This version of the form is not currently in use and is provided for reference only. Download this version of

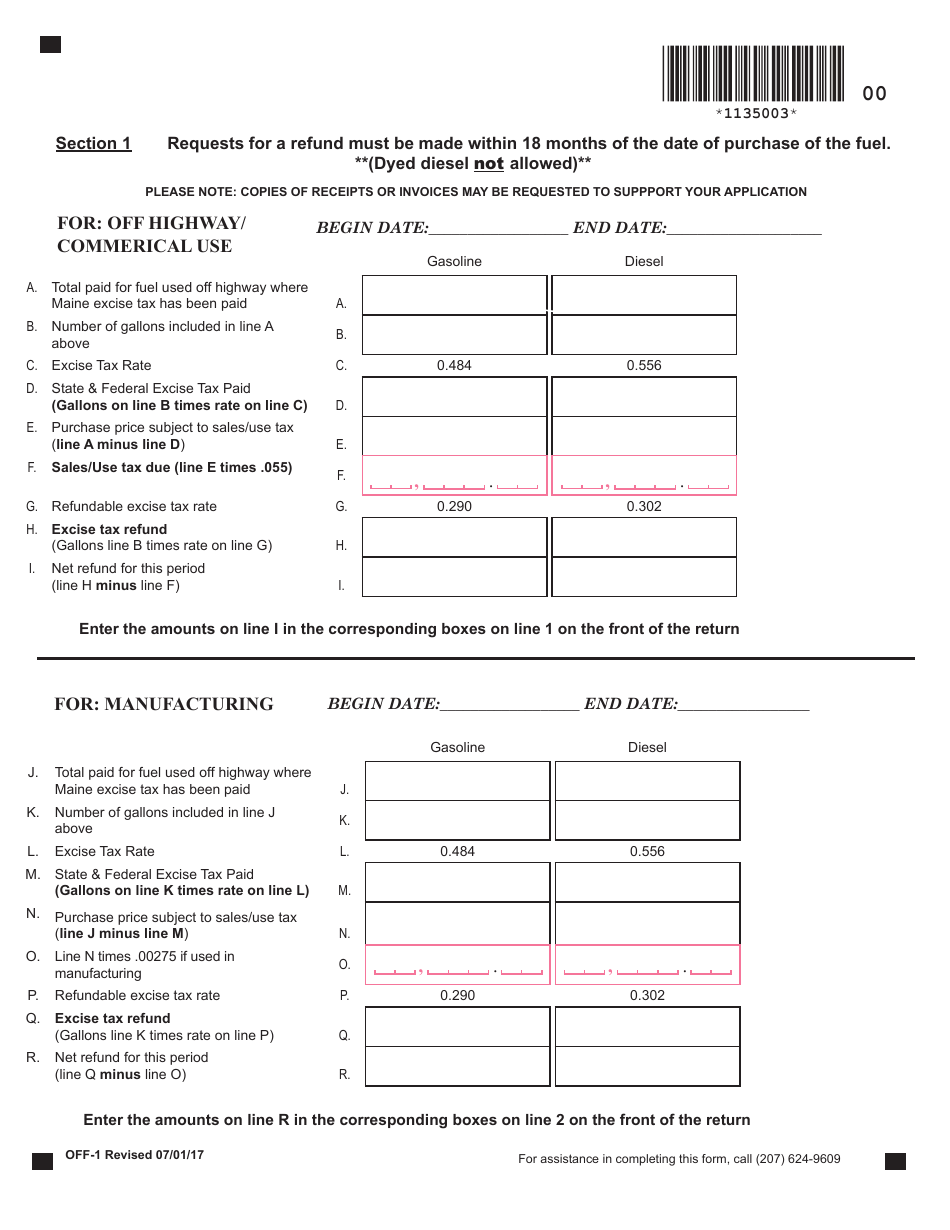

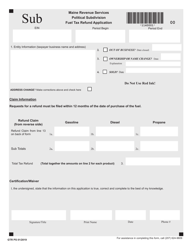

Form OFF-1

for the current year.

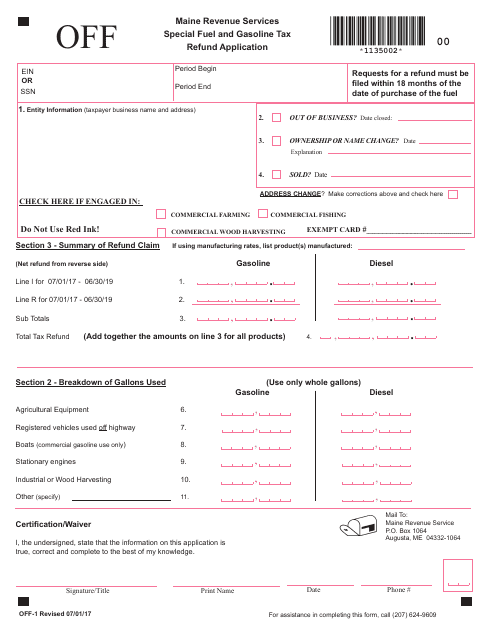

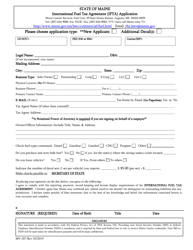

Form OFF-1 Off Highway Refund Application - Special Fuel and Gasoline Tax - Maine

What Is Form OFF-1?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form OFF-1?

A: Form OFF-1 is the Off Highway Refund Application for Special Fuel and Gasoline Tax in Maine.

Q: What is the purpose of form OFF-1?

A: The purpose of form OFF-1 is to apply for a refund of special fuel and gasoline tax paid on fuel used for off-highway purposes in Maine.

Q: Who should use form OFF-1?

A: Individuals or businesses who have paid special fuel and gasoline tax on fuel used for off-highway purposes in Maine should use form OFF-1.

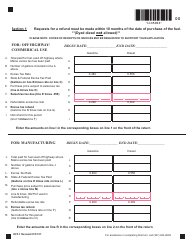

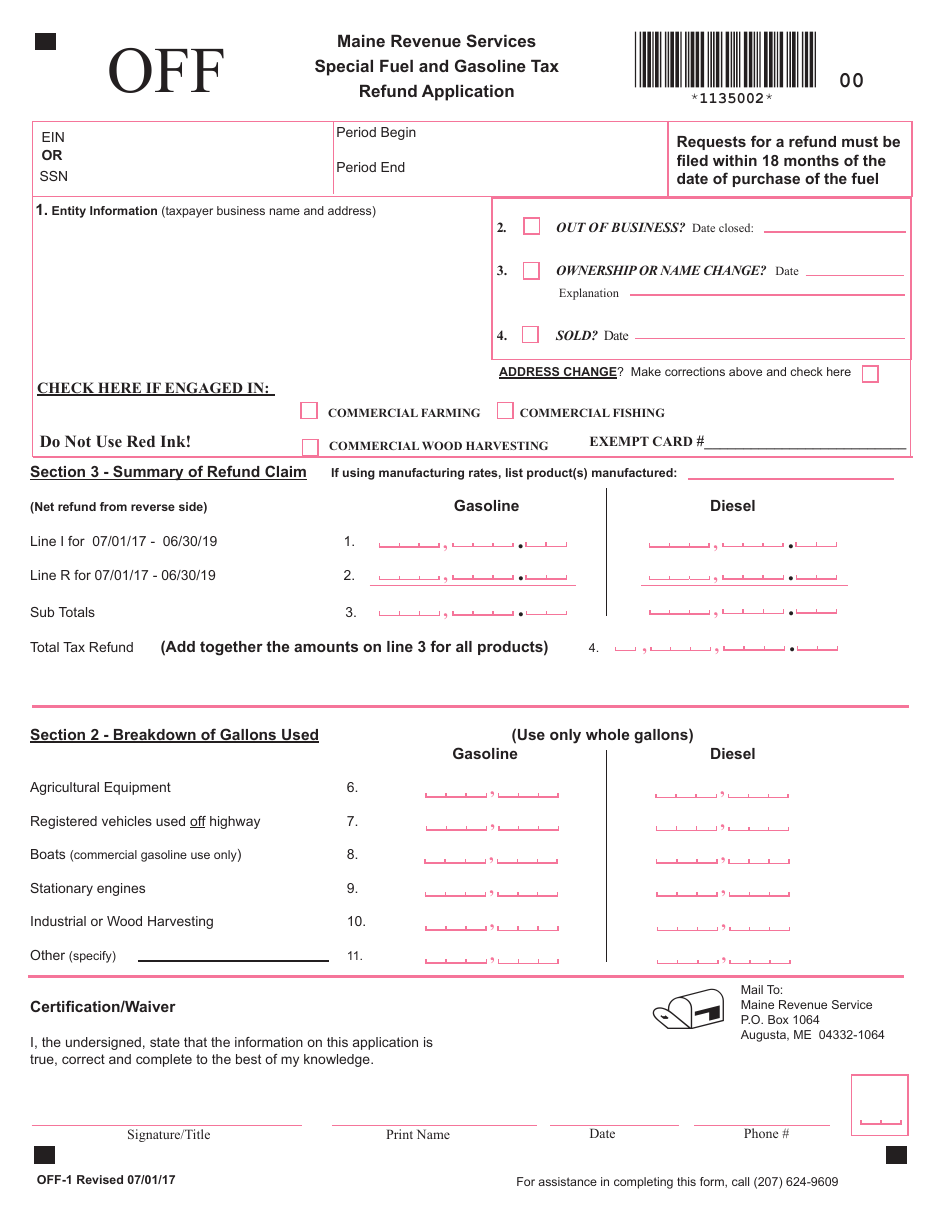

Q: How tofill out form OFF-1?

A: To fill out form OFF-1, you need to provide information about the fuel purchased, off-highway use, and the amount of tax paid. You also need to attach supporting documentation.

Q: Are there any deadlines for submitting form OFF-1?

A: Yes, form OFF-1 must be filed with the Maine Revenue Services within three years from the last day of the calendar quarter in which the fuel was purchased.

Q: What happens after submitting form OFF-1?

A: After submitting form OFF-1, the Maine Revenue Services will review the application and supporting documentation to determine if a refund is due. If approved, the refund will be issued.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OFF-1 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.