This version of the form is not currently in use and is provided for reference only. Download this version of

Form M-2

for the current year.

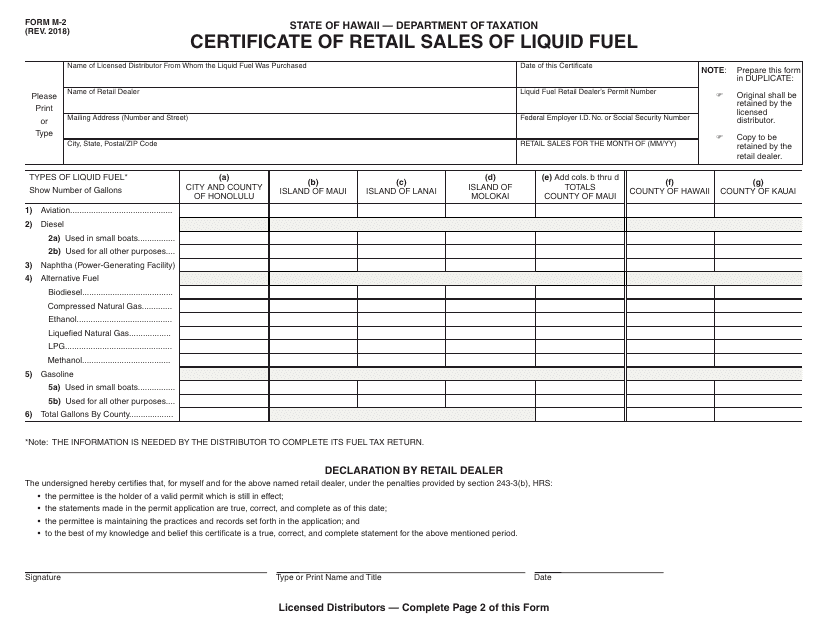

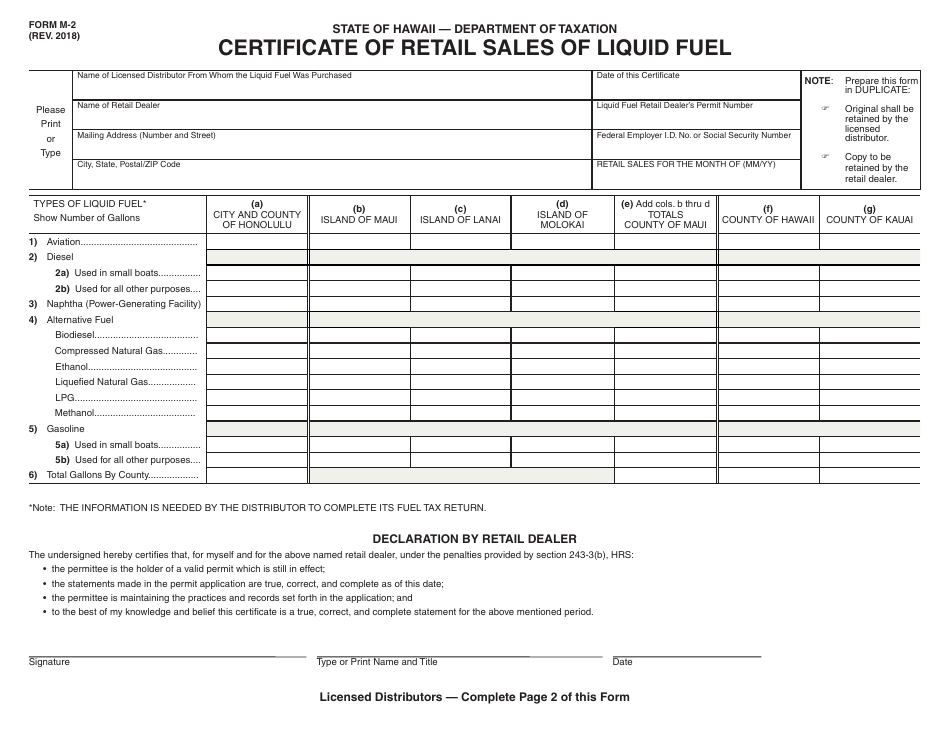

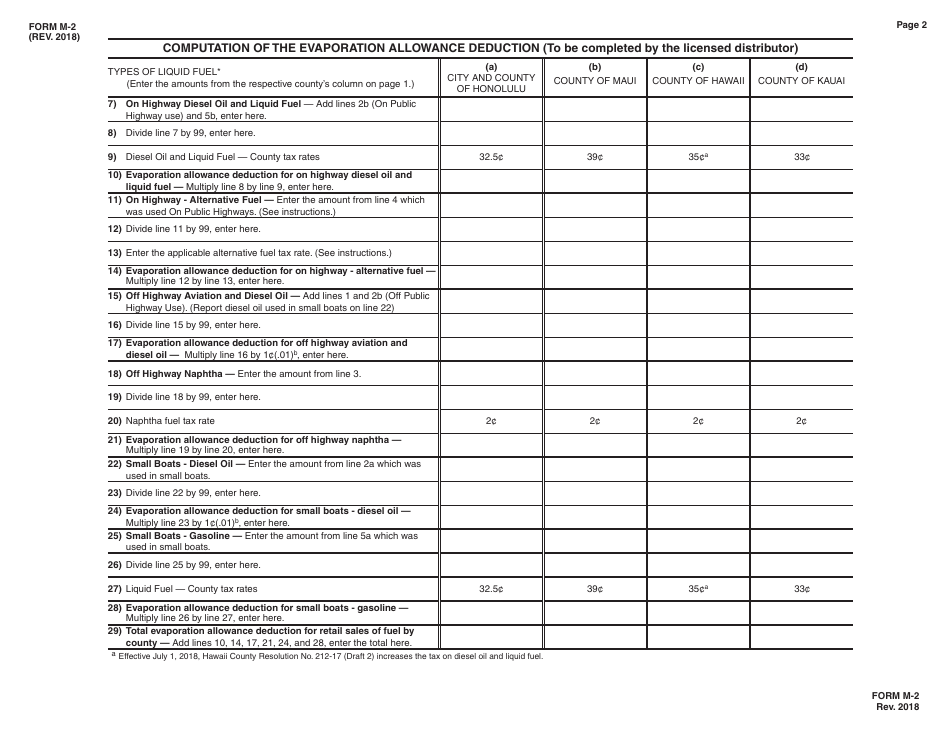

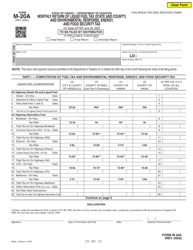

Form M-2 Certificate of Retail Sales of Liquid Fuel - Hawaii

What Is Form M-2?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form M-2 Certificate of Retail Sales of Liquid Fuel?

A: Form M-2 is a certificate used to report retail sales of liquid fuel in Hawaii.

Q: Who needs to file Form M-2?

A: Retail sellers of liquid fuel in Hawaii need to file Form M-2 to report their sales.

Q: How often do I need to file Form M-2?

A: Form M-2 needs to be filed monthly by the 20th day of the following month.

Q: What information do I need to provide on Form M-2?

A: You will need to provide details about your retail sales of liquid fuel, including the quantity sold and the amount of tax due.

Q: Is there a penalty for not filing Form M-2?

A: Yes, there is a penalty for failure to file Form M-2 or for filing it late.

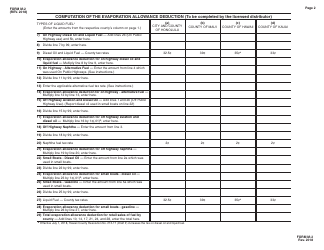

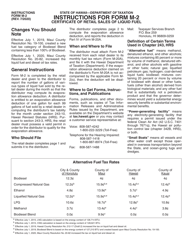

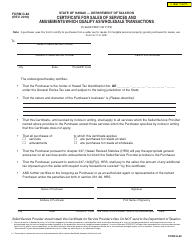

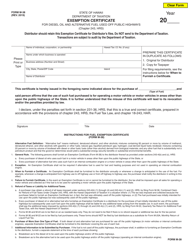

Q: Are there any exemptions or deductions available for Form M-2?

A: Yes, there may be exemptions or deductions available for certain types of sales or transactions. You should consult the instructions or a tax professional for more information.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-2 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.