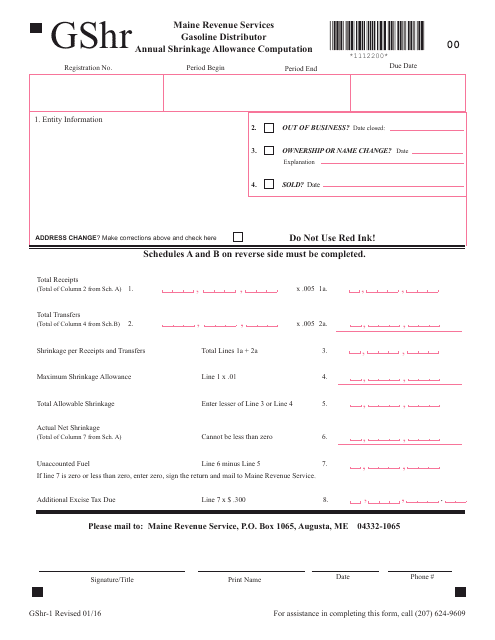

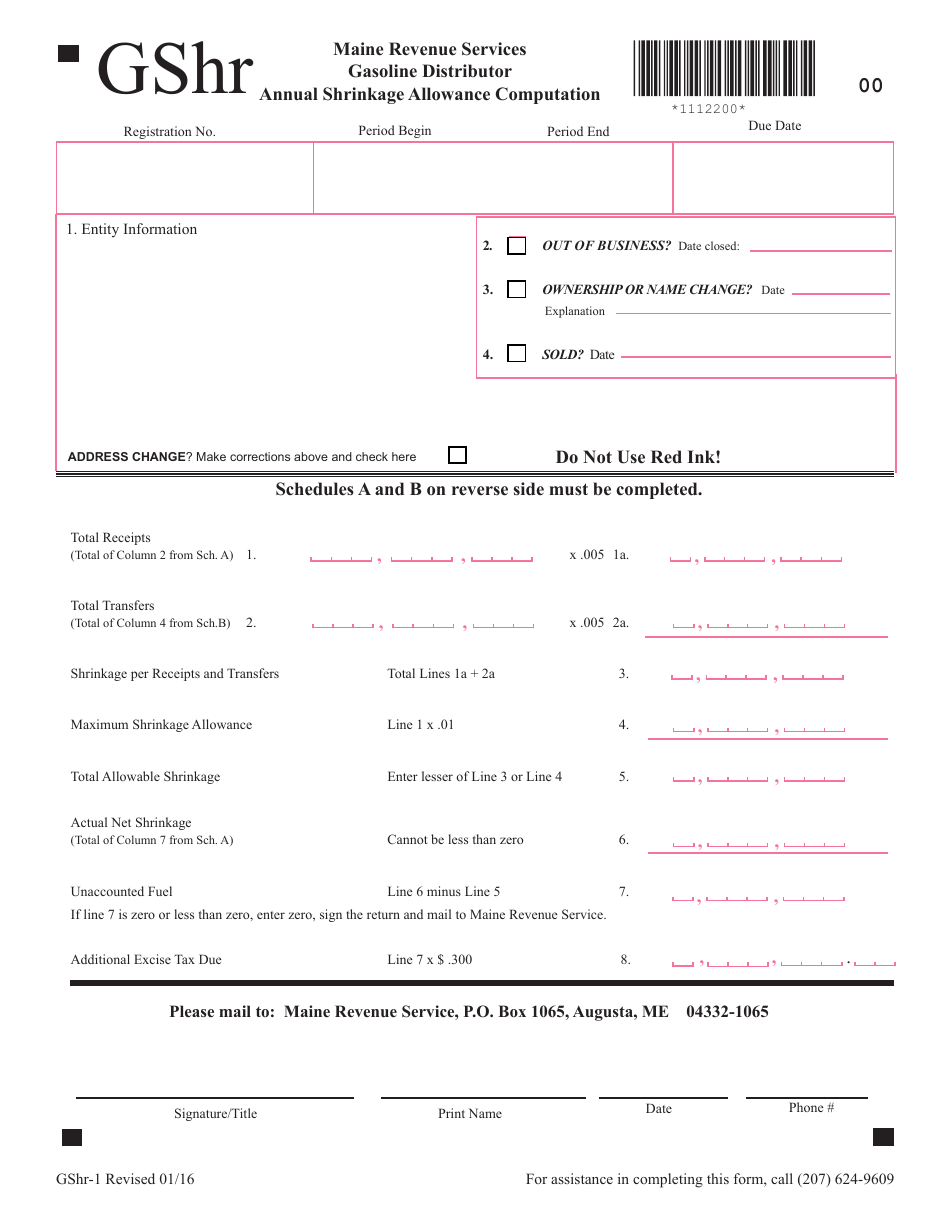

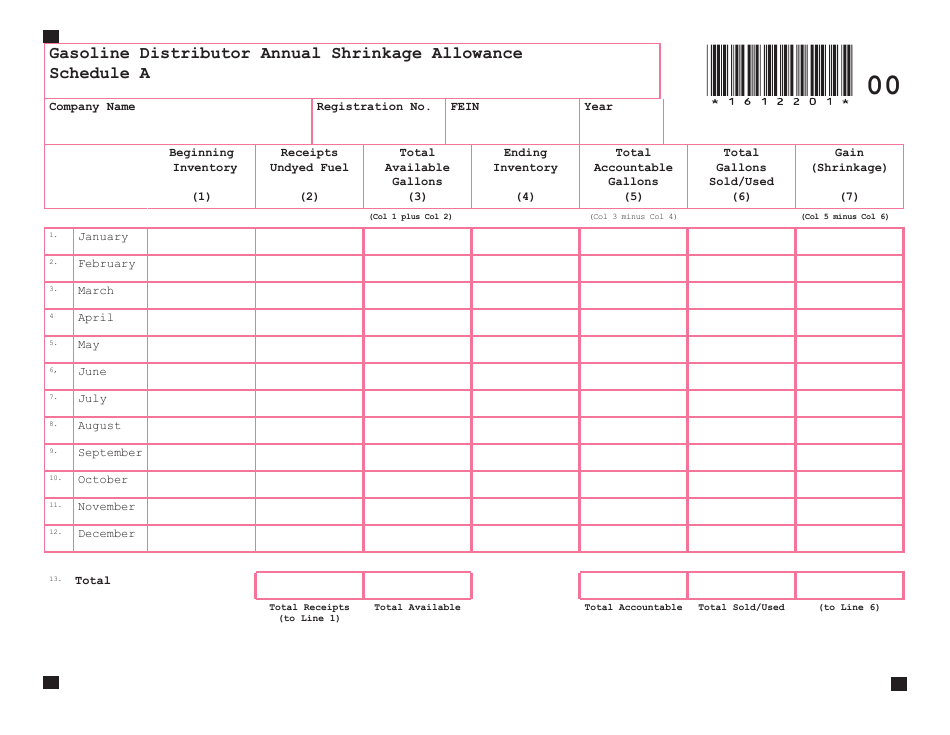

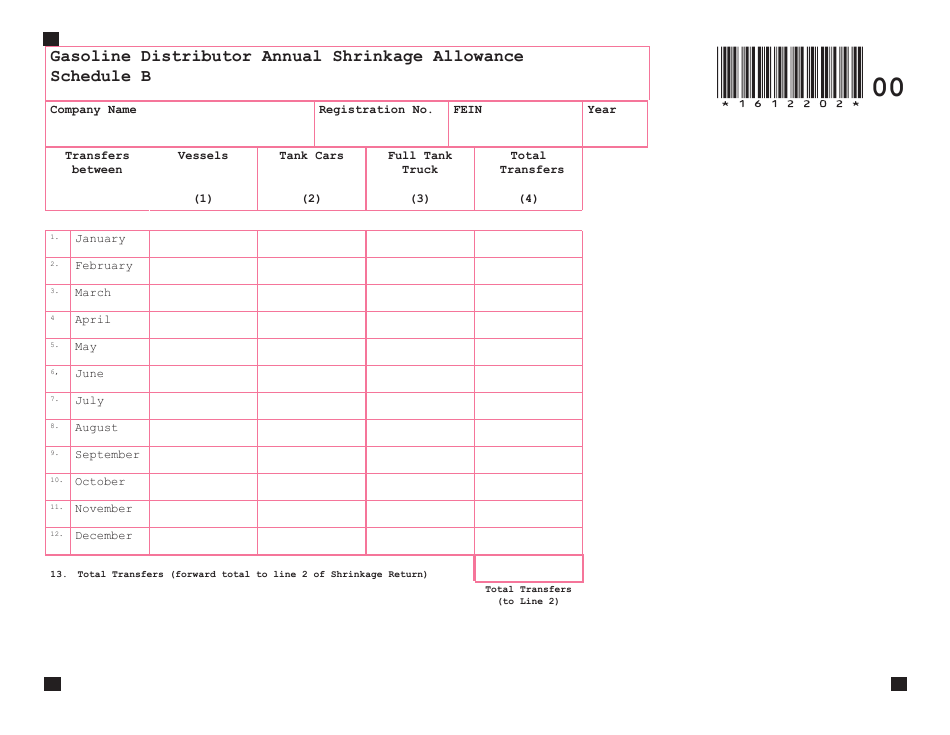

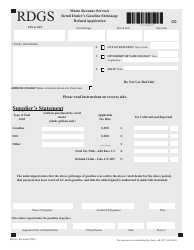

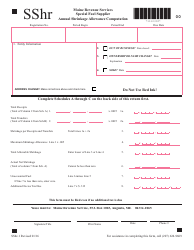

Form GSHR-1 Gasoline Distributor Annual Shrinkage Allowance Computation - Maine

What Is Form GSHR-1?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GSHR-1?

A: Form GSHR-1 is a document used for computing the annual shrinkage allowance for gasoline distributors in Maine.

Q: Who needs to fill out Form GSHR-1?

A: Gasoline distributors in Maine are required to fill out Form GSHR-1.

Q: What is the purpose of Form GSHR-1?

A: The purpose of Form GSHR-1 is to calculate the annual shrinkage allowance for gasoline distributors.

Q: What is the annual shrinkage allowance?

A: The annual shrinkage allowance is the amount deducted from the total gasoline inventory to account for shrinkage or loss during the year.

Q: How is the annual shrinkage allowance calculated?

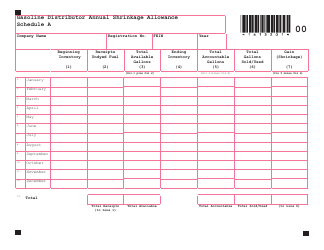

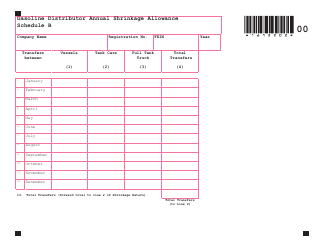

A: The annual shrinkage allowance is calculated by multiplying the average inventory by the shrinkage percentage.

Q: What information is needed to fill out Form GSHR-1?

A: To fill out Form GSHR-1, gasoline distributors will need to provide information such as the average inventory, shrinkage percentage, and other relevant details.

Q: Is there any penalty for not filing Form GSHR-1?

A: Failure to file Form GSHR-1 or filing it late may result in penalties or consequences as specified by the Maine Revenue Services.

Q: Can I claim a refund based on the shrinkage allowance?

A: No, the shrinkage allowance is not considered a refundable credit, and it does not result in a direct refund for gasoline distributors.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GSHR-1 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.