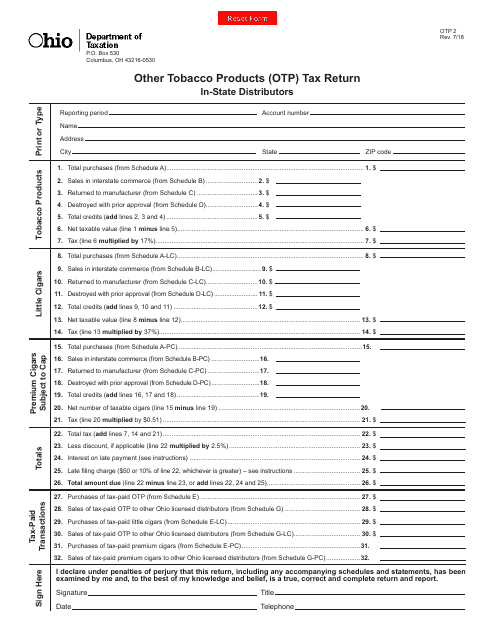

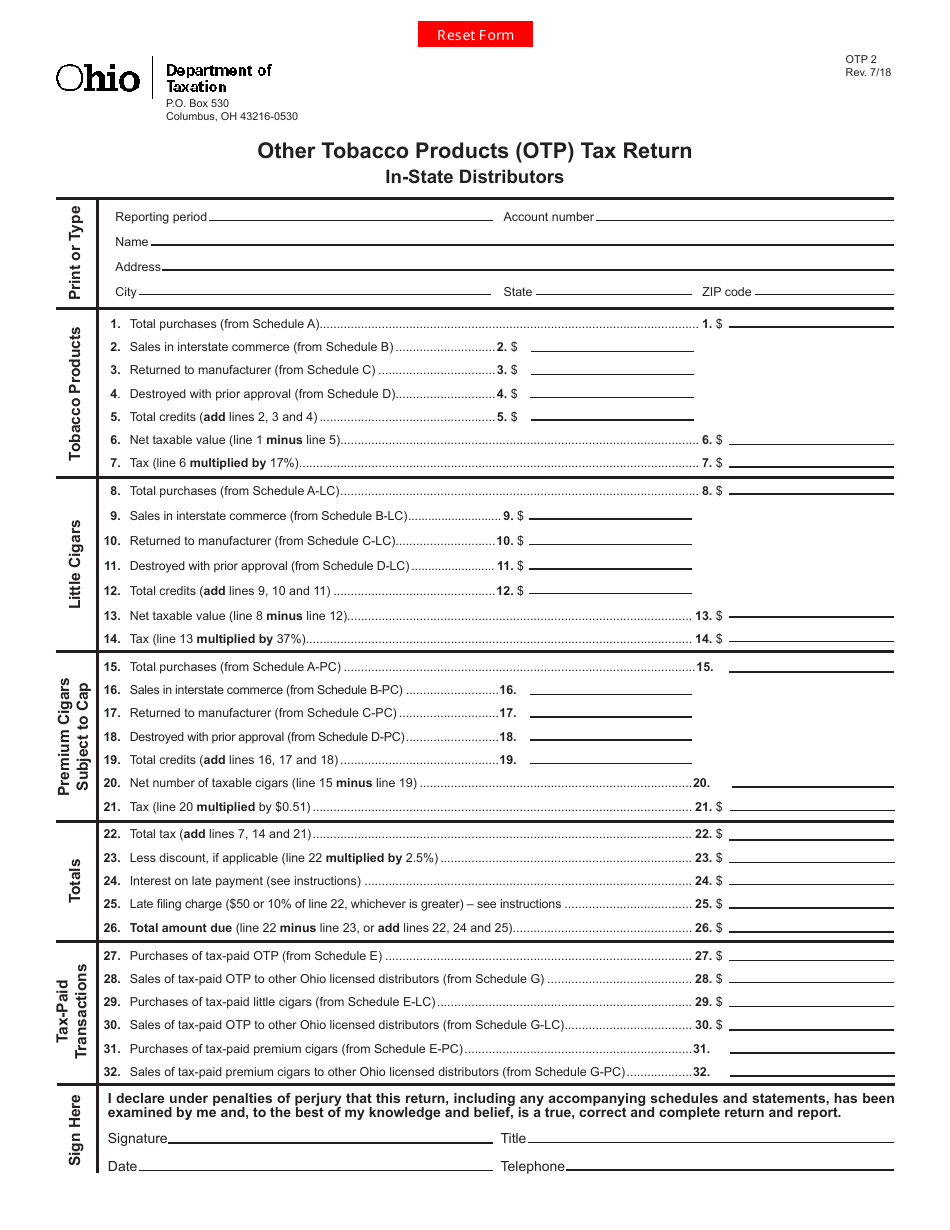

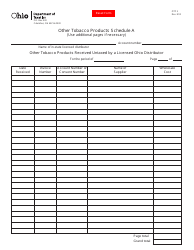

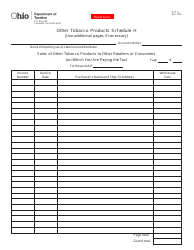

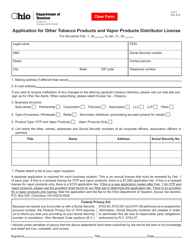

Form OTP2 Other Tobacco Products (Otp) Tax Return - in-State Distributors - Ohio

What Is Form OTP2?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTP2 Other Tobacco Products Tax Return?

A: The OTP2 Other Tobacco Products Tax Return is a form used by in-state distributors in Ohio to report and pay taxes on other tobacco products.

Q: Who needs to file the OTP2 Other Tobacco Products Tax Return?

A: In-state distributors of other tobacco products in Ohio need to file the OTP2 Other Tobacco Products Tax Return.

Q: What are considered other tobacco products?

A: Other tobacco products include cigars, pipe tobacco, chewing tobacco, snuff, and other non-cigarette tobacco products.

Q: How often is the OTP2 Other Tobacco Products Tax Return filed?

A: The OTP2 Other Tobacco Products Tax Return is filed on a monthly basis.

Q: When is the OTP2 Other Tobacco Products Tax Return due?

A: The OTP2 Other Tobacco Products Tax Return is due on the 23rd of each month for the previous month's sales.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OTP2 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.