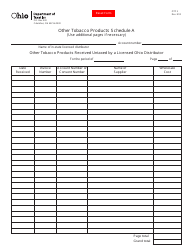

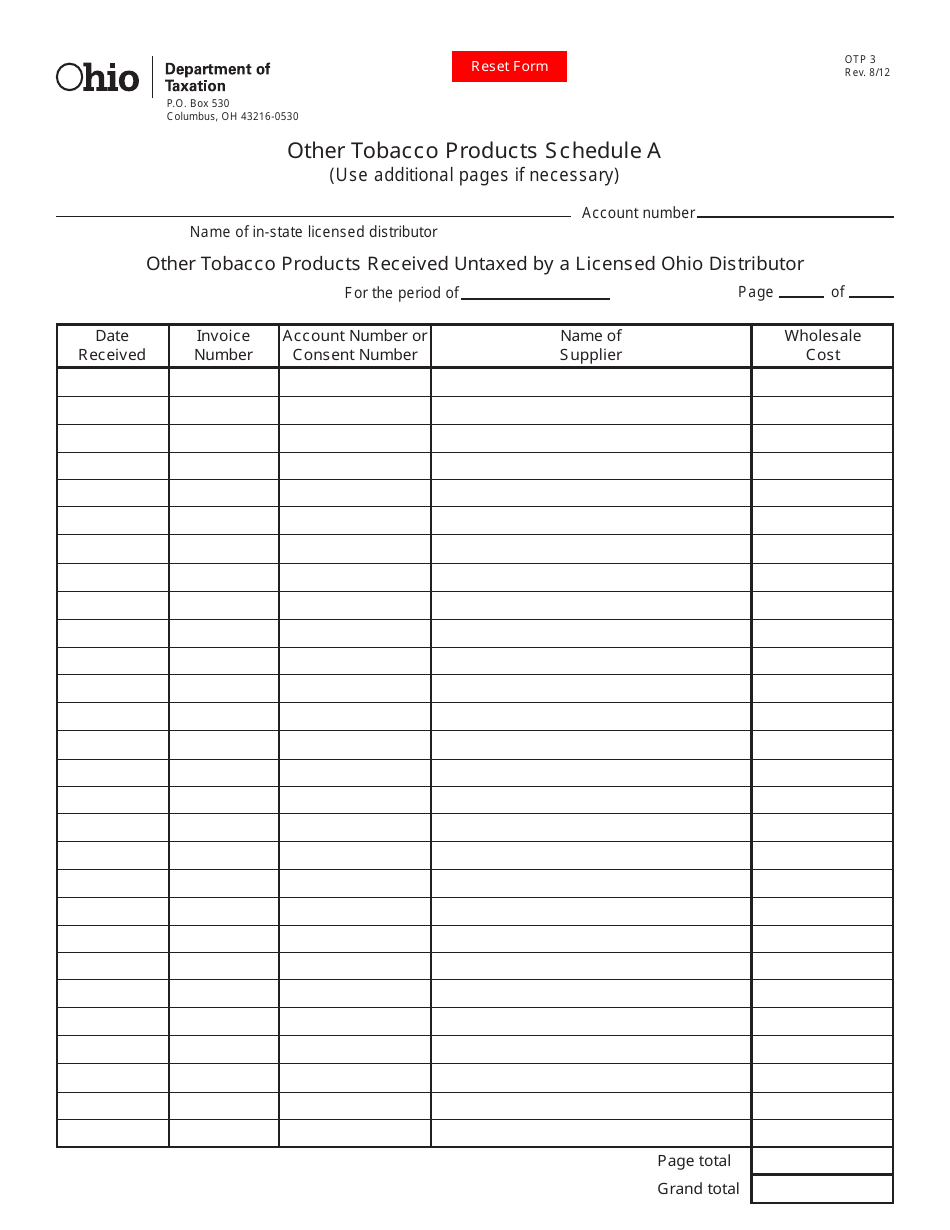

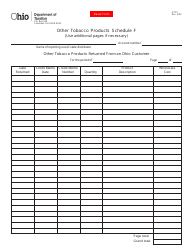

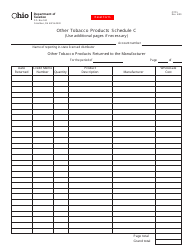

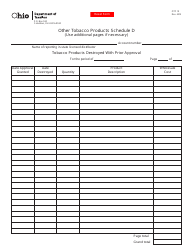

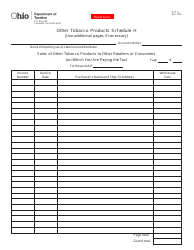

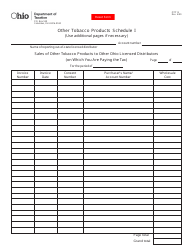

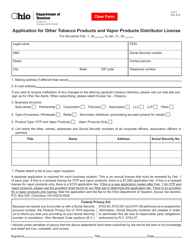

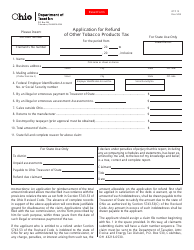

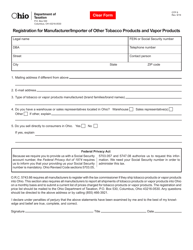

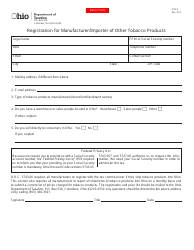

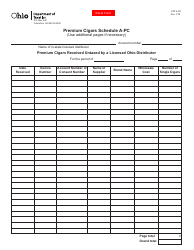

Form OTP-3 Other Tobacco Products Schedule a - Other Tobacco Products Received Untaxed by a Licensed Ohio Distributor - Ohio

What Is Form OTP-3?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OTP-3?

A: Form OTP-3 is a form used for reporting other tobacco products received untaxed by a licensed Ohio distributor.

Q: What are other tobacco products?

A: Other tobacco products refer to tobacco products other than cigarettes, such as cigars, pipe tobacco, and smokeless tobacco.

Q: Who needs to file Form OTP-3?

A: Licensed Ohio distributors who have received untaxed other tobacco products need to file Form OTP-3.

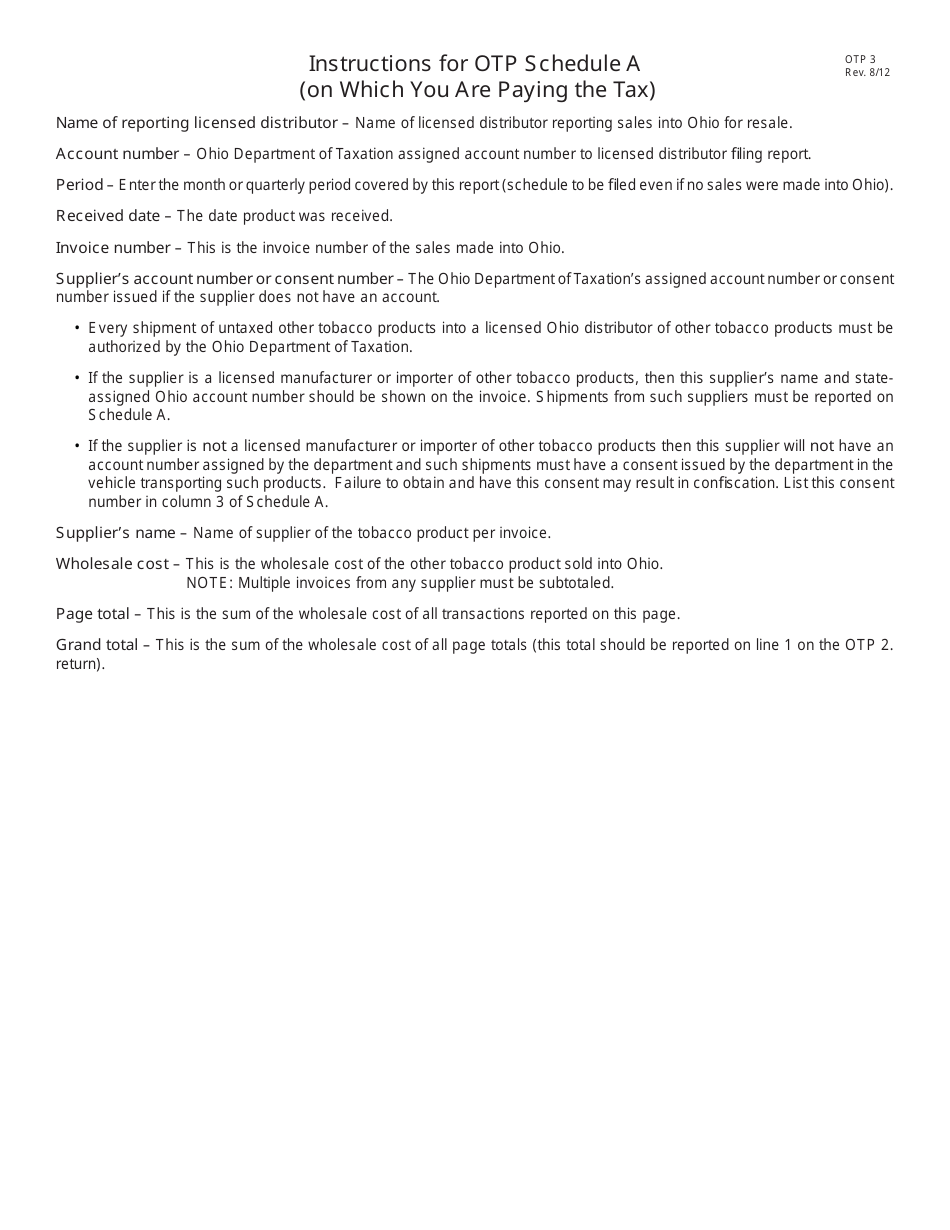

Q: What information needs to be provided on Form OTP-3?

A: Form OTP-3 requires the distributor to provide information about the quantity and value of untaxed other tobacco products received.

Q: Why do licensed Ohio distributors need to file Form OTP-3?

A: Filing Form OTP-3 allows the Ohio Department of Taxation to track and collect the appropriate taxes on other tobacco products.

Q: Is Form OTP-3 specific to Ohio?

A: Yes, Form OTP-3 is specific to licensed Ohio distributors.

Q: Are there any penalties for not filing Form OTP-3?

A: Failure to file Form OTP-3 or filing incorrect information may result in penalties and interest.

Q: When is the deadline for filing Form OTP-3?

A: The deadline for filing Form OTP-3 is usually the 20th day of the month following the month of receipt of untaxed other tobacco products.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OTP-3 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.