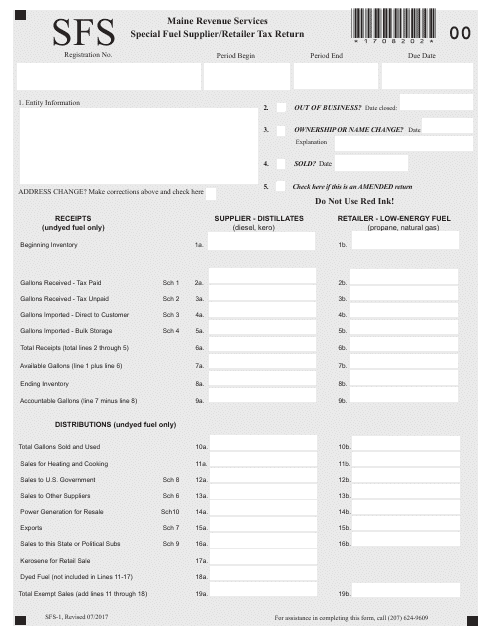

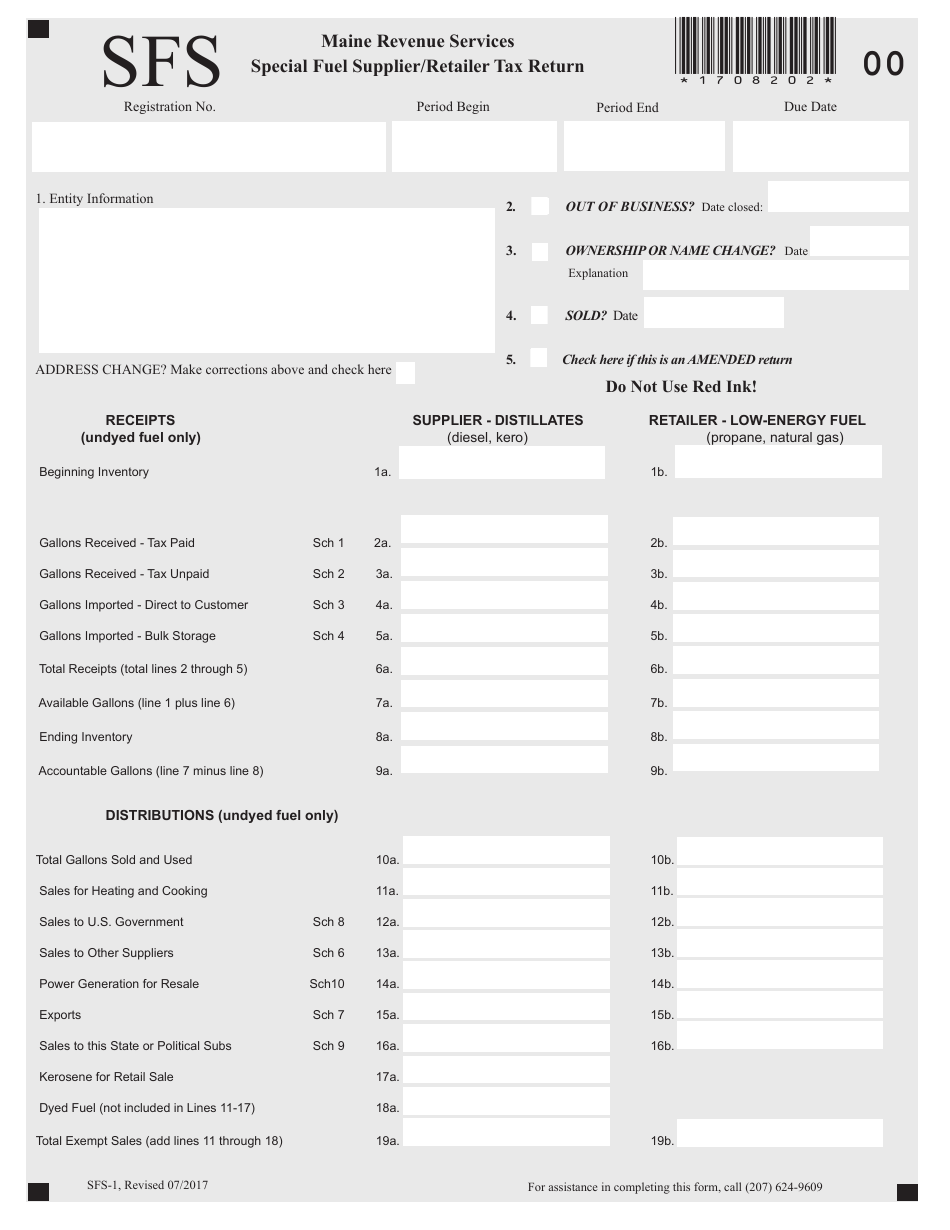

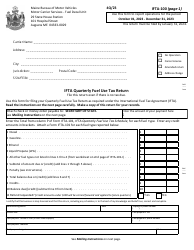

Form SFS-1 Special Fuel Supplier / Retailer Tax Return - Maine

What Is Form SFS-1?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFS-1?

A: Form SFS-1 is the Special Fuel Supplier/Retailer Tax Return in the state of Maine.

Q: Who needs to file Form SFS-1?

A: Special fuel suppliers and retailers in Maine need to file Form SFS-1.

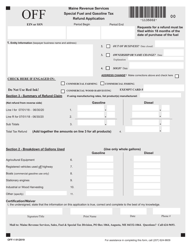

Q: What is special fuel?

A: Special fuel refers to diesel fuel, propane, or any other combustible liquid or gas used to operate motor vehicles.

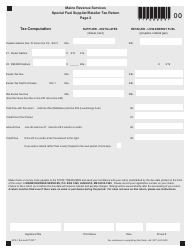

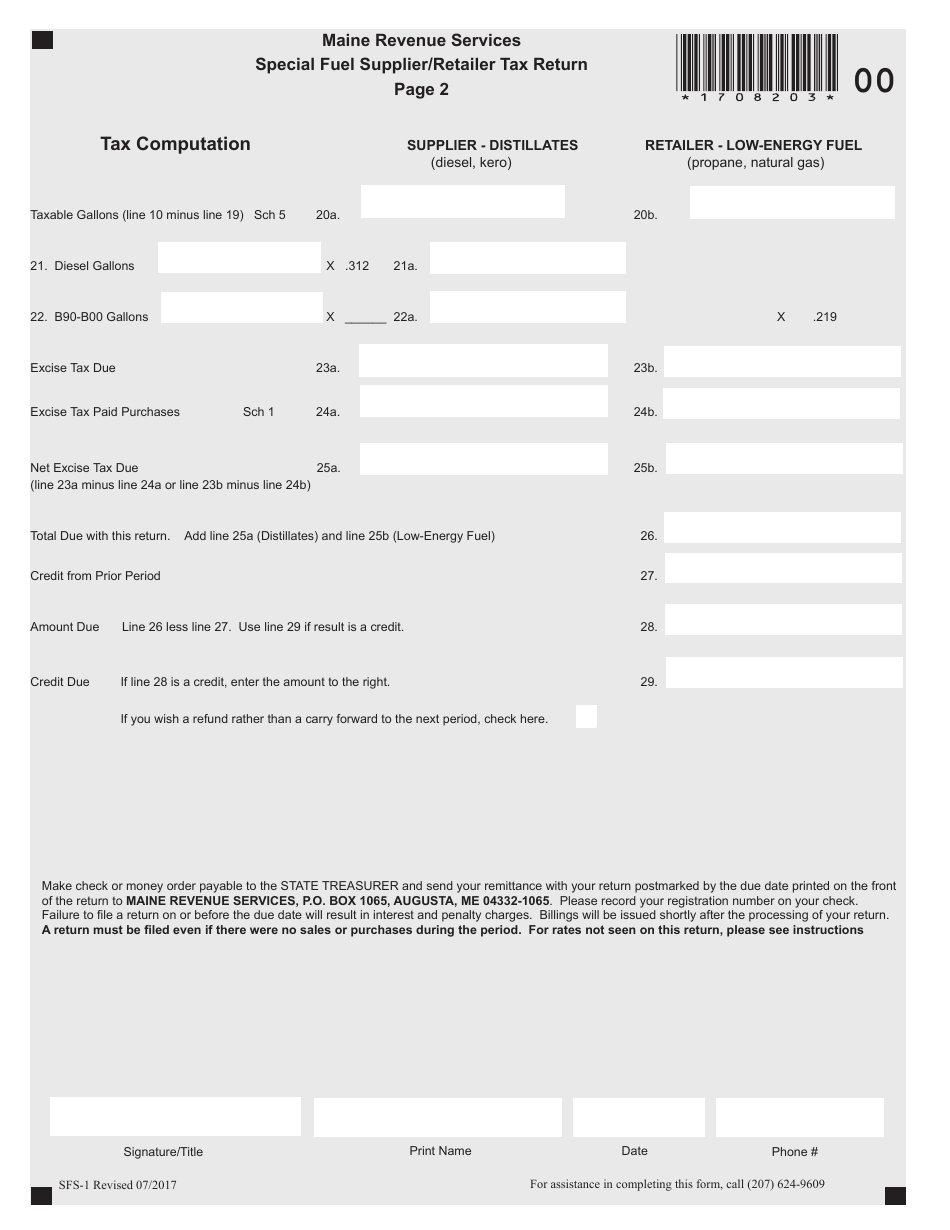

Q: What information is required on Form SFS-1?

A: Form SFS-1 requires information such as the number of gallons of special fuel sold, the total amount of sales, and any tax credits claimed.

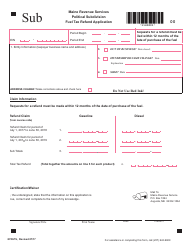

Q: When is Form SFS-1 due?

A: Form SFS-1 is due on a quarterly basis, with deadlines falling on the last day of the month following the end of each quarter.

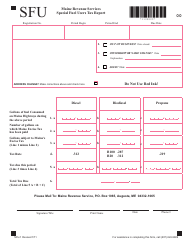

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFS-1 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.