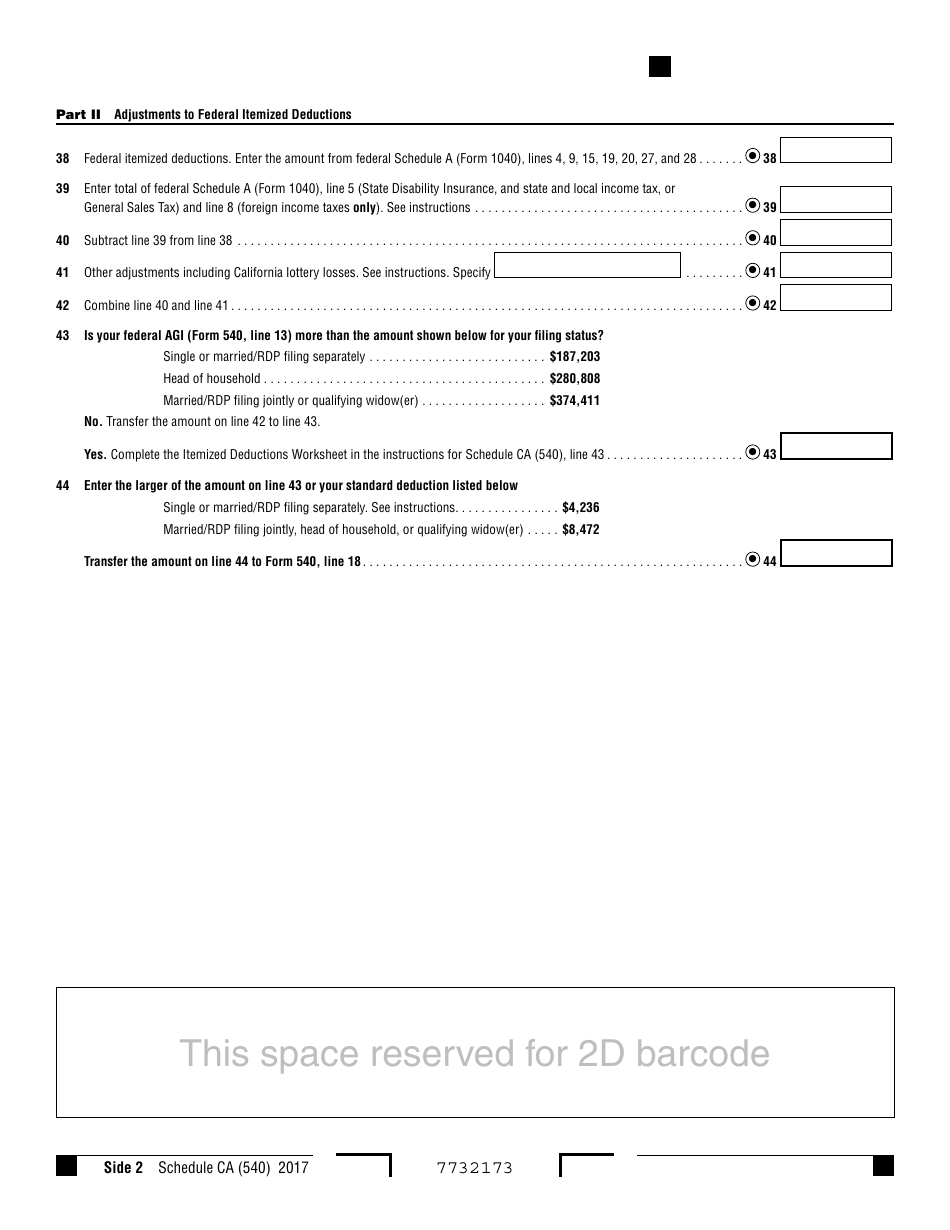

Form 540 Schedule CA

for the current year.

Form 540 Schedule CA California Adjustments " Residents - California

What Is Form 540 Schedule CA?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 540 Schedule CA?

A: Form 540 Schedule CA is a supplemental form used by California resident taxpayers to report specific adjustments to their income.

Q: Who needs to use Form 540 Schedule CA?

A: California resident taxpayers who need to report specific adjustments to their income should use Form 540 Schedule CA.

Q: What type of adjustments can be reported on Form 540 Schedule CA?

A: Form 540 Schedule CA allows taxpayers to report adjustments such as deductions, credits, and other modifications to their income.

Q: Is Form 540 Schedule CA required for all California residents?

A: Form 540 Schedule CA is not required for all California residents. It is only necessary for those who need to report specific adjustments to their income.

Q: Do I need to file Form 540 Schedule CA if I don't have any adjustments to report?

A: If you don't have any adjustments to report, you do not need to file Form 540 Schedule CA.

Q: Can I e-file Form 540 Schedule CA?

A: Yes, you can e-file Form 540 Schedule CA if you are filing your California tax return electronically.

Q: When is the due date for Form 540 Schedule CA?

A: The due date for Form 540 Schedule CA is the same as the due date for your California tax return, which is typically April 15th.

Q: Can I amend my Form 540 Schedule CA?

A: Yes, you can amend your Form 540 Schedule CA if you need to make changes or report additional adjustments. You will need to use Form 540X to amend your California tax return.

Q: What happens if I don't include Form 540 Schedule CA with my California tax return?

A: If you need to report adjustments but fail to include Form 540 Schedule CA with your California tax return, your return may be considered incomplete and you may be contacted by the tax authorities for additional information.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 540 Schedule CA by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.