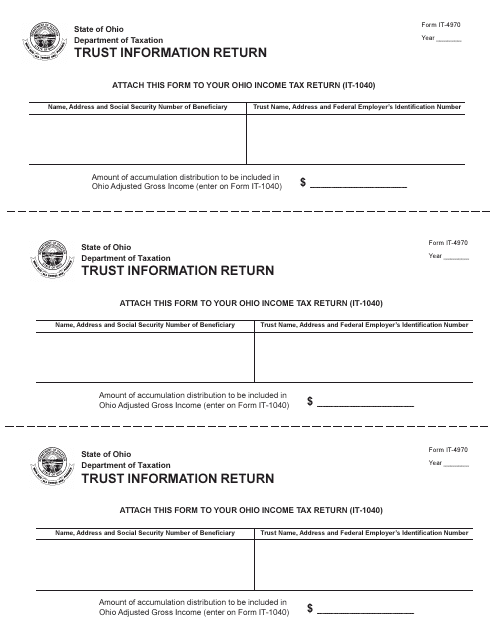

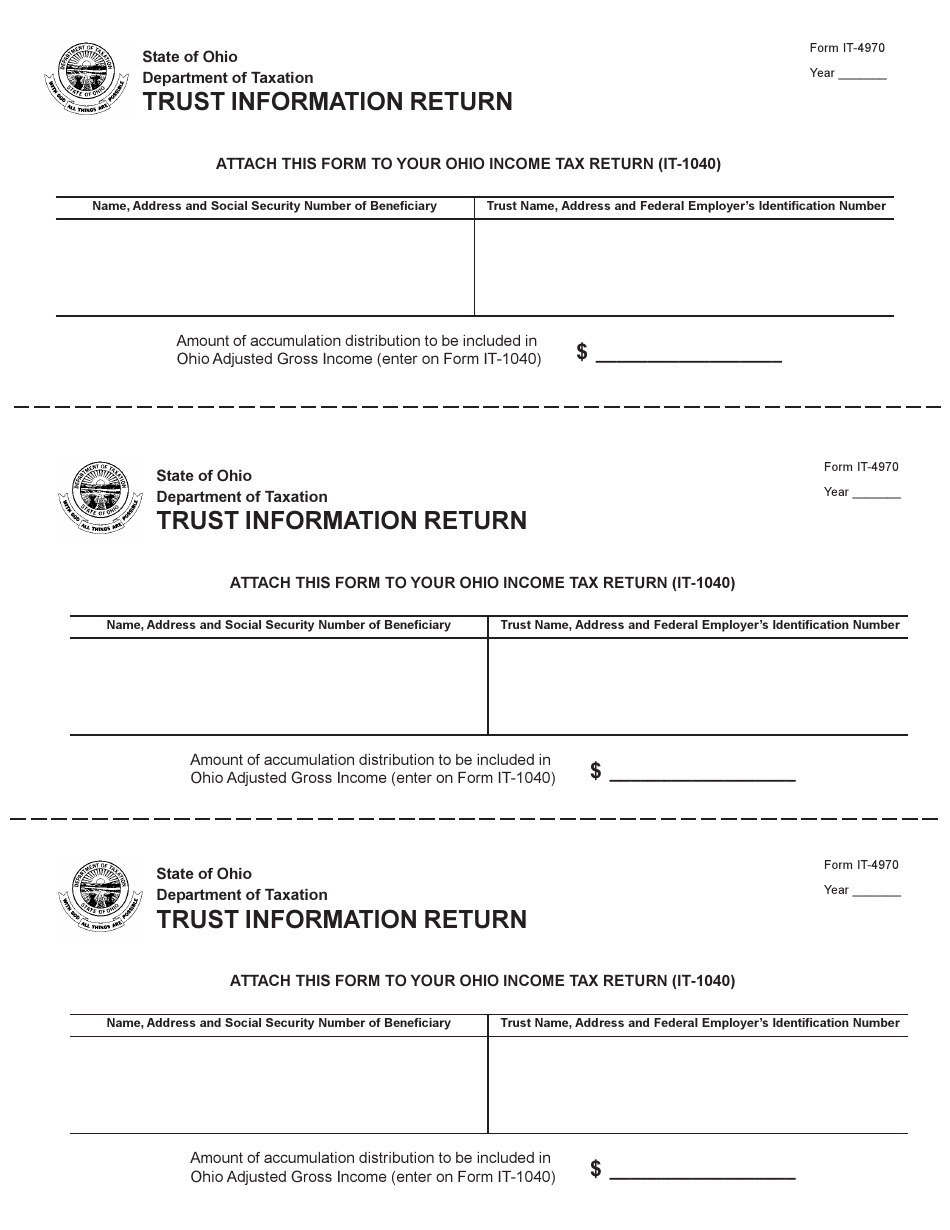

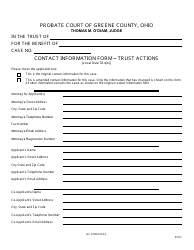

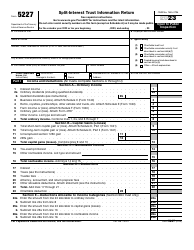

Form IT-4970 Trust Information Return - Ohio

What Is Form IT-4970?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-4970?

A: Form IT-4970 is the Trust Information Return for the state of Ohio.

Q: Who needs to file Form IT-4970?

A: The trustees of qualified trusts or Ohio resident trust need to file Form IT-4970.

Q: What information is required on Form IT-4970?

A: Form IT-4970 requires information about the trust's income, deductions, credits, and tax liability.

Q: When is Form IT-4970 due?

A: Form IT-4970 is due on the 15th day of the 4th month after the close of the trust's taxable year.

Q: Is there a penalty for late filing of Form IT-4970?

A: Yes, failure to file or late filing of Form IT-4970 may result in penalties and interest on any unpaid tax.

Q: Can I e-file Form IT-4970?

A: No, as of now, e-filing is not available for Form IT-4970. It must be filed by mail.

Q: Are there any exceptions to filing Form IT-4970?

A: Certain small trusts with low amounts of gross receipts may be exempt from filing Form IT-4970. Consult the instructions for more details.

Q: Do I need to include any supporting documents with Form IT-4970?

A: Yes, certain schedules and attachments may need to be included with Form IT-4970 depending on the trust's activities and income.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-4970 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.