This version of the form is not currently in use and is provided for reference only. Download this version of

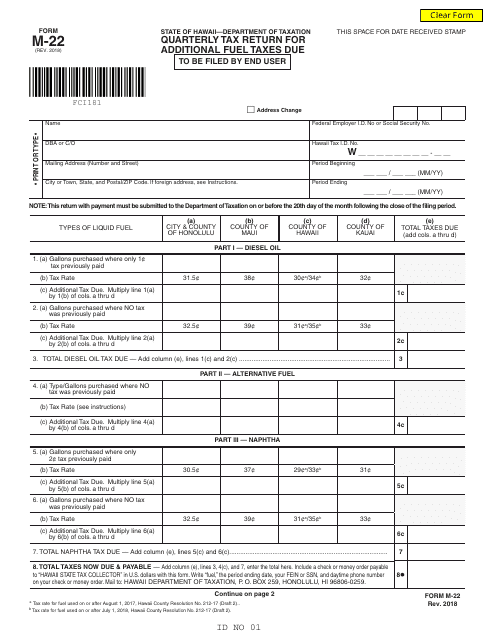

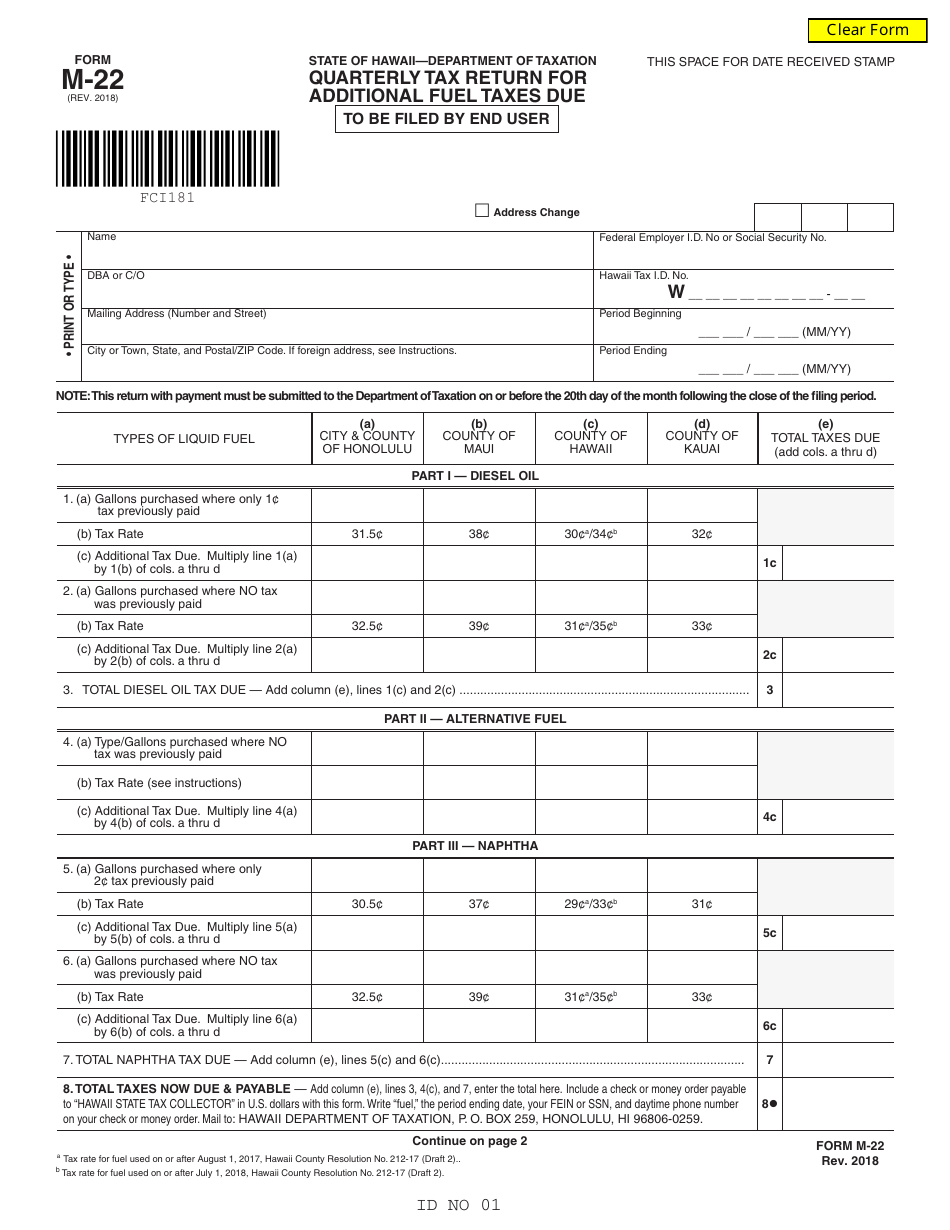

Form M-22

for the current year.

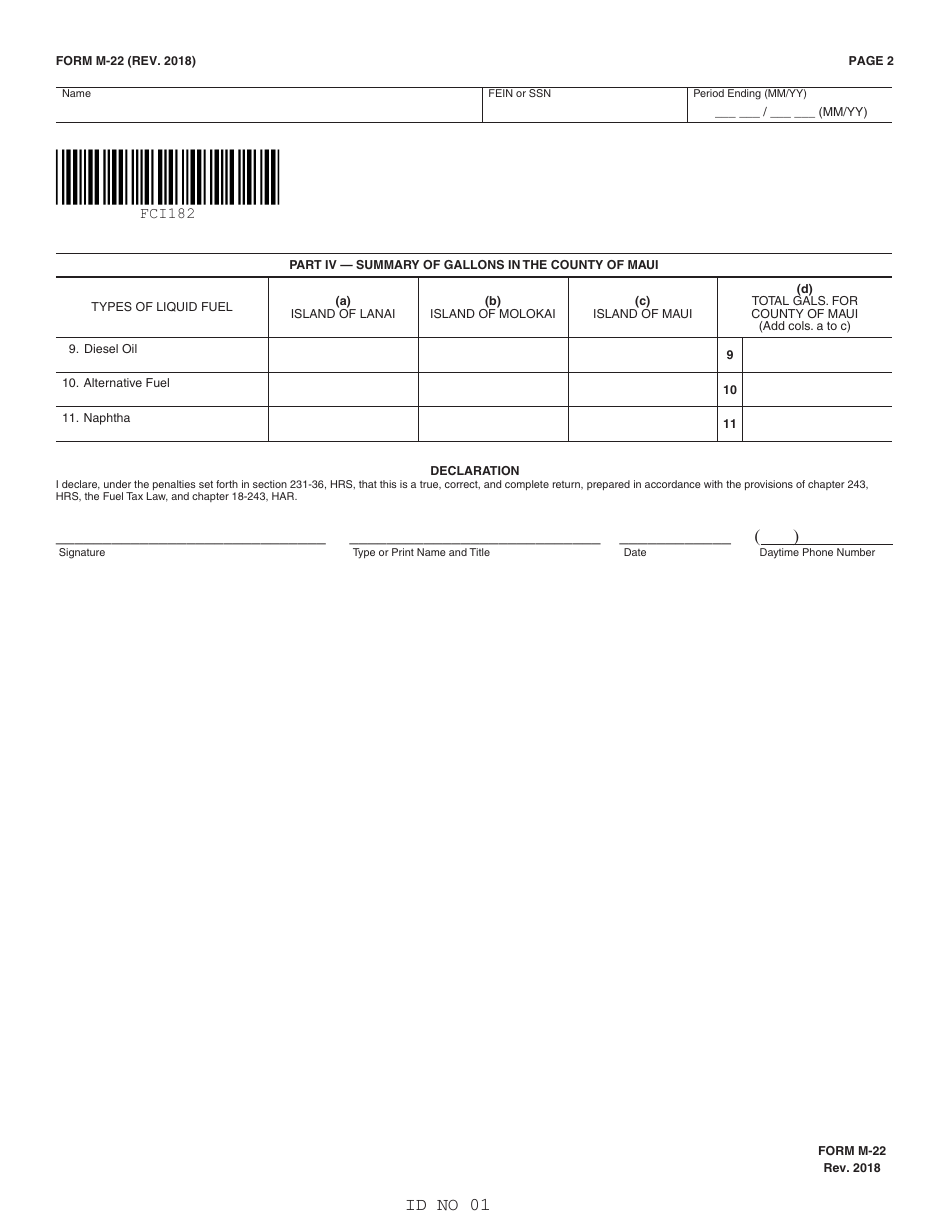

Form M-22 Quarterly Tax Return for Additional Fuel Taxes Due - Hawaii

What Is Form M-22?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form M-22?

A: Form M-22 is the Quarterly Tax Return for Additional Fuel Taxes Due in Hawaii.

Q: Who needs to file Form M-22?

A: Individuals or businesses that owe additional fuel taxes in Hawaii need to file Form M-22.

Q: When is Form M-22 due?

A: Form M-22 is due quarterly. The due dates are April 30, July 31, October 31, and January 31.

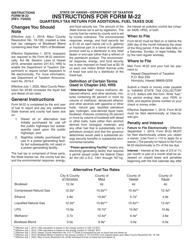

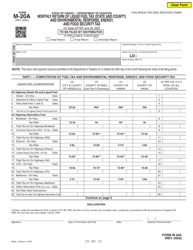

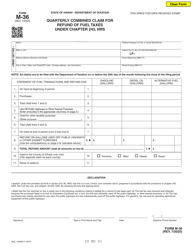

Q: What are additional fuel taxes?

A: Additional fuel taxes are taxes imposed on the sale or use of certain fuels in Hawaii.

Q: What information is required to complete Form M-22?

A: You will need to provide information about your fuel purchases, sales, and usage, as well as any other relevant information.

Q: Are there any penalties for late filing of Form M-22?

A: Yes, there may be penalties for late filing or failure to file Form M-22.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-22 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.