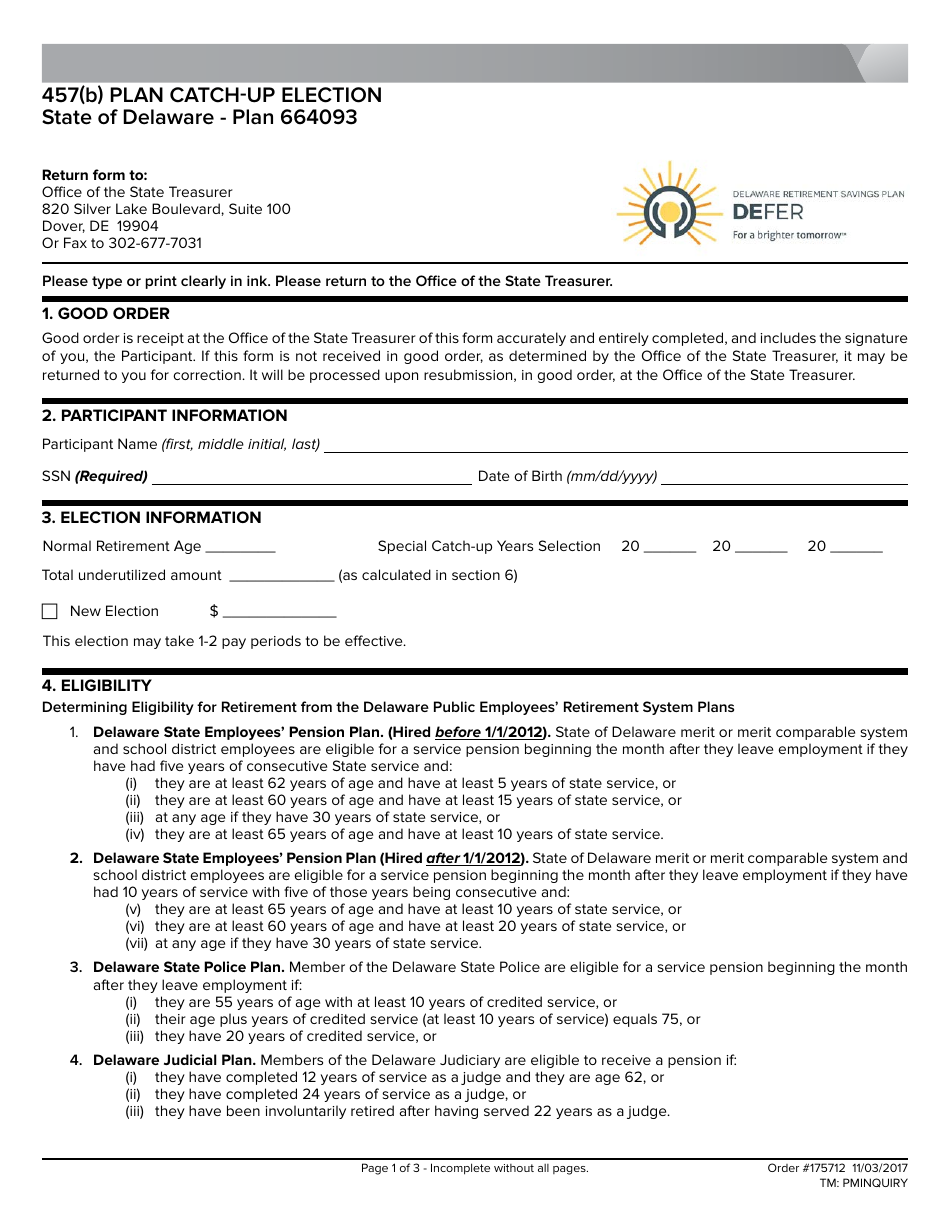

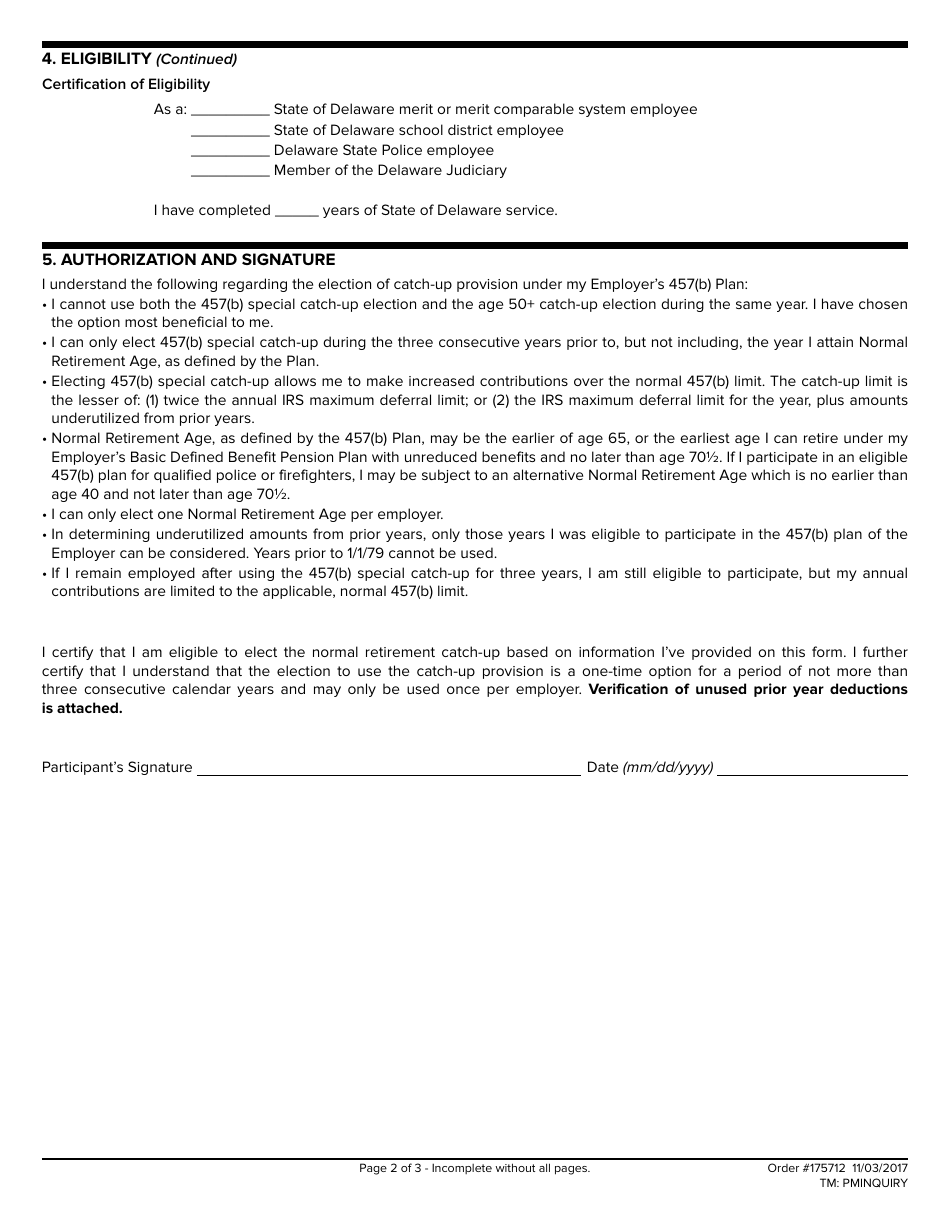

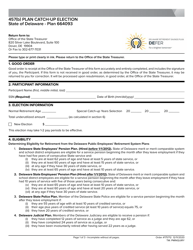

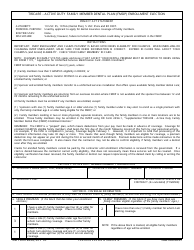

457(B) Plan Catch-Up Election - Delware Plan 664093 - Delaware

457(B) Plan Catch-Up Election - Delware Plan 664093 is a legal document that was released by the Delaware Office of the State Treasurer - a government authority operating within Delaware.

FAQ

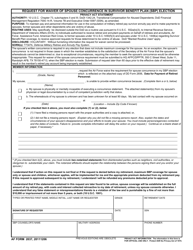

Q: What is a 457(b) Plan?

A: A 457(b) Plan is a type of retirement plan available to government employees.

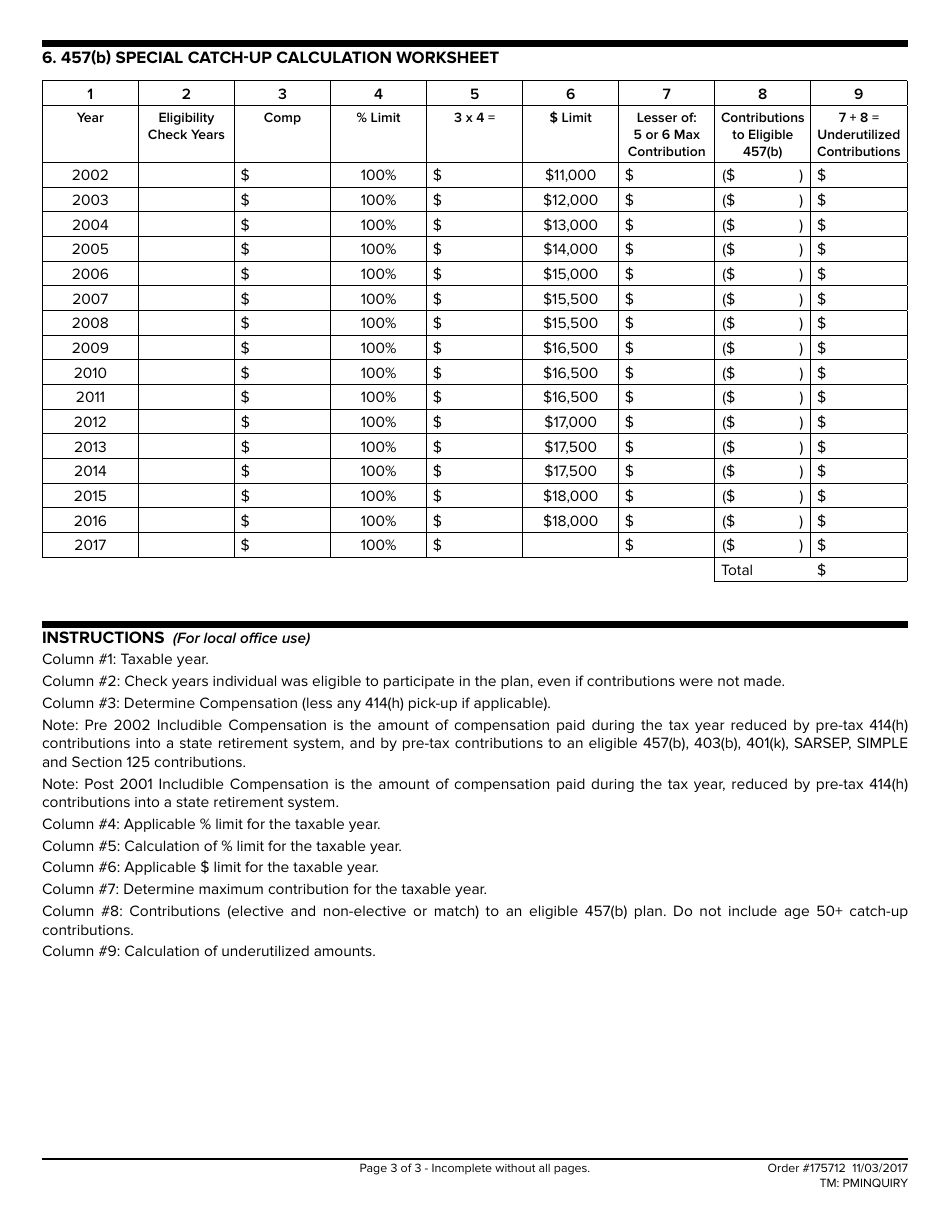

Q: What is a catch-up election in a 457(b) Plan?

A: A catch-up election allows participants aged 50 or older to contribute additional funds to their 457(b) plan to "catch up" on retirement savings.

Q: What is Plan 664093 in Delaware?

A: Plan 664093 is a specific 457(b) Plan available in Delaware for eligible employees to participate in.

Q: Who is eligible to participate in the Delaware Plan 664093?

A: Eligible employees, typically government employees in Delaware, are eligible to participate in Plan 664093.

Q: Are catch-up contributions in a 457(b) Plan tax-deductible?

A: Yes, catch-up contributions made to a 457(b) Plan are generally tax-deductible, which can provide potential tax benefits to participants.

Q: How much can I contribute as a catch-up election in a 457(b) Plan?

A: The maximum catch-up contribution limit for a 457(b) Plan is $6,500 per year as of 2021.

Form Details:

- Released on November 3, 2017;

- The latest edition currently provided by the Delaware Office of the State Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Office of the State Treasurer.