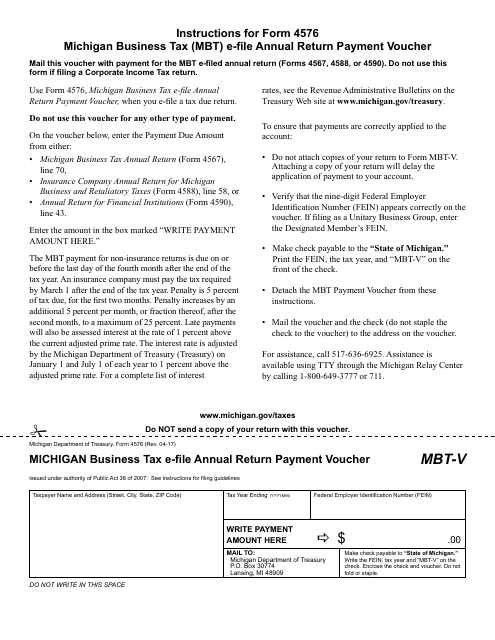

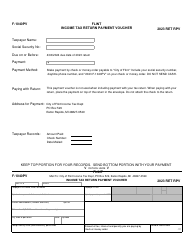

Form 4576 (MBT-V) Michigan Business Tax E-File Annual Return Payment Voucher - Michigan

What Is Form 4576 (MBT-V)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4576 (MBT-V)?

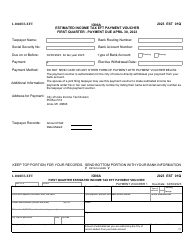

A: Form 4576 (MBT-V) is the Michigan Business Tax E-File Annual Return Payment Voucher.

Q: What is the purpose of Form 4576 (MBT-V)?

A: The purpose of Form 4576 (MBT-V) is to submit payment for the Michigan Business Tax Annual Return.

Q: Do I need to file Form 4576 (MBT-V)?

A: Yes, if you are required to file the Michigan Business Tax Annual Return, you will also need to file Form 4576 (MBT-V) to submit payment.

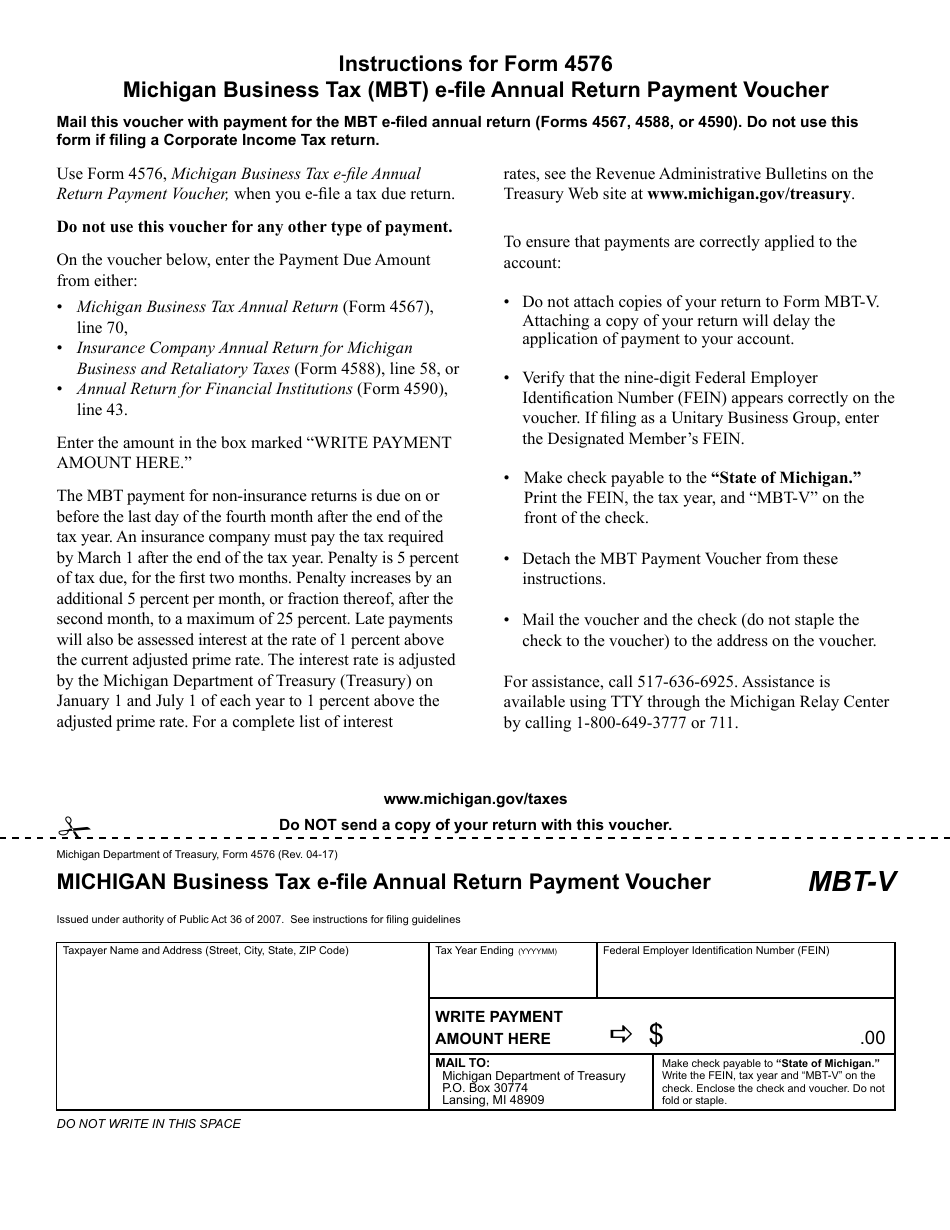

Q: How do I fill out Form 4576 (MBT-V)?

A: You will need to fill out the required information on Form 4576 (MBT-V), including your taxpayer identification number, name, address, and the amount you are paying.

Q: How do I submit Form 4576 (MBT-V)?

A: You can submit Form 4576 (MBT-V) by mail along with your payment or you may be able to e-file the form depending on the options provided by the Michigan Department of Treasury.

Q: What do I do if I have questions about Form 4576 (MBT-V)?

A: If you have questions about Form 4576 (MBT-V), you can contact the Michigan Department of Treasury for assistance.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4576 (MBT-V) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.