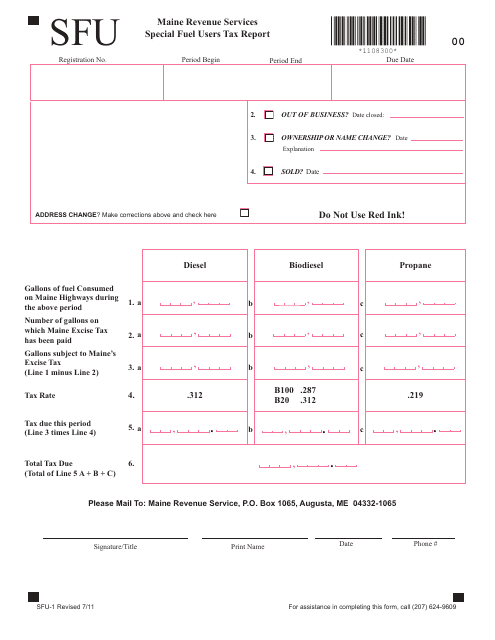

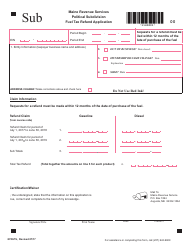

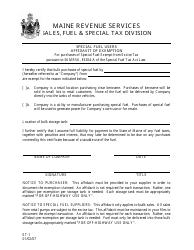

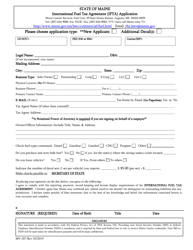

Form SFU-1 Special Fuel Users Tax Report - Maine

What Is Form SFU-1?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFU-1?

A: Form SFU-1 is the Special Fuel Users Tax Report.

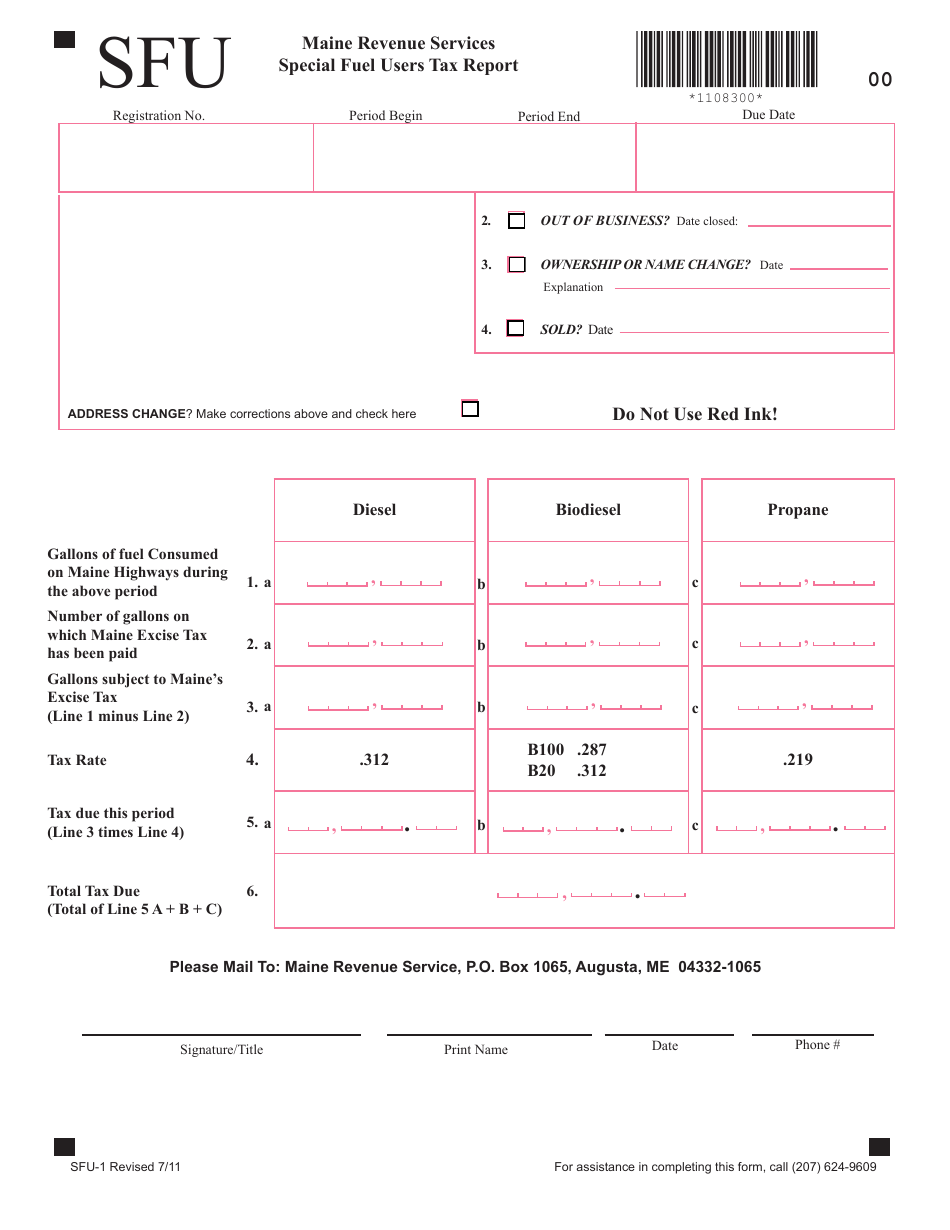

Q: Who needs to file Form SFU-1?

A: Anyone who is a special fuel user in the state of Maine needs to file Form SFU-1.

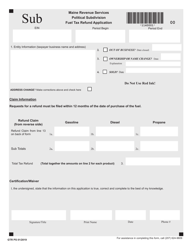

Q: What is special fuel?

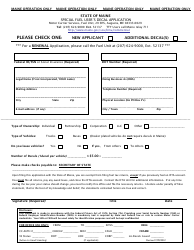

A: Special fuel refers to diesel fuel, liquefied petroleum gas (LPG), compressed natural gas (CNG), and liquefied natural gas (LNG).

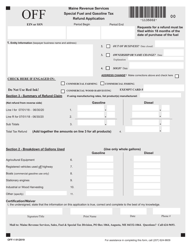

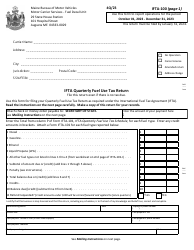

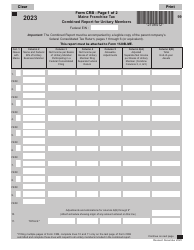

Q: What information is required on Form SFU-1?

A: Form SFU-1 requires information such as gallons of special fuel used, tax rates, and total tax due.

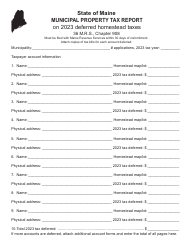

Q: When is Form SFU-1 due?

A: Form SFU-1 is due quarterly, with deadlines falling on the last day of the month following the end of the quarter.

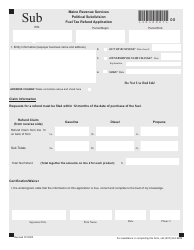

Q: Are there any penalties for late or incorrect filing of Form SFU-1?

A: Yes, there are penalties for late or incorrect filing of Form SFU-1. It is important to file the form accurately and on time to avoid penalties.

Form Details:

- Released on July 1, 2011;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFU-1 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.