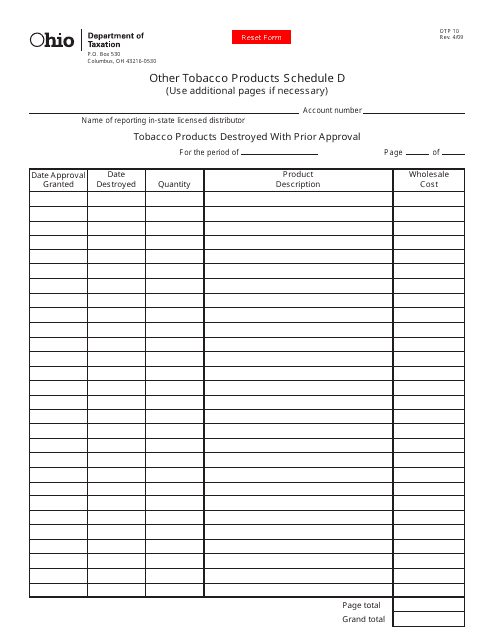

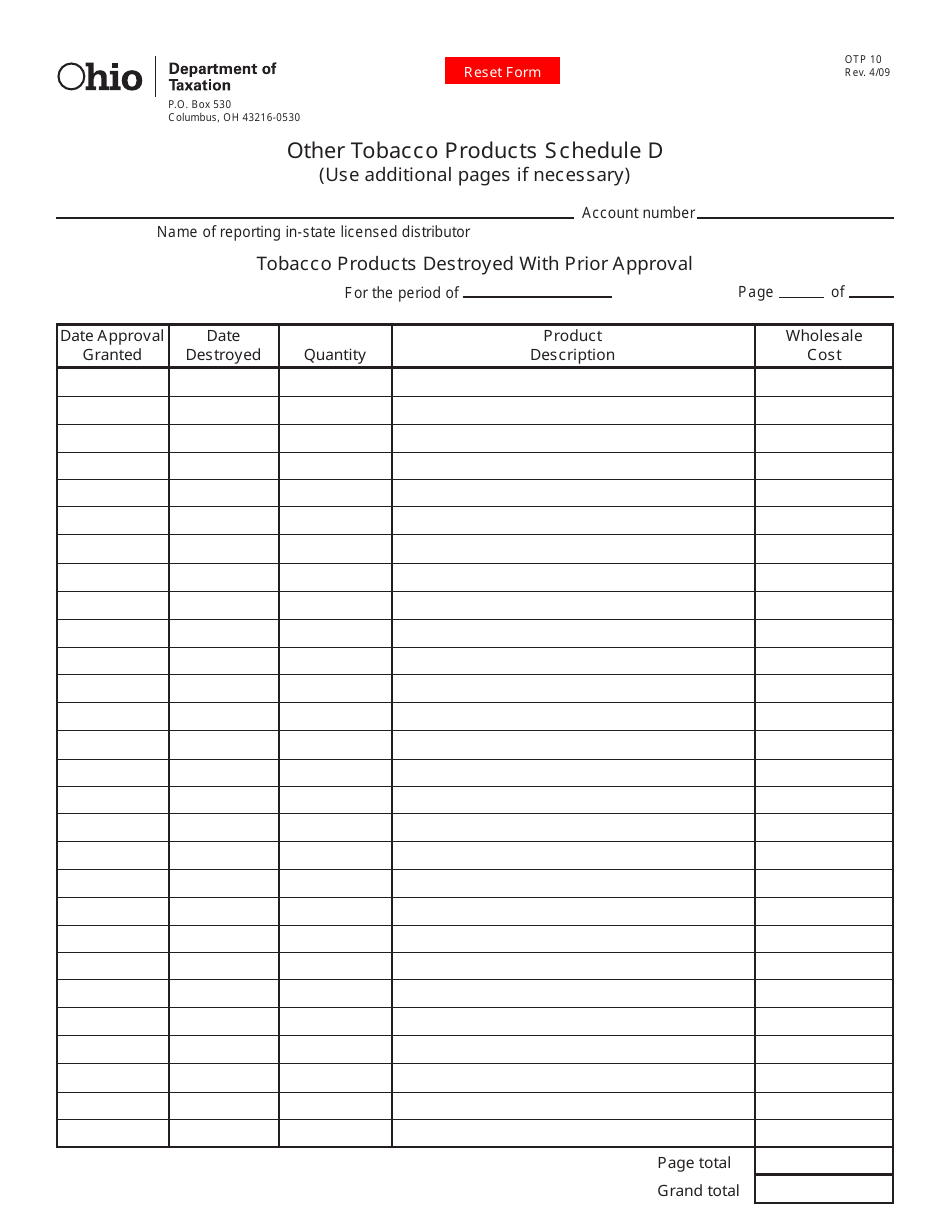

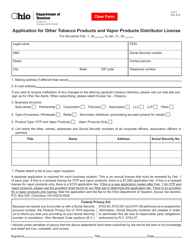

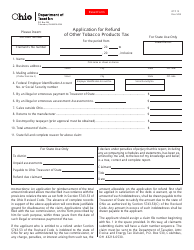

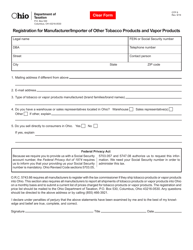

Form OTP10 Other Tobacco Products Schedule D - Tobacco Products Destroyed With Prior Approval - Ohio

What Is Form OTP10?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OTP10?

A: Form OTP10 is a form used in Ohio to report tobacco products that were destroyed with prior approval.

Q: What are other tobacco products?

A: Other tobacco products refer to any tobacco products other than cigarettes, such as cigars, pipe tobacco, chewing tobacco, snuff, etc.

Q: Why would tobacco products need prior approval before being destroyed?

A: Prior approval is required to ensure that the destruction of tobacco products complies with state regulations and to keep track of the tobacco products that are destroyed.

Q: When should Form OTP10 be filed?

A: Form OTP10 should be filed within 10 days of the destruction of the tobacco products.

Q: Who needs to file Form OTP10?

A: Any person or entity who is authorized to possess or sell tobacco products in Ohio and has obtained prior approval for the destruction of tobacco products needs to file Form OTP10.

Q: Are there any fees associated with filing Form OTP10?

A: No, there are no fees associated with filing Form OTP10.

Q: Is there a penalty for not filing Form OTP10?

A: Yes, failure to file Form OTP10 or filing incorrect information may result in penalties or fines.

Q: Who can I contact for further assistance or questions regarding Form OTP10?

A: For further assistance or questions regarding Form OTP10, you can contact the Ohio Department of Taxation.

Form Details:

- Released on April 1, 2009;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OTP10 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.