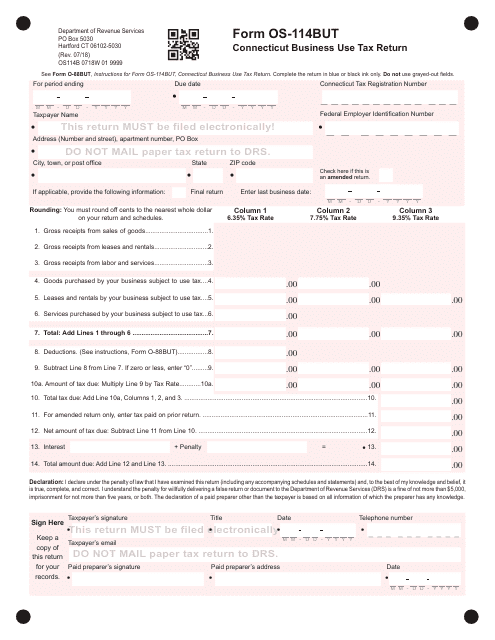

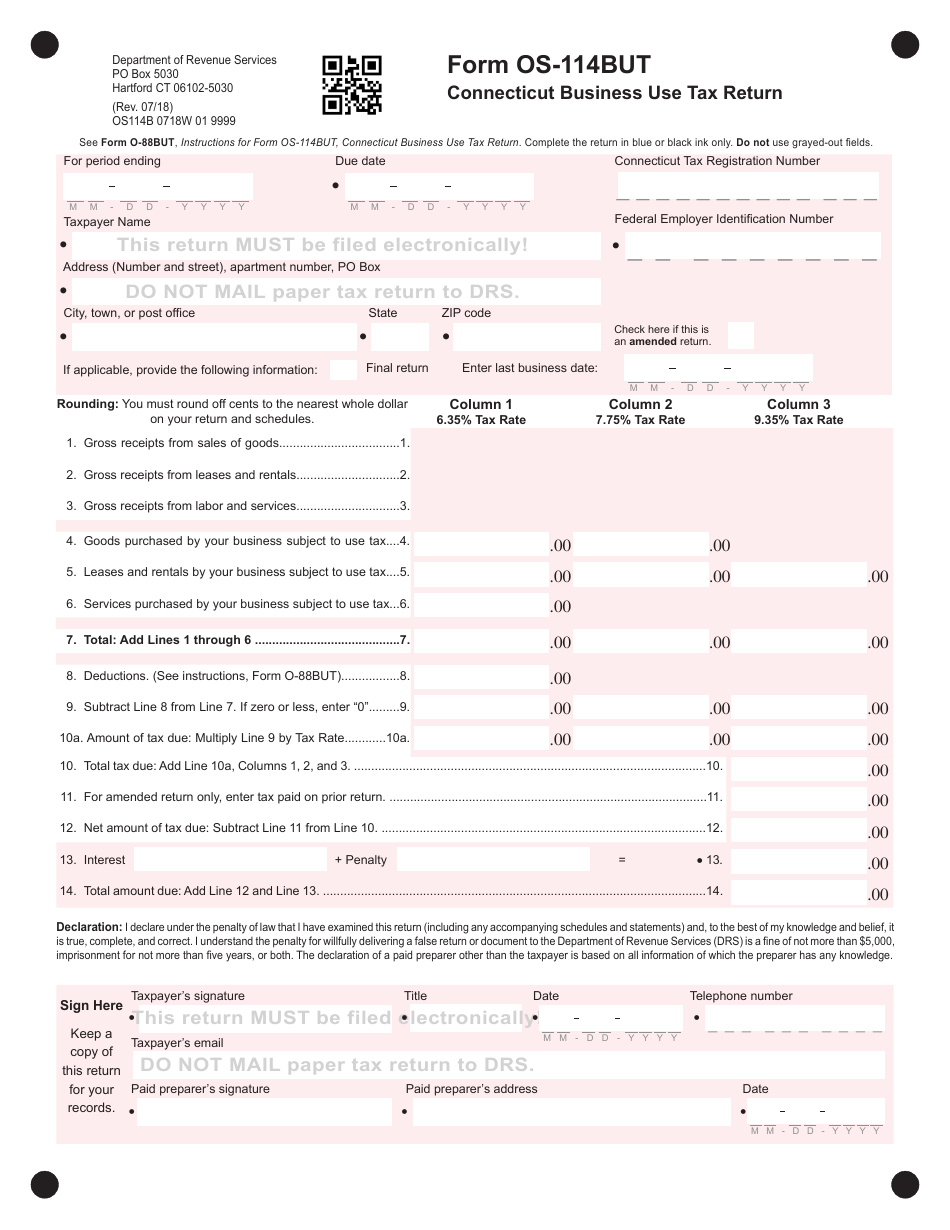

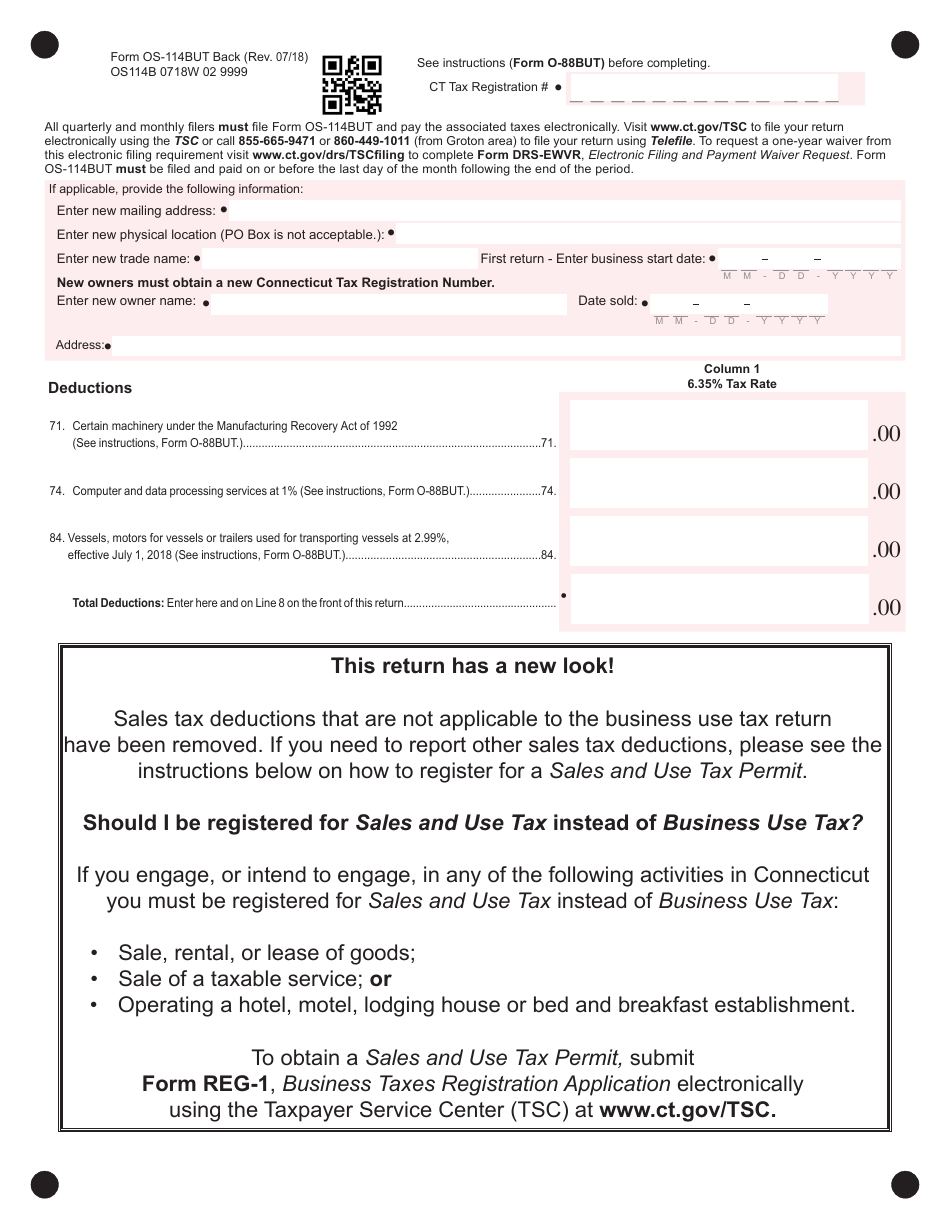

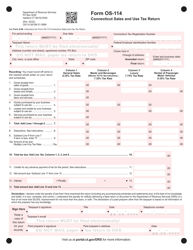

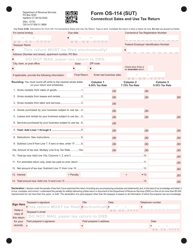

Form OS-114BUT Connecticut Business Use Tax Return - Connecticut

What Is Form OS-114BUT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OS-114BUT?

A: Form OS-114BUT is the Connecticut Business Use Tax Return.

Q: Who needs to file Form OS-114BUT?

A: Businesses in Connecticut that make out-of-state purchases and use the purchased items in Connecticut need to file Form OS-114BUT.

Q: What is the purpose of Form OS-114BUT?

A: Form OS-114BUT is used to report and pay the business use tax on out-of-state purchases.

Q: How often should Form OS-114BUT be filed?

A: Form OS-114BUT is filed annually. It is due on or before the last day of the month following the end of the reporting period.

Q: Are there any penalties for late or incorrect filing of Form OS-114BUT?

A: Yes, there are penalties for late or incorrect filing of Form OS-114BUT. It is important to file the form accurately and on time to avoid penalties.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OS-114BUT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.