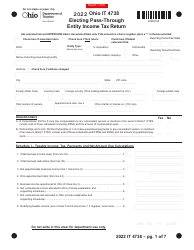

This version of the form is not currently in use and is provided for reference only. Download this version of

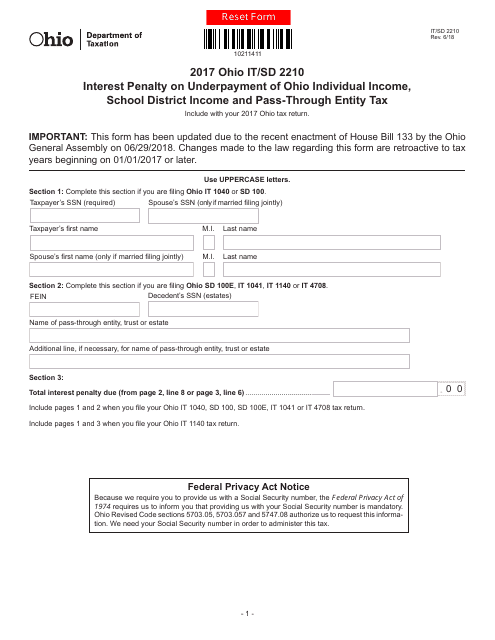

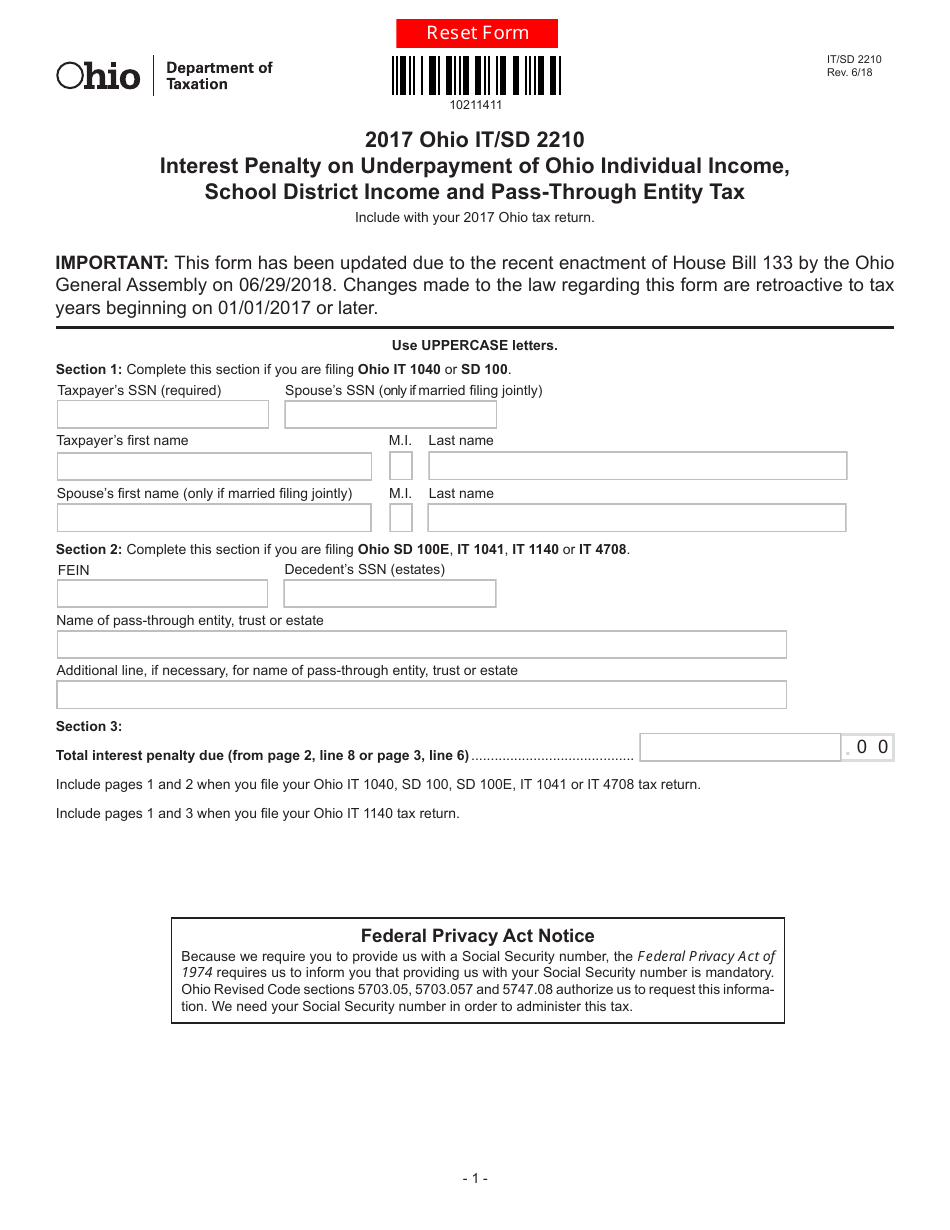

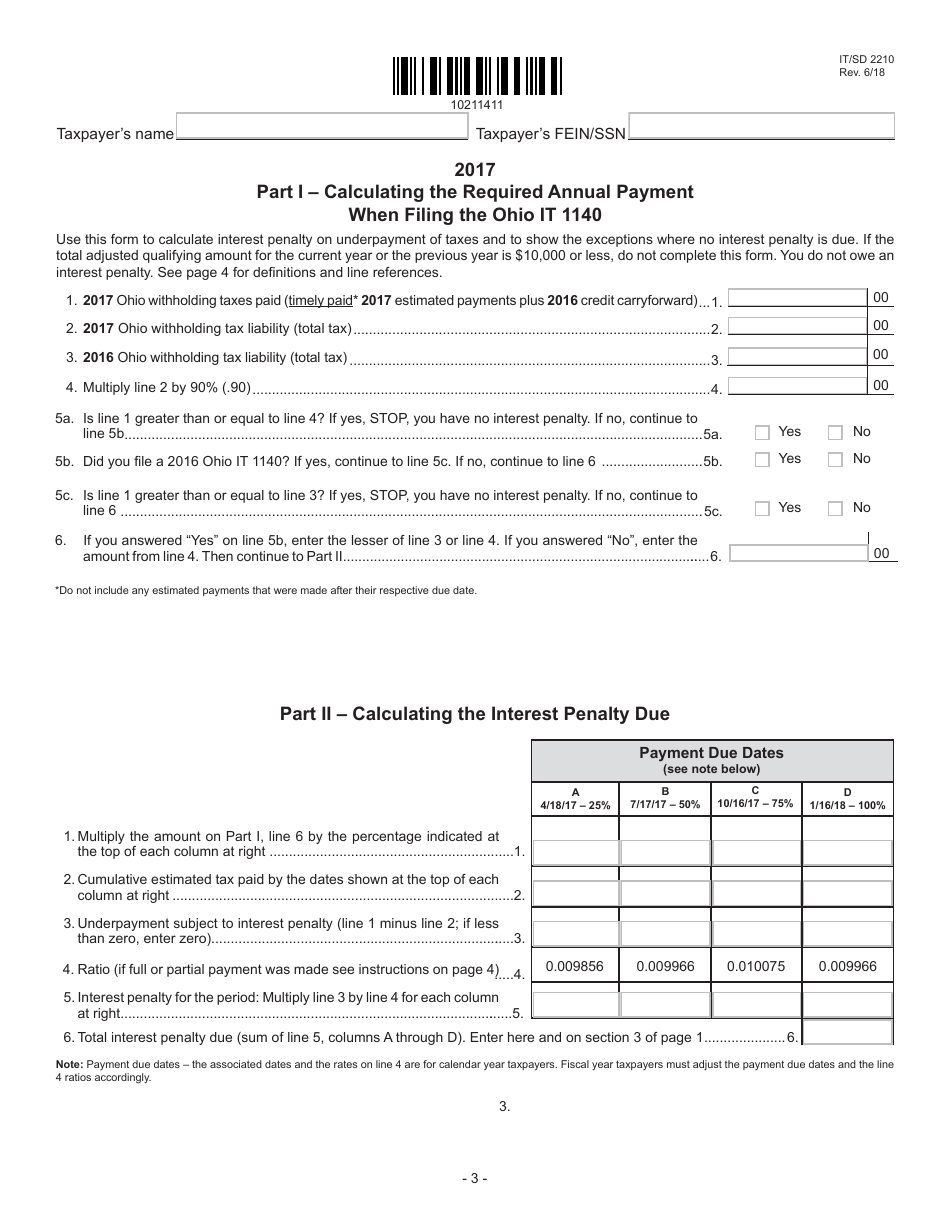

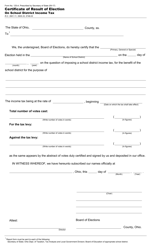

Form IT/SD2210

for the current year.

Form IT / SD2210 Interest Penalty on Underpayment of Ohio Individual Income, School District Income and Pass-Through Entity Tax - Ohio

What Is Form IT/SD2210?

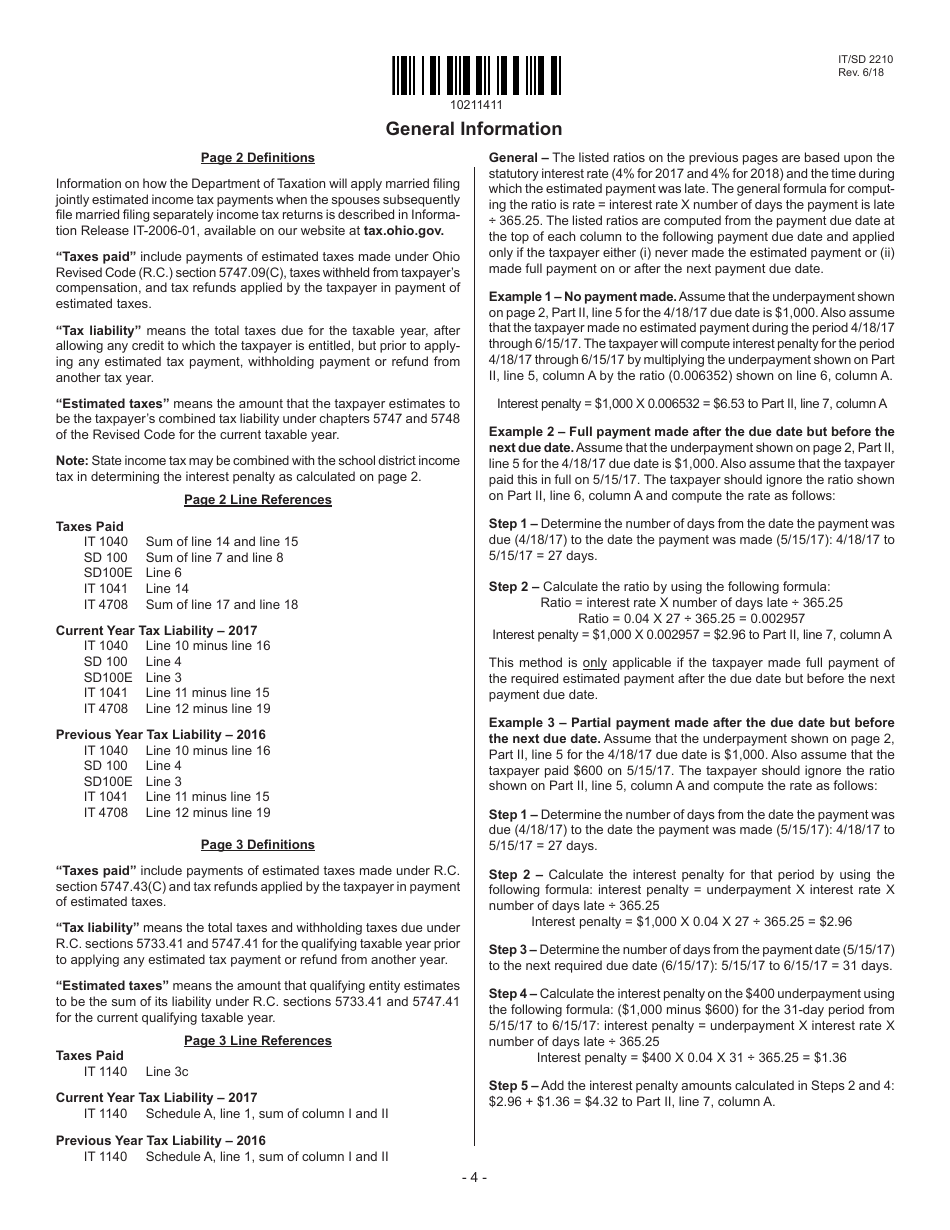

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is IT/SD2210?

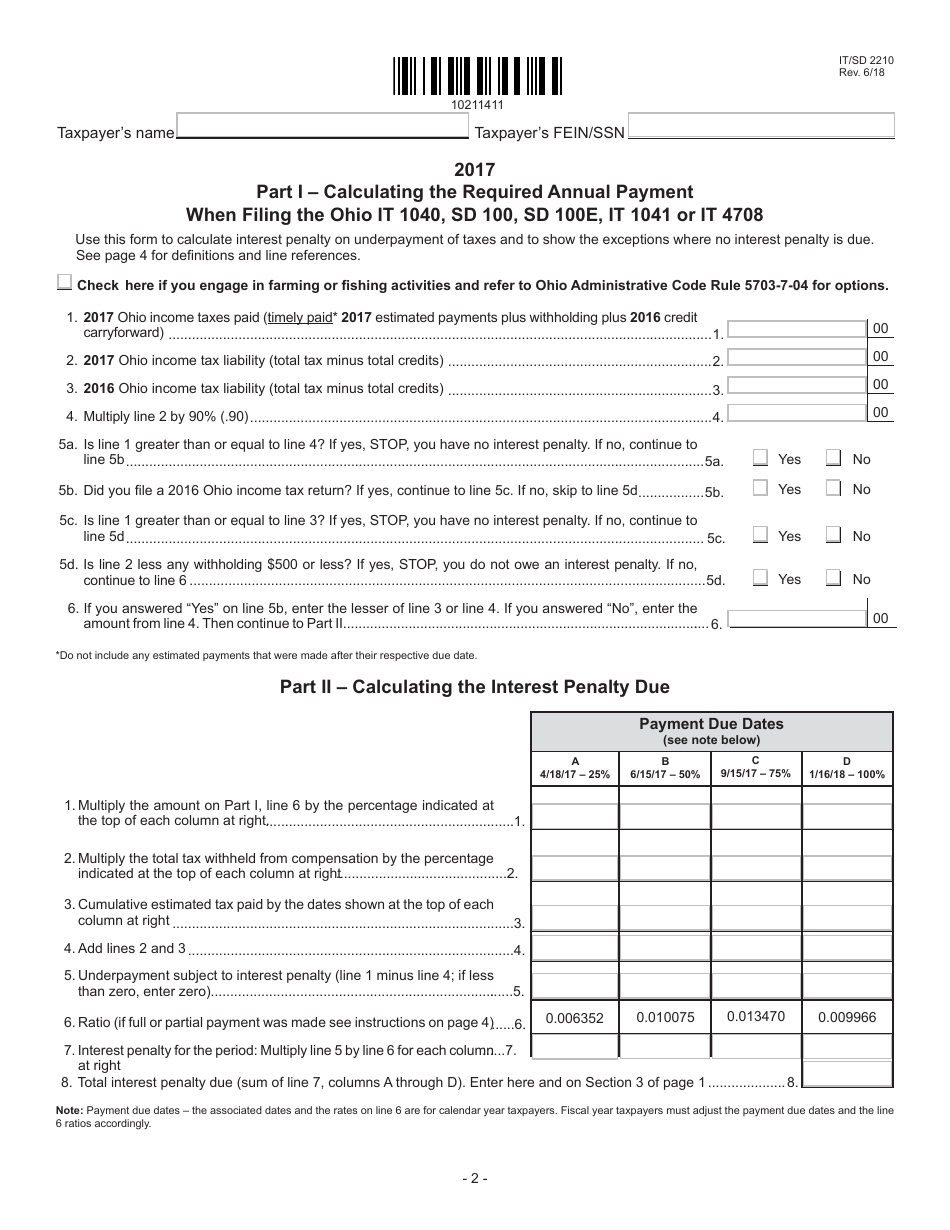

A: IT/SD2210 is a form used to calculate the interest penalty on underpayment of Ohio Individual Income, School District Income, and Pass-Through Entity Tax.

Q: What does the form calculate?

A: The form calculates the interest penalty for underpayment of Ohio taxes.

Q: Which taxes does the form cover?

A: The form covers Ohio Individual Income Tax, School District Income Tax, and Pass-Through Entity Tax.

Q: When should the form be used?

A: The form should be used if you have underpaid your Ohio taxes.

Q: What information is required to fill out the form?

A: You will need information about your tax payments, including payment dates and amounts.

Q: Is the form for individuals only?

A: No, the form also applies to pass-through entities such as partnerships or S corporations.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT/SD2210 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.