This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

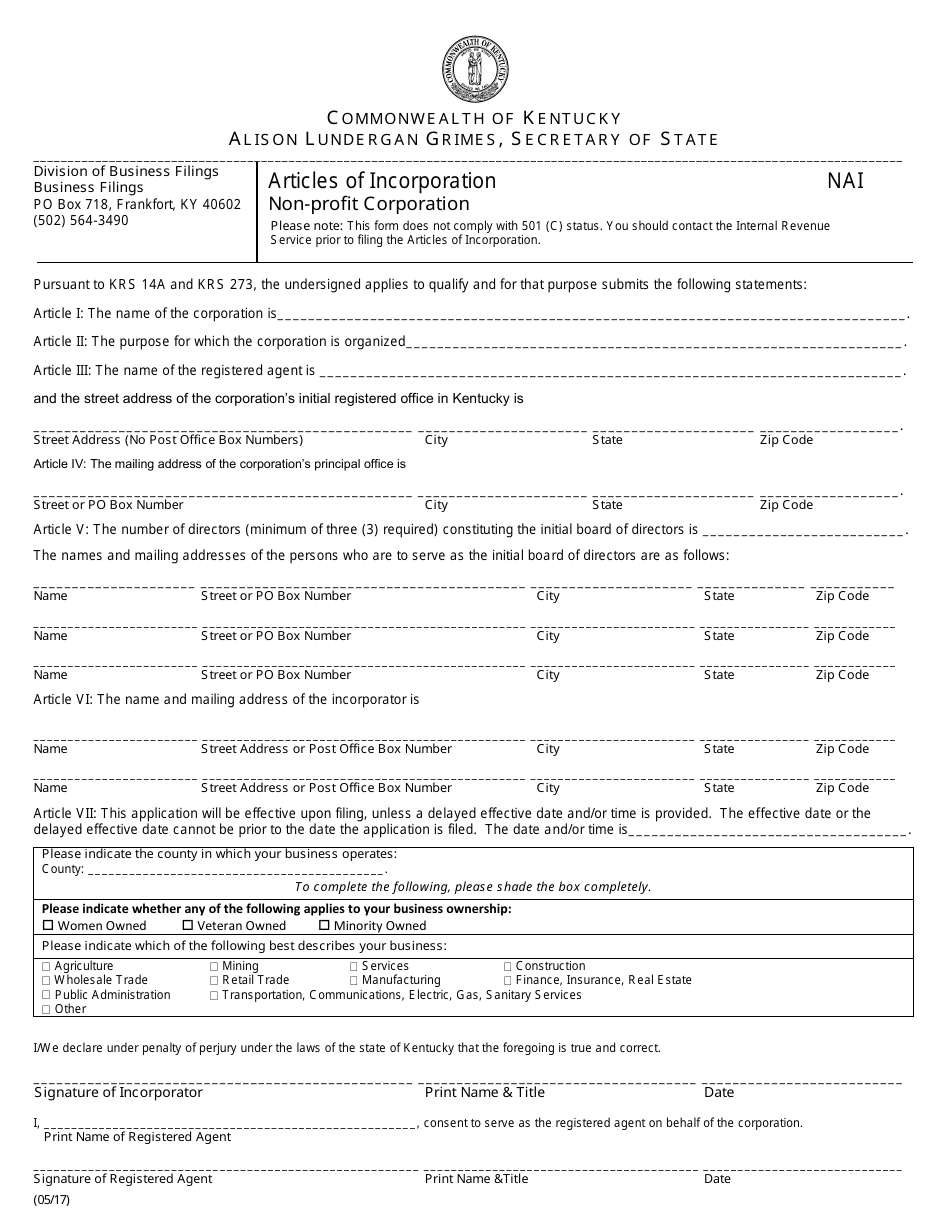

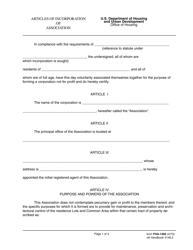

Articles of Incorporation - Non-profit Corporation - Kentucky

Articles of Incorporation - Non-profit Corporation is a legal document that was released by the Kentucky Secretary of State - a government authority operating within Kentucky.

FAQ

Q: What is Articles of Incorporation?

A: Articles of Incorporation is a legal document that establishes a corporation as a separate legal entity.

Q: What is a non-profit corporation?

A: A non-profit corporation is a type of organization that is formed for purposes other than making a profit, such as charitable, educational, or religious reasons.

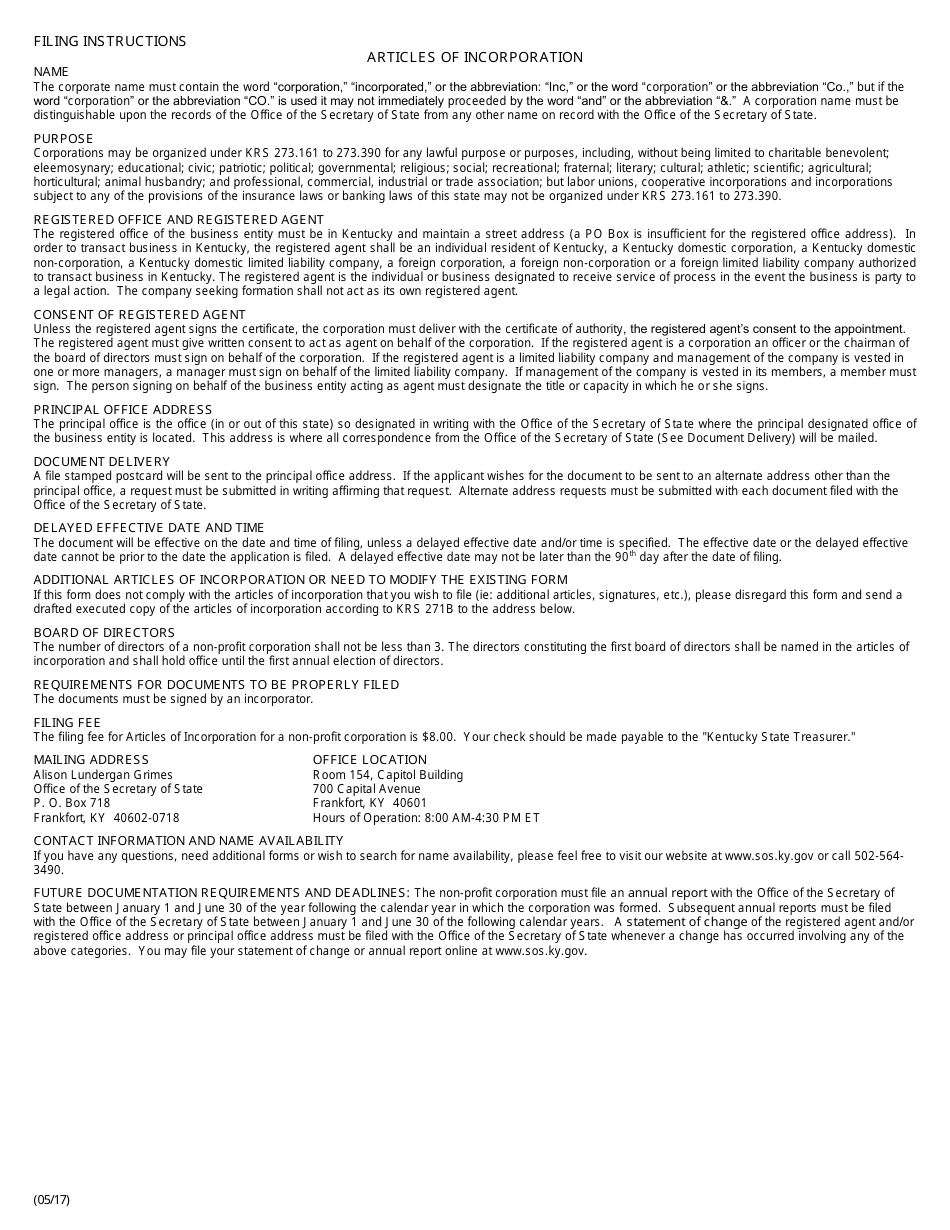

Q: What is the process of incorporating a non-profit corporation in Kentucky?

A: To incorporate a non-profit corporation in Kentucky, you need to file Articles of Incorporation with the Secretary of State.

Q: What information is required in the Articles of Incorporation?

A: The Articles of Incorporation generally require information such as the name of the corporation, its purpose, the registered agent, and the names of the initial directors.

Q: What are the advantages of incorporating a non-profit corporation?

A: Incorporating a non-profit corporation provides limited liability protection to its members, allows for tax-exempt status, and enhances credibility and public trust.

Q: Are there any ongoing requirements for a non-profit corporation in Kentucky?

A: Yes, non-profit corporations in Kentucky must file an annual report and maintain proper records of their finances and activities.

Q: Can a non-profit corporation make a profit?

A: While a non-profit corporation is generally not formed with the intention of making a profit, it can generate revenue and engage in activities that further its mission.

Q: Can the directors of a non-profit corporation be paid?

A: Directors of a non-profit corporation can be paid reasonable compensation for services rendered, as long as the payments are not excessive and are in line with the organization's mission and goals.

Q: What is the difference between a non-profit corporation and a for-profit corporation?

A: The main difference is that a non-profit corporation is not organized for the purpose of generating profit for its members, while a for-profit corporation is established with the goal of making money for its owners or shareholders.

Q: Are non-profit corporations eligible for tax exemptions?

A: Non-profit corporations can apply for tax-exempt status with the IRS, which allows them to be exempt from paying federal income taxes on their earnings.

Form Details:

- Released on May 1, 2017;

- The latest edition currently provided by the Kentucky Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Secretary of State.