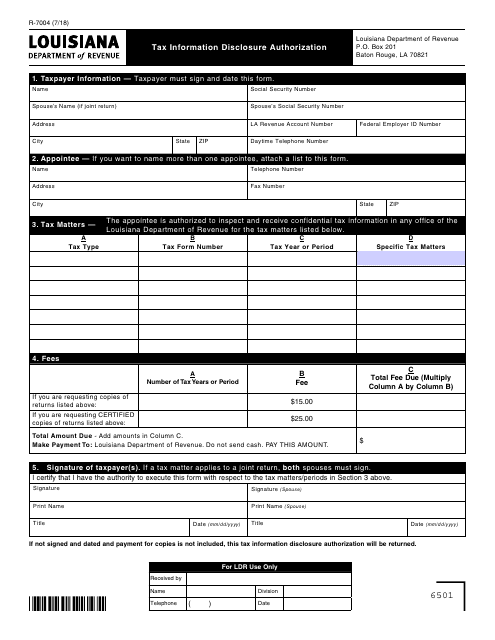

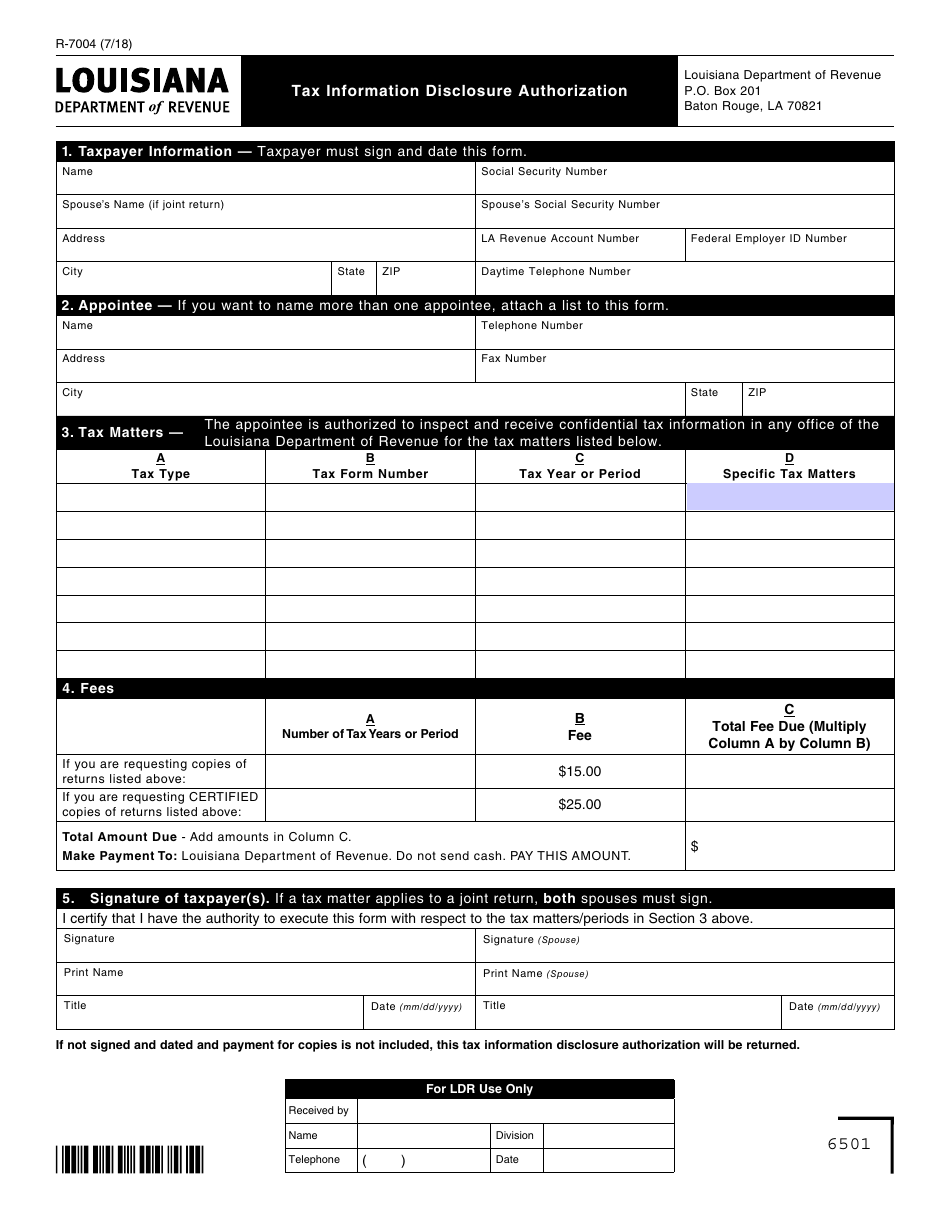

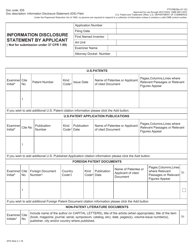

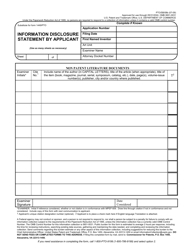

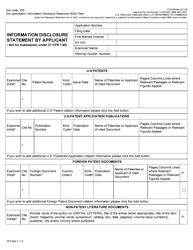

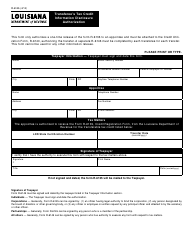

Form R-7004 Tax Information Disclosure Authorization - Louisiana

What Is Form R-7004?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-7004?

A: Form R-7004 is the Tax Information Disclosure Authorization form used in the state of Louisiana.

Q: What is the purpose of Form R-7004?

A: The purpose of Form R-7004 is to authorize the disclosure of tax information to a designated third party.

Q: Who needs to file Form R-7004?

A: Anyone who wants to authorize the disclosure of their tax information to a designated third party in Louisiana needs to file Form R-7004.

Q: Is there a fee to file Form R-7004?

A: No, there is no fee to file Form R-7004.

Q: What information do I need to provide on Form R-7004?

A: You will need to provide your name and contact information, the name of the authorized third party, and the types of tax information you want to authorize the disclosure of.

Q: What is the deadline for filing Form R-7004?

A: The deadline for filing Form R-7004 is typically the same as the deadline for filing your tax return, but it may vary depending on the specific tax form being filed.

Q: Can I revoke or amend a Form R-7004?

A: Yes, you can revoke or amend a Form R-7004 by submitting a new authorization form or a written revocation or amendment to the Louisiana Department of Revenue.

Q: What happens if I don't file Form R-7004?

A: If you don't file Form R-7004, the Louisiana Department of Revenue will not disclose your tax information to any third party.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-7004 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.