This version of the form is not currently in use and is provided for reference only. Download this version of

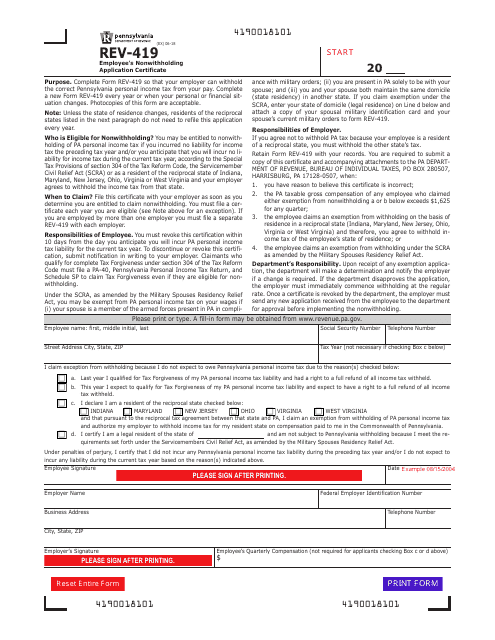

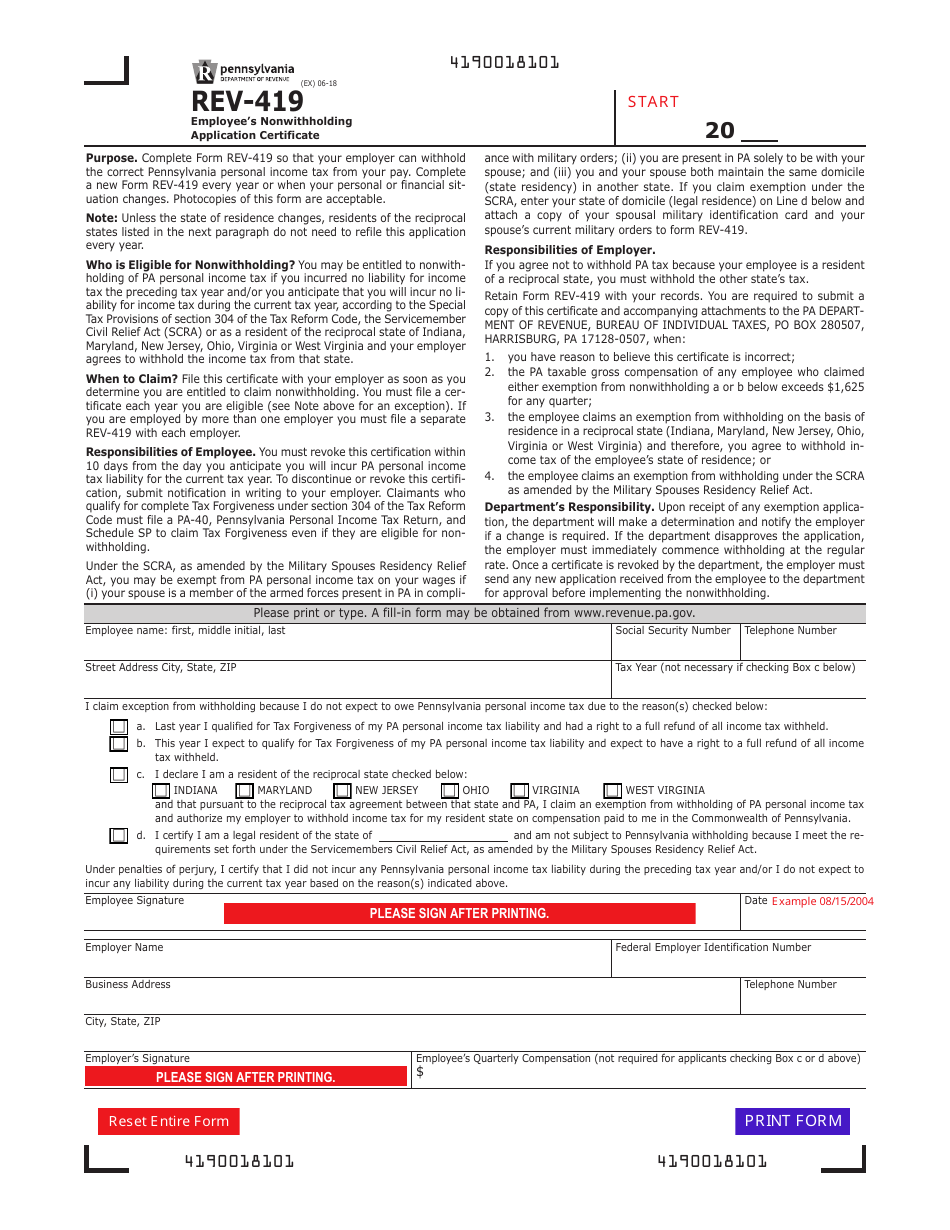

Form REV-419

for the current year.

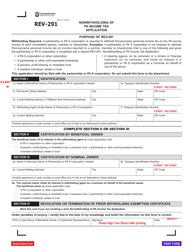

Form REV-419 Employee's Nonwithholding Application Certificate - Pennsylvania

What Is Form REV-419?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to fill out Form REV-419?

A: Employees who are claiming exemption from Pennsylvania income tax withholding.

Q: What information is required on Form REV-419?

A: The employee's personal information, including name, address, Social Security number, and exemptions claimed.

Q: When should Form REV-419 be filled out?

A: Form REV-419 should be filled out when an employee is starting a new job and wants to claim exemption from Pennsylvania income tax withholding.

Q: Is Form REV-419 only for Pennsylvania residents?

A: No, Form REV-419 can be used by both Pennsylvania residents and non-residents who are claiming exemption from Pennsylvania income tax withholding.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-419 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.