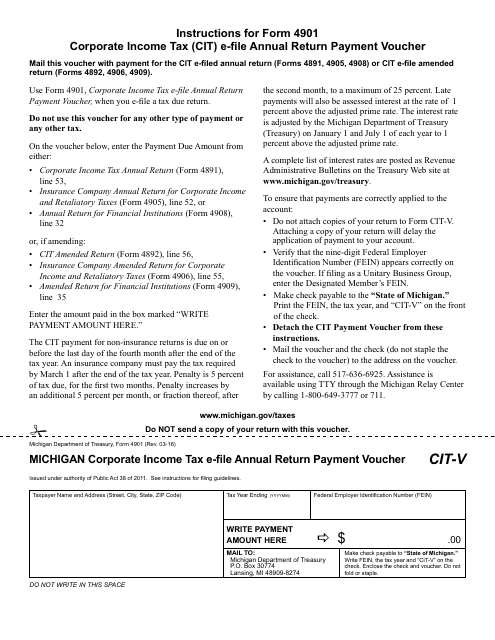

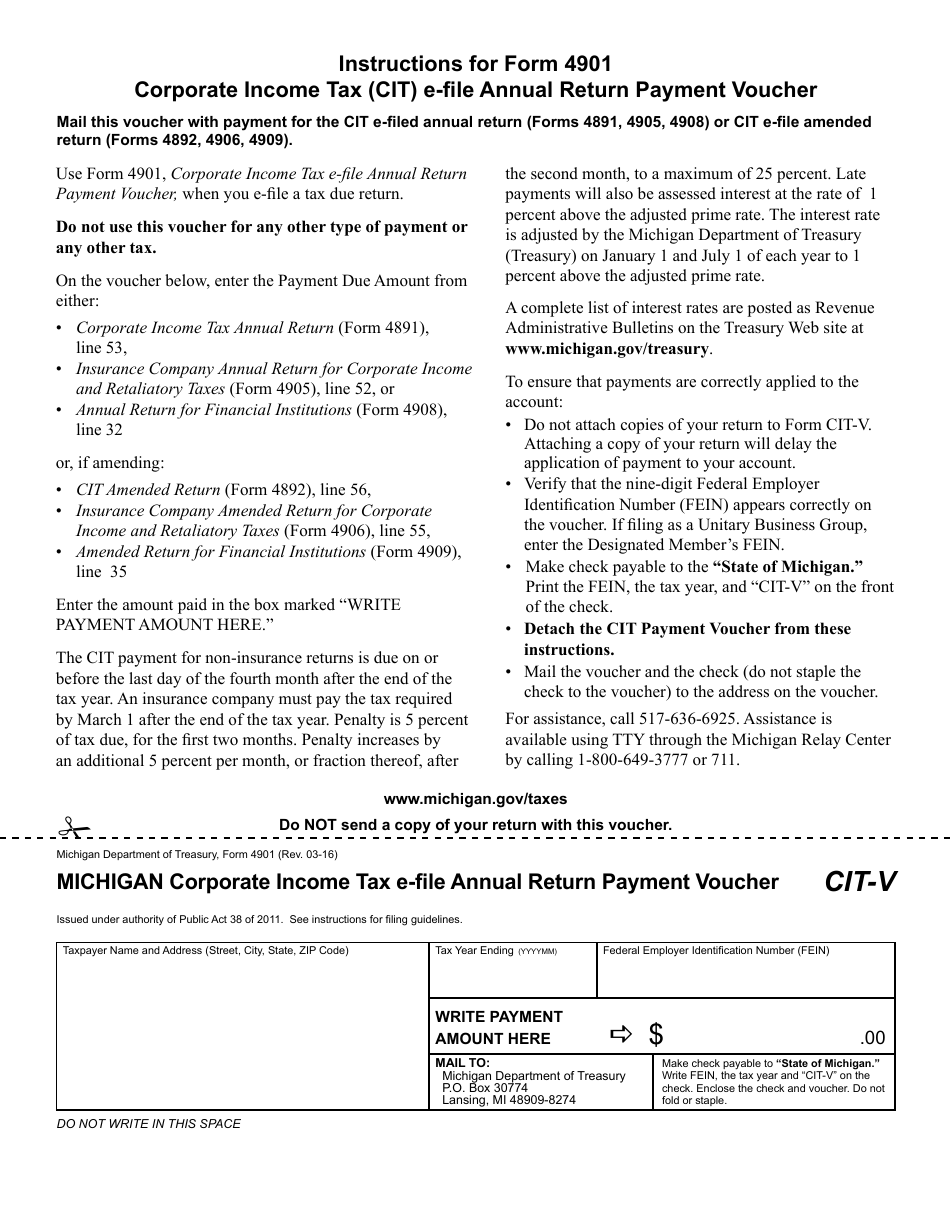

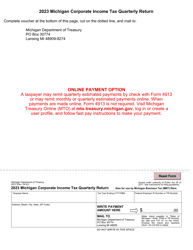

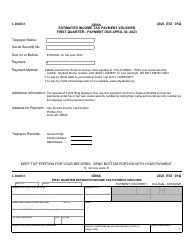

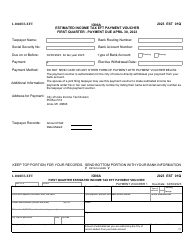

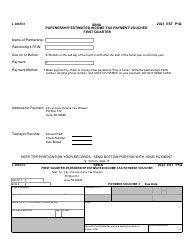

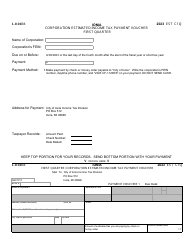

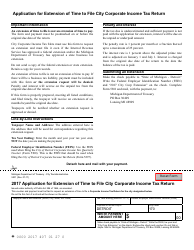

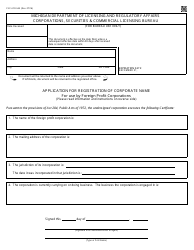

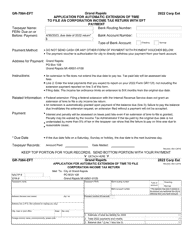

Form 4901 (CIT-V) Michigan Corporate Income Tax E-File Annual Return Payment Voucher - Michigan

What Is Form 4901 (CIT-V)?

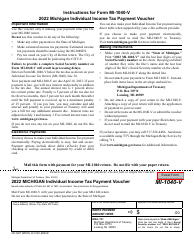

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4901 (CIT-V)?

A: Form 4901 (CIT-V) is the Michigan Corporate Income Tax E-File Annual Return Payment Voucher.

Q: What is the purpose of Form 4901 (CIT-V)?

A: Form 4901 (CIT-V) is used to submit payment for the Michigan Corporate Income Tax annual return.

Q: Who needs to file Form 4901 (CIT-V)?

A: Businesses that need to pay the Michigan Corporate Income Tax must file Form 4901 (CIT-V).

Q: How do I file Form 4901 (CIT-V)?

A: Form 4901 (CIT-V) can be filed electronically through the Michigan Department of Treasury's e-File system.

Q: Is Form 4901 (CIT-V) for individuals or businesses?

A: Form 4901 (CIT-V) is specifically for businesses, not individuals.

Q: What should I do if I have questions about Form 4901 (CIT-V)?

A: If you have questions about Form 4901 (CIT-V), you should contact the Michigan Department of Treasury for assistance.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4901 (CIT-V) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.