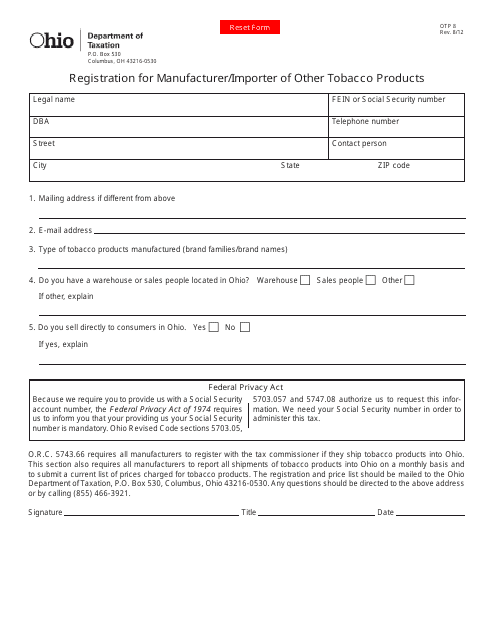

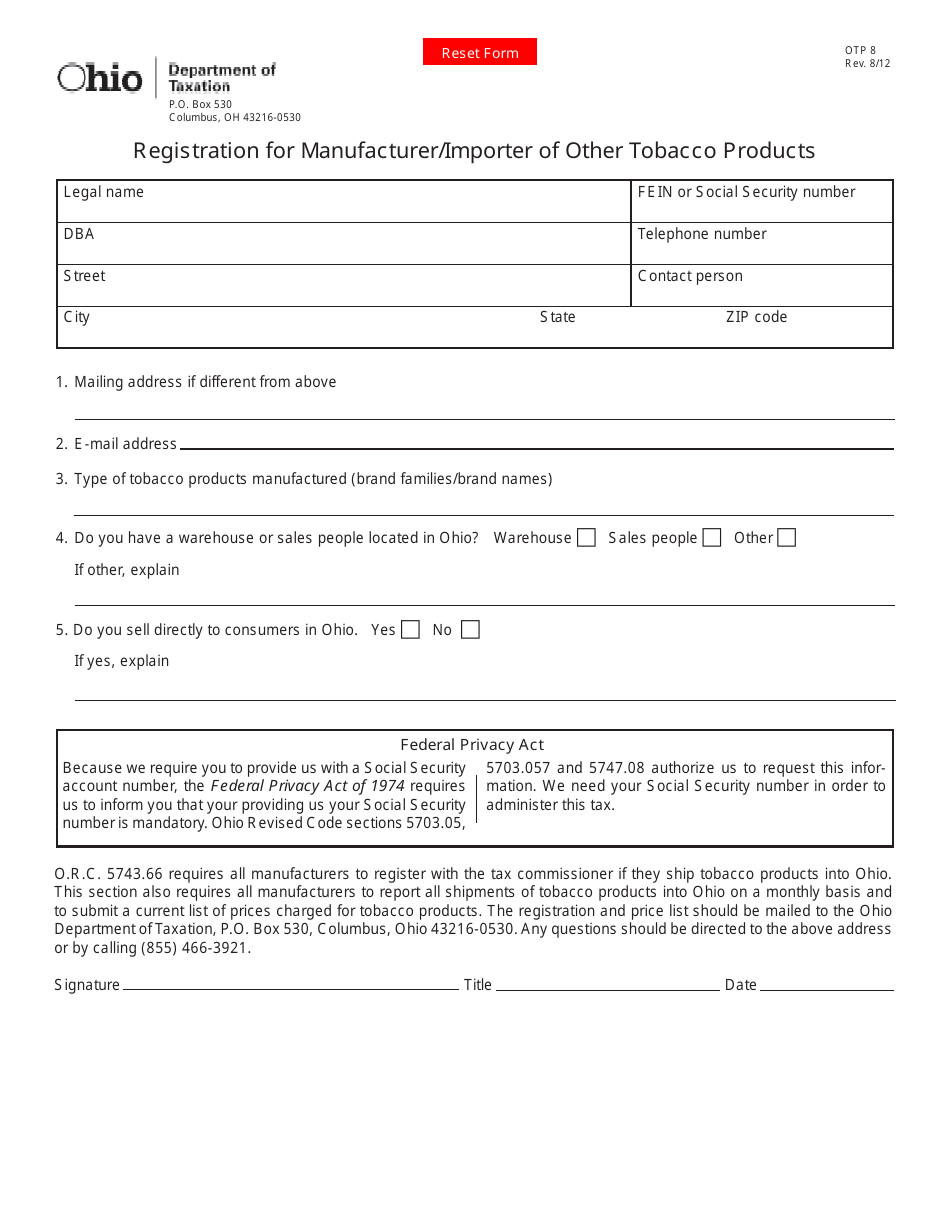

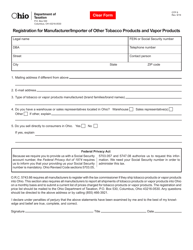

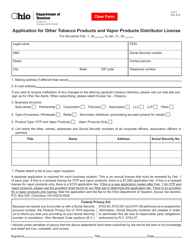

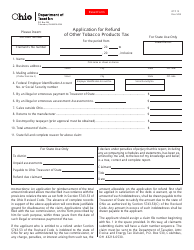

Form OTP-8 Registration for Manufacturer / Importer of Other Tobacco Products - Ohio

What Is Form OTP-8?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTP-8?

A: OTP-8 is a registration form for manufacturers and importers of other tobacco products in Ohio.

Q: Who needs to fill out OTP-8?

A: Manufacturers and importers of other tobacco products in Ohio need to fill out OTP-8.

Q: What are other tobacco products?

A: Other tobacco products include cigars, pipe tobacco, chewing tobacco, and snuff, among others.

Q: How do I fill out OTP-8?

A: You can fill out OTP-8 by providing the required information, such as company details, product information, and payment.

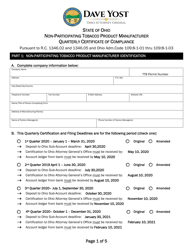

Q: Is there a deadline for submitting OTP-8?

A: Yes, OTP-8 must be submitted annually by the 10th day of the month following the end of each calendar quarter.

Q: Are there any fees associated with OTP-8?

A: Yes, there is a fee for submitting OTP-8. The fee amount depends on the type and volume of products being registered.

Q: What happens after I submit OTP-8?

A: After submitting OTP-8, your registration as a manufacturer or importer of other tobacco products in Ohio will be processed.

Q: Do I need to renew my registration?

A: Yes, your registration needs to be renewed annually by submitting a new OTP-8 form.

Q: What if there are changes to my registration information?

A: If there are changes to your registration information, you must notify the Ohio Department of Taxation within 10 days of the change.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OTP-8 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.