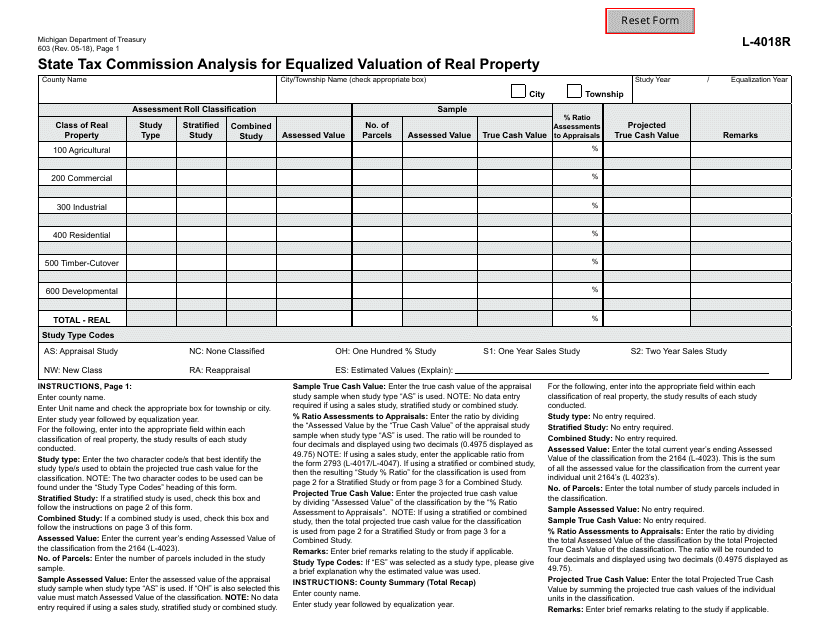

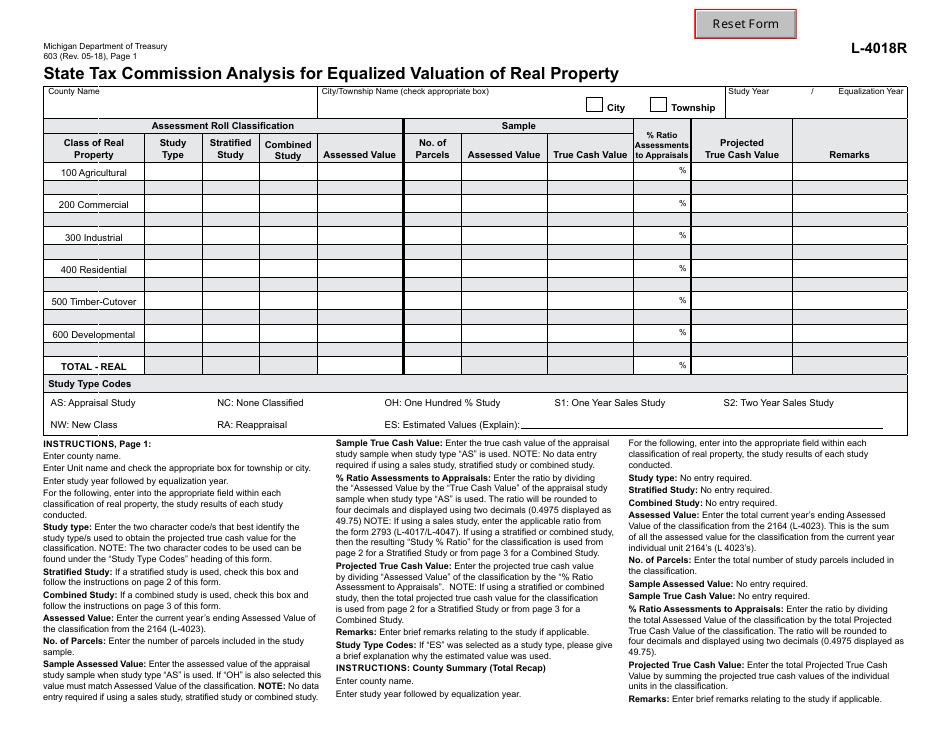

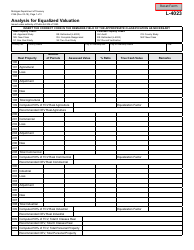

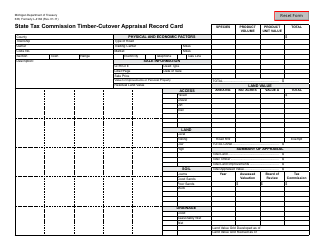

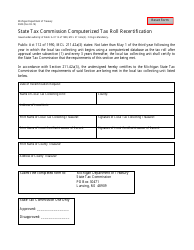

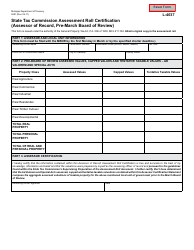

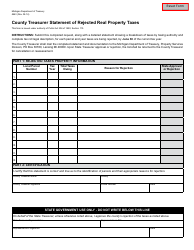

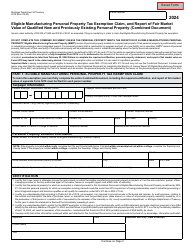

Form 603 State Tax Commission Analysis for Equalized Valuation of Real Property - Michigan

What Is Form 603?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 603?

A: Form 603 is an analysis conducted by the State Tax Commission for the equalized valuation of real property in Michigan.

Q: Who is responsible for conducting the analysis?

A: The State Tax Commission is responsible for conducting the analysis.

Q: What is the purpose of the analysis?

A: The analysis is conducted to determine the equalized valuation of real property in Michigan.

Q: What does 'equalized valuation' mean?

A: Equalized valuation refers to the value assigned to real property after taking into account factors such as market conditions and property characteristics.

Q: How is the equalized valuation determined?

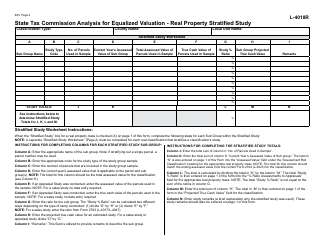

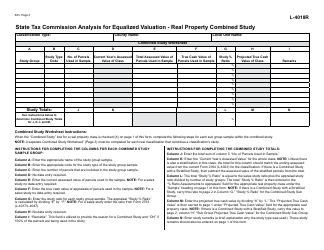

A: The equalized valuation is determined by applying a specific formula, which takes into account various factors such as sales ratio studies and property assessments.

Q: Why is it important to determine the equalized valuation?

A: Determining the equalized valuation is important as it ensures fair and equitable distribution of property taxes among different jurisdictions in Michigan.

Q: Who can access Form 603?

A: Form 603 is a public document and can be accessed by anyone who wishes to review the analysis conducted by the State Tax Commission.

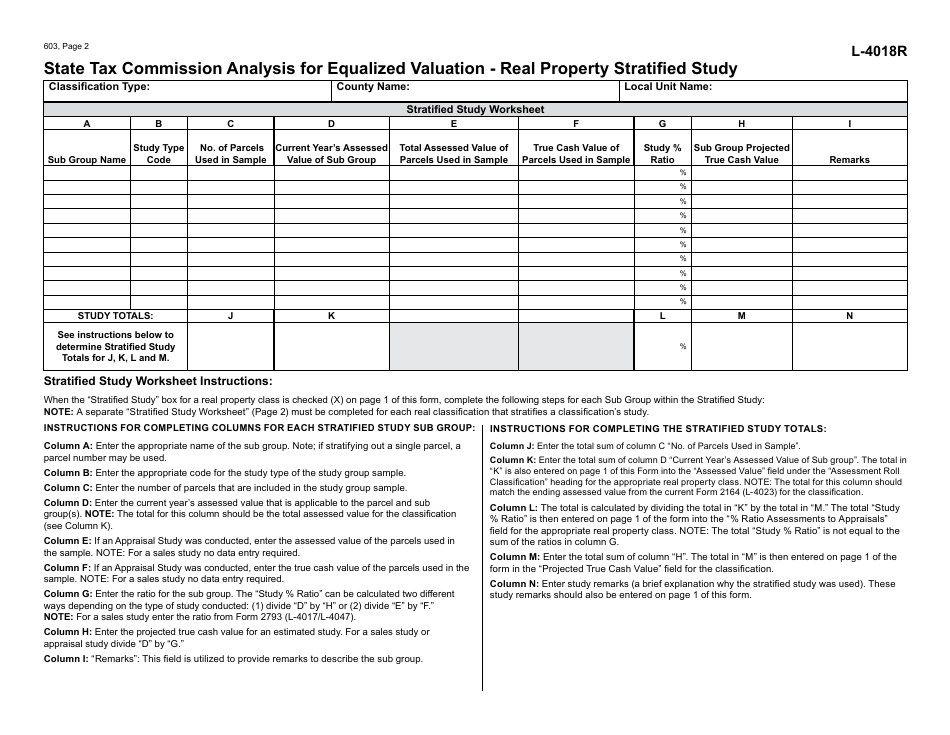

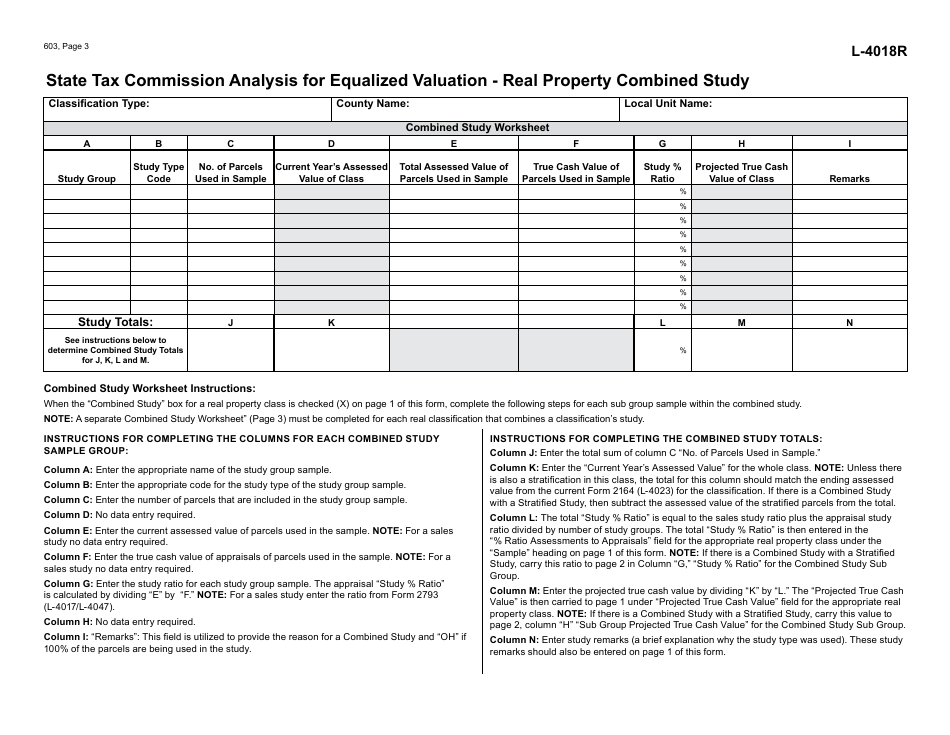

Q: What other information is included in Form 603?

A: Form 603 includes details such as the assessed value of real property, sales ratio studies, and any adjustments made to the equalized valuation.

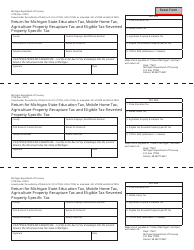

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 603 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.