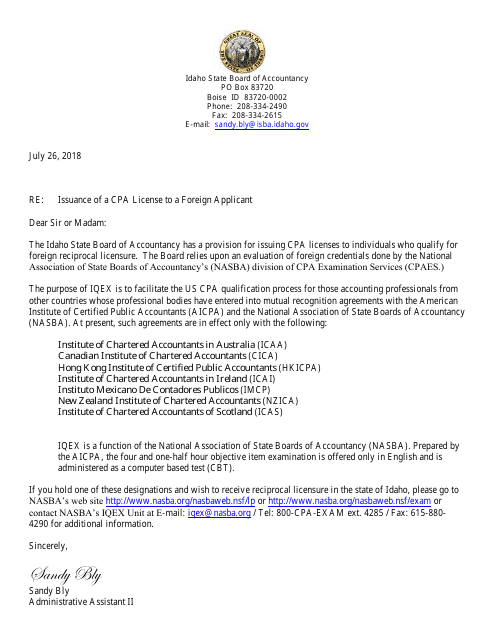

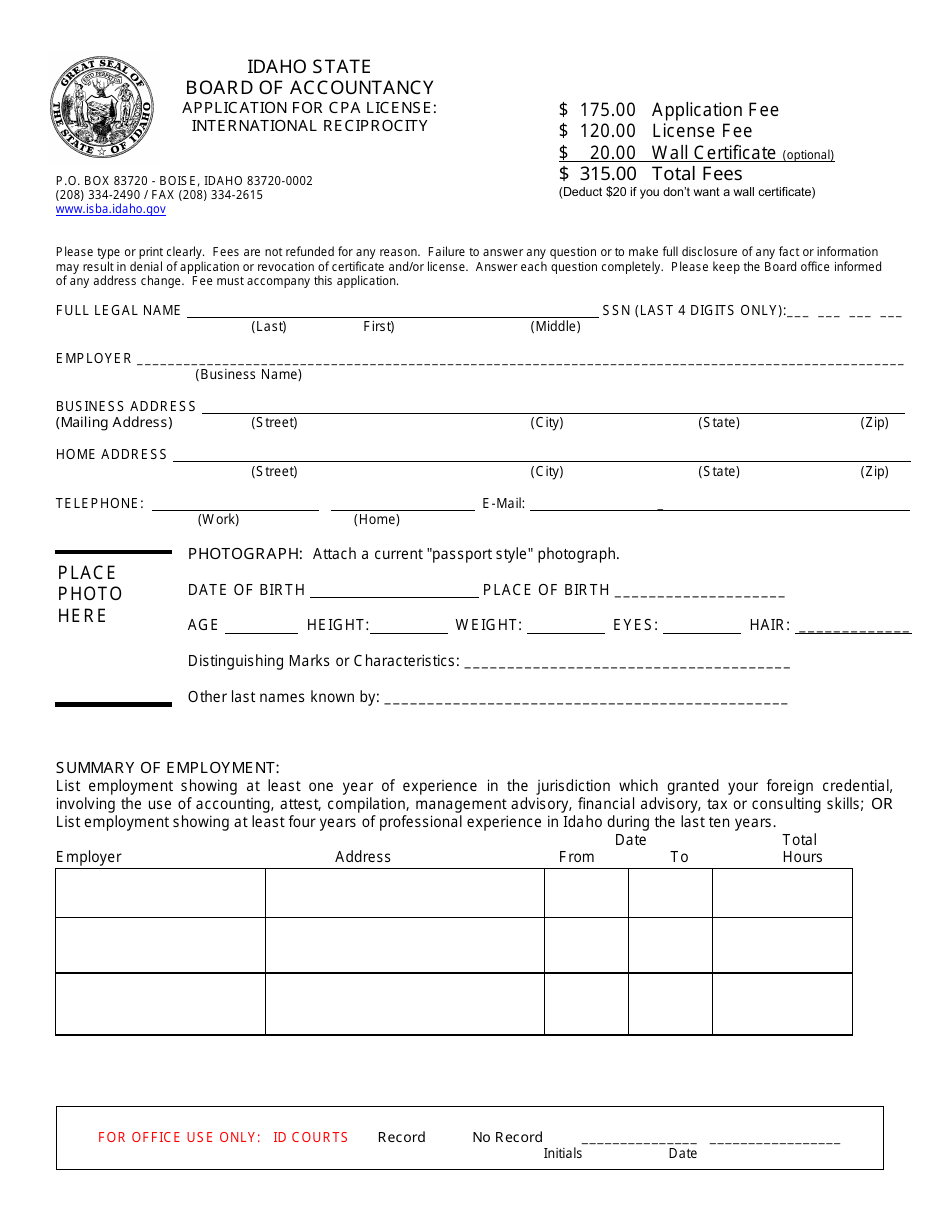

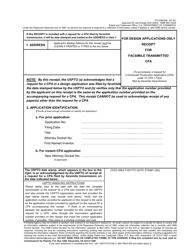

Application for CPA License: International Reciprocity - Idaho

Application for CPA License: International Reciprocity is a legal document that was released by the Idaho Secretary of State - a government authority operating within Idaho.

FAQ

Q: What is the international reciprocity application for CPA license in Idaho?

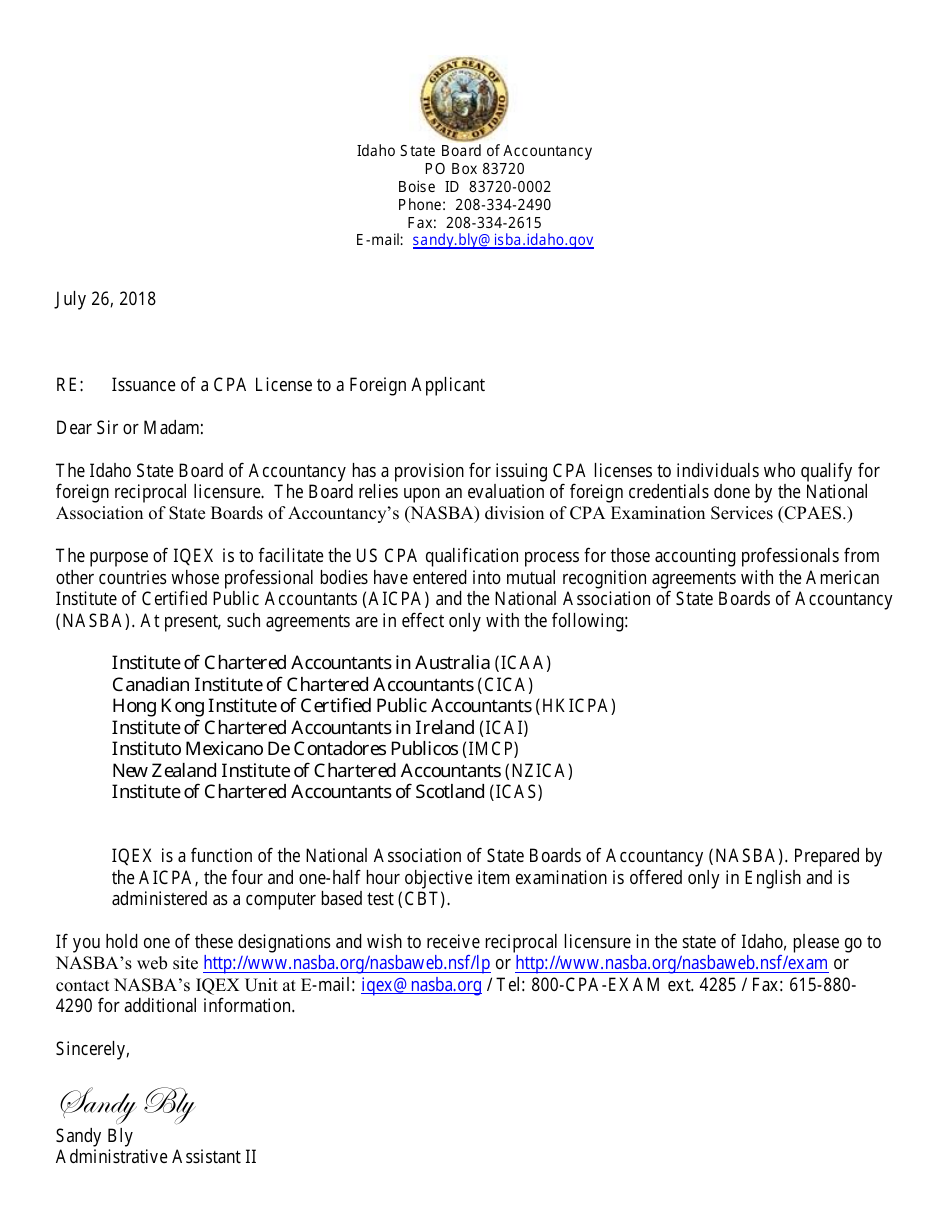

A: The international reciprocity application for CPA license in Idaho allows individuals who hold a CPA license in a foreign country to apply for a license in Idaho.

Q: Who is eligible to apply for international reciprocity?

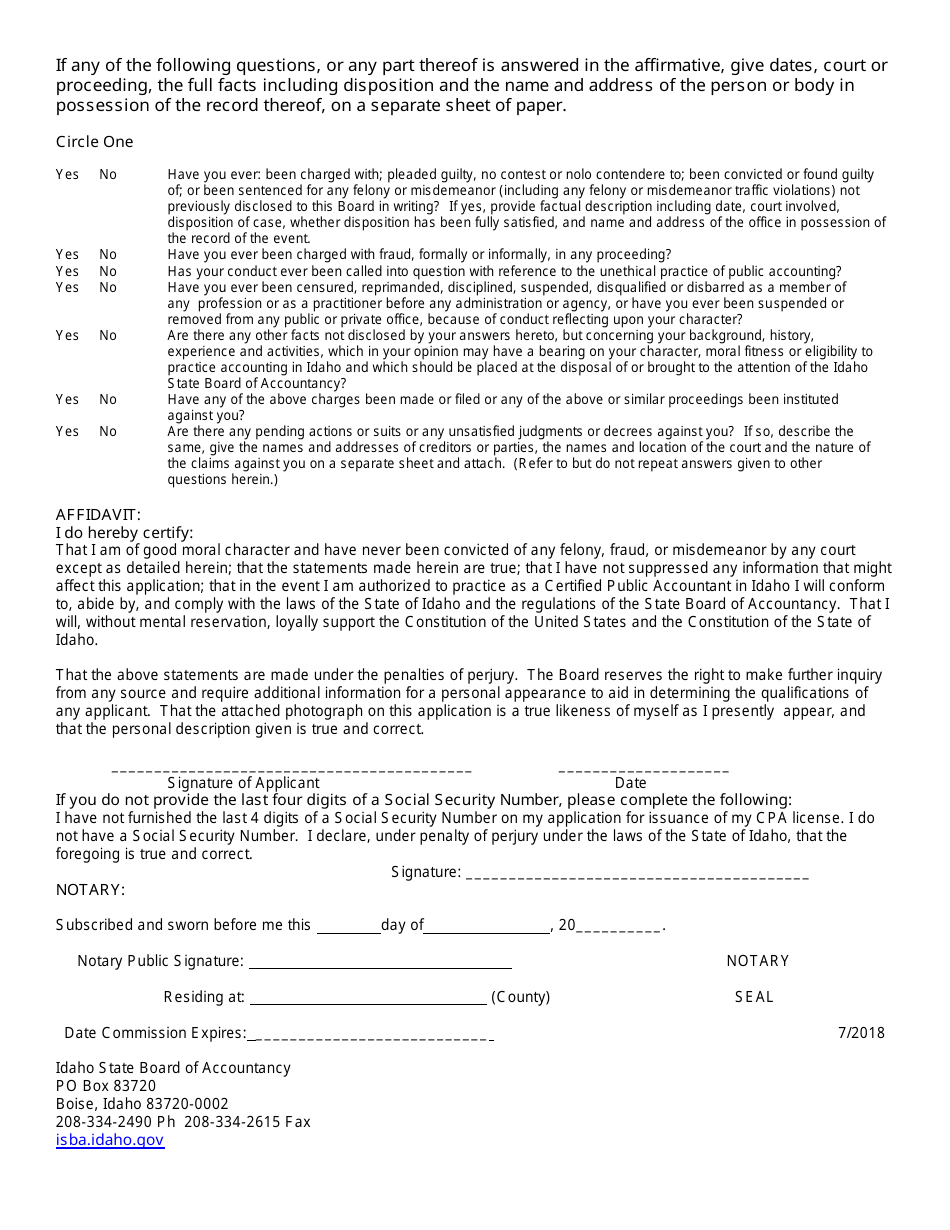

A: Individuals who hold a CPA license in a foreign country and meet the specific requirements set by the Idaho State Board of Accountancy are eligible to apply for international reciprocity.

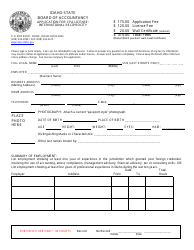

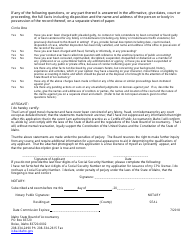

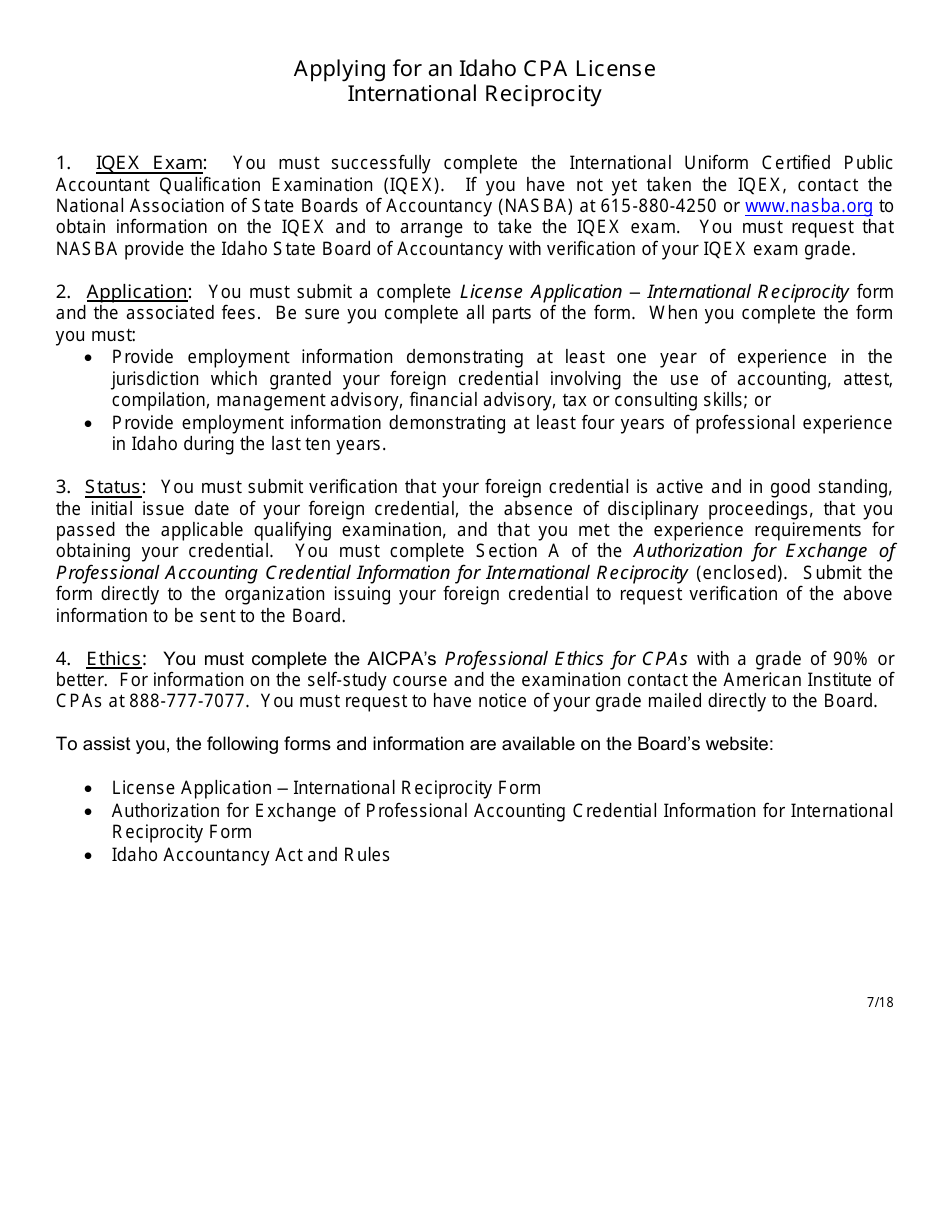

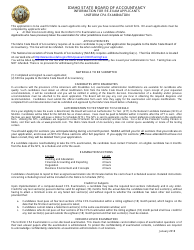

Q: What are the requirements for international reciprocity?

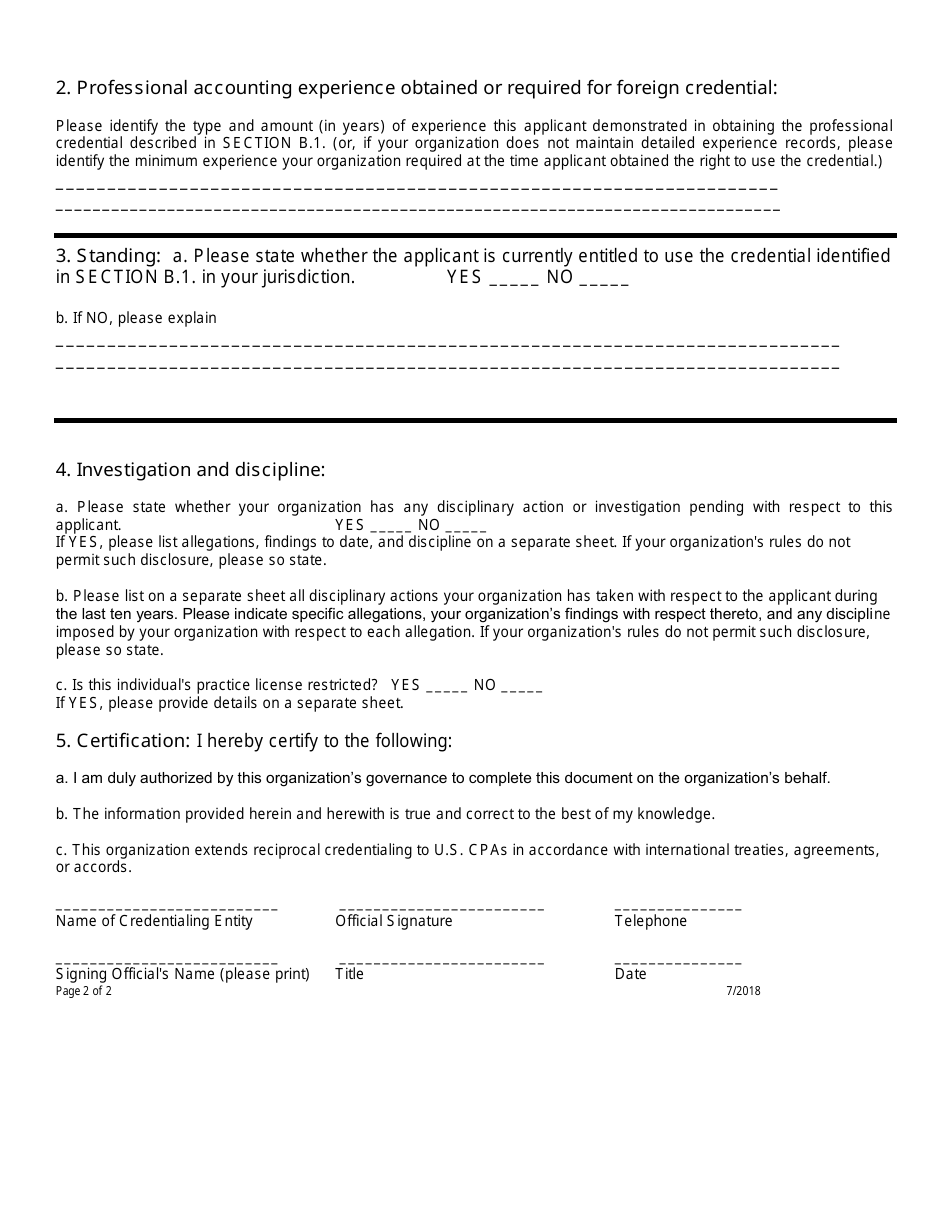

A: The specific requirements for international reciprocity vary depending on the country of the CPA license. Generally, applicants must have education, experience, and examination requirements equivalent to the requirements in Idaho.

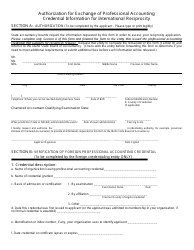

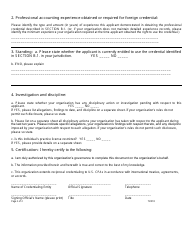

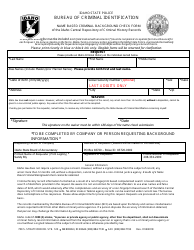

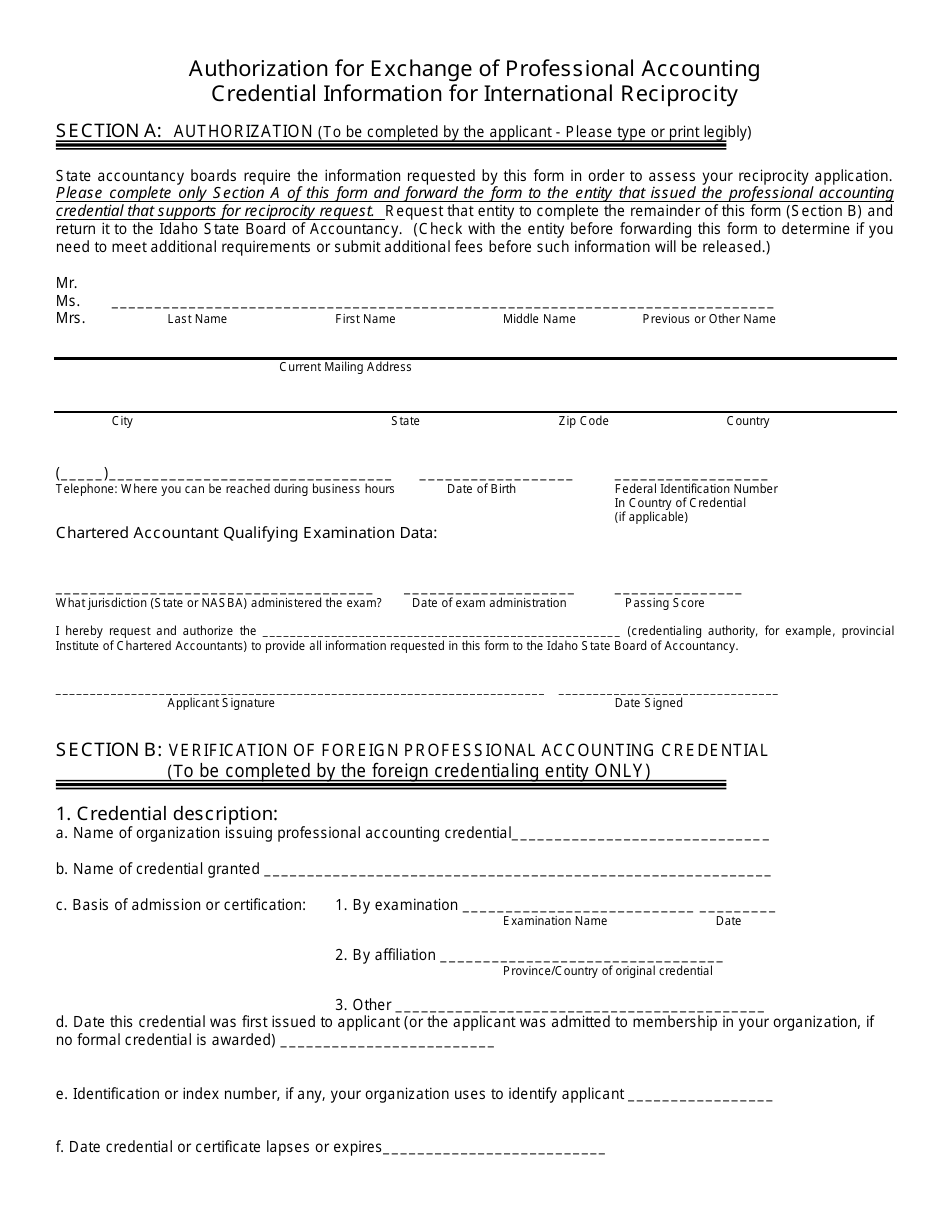

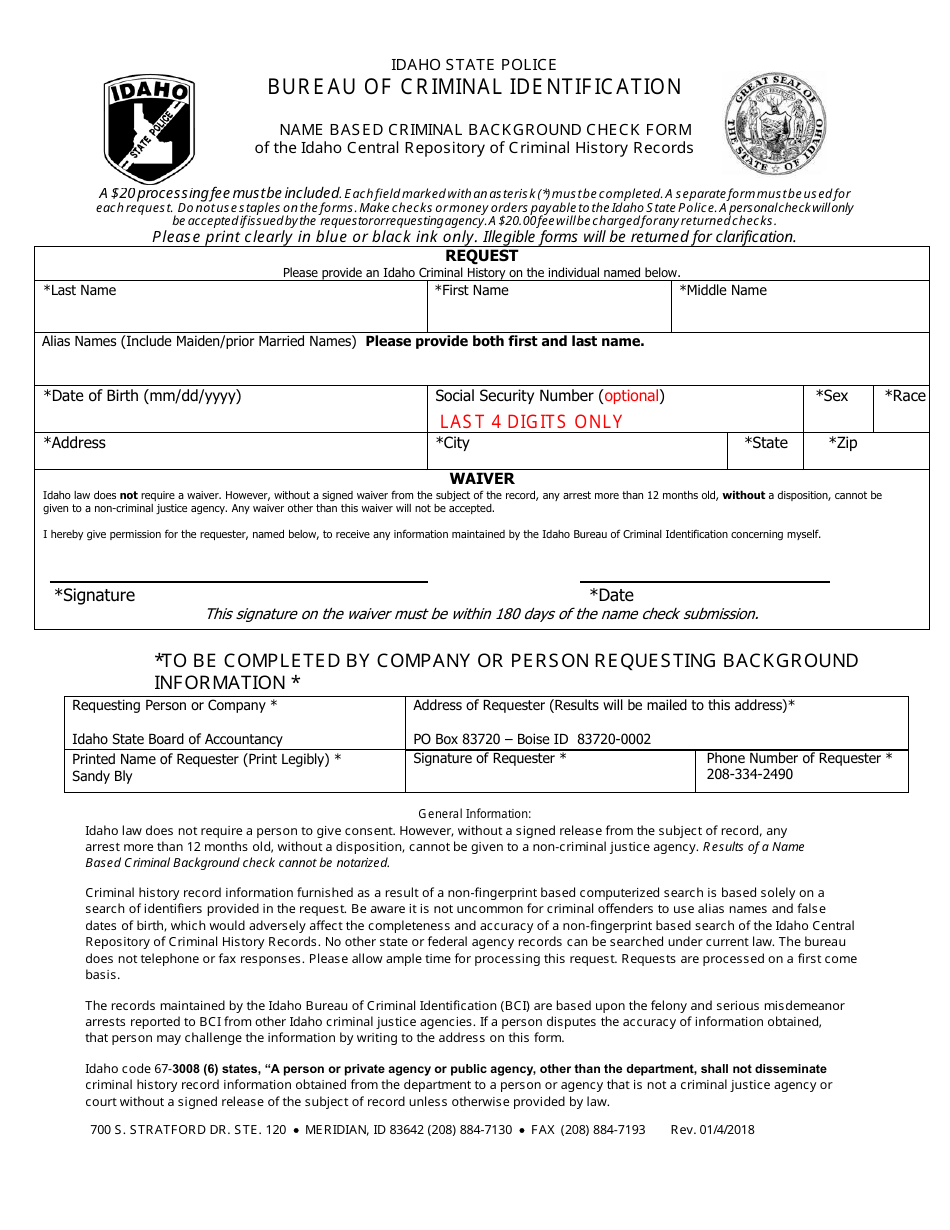

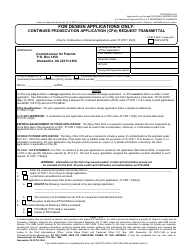

Q: What documents are required for the international reciprocity application?

A: Applicants are typically required to submit an application form, official transcripts, proof of CPA licensure in a foreign country, evidence of experience, and any other supporting documentation requested by the Idaho State Board of Accountancy.

Q: Is there an application fee for international reciprocity?

A: Yes, there is an application fee for international reciprocity. The fee amount may vary and should be paid at the time of application.

Form Details:

- Released on July 1, 2018;

- The latest edition currently provided by the Idaho Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Idaho Secretary of State.