This version of the form is not currently in use and is provided for reference only. Download this version of

Form M-20A

for the current year.

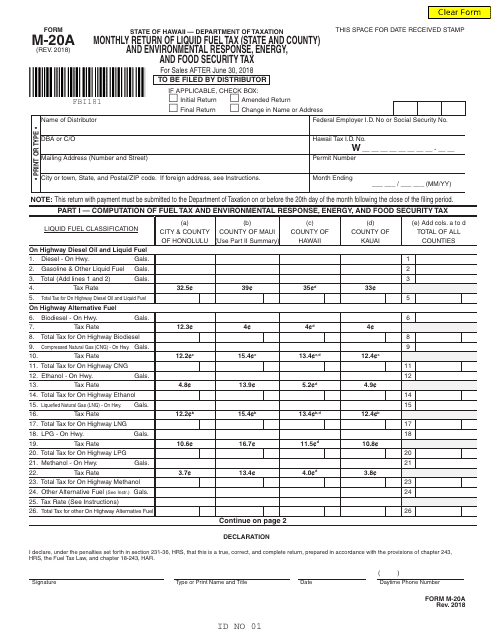

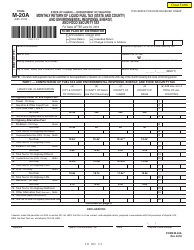

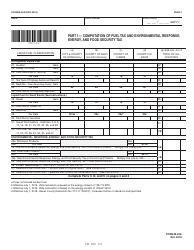

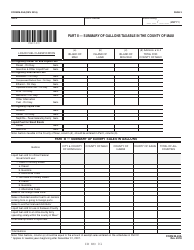

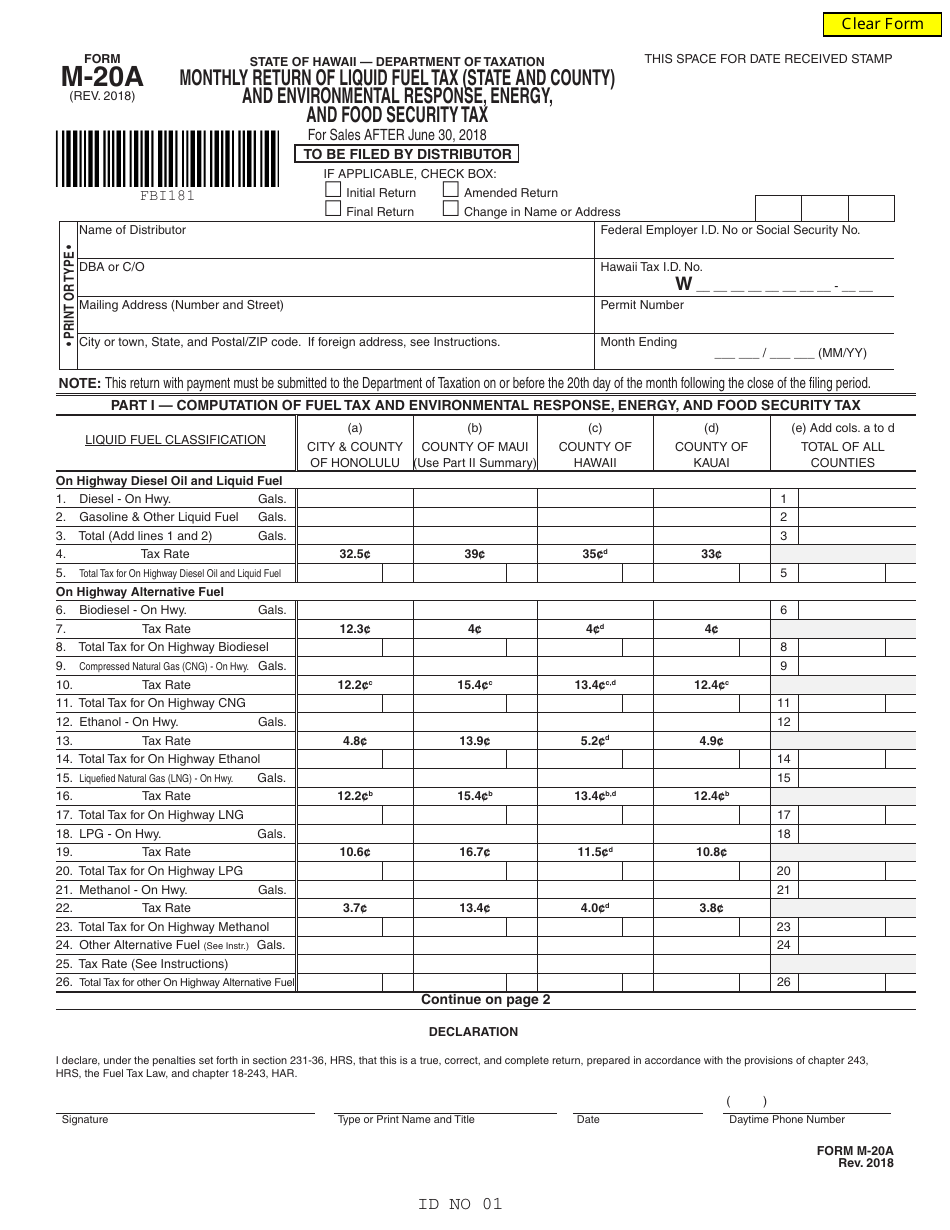

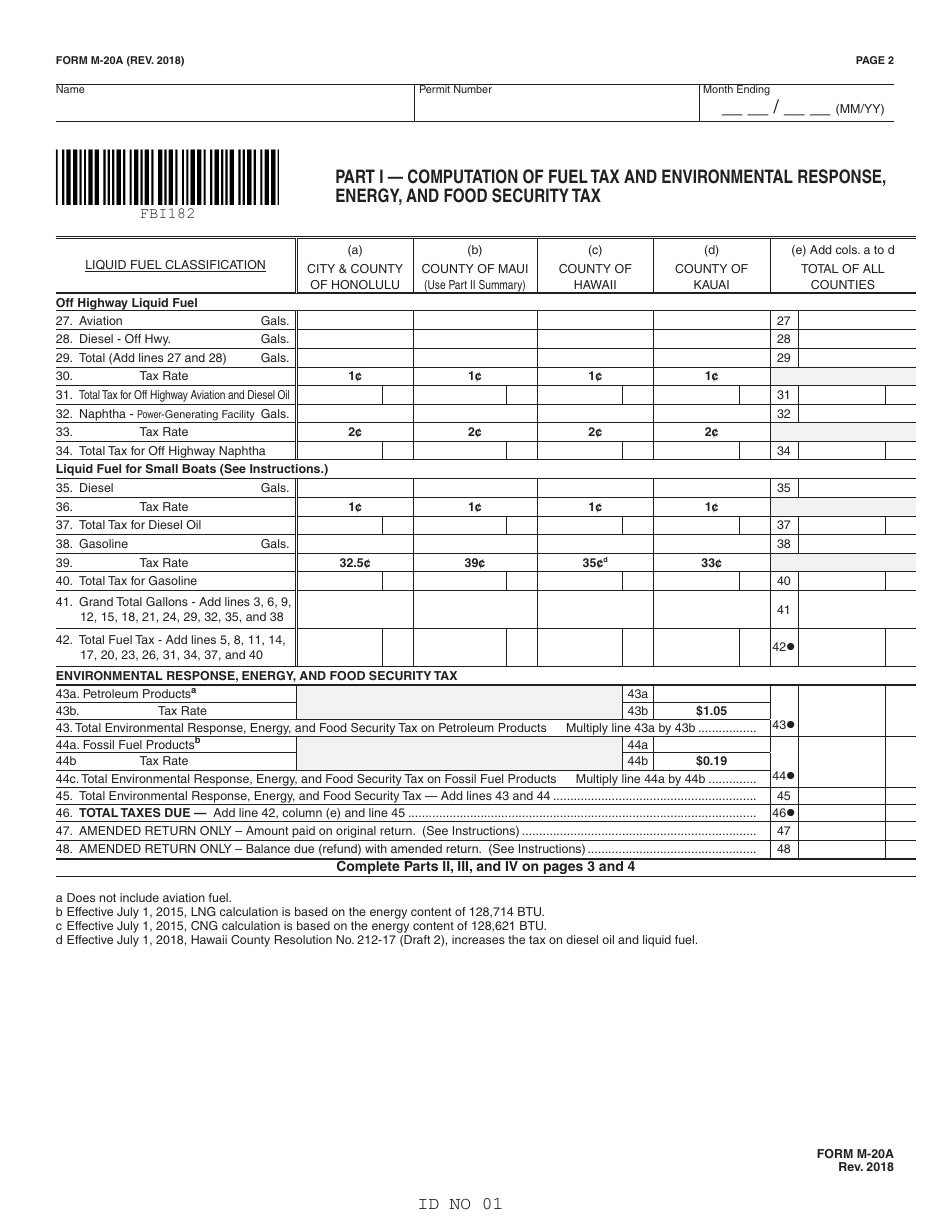

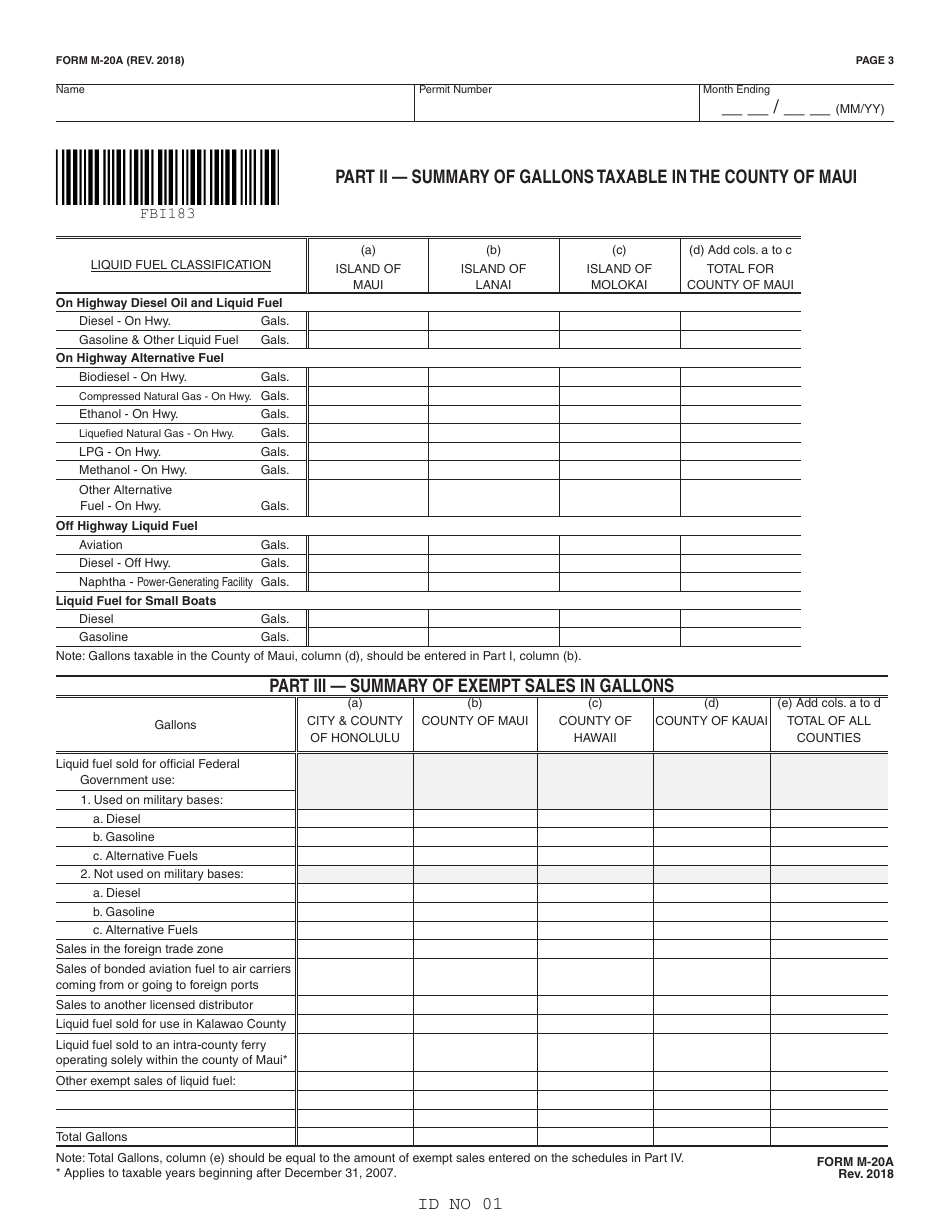

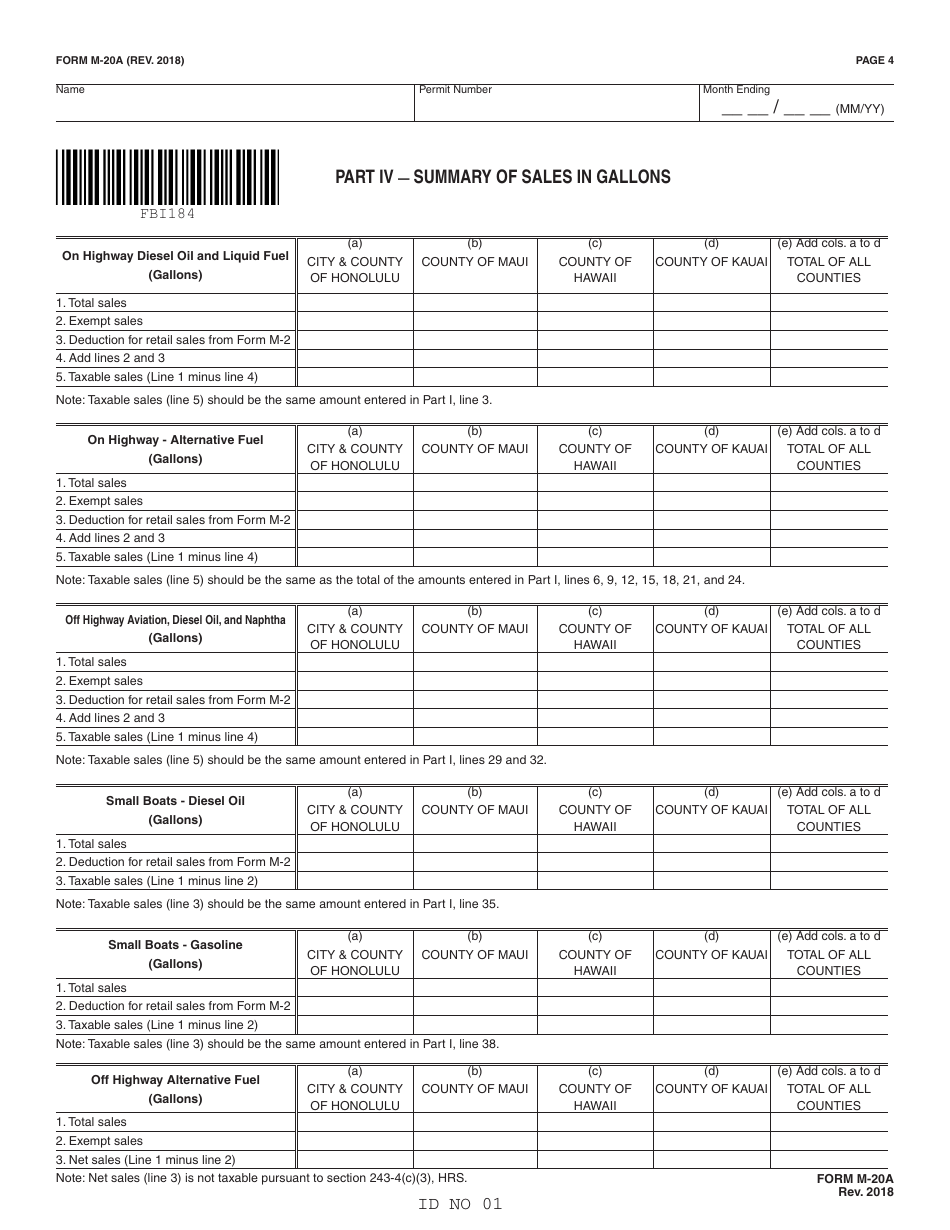

Form M-20A Monthly Return of Liquid Fuel Tax (State and County) and Environmental Response, Energy, and Food Security Tax - Hawaii

What Is Form M-20A?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form M-20A?

A: Form M-20A is the Monthly Return of Liquid Fuel Tax (State and County) and Environmental Response, Energy, and Food Security Tax in Hawaii.

Q: What does Form M-20A include?

A: Form M-20A includes the reporting of liquid fuel tax (state and county) as well as the environmental response, energy, and food security tax.

Q: Who needs to file Form M-20A?

A: Businesses in Hawaii that are involved in activities related to liquid fuel are required to file Form M-20A.

Q: What taxes are reported on Form M-20A?

A: Form M-20A is used to report the liquid fuel tax (state and county) and the environmental response, energy, and food security tax.

Q: Is Form M-20A filed monthly?

A: Yes, Form M-20A is filed on a monthly basis.

Q: Are there any penalties for not filing Form M-20A?

A: Yes, there are penalties for failure to file or late filing of Form M-20A. It is important to file the form on time to avoid penalties.

Q: Are there any exemptions for filing Form M-20A?

A: Yes, certain exemptions may apply for certain activities or fuel types. Refer to the instructions provided with the form or consult with the Hawaii Department of Taxation for more information.

Q: When is the deadline to file Form M-20A?

A: Form M-20A must be filed by the 20th day of the following month. For example, the form for January must be filed by February 20th.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-20A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.