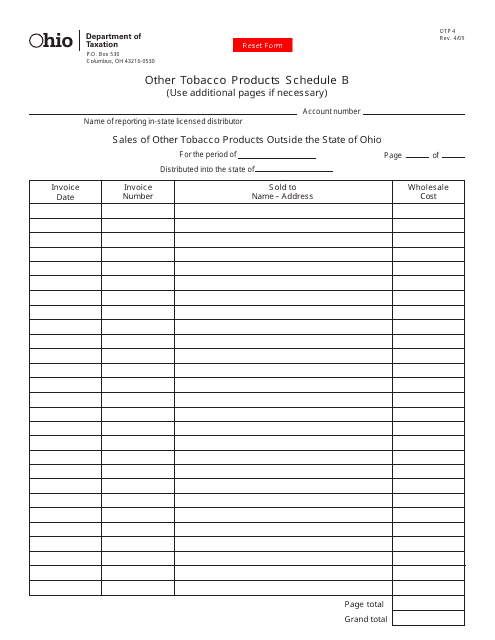

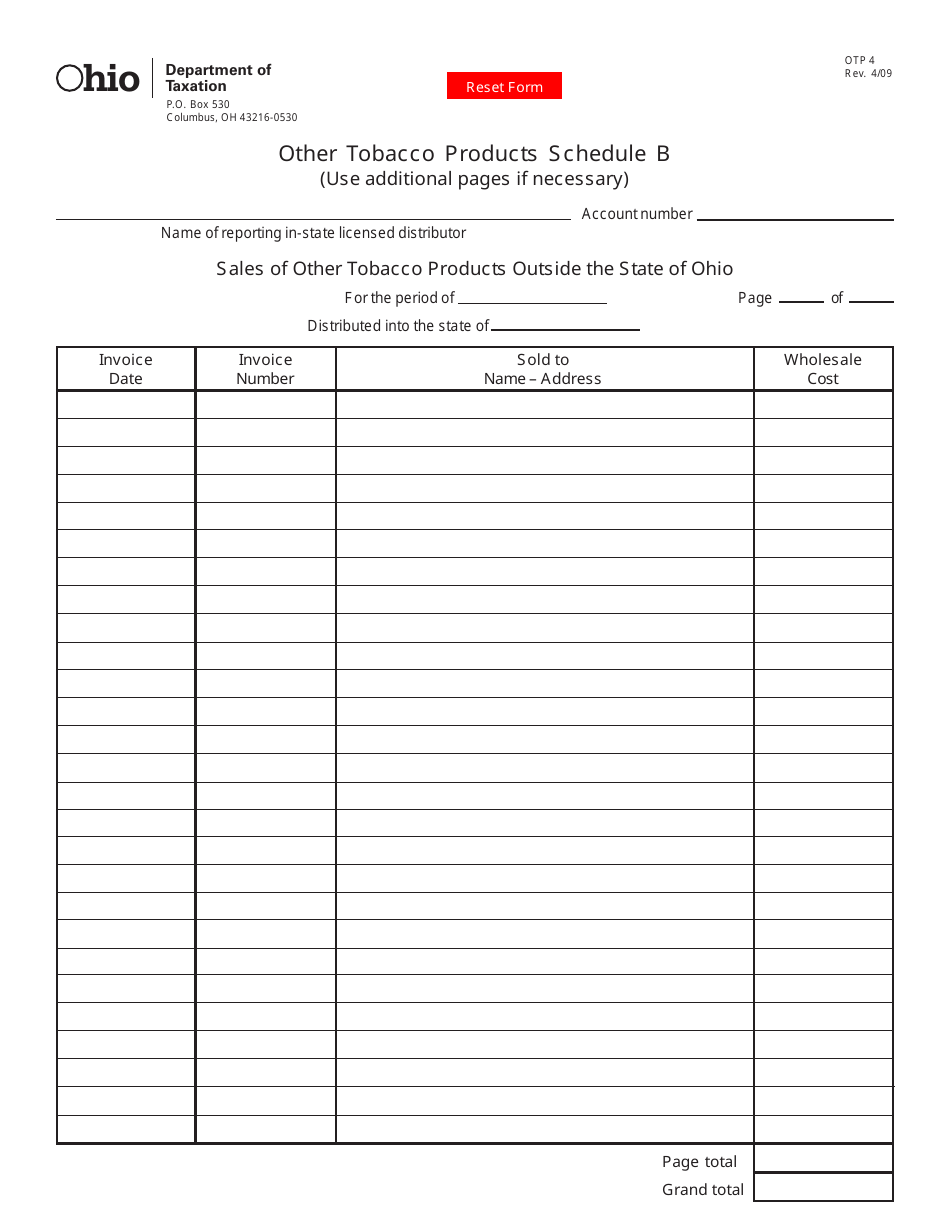

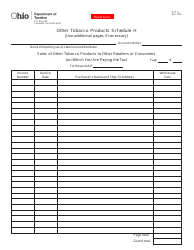

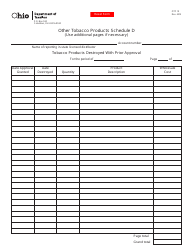

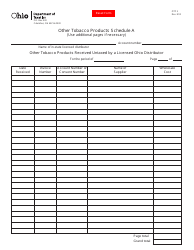

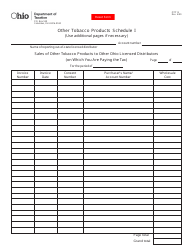

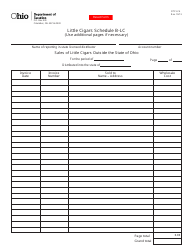

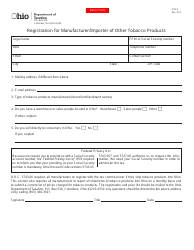

Form OTP-4 Other Tobacco Products Schedule B - Sales of Other Tobacco Products Outside the State of Ohio - Ohio

What Is Form OTP-4?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTP-4?

A: OTP-4 refers to the Other Tobacco Products Schedule B.

Q: What does OTP-4 report?

A: OTP-4 reports the sales of other tobacco products outside the state of Ohio.

Q: What are other tobacco products?

A: Other tobacco products refer to tobacco products other than cigarettes, such as cigars, chewing tobacco, snuff, pipe tobacco, and electronic cigarettes.

Q: Why does Ohio require reporting of sales of other tobacco products outside the state?

A: Ohio requires reporting to monitor and regulate the sales and distribution of tobacco products in order to protect public health and enforce tax compliance.

Q: Who needs to file OTP-4?

A: Businesses that sell other tobacco products outside the state of Ohio need to file OTP-4.

Q: Are there any exemptions for filing OTP-4?

A: Certain businesses, such as wholesale dealers who only sell to other licensed wholesale dealers, are exempt from filing OTP-4.

Q: When is OTP-4 due?

A: OTP-4 is due on a monthly basis and must be filed and the payment must be made by the 23rd day of the following month.

Q: What happens if I fail to file OTP-4 or make the payment on time?

A: Failure to file OTP-4 or make the payment on time may result in penalties and fines imposed by the Ohio Department of Taxation.

Q: Can I request an extension for filing OTP-4?

A: No, there is no provision for an extension of time to file OTP-4. It must be filed by the due date.

Form Details:

- Released on April 1, 2009;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OTP-4 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.