This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

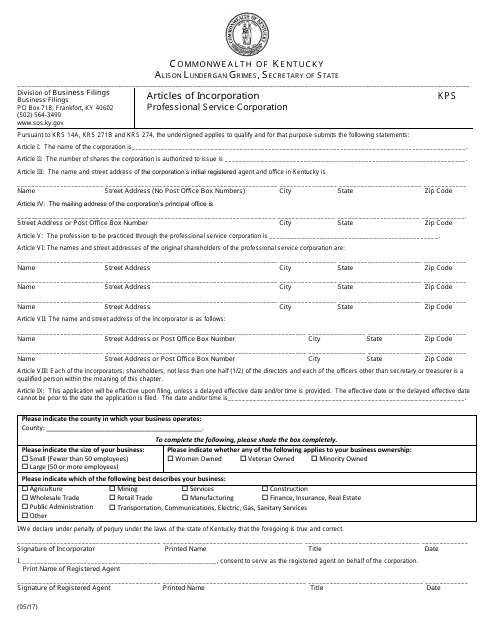

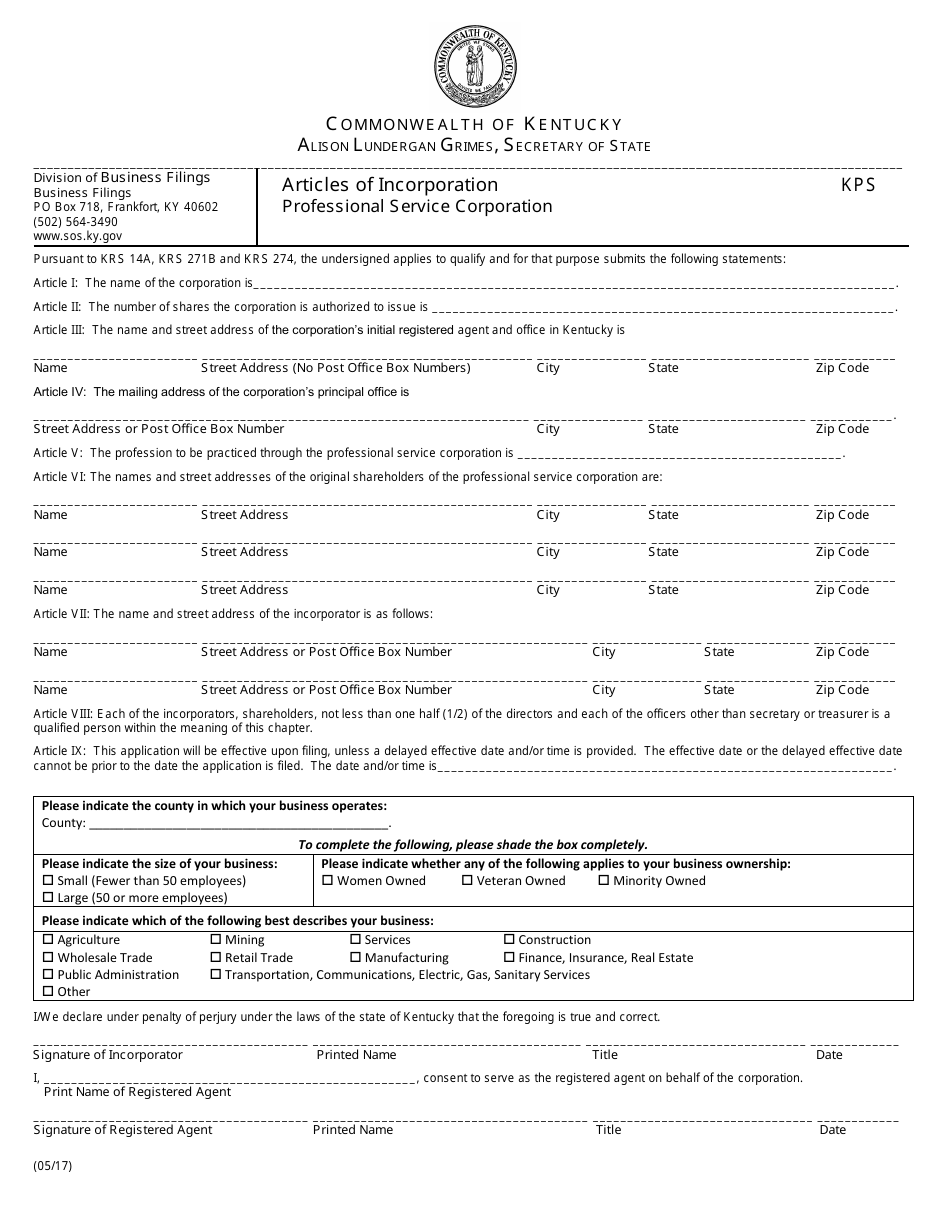

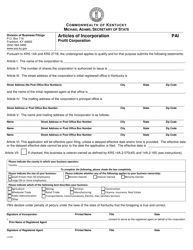

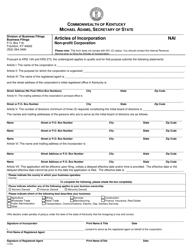

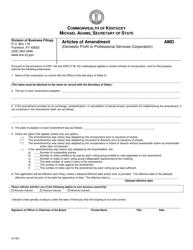

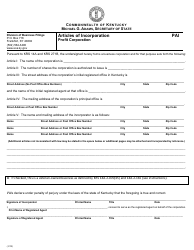

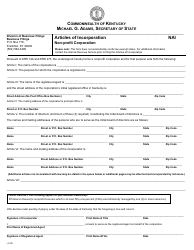

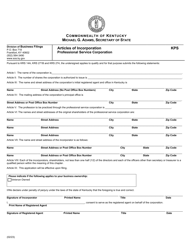

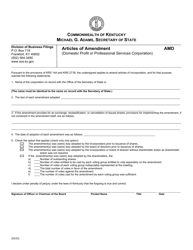

Articles of Incorporation - Professional Service Corporation - Kentucky

Articles of Incorporation - Professional Service Corporation is a legal document that was released by the Kentucky Secretary of State - a government authority operating within Kentucky.

FAQ

Q: What is a Professional Service Corporation?

A: A Professional Service Corporation (PSC) is a type of legal entity that is specifically designed for professionals who provide specialized services, such as doctors, lawyers, and accountants.

Q: Why would someone choose to form a Professional Service Corporation?

A: Forming a Professional Service Corporation offers certain benefits, such as limited liability protection for the individual professionals, as well as potential tax advantages.

Q: How do I form a Professional Service Corporation in Kentucky?

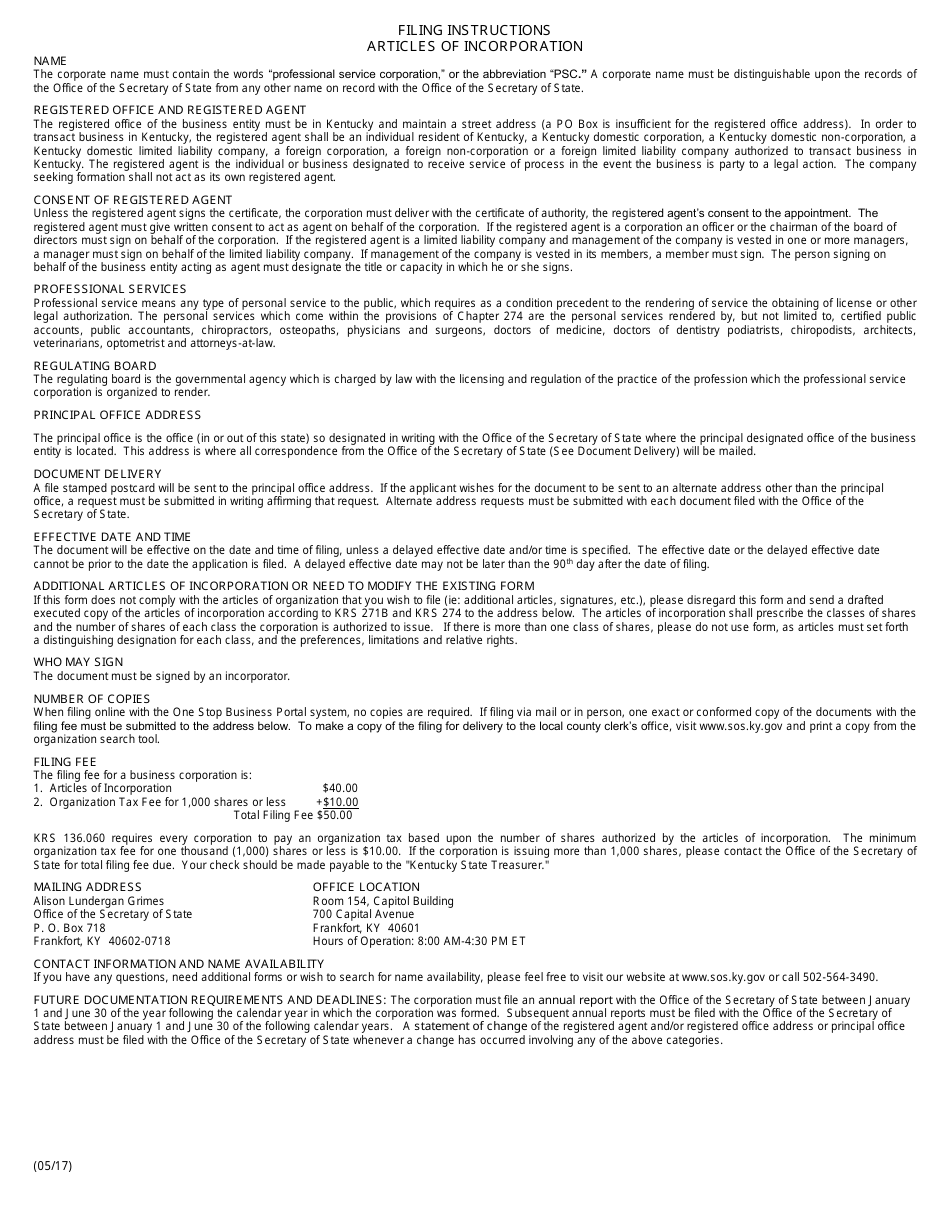

A: To form a Professional Service Corporation in Kentucky, you need to file Articles of Incorporation with the Kentucky Secretary of State, along with the required filing fee.

Q: What information is typically required in the Articles of Incorporation?

A: The Articles of Incorporation typically require information such as the name of the corporation, the specific professional services to be provided, and the names and addresses of the incorporators.

Q: What are the ongoing requirements for a Professional Service Corporation?

A: Ongoing requirements for a Professional Service Corporation may include obtaining any necessary professional licenses, maintaining corporate records, and filing annual reports with the state.

Q: Can a Professional Service Corporation have shareholders?

A: Yes, a Professional Service Corporation can have shareholders, but they must be professionals licensed to provide the specified professional services.

Q: Can I form a Professional Service Corporation by myself, or do I need partners?

A: You can form a Professional Service Corporation by yourself, without partners, although you will need to have the necessary professional license to provide the services offered by the corporation.

Q: What are the advantages of forming a Professional Service Corporation?

A: Advantages of forming a Professional Service Corporation include limited liability protection for individual professionals, potential tax advantages, and the ability to offer stock options to attract and retain employees.

Q: What are the potential disadvantages of forming a Professional Service Corporation?

A: Potential disadvantages of forming a Professional Service Corporation include additional paperwork and regulatory requirements, restrictions on who can be a shareholder or owner, and potential personal liability for professional malpractice.

Q: Can a Professional Service Corporation be formed for any type of professional service?

A: No, a Professional Service Corporation can only be formed for specific professional services that require a professional license, such as medical, legal, accounting, and architectural services.

Form Details:

- Released on May 1, 2017;

- The latest edition currently provided by the Kentucky Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Secretary of State.