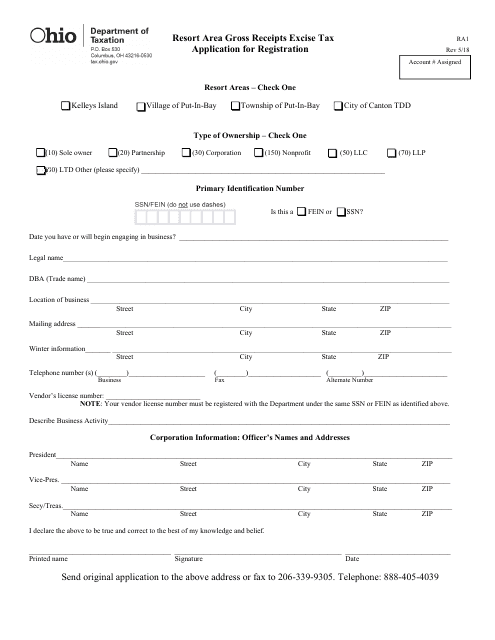

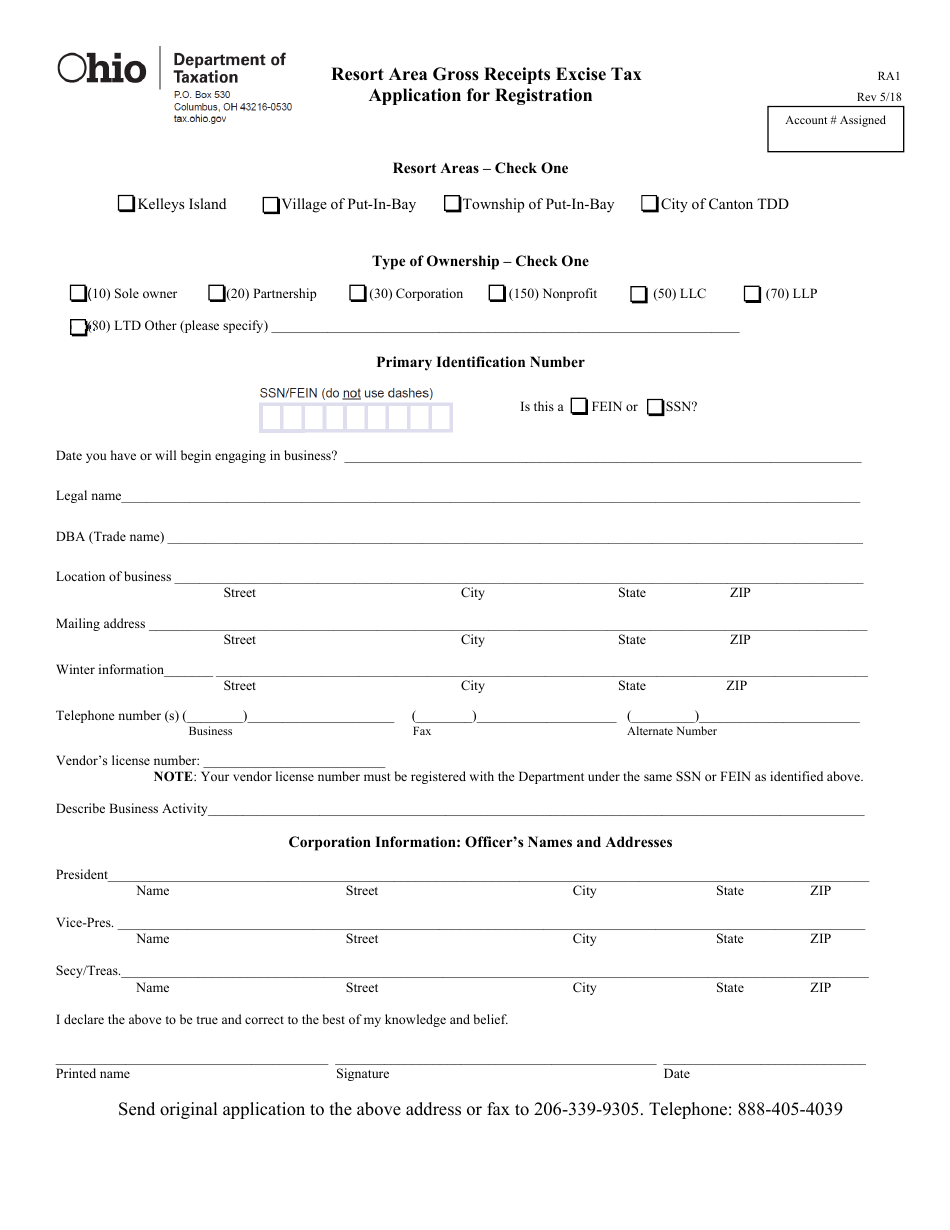

Form RA-1 Application for Registration - Resort Area Gross Receipts Excise Tax - Ohio

What Is Form RA-1?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RA-1?

A: Form RA-1 is an application for registration for the Resort Area Gross Receipts Excise Tax in Ohio.

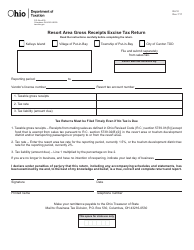

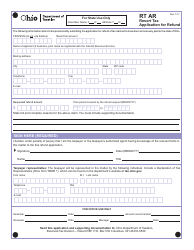

Q: What is the Resort Area Gross Receipts Excise Tax?

A: The Resort Area Gross Receipts Excise Tax is a tax levied on gross receipts of businesses operating within designated resort areas in Ohio.

Q: Who needs to file Form RA-1?

A: Businesses operating within designated resort areas in Ohio need to file Form RA-1 to register for the Resort Area Gross Receipts Excise Tax.

Q: What information is required on Form RA-1?

A: Form RA-1 requires information such as the business name, address, federal employer identification number (FEIN), and gross receipts information.

Q: When is the deadline to file Form RA-1?

A: The deadline to file Form RA-1 is typically the last day of the month following the end of the calendar quarter.

Q: Are there any penalties for late filing of Form RA-1?

A: Yes, there may be penalties for late filing of Form RA-1, including interest charges on any unpaid tax.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RA-1 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.