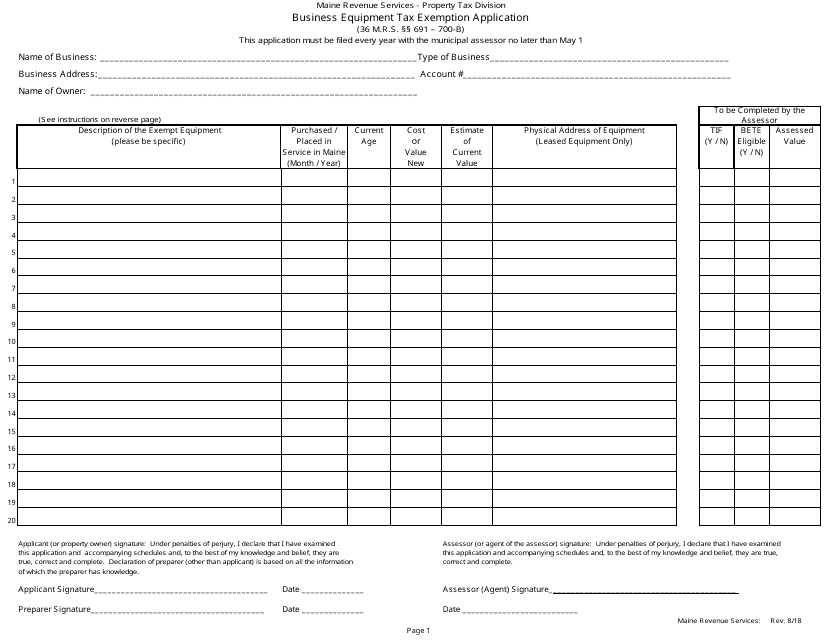

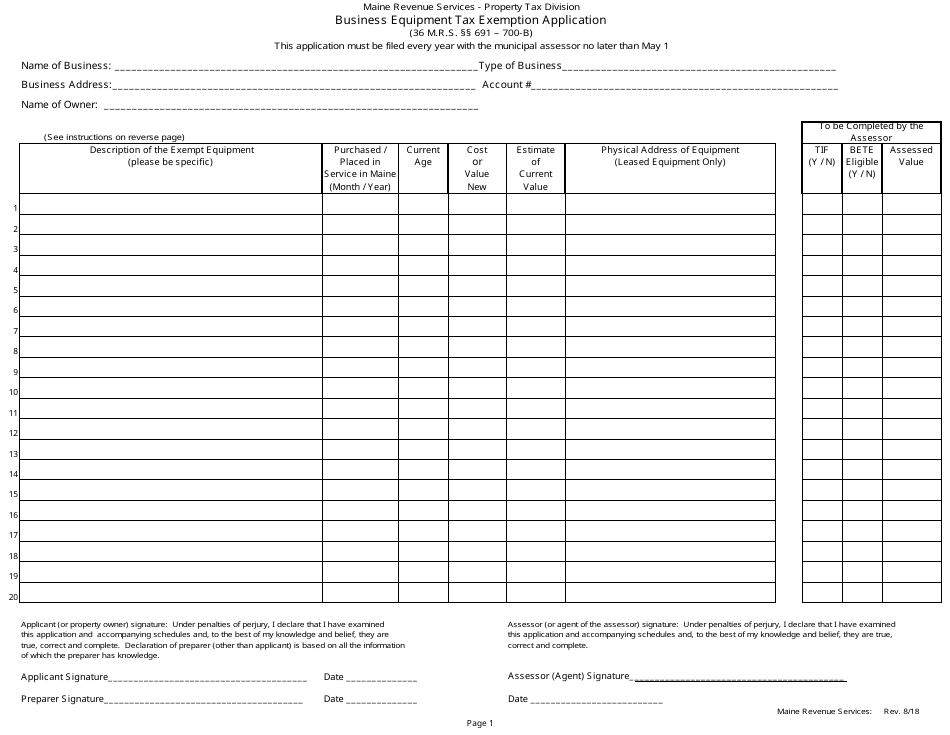

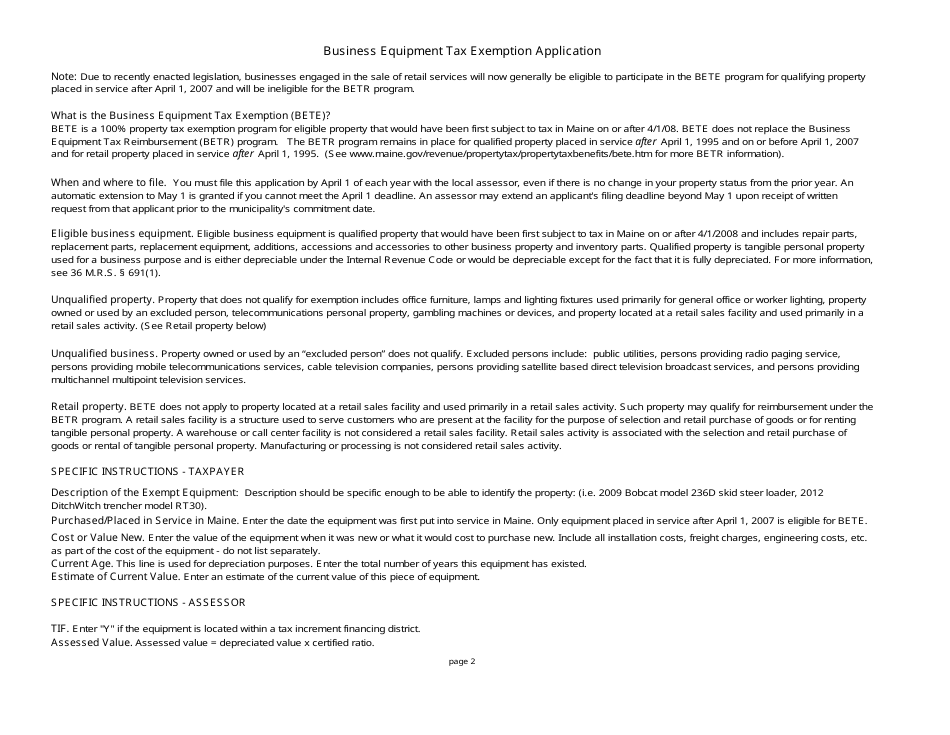

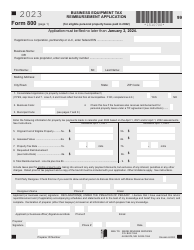

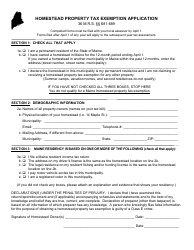

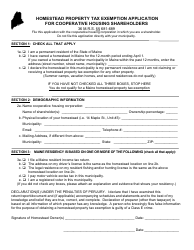

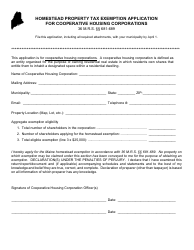

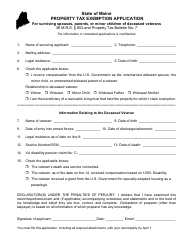

Business Equipment Tax Exemption Application - Maine

Business Equipment Tax Exemption Application is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

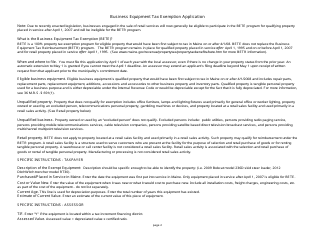

Q: What is the Business Equipment Tax Exemption Application?

A: The Business Equipment Tax Exemption Application is a form used in Maine to apply for a tax exemption for business equipment.

Q: Who is eligible for the tax exemption?

A: Eligibility for the tax exemption is determined by the State of Maine.

Q: What types of business equipment are eligible for the exemption?

A: Various types of business equipment may be eligible for the exemption, such as machinery, furniture, and computer equipment.

Q: What should I include with the application?

A: You will need to provide certain information and documentation, such as a list of the equipment and its value, proof of ownership, and any applicable leases or contracts.

Q: Is there a deadline for submitting the application?

A: Yes, there is a specific deadline for submitting the application, which is determined by the State of Maine.

Q: Can I appeal a denial of the tax exemption?

A: Yes, you have the right to appeal a denial of the tax exemption. The process for appealing will be outlined in the denial notice.

Form Details:

- Released on August 1, 2018;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.