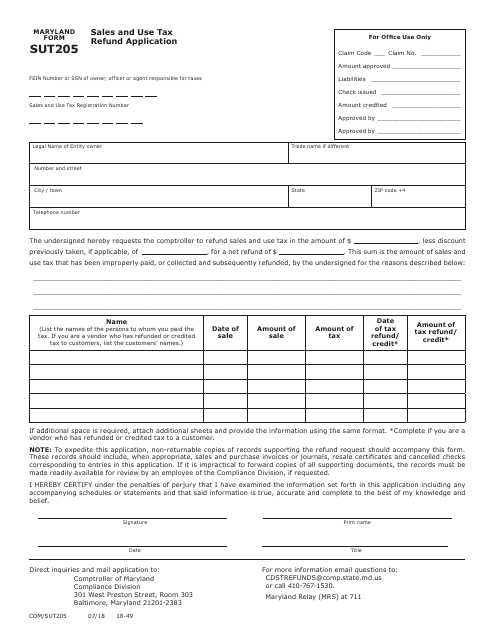

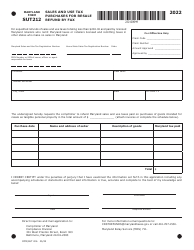

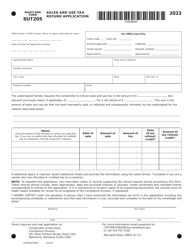

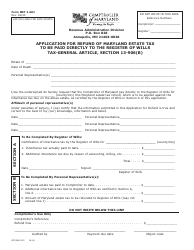

Form COM / ST-205 (Maryland Form SUT205) Sales and Use Tax Refund Application - Maryland

What Is Form COM/ST-205 (Maryland Form SUT205)?

This is a legal form that was released by the Comptroller of Maryland - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/ST-205?

A: Form COM/ST-205 is the Maryland Sales and Use Tax Refund Application.

Q: What is the purpose of Form COM/ST-205?

A: The purpose of Form COM/ST-205 is to request a refund of sales and use tax paid to the state of Maryland.

Q: Who should use Form COM/ST-205?

A: Anyone who has paid sales and use tax to the state of Maryland and wishes to request a refund should use Form COM/ST-205.

Q: Is there a deadline to submit Form COM/ST-205?

A: Yes, Form COM/ST-205 should be submitted within three years from the date the tax was paid.

Q: Are there any supporting documents required with Form COM/ST-205?

A: Yes, supporting documents such as receipts or invoices showing the payment of the sales and use tax should be included with Form COM/ST-205.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Comptroller of Maryland;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/ST-205 (Maryland Form SUT205) by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.