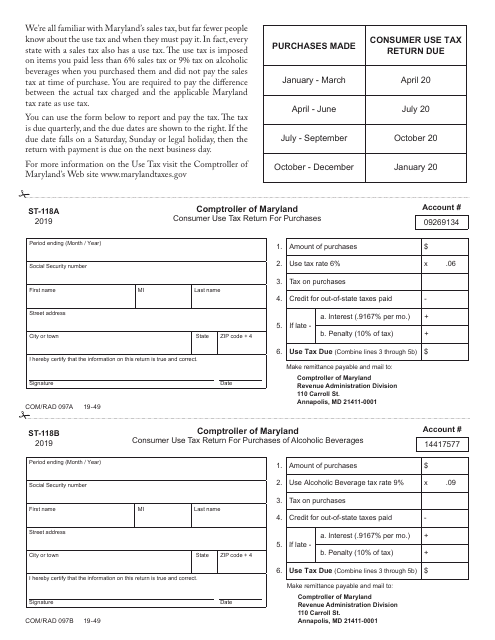

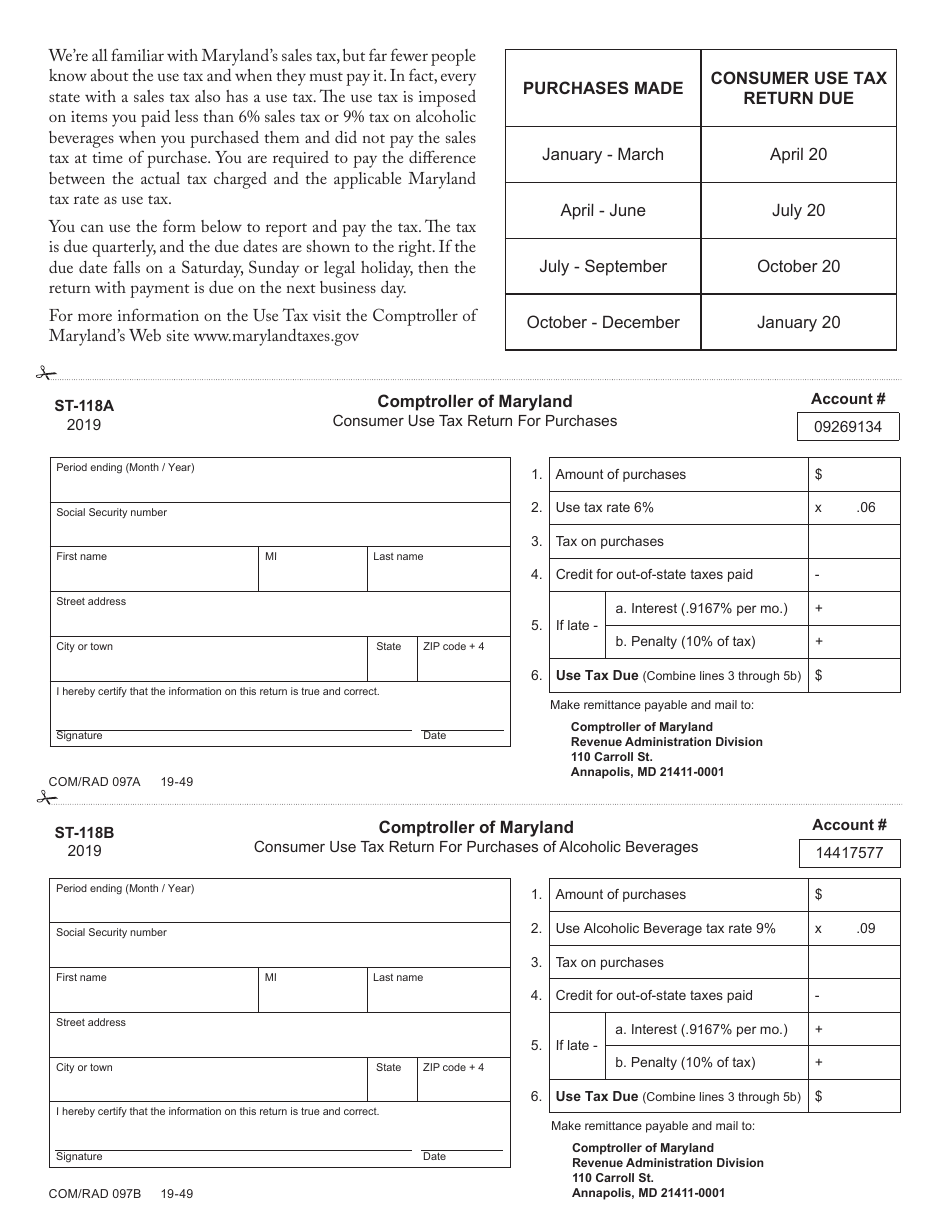

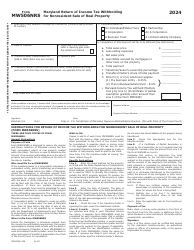

Form COM / RAD097B (ST-118B) Consumer Use Tax Return for Purchases - Maryland

What Is Form COM/RAD097B (ST-118B)?

This is a legal form that was released by the Comptroller of Maryland - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/RAD097B (ST-118B)?

A: Form COM/RAD097B (ST-118B) is the Consumer Use Tax Return for Purchases in Maryland.

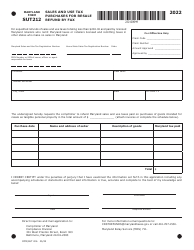

Q: Who needs to file Form COM/RAD097B (ST-118B)?

A: Individuals or businesses who made taxable purchases in Maryland and did not pay Maryland sales tax at the time of purchase need to file this form.

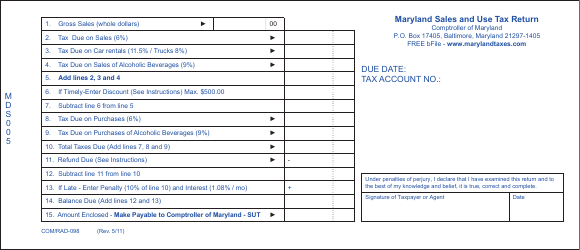

Q: What is the purpose of Form COM/RAD097B (ST-118B)?

A: The purpose of this form is to report and remit the consumer use tax owed on taxable purchases made in Maryland.

Q: When is the due date for filing Form COM/RAD097B (ST-118B)?

A: The due date for filing this form is on or before the 20th day of the month following the end of the reporting period.

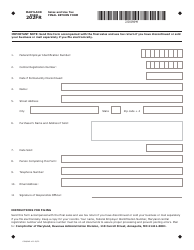

Q: What information is required to complete Form COM/RAD097B (ST-118B)?

A: You will need to provide information about your purchases, including the date of purchase, description of the items purchased, and the amount of tax due.

Q: Are there any penalties for not filing Form COM/RAD097B (ST-118B) on time?

A: Yes, there are penalties for late filing or non-filing of this form. It is important to file and pay the consumer use tax by the due date to avoid penalties and interest charges.

Q: Can I file Form COM/RAD097B (ST-118B) electronically?

A: Yes, you can file this form electronically through the Maryland Business Express portal.

Form Details:

- The latest edition provided by the Comptroller of Maryland;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD097B (ST-118B) by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.