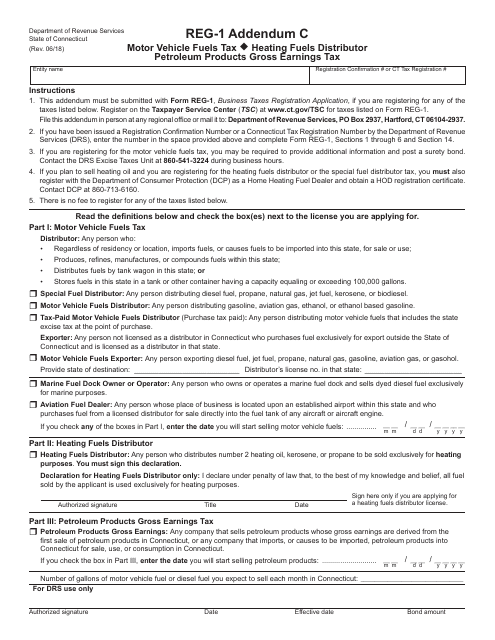

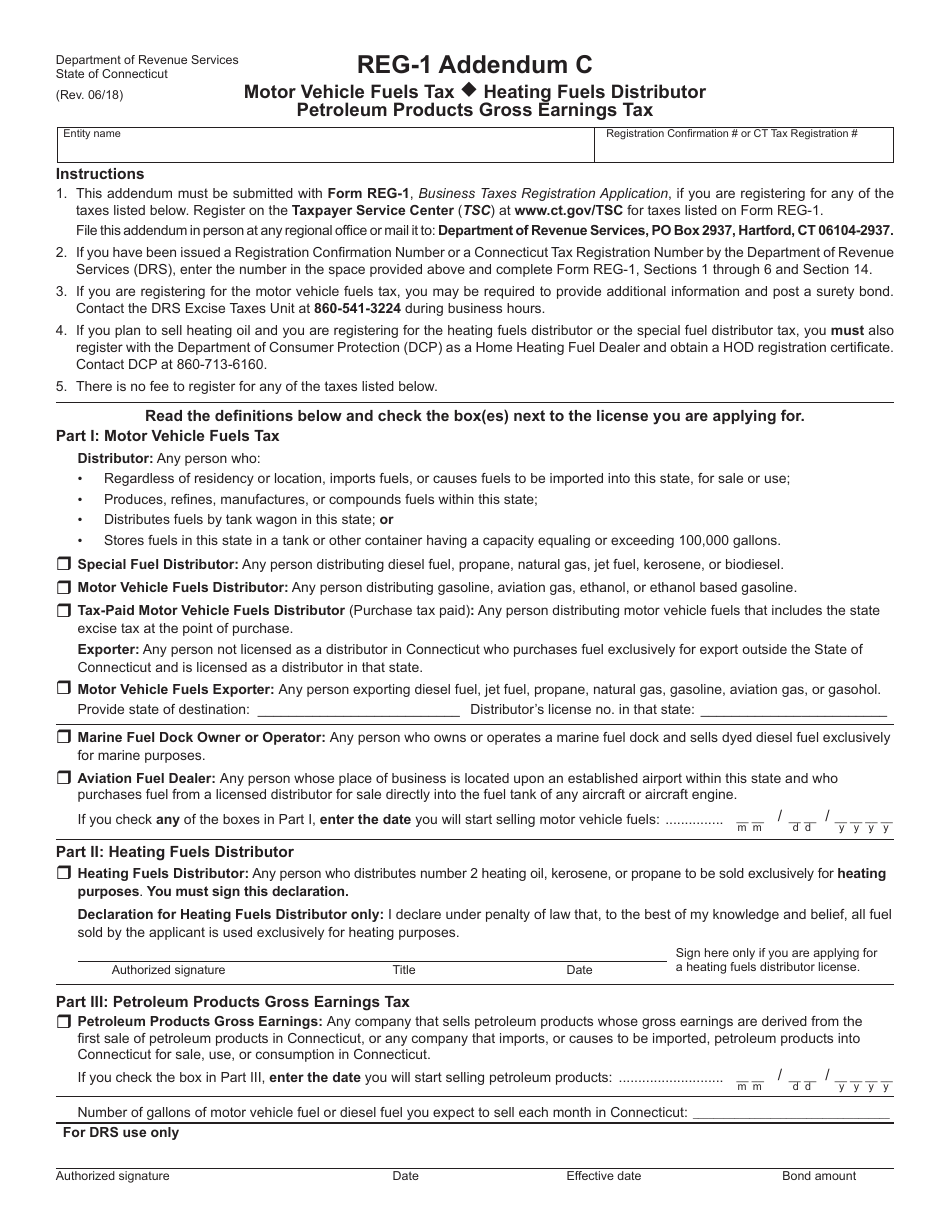

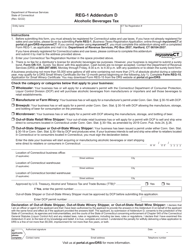

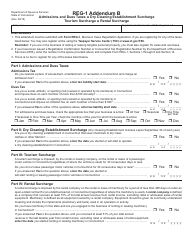

Form REG-1 Addendum C Motor Vehicle Fuels Tax / Heating Fuels Distributor / Petroleum Products Gross Earnings Tax - Connecticut

What Is Form REG-1 Addendum C?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REG-1 Addendum C?

A: Form REG-1 Addendum C is a tax form used in Connecticut for reporting Motor Vehicle Fuels Tax, Heating Fuels Distributor Tax, and Petroleum ProductsGross Earnings Tax.

Q: Who needs to file Form REG-1 Addendum C?

A: Motor Vehicle Fuels Tax/Heating Fuels Distributor/Petroleum Products Gross Earnings Tax filers in Connecticut need to file Form REG-1 Addendum C.

Q: What taxes are reported on Form REG-1 Addendum C?

A: Motor Vehicle Fuels Tax, Heating Fuels Distributor Tax, and Petroleum Products Gross Earnings Tax are reported on Form REG-1 Addendum C.

Q: How do I fill out Form REG-1 Addendum C?

A: You need to provide specific information about your fuel sales and taxable gallons sold on Form REG-1 Addendum C. The form also requires information about your business.

Q: When is the due date for Form REG-1 Addendum C?

A: The due date for Form REG-1 Addendum C varies depending on the reporting period. It is generally due on a monthly, quarterly, or annual basis.

Q: Are there any penalties for not filing Form REG-1 Addendum C?

A: Yes, there can be penalties for not filing Form REG-1 Addendum C or for filing it late. It is important to file the form on time to avoid penalties.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REG-1 Addendum C by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.