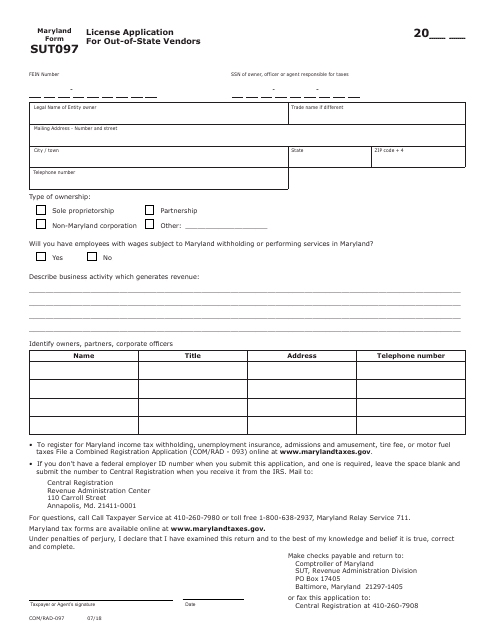

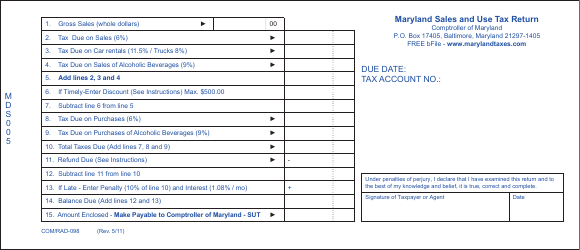

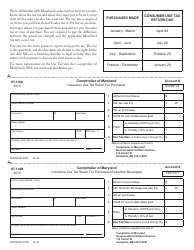

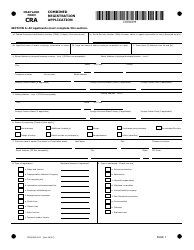

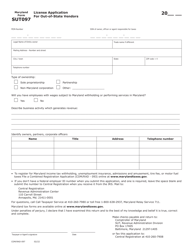

Form COM / RAD-097 (Maryland Form SUT097) License Application for Out-of-State Vendors - Maryland

What Is Form COM/RAD-097 (Maryland Form SUT097)?

This is a legal form that was released by the Comptroller of Maryland - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is COM/RAD-097?

A: COM/RAD-097 is the License Application for Out-of-State Vendors in Maryland.

Q: Who needs to use Form COM/RAD-097?

A: Out-of-state vendors who want to do business in Maryland need to use Form COM/RAD-097.

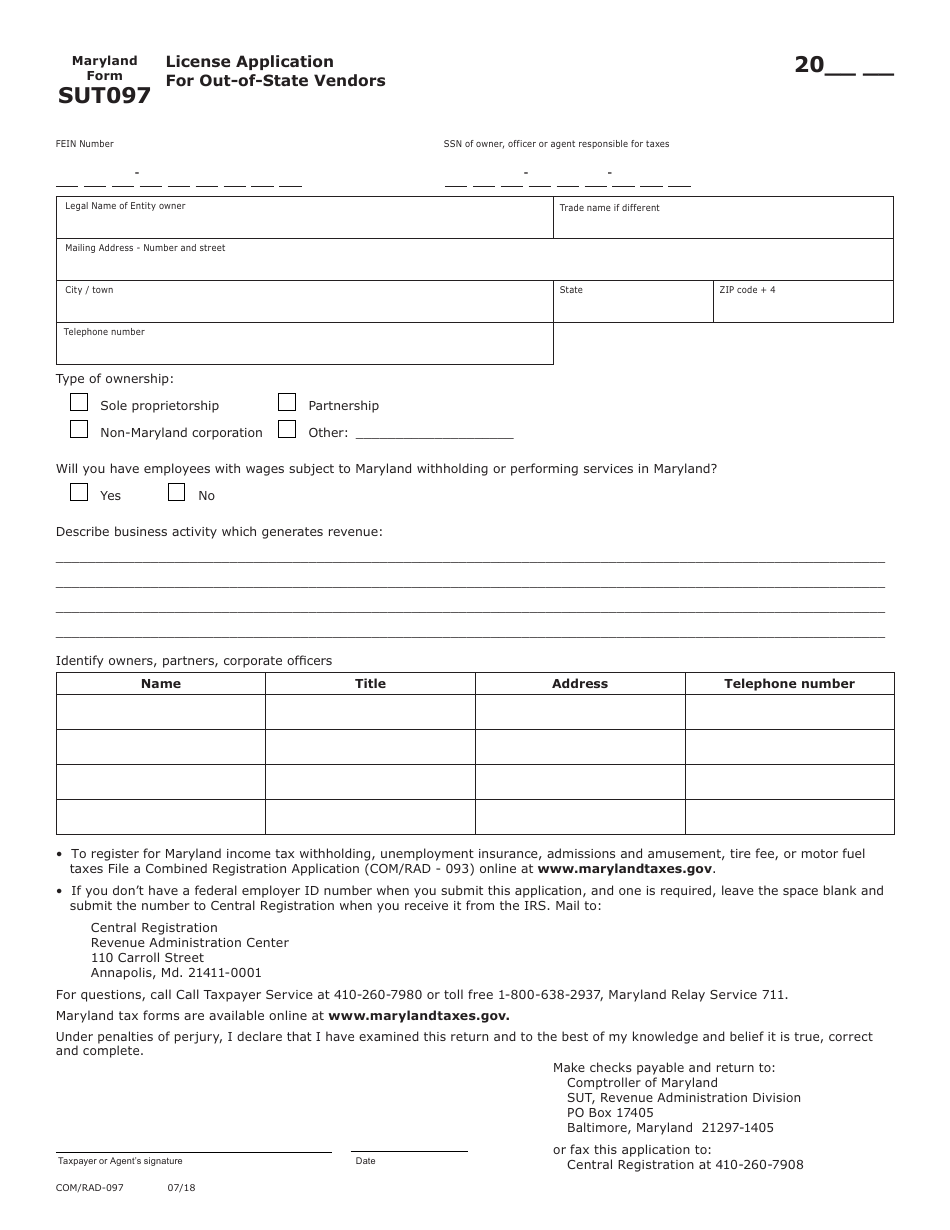

Q: What is the purpose of Form COM/RAD-097?

A: The purpose of Form COM/RAD-097 is to apply for a license to collect and remit sales and use tax in Maryland.

Q: Are there any fees for submitting Form COM/RAD-097?

A: Yes, there is a fee associated with submitting Form COM/RAD-097. The fee amount depends on various factors such as the type of business and projected gross sales in Maryland.

Q: What information do I need to provide on Form COM/RAD-097?

A: You need to provide information about your business, including contact details, ownership structure, estimated annual sales in Maryland, and previous tax registration information.

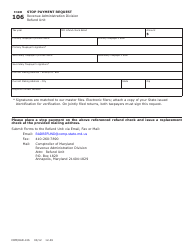

Q: What happens after I submit Form COM/RAD-097?

A: After submitting Form COM/RAD-097, the Comptroller's office will review your application, conduct any necessary verification, and inform you about the status of your license application.

Q: How long does it take to get a license after submitting Form COM/RAD-097?

A: The processing time for a license application can vary. It is best to check with the Maryland Comptroller's office for the current processing time.

Q: Do I need to renew my license obtained through Form COM/RAD-097?

A: Yes, the license obtained through Form COM/RAD-097 needs to be renewed periodically. The renewal period and process will be communicated by the Comptroller's office.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Comptroller of Maryland;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD-097 (Maryland Form SUT097) by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.