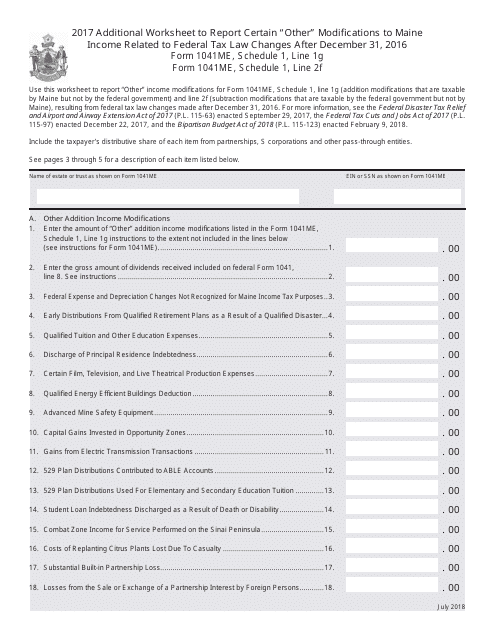

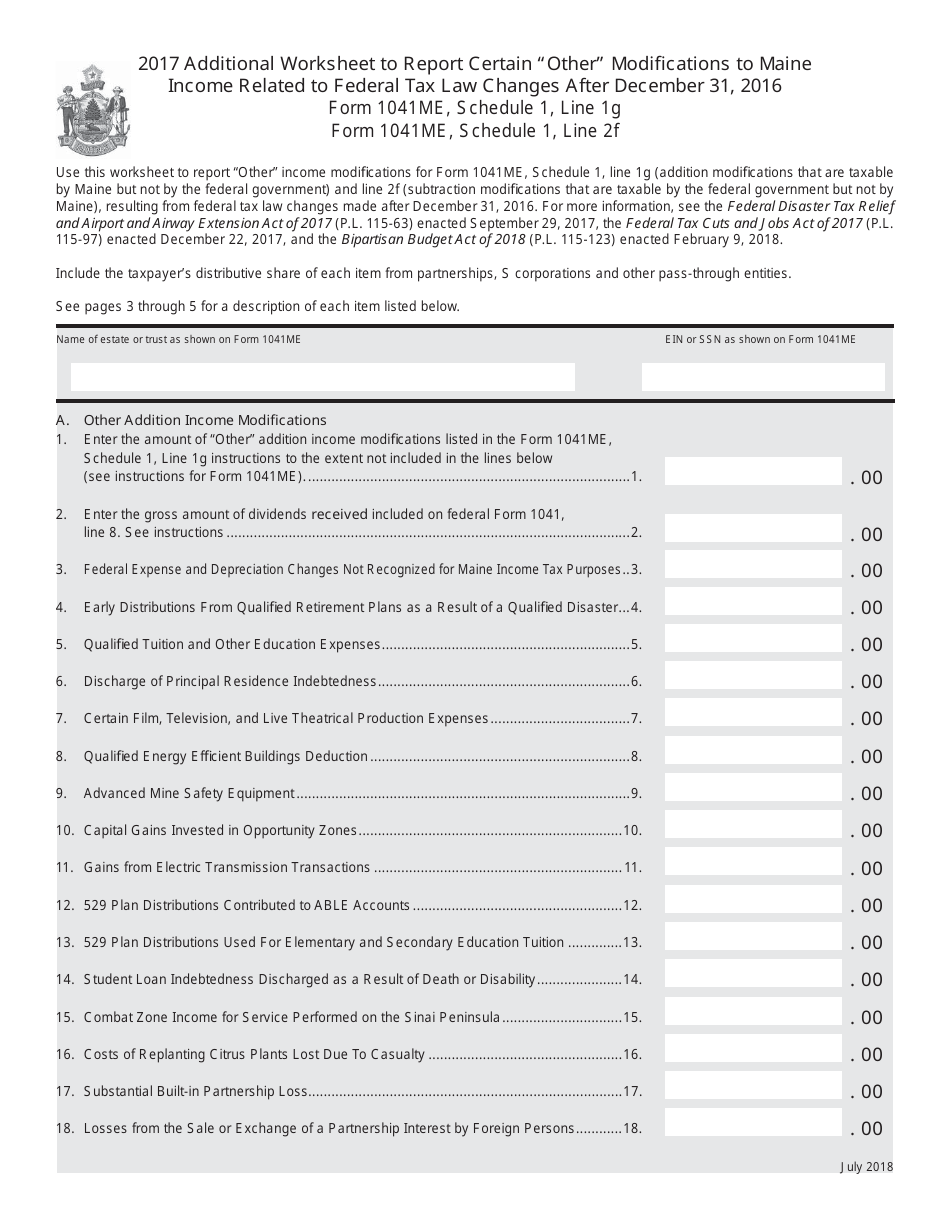

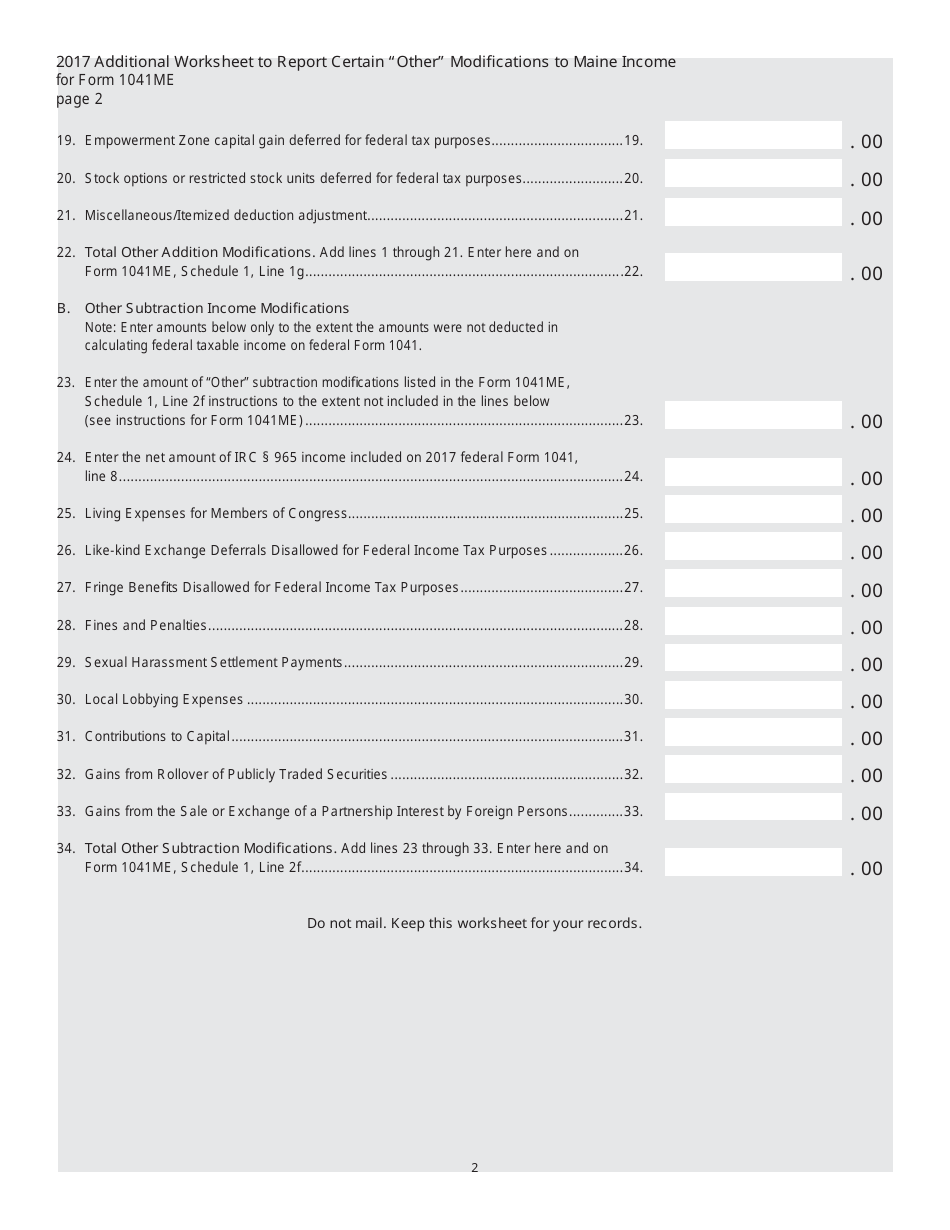

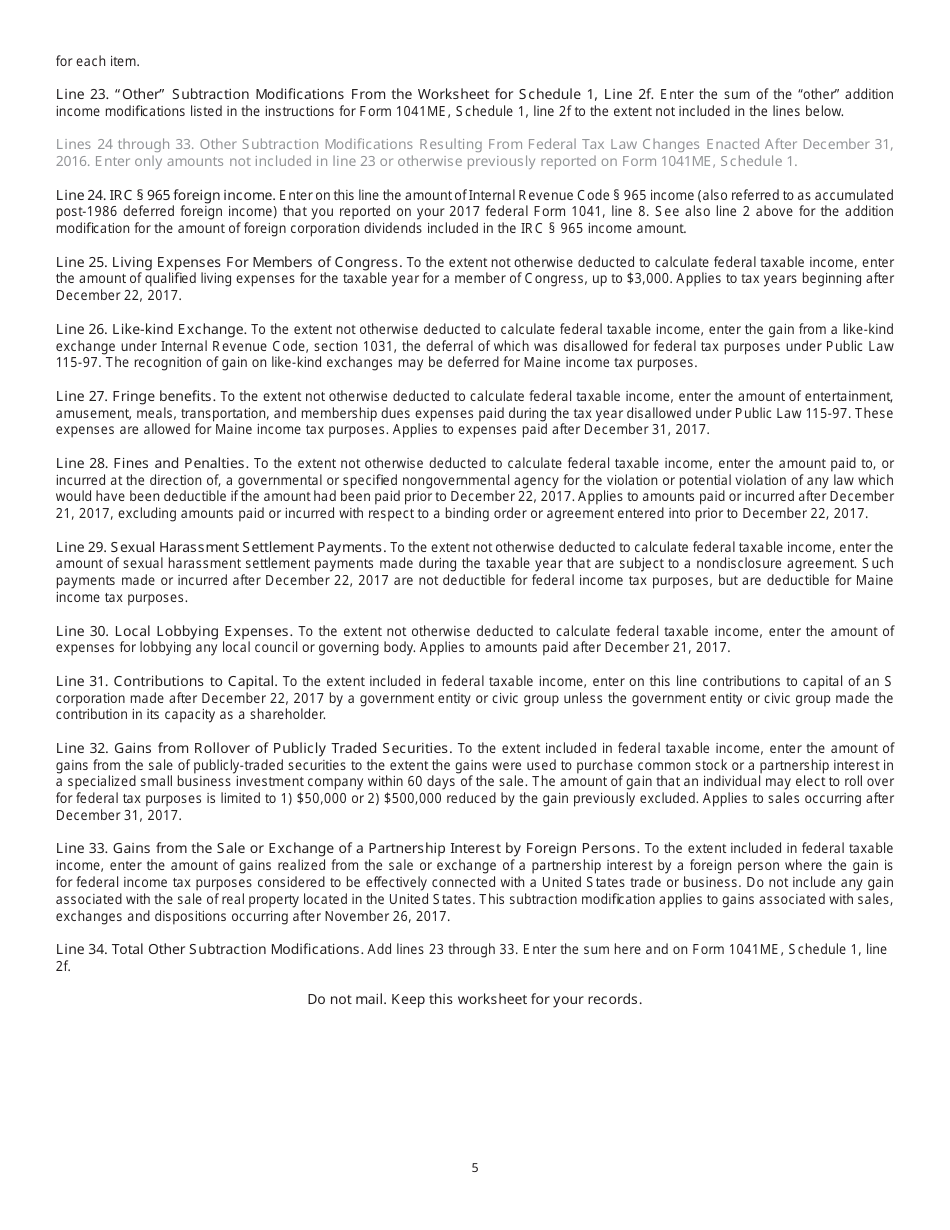

Form 1041ME Additional Worksheet to Report Certain "other" Modifi Cations to Maine Income Related to Federal Tax Law Changes After December 31, 2016 - Maine

What Is Form 1041ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1041ME?

A: Form 1041ME is a tax form used in Maine to report certain modifications to income related to federal tax law changes after December 31, 2016.

Q: What is the purpose of Form 1041ME?

A: The purpose of Form 1041ME is to report any modifications to income that need to be made as a result of federal tax law changes after December 31, 2016.

Q: Who needs to file Form 1041ME?

A: Anyone who needs to report certain modifications to their income in Maine due to federal tax law changes after December 31, 2016, may need to file Form 1041ME.

Q: When do I need to file Form 1041ME?

A: Form 1041ME should be filed when you need to report certain modifications to your income in Maine due to federal tax law changes after December 31, 2016.

Q: Is there a deadline for filing Form 1041ME?

A: Yes, there is a deadline for filing Form 1041ME. The deadline typically follows the same deadline as your federal income tax return, usually April 15th.

Q: What should I do if I need help filling out Form 1041ME?

A: If you need help filling out Form 1041ME, you can refer to the instructions provided with the form or seek assistance from a tax professional.

Q: Are there any penalties for not filing Form 1041ME?

A: Yes, there may be penalties for not filing Form 1041ME. It's important to consult the Maine Revenue Services or a tax professional for specific information on penalties.

Q: Can I e-file Form 1041ME?

A: At this time, Maine does not offer the option to electronically file Form 1041ME. It must be filed by mail.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1041ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.