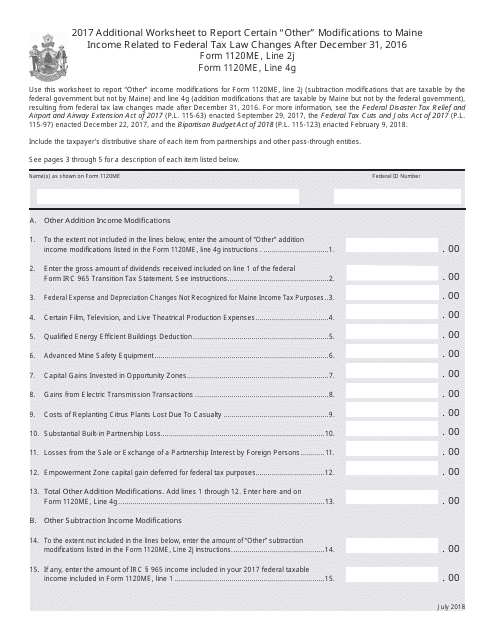

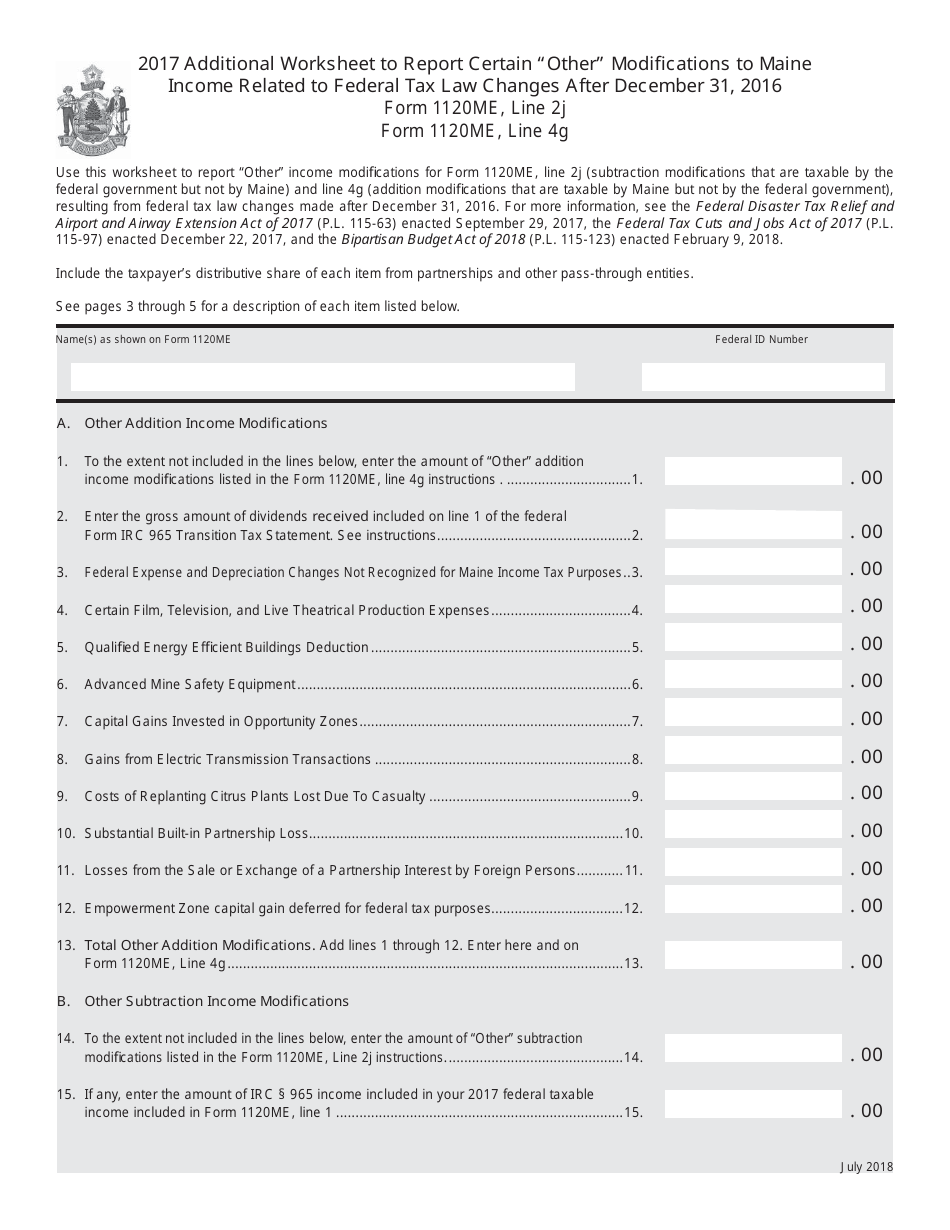

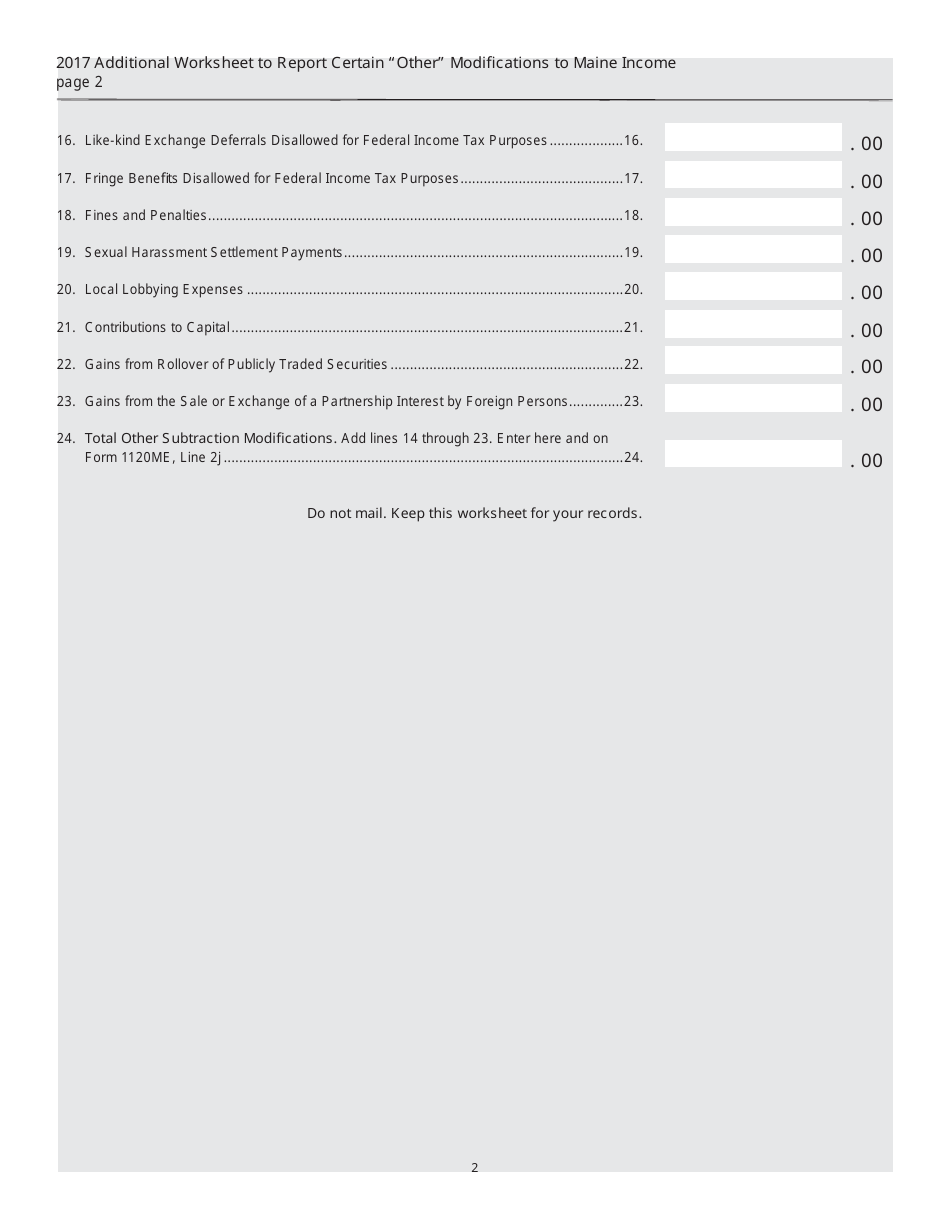

Form 1120ME Additional Worksheet to Report Certain "other" Modifi Cations to Maine Income Related to Federal Tax Law Changes After December 31, 2016 - Maine

What Is Form 1120ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120ME?

A: Form 1120ME is an additional worksheet used to report certain 'other' modifications to Maine income related to federal tax law changes after December 31, 2016.

Q: What is the purpose of Form 1120ME?

A: The purpose of Form 1120ME is to report modifications to Maine income that result from federal tax law changes after December 31, 2016.

Q: Who needs to file Form 1120ME?

A: Individuals or businesses that have modifications to their Maine income due to federal tax law changes after December 31, 2016 need to file Form 1120ME.

Q: What are 'other' modifications to Maine income?

A: 'Other' modifications to Maine income refer to changes in income that are not covered by other specific tax forms or schedules.

Q: When is Form 1120ME due?

A: Form 1120ME is due on the same date as your Maine income tax return, which is typically April 15th.

Q: Is Form 1120ME required for federal tax law changes before December 31, 2016?

A: No, Form 1120ME is specifically for federal tax law changes after December 31, 2016.

Q: Can I electronically file Form 1120ME?

A: Yes, you can electronically file Form 1120ME if you choose to.

Q: Are there any penalties for not filing Form 1120ME?

A: Yes, there may be penalties for not filing Form 1120ME or for filing it late. It is important to comply with all tax filing requirements.

Q: Can I use Form 1120ME for personal income tax modifications?

A: No, Form 1120ME is specifically for reporting business income modifications related to federal tax law changes after December 31, 2016.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1120ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.