This version of the form is not currently in use and is provided for reference only. Download this version of

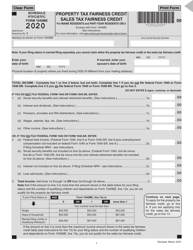

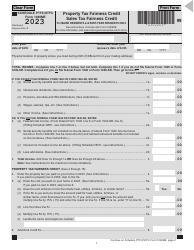

Form ST-7

for the current year.

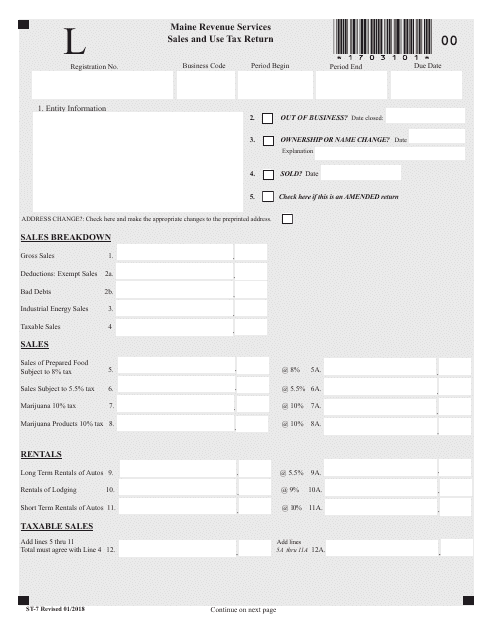

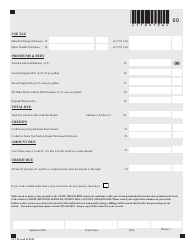

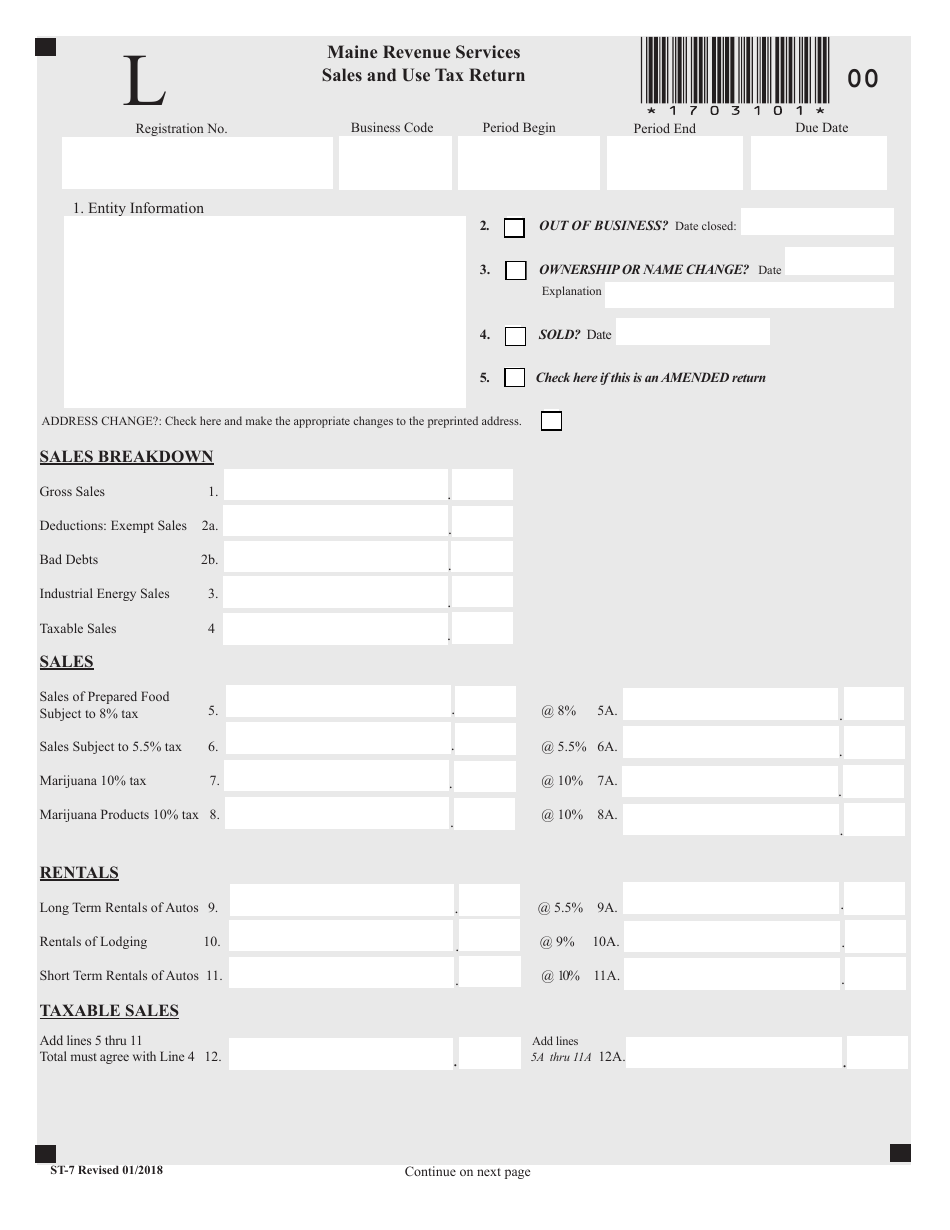

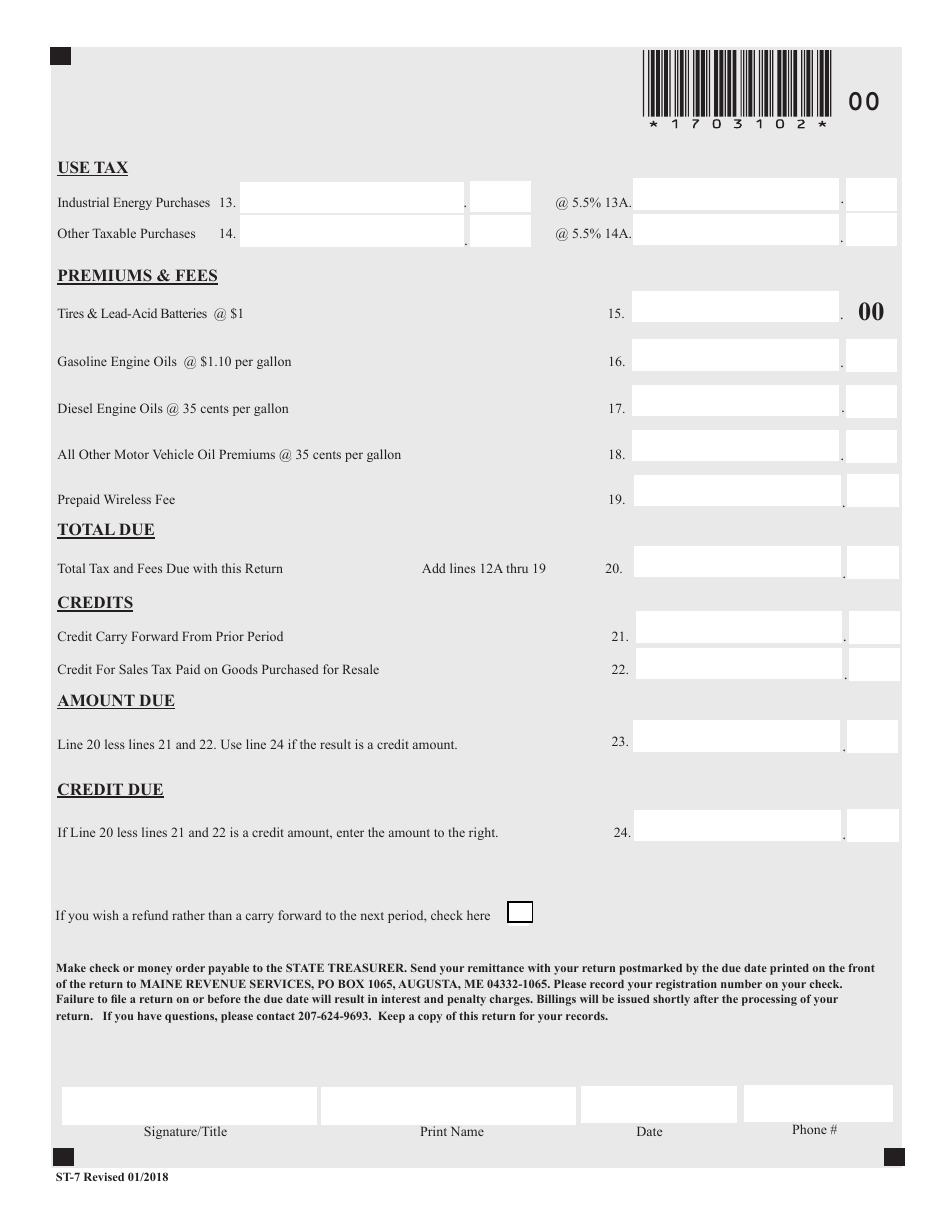

Form ST-7 Sales and Use Tax Return - Maine

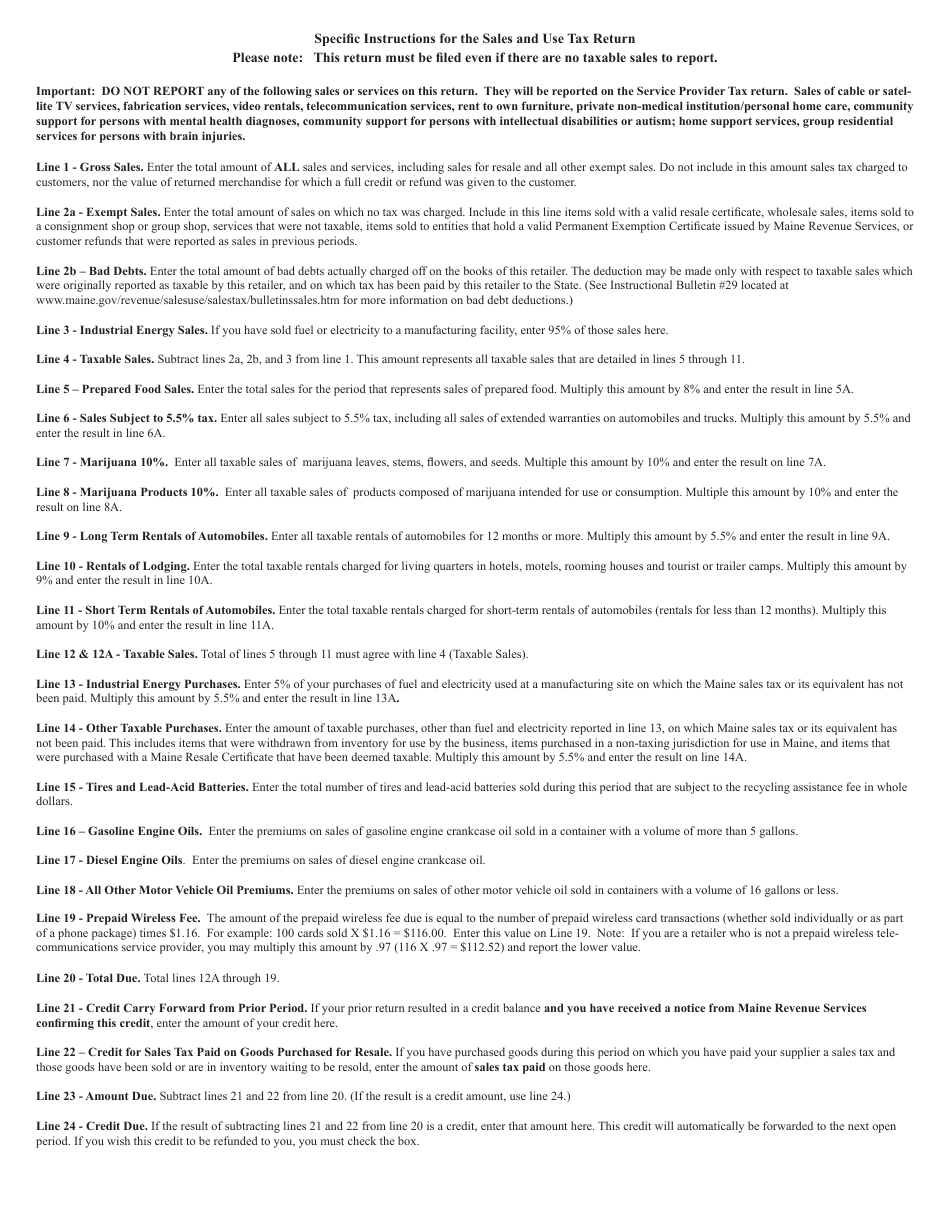

What Is Form ST-7?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-7?

A: Form ST-7 is the Sales and Use Tax Return for the state of Maine.

Q: Who should file Form ST-7?

A: Businesses that are required to collect and remit sales tax in Maine should file Form ST-7.

Q: What is the purpose of Form ST-7?

A: The purpose of Form ST-7 is to report and remit sales and use tax collected by businesses in Maine.

Q: How often should Form ST-7 be filed?

A: Form ST-7 should be filed monthly, quarterly, or annually, depending on the business's sales tax liability.

Q: Are there any exemptions or deductions available on Form ST-7?

A: Yes, there are certain exemptions and deductions available on Form ST-7. Consult the instructions provided with the form for more details.

Q: What happens if I don't file Form ST-7 or pay the sales and use tax?

A: Failure to file Form ST-7 or pay the sales and use tax can result in penalties and interest charges.

Q: Can I make changes to a filed Form ST-7?

A: Yes, you can make changes to a filed Form ST-7 by submitting an amended return using Form ST-7X.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-7 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.